Prediction Markets May Outperform Bitcoin Spot Holding, But AI Bots Raise Insider Trading Concerns

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

Crypto prediction markets provide traders with higher potential returns than holding spot cryptocurrencies, but the presence of AI bots and accounts with perfect win rates sparks concerns over insider trading and market fairness.

-

Prediction markets in crypto offer asymmetric payoffs, potentially yielding 100x gains on bets compared to 1.65x from spot holdings.

-

These platforms attract both retail speculators and professional traders, creating information asymmetries and arbitrage opportunities.

-

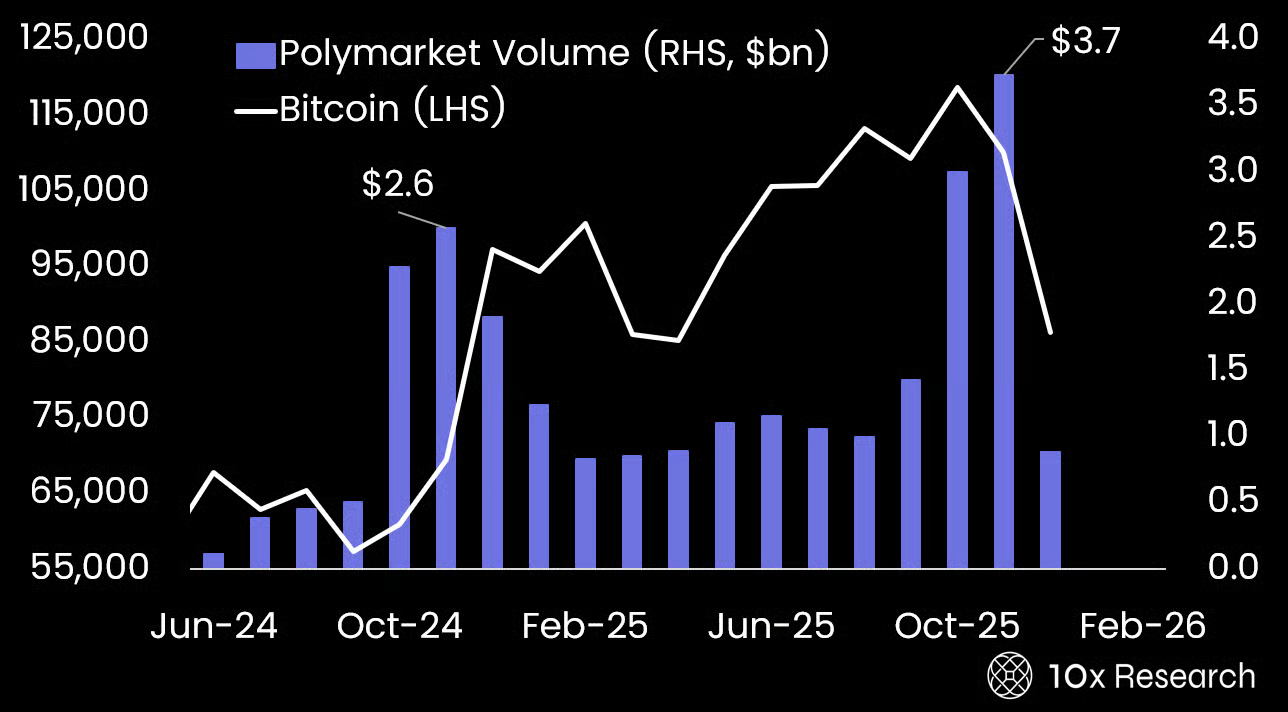

Reports from crypto research firms like 10x Research highlight growing volumes in Bitcoin and crypto-related events, with sports bets still dominating activity, per platform data showing billions in total volume.

Explore how crypto prediction markets outperform spot trading amid rising suspicions of insider trading. Discover key insights and risks for traders in 2025—start analyzing opportunities today.

What Are Crypto Prediction Markets and How Do They Offer More Upside Than Spot Crypto?

Crypto prediction markets are blockchain-based platforms where users bet on the outcomes of future events using digital tokens, providing leveraged returns that often exceed those from simply holding spot cryptocurrencies. These markets function like decentralized betting exchanges, allowing participants to buy “yes” or “no” shares on events ranging from election results to cryptocurrency price milestones. According to analysis from crypto research company 10x Research, they create extreme information asymmetry, enabling savvy traders to exploit arbitrage windows that spot holders cannot access as efficiently.

How Do High Win-Rate Accounts and AI Bots Raise Insider Trading Concerns in Crypto Prediction Markets?

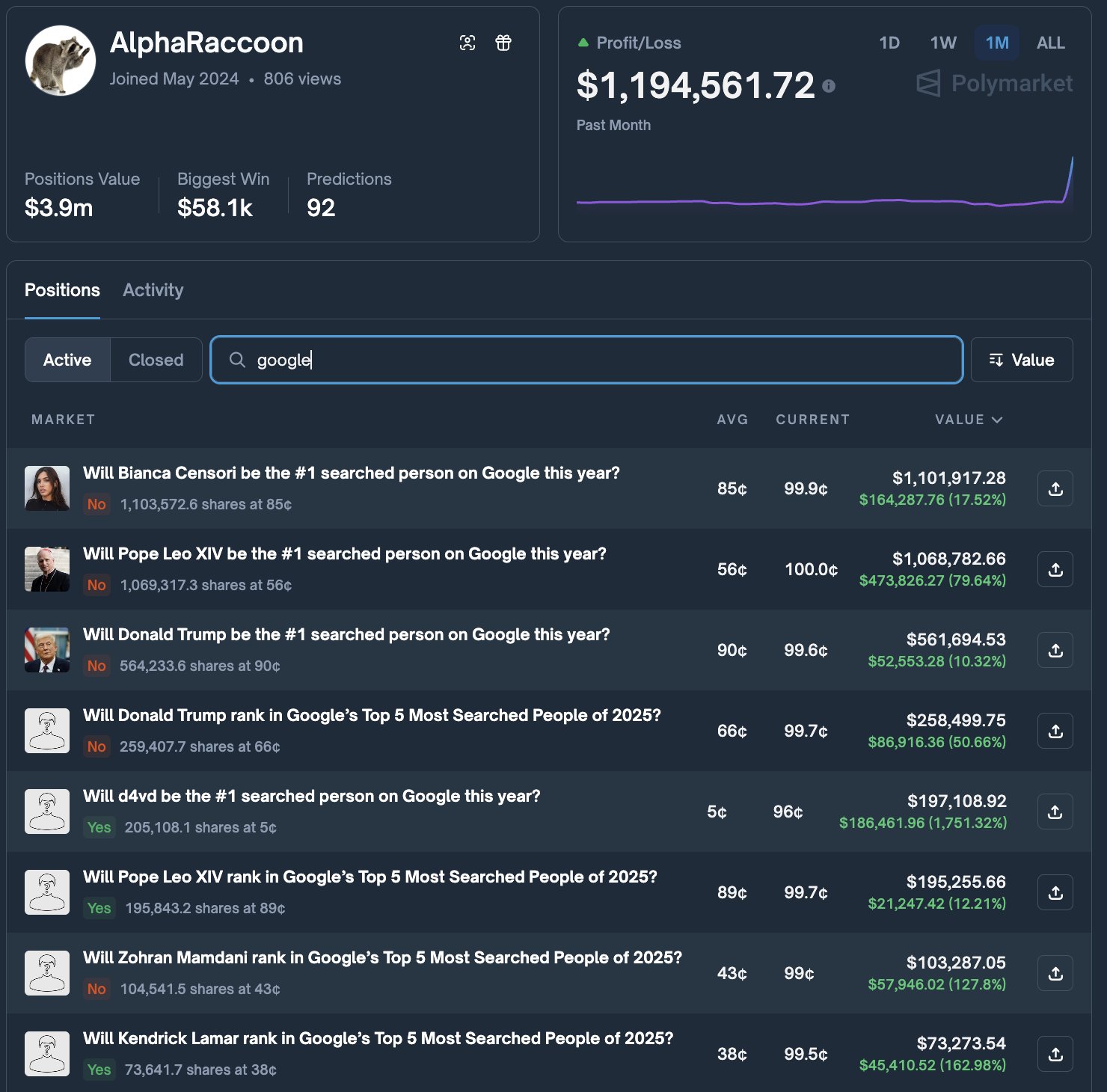

High win-rate accounts and AI-driven bots in crypto prediction markets are fueling suspicions of insider trading by demonstrating unnatural success patterns that suggest access to non-public information or advanced automation. For example, a Polymarket user known as AlphaRaccoon reportedly generated over $1 million in profits from 22 winning bets out of 23, including accurate predictions on Google search trends and the early release of Gemini 3.0, as noted by crypto investor Haeju in public discussions. This level of consistency, far beyond typical retail trading, points to potential insider knowledge.

Similarly, another user, ilovecircle, amassed more than $2.2 million over two months with a 74% win rate across politics, sports, and cryptocurrency bets, which prediction market trader Archive attributes to the likely use of machine learning models for cross-niche arbitrage and automated trading. Such bots leverage vast datasets to identify edges, but when combined with perfect or near-perfect streaks, they erode trust in the platform’s fairness. 10x Research emphasizes that many crypto trading venues historically operated internal market-making desks to profit from retail flows, a practice that could parallel these sophisticated accounts. Data from Polymarket shows overall volumes surging, with crypto-specific events like BNB reaching $1,500 by December 31, 2025, trading at just $0.01 for “yes” shares—offering a potential 100x return versus a 1.65x spot gain from current levels.

Polymarket volume, right-hand-side price, Bitcoin left-hand-side price. Source: 10x Research

While these markets democratize speculation, the influx of quantitative traders using AI tools highlights regulatory gaps. Experts like those at 10x Research warn that without oversight, insider trading could deter retail participation, mirroring issues in traditional finance. Platforms must implement better transparency measures, such as on-chain auditing of bets, to maintain integrity. As volumes grow—Polymarket alone has seen billions in activity—balancing innovation with fairness becomes crucial for the sector’s sustainability.

Frequently Asked Questions

What Advantages Do Crypto Prediction Markets Have Over Holding Spot Cryptocurrencies?

Crypto prediction markets offer leveraged exposure to specific events, potentially delivering returns like 100x on low-priced shares, far surpassing the linear gains from spot holdings, such as 1.65x for BNB reaching $1,500. They allow targeted speculation without owning the asset, but require accurate event forecasting based on available data.

Are AI Bots Causing Unfair Advantages in Crypto Prediction Markets?

Yes, AI bots in crypto prediction markets like Polymarket provide edges through automated arbitrage across niches, achieving win rates up to 74% as seen with high-profile accounts. This automation processes real-time data faster than humans, but raises fairness concerns when it borders on manipulative practices akin to insider trading.

BTC poised for December recovery on ‘macro tailwinds,’ Fed rate cut: Coinbase

For quantitative traders, prediction markets can offer asymmetric payoffs that compare favorably with the upside on underlying spot tokens, the report suggested.

BitMine buys $199M in Ether as smart money traders bet on ETH decline

However, some prediction market accounts are showing concerning signs of insider trading, particularly a newly emerged account that made over $1 million in a single day by betting on Google search trends.

Polymarket user ‘AlphaRaccoon’ generated $1 million by successfully winning 22 out of 23 placed bets, according to crypto investors Haeju.

“This isn’t a lucky streak. He previously made $150K+ predicting the early release of Gemini 3.0 before results were out,” he wrote in a Thursday X post.

Source: haeju.eth

Others are employing artificial intelligence bots to increase their chances of winning.

Polymarkt user “ilovecircle” earned over $2.2 million during the past two months, boasting a 74% win rate through bets encompassing politics, sports and cryptocurrency.

The user’s volume and winning consistency “almost guarantees” that it is employing a machine learning (ML) model for “cross-niche arbitrage and auto trading,” wrote prediction market trader Archive, in a Sunday X post.

Magazine: Train AI agents to make better predictions… for token rewards

Key Takeaways

- Superior Returns Potential: Crypto prediction markets enable outsized gains through event-specific bets, outpacing spot crypto holdings by offering leveraged exposure to outcomes like price targets.

- Insider Trading Risks: Accounts with 100% win rates, such as AlphaRaccoon’s $1 million day, suggest non-public information advantages, undermining market trust.

- AI’s Growing Role: Bots achieving 74% success rates highlight the need for regulatory safeguards to ensure fair play in these decentralized platforms.

Conclusion

Blockchain-based crypto prediction markets are reshaping speculation by delivering higher upside than traditional spot holdings, yet the emergence of suspicious high win-rate accounts and insider trading concerns from AI bots demands greater scrutiny. As platforms like Polymarket see surging volumes in Bitcoin and altcoin events, fostering transparency will be key to attracting ethical participation. Traders should stay informed on these developments to navigate opportunities while mitigating risks in this evolving landscape.

Comments

Other Articles

Bitwise Files for 11 Altcoin ETFs Including AAVE, UNI Amid SOL, XRP Muted Gains

December 31, 2025 at 08:47 PM UTC

Ethereum Stablecoins Reach 2025 Peaks Led by USDT, Amid Sustained Activity

December 31, 2025 at 07:01 PM UTC

Ethereum Could Target $8,500 as Bullish Momentum Builds Near $4,811

December 31, 2025 at 02:39 PM UTC