Pump.fun Co-Founder Disputes $436M USDC Transfers as Routine PUMP Treasury Operations

SOL/USDT

$4,203,361,175.30

$82.37 / $77.12

Change: $5.25 (6.81%)

-0.0056%

Shorts pay

Contents

Pump.fun’s USDC transfers involve routine treasury management, not a massive off-ramp. The co-founder clarified that over $436 million in stablecoins from the PUMP ICO were simply redistributed to internal wallets for business reinvestment, countering misinformation from blockchain analytics reports.

-

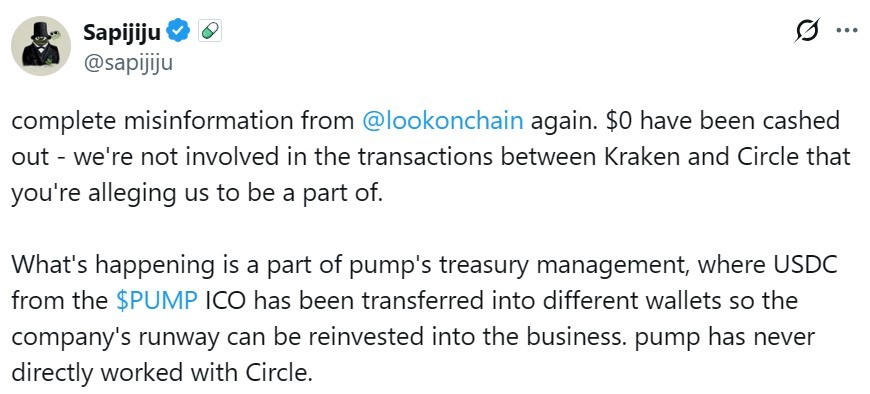

Pump.fun co-founder Sapijiju denied any selling activity, emphasizing the moves as standard treasury operations.

-

Transfers totaled $436 million in USDC to Kraken since mid-October, but funds remain unsold.

-

Pump.fun holds $855 million in stablecoins and $211 million in SOL, per data from DefiLlama, Arkham, and Lookonchain.

Pump.fun USDC transfers spark controversy: Co-founder debunks off-ramp claims as treasury management. Learn the facts behind the $436M moves and what it means for memecoin investors. Stay informed on Solana trends.

What Are the Pump.fun USDC Transfers?

Pump.fun USDC transfers refer to the movement of over $436 million in stablecoins from project-linked wallets to the Kraken exchange since mid-October. According to Pump.fun co-founder Sapijiju, these actions are part of routine treasury management and not an indication of selling pressure. The funds originated from the PUMP token’s initial coin offering and were redistributed to internal wallets to support ongoing business operations and reinvestment.

Why Did Lookonchain Report These Movements as a Potential Off-Ramp?

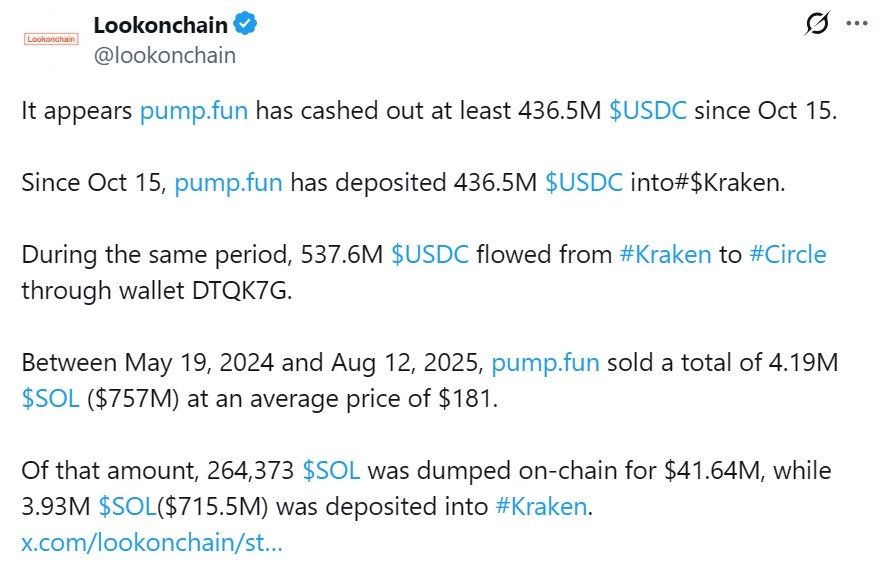

Blockchain analytics firm Lookonchain flagged the transfers as a possible large-scale cash-out, raising concerns among the crypto community about impending market dumps. This interpretation gained traction amid Pump.fun’s monthly revenue dropping to $27.3 million in November, the lowest since July, based on DefiLlama data. However, Sapijiju countered this in an X post, labeling the claims as “complete misinformation” and clarifying that the USDC was not sold but reallocated for treasury purposes. Research analyst Nicolai Sondergaard from Nansen noted that such moves could signal further activity, yet others like EmberCN attributed the funds to institutional private placements of the PUMP token, avoiding any active selling narrative.

Source: Sapijiju

Fund Movement Sparked Fears of Selling Pressure

The sequence of USDC transfers aligned with broader market jitters in the memecoin sector, where Pump.fun operates as a prominent Solana-based launchpad. Despite the revenue dip, on-chain data from platforms like DefiLlama, Arkham, and Lookonchain reveal substantial holdings: over $855 million in stablecoins and $211 million in SOL remain in tagged wallets. This liquidity underscores the project’s financial stability, even as external analyses initially painted a picture of distress.

Source: Lookonchain

Related: Memecoin market sinks to 2025 low as $5B wiped out in a day

Community Split Between Skepticism, Defense and Calls for Audits

Reactions within the crypto community have been polarized following Sapijiju’s clarification. Critics highlighted perceived inconsistencies in the co-founder’s statement, particularly around the project’s involvement in the transfers versus treasury oversight. For instance, X user Voss pointed out what they saw as a self-contradiction in the 10-hour delayed response, questioning the transparency of the process.

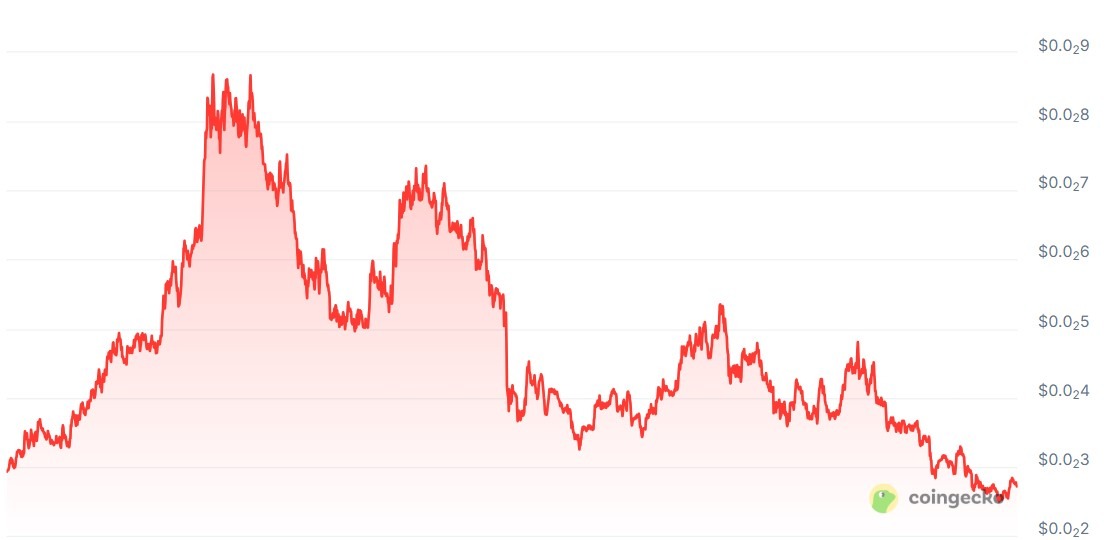

Others, like user EthSheepwhale, went further by dismissing the explanation outright and accusing Pump.fun of price manipulation through airdrops, noting the PUMP token’s current trading price of $0.002714—down 32% from its ICO level of $0.004 and nearly 70% from its September peak of $0.0085, according to CoinGecko data.

Pump.fun price chart. Source: CoinGecko

On the supportive side, voices like Matty.Sol defended the project’s autonomy, arguing that revenue and ICO proceeds can be deployed as the team sees fit without wrongdoing. User Oga NFT echoed this by normalizing post-ICO USDC movements among legitimate projects and shifting focus to verifying whether reserves adequately back the circulating supply. This divide highlights ongoing demands for greater transparency, such as independent audits, to rebuild trust in Pump.fun’s operations.

Sapijiju further emphasized that Pump.fun has never directly partnered with Circle, the issuer of USDC, reinforcing that the transfers were internal and not tied to any external redemption or off-ramping. Treasury management, in this context, involves allocating ICO proceeds, operating capital, and reserves to sustain development and runway. Such practices are standard in the crypto space to prepare for future budgets without implying liquidation.

The pseudonymous co-founder’s rebuttal aims to quell fears exacerbated by the timing of the moves, which overlapped with a memecoin market downturn. As Pump.fun continues to navigate these challenges, its substantial holdings provide a buffer, but community calls for audits could shape future perceptions of accountability in decentralized projects.

Magazine: Bitcoin whale Metaplanet ‘underwater’ but eyeing more BTC: Asia Express

Frequently Asked Questions

What Triggered the Claims of a $436 Million Off-Ramp by Pump.fun?

Blockchain analytics from Lookonchain detected $436 million in USDC moving from Pump.fun-linked wallets to Kraken since mid-October, interpreted by some as a cash-out amid falling revenues. Co-founder Sapijiju refuted this, stating the funds were ICO proceeds redistributed for treasury management, not sold.

How Does Pump.fun Manage Its Treasury After the PUMP ICO?

Pump.fun handles treasury operations by transferring USDC from ICO sources into various internal wallets to fund business growth and extend runway. This includes wallet reorganization and budgeting for developments, ensuring operational continuity without direct involvement from issuers like Circle.

Key Takeaways

- No Evidence of Selling: Sapijiju confirmed the USDC transfers as internal treasury actions, with no funds liquidated on exchanges.

- Strong Holdings Intact: Despite revenue drops to $27.3 million in November, Pump.fun retains $855 million in stablecoins and $211 million in SOL per multiple data sources.

- Transparency Push: Community advocates for audits to verify reserves and build confidence in post-ICO fund handling.

Conclusion

The Pump.fun USDC transfers controversy underscores the importance of clear communication in Pump.fun treasury management, especially amid memecoin volatility. While initial reports from firms like Lookonchain fueled off-ramp fears, the co-founder’s explanation highlights routine operations backed by robust holdings. As the project moves forward, enhanced transparency could mitigate skepticism and support sustained growth in the Solana ecosystem—investors should monitor on-chain data for ongoing developments.

Comments

Other Articles

Bitwise Files for 11 Altcoin ETFs Including AAVE, UNI Amid SOL, XRP Muted Gains

December 31, 2025 at 08:47 PM UTC

Bitwise’s Bitcoin-Topped Crypto Index Fund Shifts to NYSE Arca Amid Institutional Inflows

December 9, 2025 at 06:27 PM UTC

Dogecoin ETFs Hit Lowest Trading Volume Since Launch, Hinting at Fading Interest

December 9, 2025 at 12:54 PM UTC