Polygon Community Debates Reverting to MATIC Amid POL Branding Confusion

POL/USDT

$41,348,285.31

$0.1092 / $0.1005

Change: $0.008700 (8.66%)

+0.0024%

Longs pay

Contents

Polygon is grappling with an identity crisis following its 2023 token rebrand from MATIC to POL, as CEO Sandeep Nailwal notes that 95% of users outside social media are confused about MATIC’s disappearance. Community opinions are divided on reverting to the original ticker amid concerns over branding consistency and user recognition.

-

Polygon’s rebranding from MATIC to POL aimed to reflect its evolution into a multi-chain ecosystem with AggLayer integration.

-

The change has led to mixed community reactions, with some favoring a return to MATIC for better recognition while others prioritize forward momentum.

-

Despite a price drop of 83% from its 2024 peak, recent data shows 631 million POL tokens held off exchanges, signaling potential accumulation.

Explore Polygon’s MATIC to POL rebranding crisis: CEO reveals user confusion and community divide. Discover impacts on demand, price, and future branding strategies for this Ethereum L2 leader. Stay informed on crypto developments.

What is causing Polygon’s identity crisis with the POL rebrand?

Polygon’s identity crisis stems from the 2023 shift from MATIC to POL, leaving many users puzzled about the original token’s whereabouts, as highlighted by CEO Sandeep Nailwal. This rebranding was intended to signify Polygon’s growth into a comprehensive aggregation layer ecosystem, but it has sparked debate over whether to revert due to widespread familiarity with MATIC. Non-social media users, comprising nearly 95% of the base, reportedly struggle with the transition, prompting calls for clearer communication.

How has the Polygon community responded to the rebranding debate?

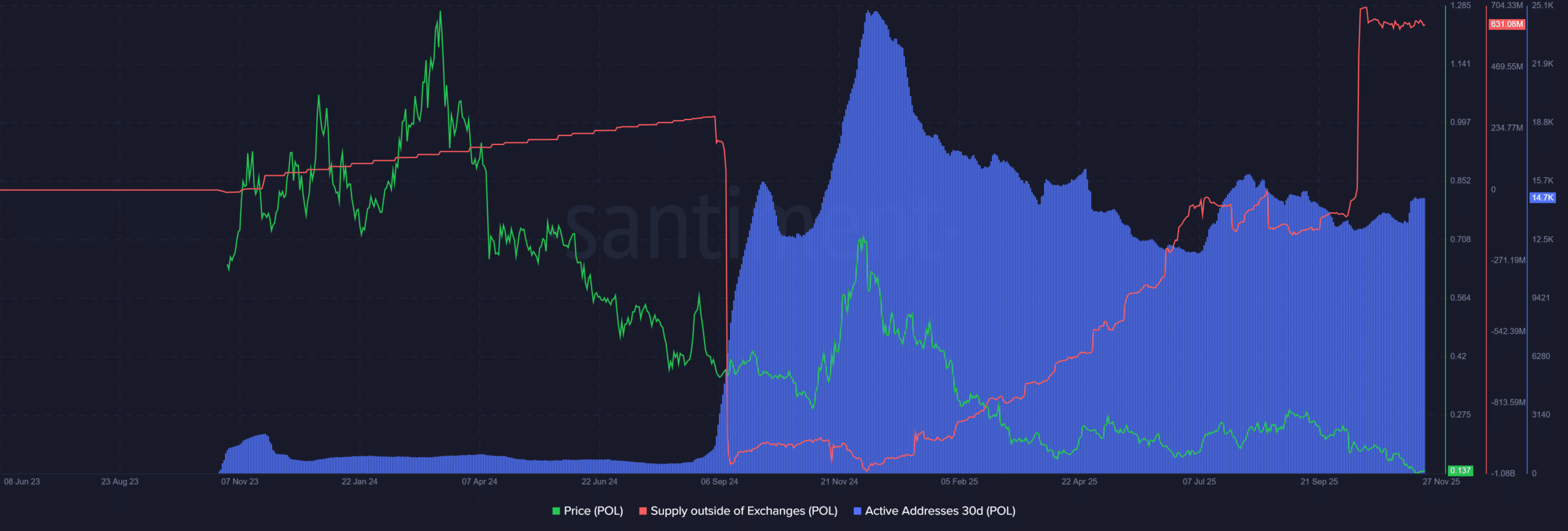

The Polygon community exhibits a split response to the proposal of reverting to MATIC. Proponents of the change emphasize the established brand value of MATIC, arguing it aids in user retention and recognition beyond crypto enthusiasts on platforms like X. Conversely, opponents stress that POL embodies the network’s progression toward advanced scaling solutions, such as the AggLayer, and warn that reversal could undermine recent efforts. One community member stated, “Recognition is key, but we should focus on education and consistent messaging rather than undoing our new identity.” This division surfaced after Nailwal’s recent feedback solicitation, underscoring the need for balanced branding strategies. Data from on-chain analytics platforms like Santiment indicates fluctuating demand post-rebrand, with active addresses stabilizing in late 2025, reflecting ongoing engagement despite the controversy.

Frequently Asked Questions

What led to the Polygon token change from MATIC to POL?

The transition from MATIC to POL occurred in mid-2023 to align the token with Polygon’s expanded role as a multi-chain framework, including zkEVM and AggLayer. Originally launched as Matic Network in 2017 and rebranded to Polygon in 2021, the token update aimed to support new functionalities in proof-of-stake staking and gas fees. This move was part of broader evolution to enhance interoperability across Ethereum’s layer-2 solutions, as per official announcements from the Polygon team.

Is Polygon considering a return to the MATIC ticker?

Polygon’s leadership, including CEO Sandeep Nailwal, is actively gauging community sentiment on potentially reverting to MATIC due to user confusion. While no final decision has been made, the discussion highlights challenges in communicating the rebrand’s benefits, such as improved scalability. For voice queries, this debate centers on balancing legacy recognition with innovative advancements in the Ethereum ecosystem, ensuring accessibility for all users regardless of their platform familiarity.

Key Takeaways

- Branding Evolution Challenge: The shift from MATIC to POL represents Polygon’s growth but has caused confusion for 95% of users outside social media, as noted by CEO Sandeep Nailwal.

- Community Divide: Supporters of MATIC cite its strong brand recall, while POL advocates push for education to reinforce the network’s scaling innovations like AggLayer.

- Market Impact Insight: POL demand dipped sharply in 2024 but shows signs of recovery with 631 million tokens off exchanges; price fell 83% from $0.75 peak, tied to market trends—consider monitoring for accumulation signals.

Conclusion

Polygon’s MATIC to POL rebranding crisis illustrates the complexities of evolving blockchain identities in the competitive Ethereum layer-2 space, where user familiarity clashes with technological progress. As community feedback highlights the need for robust education on initiatives like AggLayer, the network’s trajectory remains promising with stabilizing on-chain metrics and renewed accumulation trends. Investors and users should watch for official updates, as clearer messaging could bridge the divide and solidify Polygon’s position in the crypto landscape moving forward.

Mapping the change from Matic to Polygon

Polygon’s journey began as an Ethereum sidechain in 2017, launching its mainnet as Matic Network in 2020. At that time, MATIC served as the core token for gas fees and proof-of-stake security through staking mechanisms. The ecosystem expanded significantly, incorporating multiple chains such as Polygon zkEVM and the interoperability-focused AggLayer. By 2021, the network rebranded to Polygon to reflect this broader vision, though the token retained the MATIC name until the mid-2023 update to POL. This evolution aimed to better encapsulate the platform’s role in scaling Ethereum, but recent discussions reveal persistent user attachment to the original branding, questioning the rebrand’s effectiveness in reaching the majority audience.

Source: X

Impact of the POL rebranding

Post-rebranding analytics from Santiment reveal that demand for the POL token initially climbed gradually in late 2023 and early 2024, indicating positive reception among active participants. However, this momentum faltered sharply during the second half of 2024, with negative sentiment persisting until October 2025. A modest recovery in accumulation has since emerged, evidenced by 631 million POL tokens now held outside exchanges, which analysts view as a bullish indicator for long-term holders. Active addresses, represented in blue on relevant charts, experienced a slowdown and plateau in the latter half of 2024, correlating with broader market downturns. POL’s price performance has been challenging, declining 83% from its 2024 high of $0.75 to around $0.13, influenced by overarching crypto market weakness rather than isolated branding issues. In 2025, Polygon has garnered increased traction through ecosystem developments, suggesting that enhanced education on the rebrand could mitigate current identity challenges while price recovery hinges on wider market recovery.

Source: Santiment

Comments

Other Articles

ING Germany Expands MATIC Crypto Products with Bitwise and VanEck

February 3, 2026 at 08:50 AM UTC

Base App Content Sync: Coinbase CEO Brian Armstrong Recommends Publishing Directly on Base to Auto-Sync with Zora Without Duplicates

December 30, 2025 at 03:19 AM UTC

Kraken to Launch 2026 Prediction Market as It Expands Tokenized Equities Through Backed Finance’s xStocks Acquisition

December 25, 2025 at 01:21 AM UTC