Pompliano: Public Companies Unlikely to Match MicroStrategy’s Bitcoin Holdings

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

Bitcoin entrepreneur Anthony Pompliano states that while it’s possible for a public company to match Strategy’s Bitcoin holdings, it’s unlikely due to the company’s extensive accumulation since 2020. Strategy currently holds 671,268 BTC, representing about 3.2% of the total supply, valued at approximately $58.61 billion.

-

Strategy’s aggressive buying strategy has built a massive Bitcoin reserve over years.

-

Pompliano highlights the challenges in replicating this through capital markets or business revenue.

-

Holdings include a recent acquisition of 10,645 BTC for $980.3 million, at an average price of $92,098 per coin, per Saylor Tracker data.

Explore why catching up to Strategy’s Bitcoin holdings seems improbable, as per expert Anthony Pompliano. Discover key insights on corporate Bitcoin strategies and market implications today.

What Are Strategy’s Bitcoin Holdings and Why Are They Hard to Match?

Strategy’s Bitcoin holdings represent one of the largest corporate accumulations of the cryptocurrency, totaling 671,268 BTC out of the 21 million total supply. This stash, valued at around $58.61 billion as of recent reports, stems from a long-term strategy initiated by Michael Saylor in 2020. Bitcoin entrepreneur Anthony Pompliano, speaking on The Pomp Podcast, emphasized that while other public companies could theoretically build similar reserves, the scale and timing of Strategy’s purchases make it highly challenging.

Strategy’s approach has involved consistent buying, including a recent purchase of 10,645 BTC for $980.3 million at an average price of $92,098 per coin. Pompliano noted that this positions Strategy with roughly 3.2% of Bitcoin’s supply—a significant yet not dominant portion compared to hypothetical 10% thresholds.

However, Pompliano said that there are certain things that public companies could do, such as “tap capital markets,” but said that Saylor’s initial Bitcoin purchase in 2020 totaled around $500 million, when Bitcoin was trading between $9,000 and $10,000.

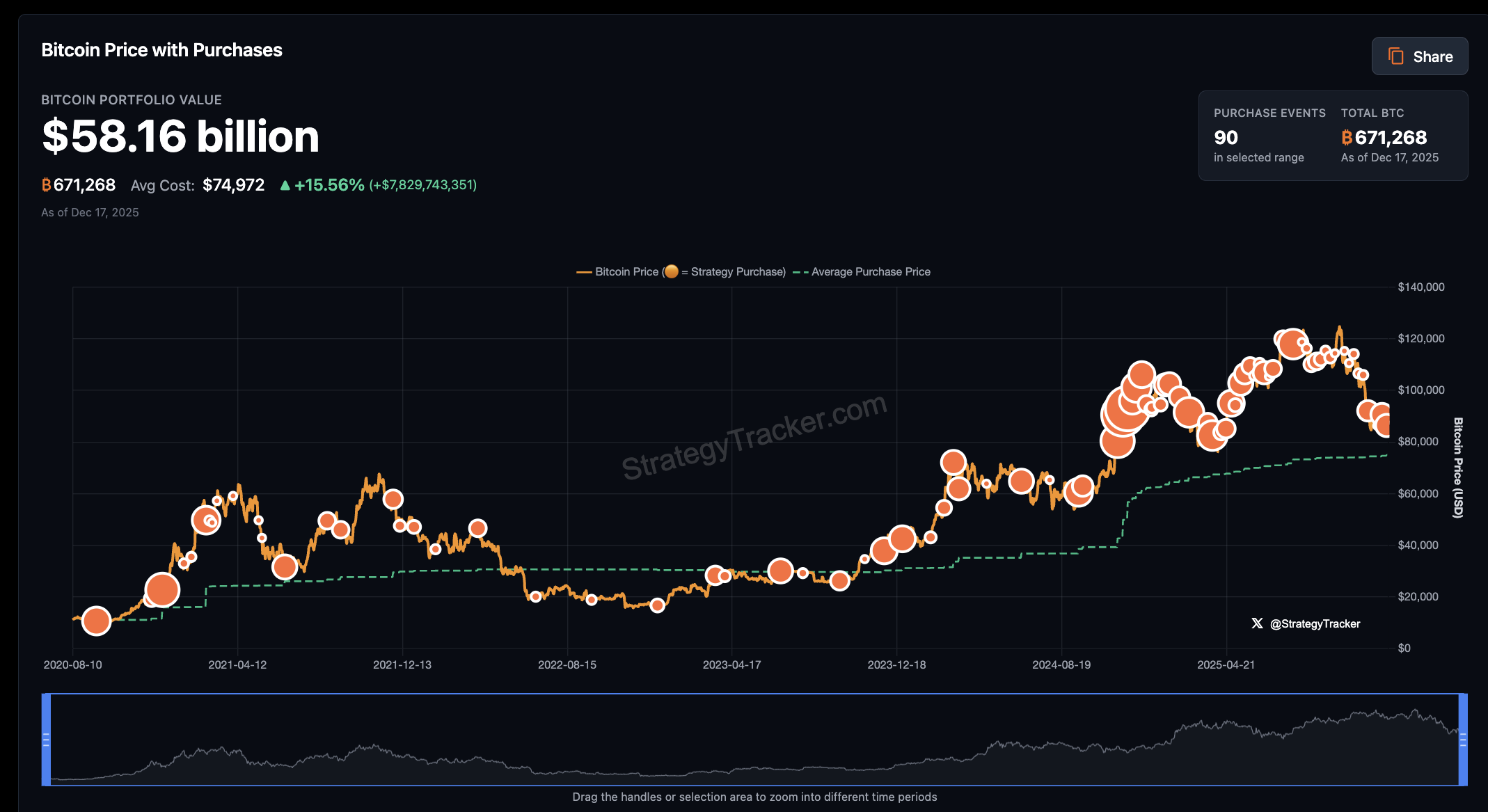

Strategy’s Bitcoin holdings is worth $58.16 billion at the time of publication. Source: Saylor Tracker

That purchase alone is now worth over $4.8 billion as Bitcoin is now trading at $87,578.

“So if you have 9X or 10X the amount of money for every purchase that they made, you gotta raise hundreds of billions of dollars, or you got the greatest business in the world that’s throwing hundreds of billions of dollars,” he said.

To contextualize, Strategy’s strategy leverages the company’s financial position to acquire Bitcoin during various market cycles, benefiting from substantial appreciation. Data from Saylor Tracker illustrates how early investments have multiplied in value, underscoring the difficulty for newcomers to achieve comparable gains without similar foresight and capital access.

Public companies interested in Bitcoin treasuries often cite diversification and inflation hedging as motivations, but matching Strategy requires not just funding but sustained commitment. Pompliano’s analysis, drawn from his experience in the Bitcoin space, highlights that even with access to capital markets, the cumulative effect of Strategy’s buys creates a formidable barrier.

How Has Strategy’s Bitcoin Accumulation Evolved Over Time?

Strategy began its Bitcoin journey in 2020 with an initial investment of approximately $500 million when prices hovered between $9,000 and $10,000 per BTC. This move was visionary, as those coins now command billions in value amid Bitcoin’s price surge to over $87,000 in recent trading sessions. According to Saylor Tracker, the company’s portfolio has grown through multiple acquisitions, reaching 671,268 BTC by late 2025.

Key milestones include the latest addition of 10,645 BTC acquired for $980.3 million, demonstrating ongoing commitment despite market volatility. Expert observers, including Pompliano, point out that this evolution reflects a deliberate treasury management approach, treating Bitcoin as a primary reserve asset. Statistics show Strategy’s holdings appreciate significantly; for instance, the 2020 purchase alone has yielded over 9x returns.

Financial analysts often reference Strategy’s model as a benchmark for corporate adoption. Pompliano, a prominent Bitcoin advocate, explained on The Pomp Podcast that replicating this requires not only raising vast sums—potentially hundreds of billions—but also navigating regulatory and market dynamics that Strategy has mastered over years. This structured accumulation, executed via over-the-counter desks to minimize market impact, sets a high standard for peers.

Frequently Asked Questions

Can Another Public Company Surpass Strategy’s Bitcoin Holdings?

While possible through aggressive capital raises or exceptional business performance, Anthony Pompliano deems it unlikely. Strategy’s early and consistent purchases since 2020 have built an insurmountable lead, holding 3.2% of Bitcoin’s supply. New entrants would need to invest hundreds of billions, far exceeding typical corporate capabilities in the short term.

What Impact Do Strategy’s Bitcoin Buys Have on the Market?

Strategy’s purchases are viewed as a strong bullish signal for Bitcoin’s price, signaling institutional confidence. Conducted through over-the-counter desks, these large buys absorb flows without immediate price disruption. As Pompliano notes, the strategy fosters long-term stability, with CEO Phong Le stating no sales until at least 2065, reducing sell-off fears.

Pompliano also addressed concerns around Strategy’s growing share of Bitcoin holdings, explaining that some observers worry about the company’s potential ability to influence the price of the asset.

However, Strategy CEO Phong Lee recently told CNBC that the company probably won’t sell any Bitcoin until at least 2065. Meanwhile, Saylor has often said in X posts that he is “going to be buying the top forever.”

Many market participants view Strategy’s Bitcoin purchases as a bullish signal for Bitcoin’s price. However, the company executes its significant purchases through over-the-counter (OTC) desks, which are designed to absorb large flows without impacting the market.

Key Takeaways

- Impressive Scale: Strategy’s 671,268 BTC holdings, worth $58.61 billion, represent 3.2% of total supply, built through strategic buys since 2020.

- Expert Perspective: Anthony Pompliano asserts that matching this is possible but improbable, requiring massive capital infusions.

- Long-Term Commitment: With no sales planned until 2065, Strategy’s approach bolsters Bitcoin’s market confidence and stability.

Conclusion

In summary, Strategy’s Bitcoin holdings stand as a testament to visionary corporate strategy, amassing 671,268 BTC valued at $58.61 billion and influencing broader market adoption. As Anthony Pompliano highlights, the challenges in replicating this— from capital demands to timing—make it a unique benchmark in the crypto space. Looking ahead, continued accumulation could further solidify Bitcoin’s role in corporate treasuries; investors should monitor these developments for insights into digital asset integration.