Pump.fun Revenue Falls 50% After Crypto Crash, Raising Solana Selling Pressure Concerns

SOL/USDT

$4,203,361,175.30

$82.37 / $77.12

Change: $5.25 (6.81%)

-0.0056%

Shorts pay

Contents

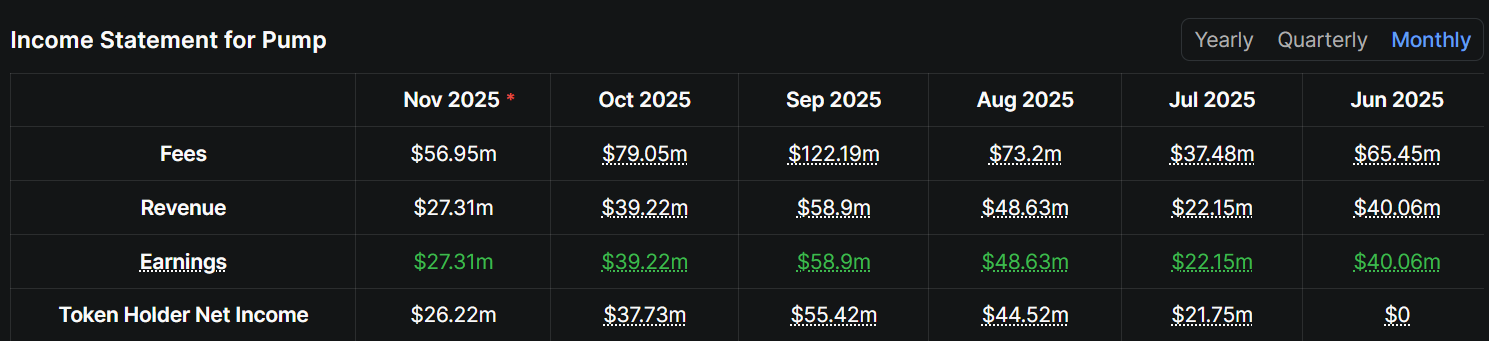

Pump.fun’s revenue has declined by 53% to $27.3 million in November from September’s $58.9 million, following a $19 billion crypto market crash in October that reduced speculative investor interest in memecoins. The platform has transferred $436 million in USDC to Kraken since mid-October, indicating cash-outs amid falling trading activity.

-

Pump.fun’s monthly revenue dropped below $40 million for the first time since July 2025.

-

The Solana-based memecoin launchpad saw trading activity slow after the October market downturn accelerated a pre-existing decline in memecoin enthusiasm.

-

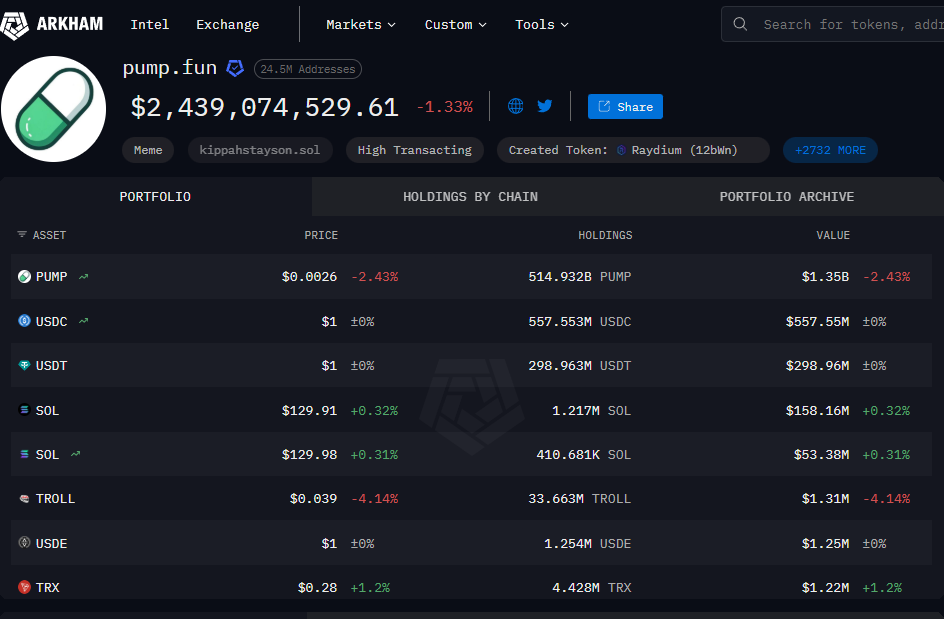

Blockchain data shows the platform’s wallet holds $855 million in stablecoins and $211 million in Solana tokens, with $436 million already moved to an exchange.

Pump.fun revenue falls 50% post-October crash: Explore the $436M cash-out and memecoin market pressures. Stay informed on crypto trends and investment risks today.

What is happening with Pump.fun’s revenue after the 2025 crypto market crash?

Pump.fun’s revenue has experienced a significant downturn, falling 53% to $27.3 million in November 2025 from $58.9 million in September, driven by reduced speculative trading in memecoins following the October market crash. The platform, a popular Solana-based launchpad for memecoins, has also transferred over $436 million in USDC stablecoins to the Kraken exchange since October 15, suggesting operators are liquidating holdings amid waning investor appetite. This shift highlights broader challenges in the volatile memecoin sector.

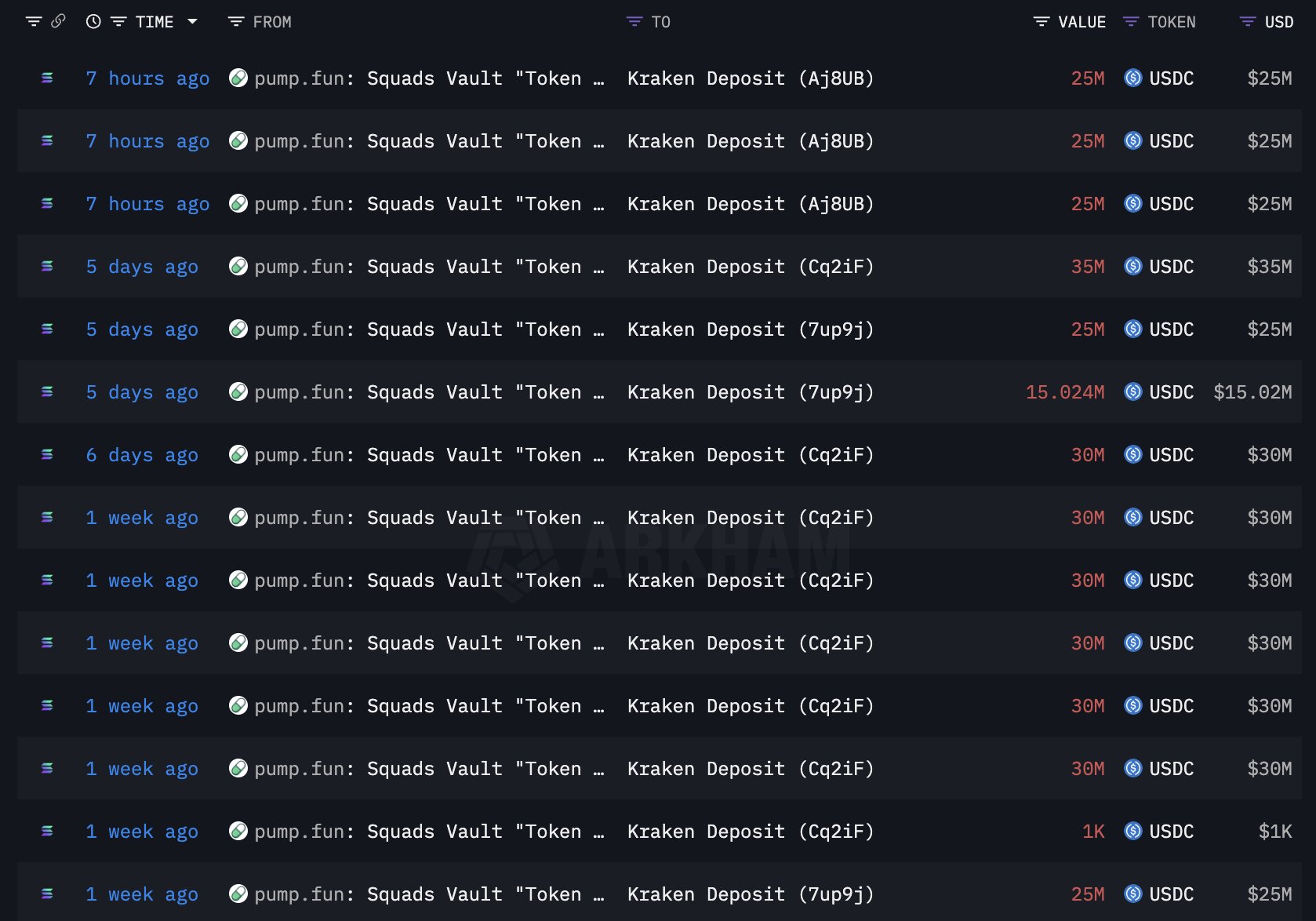

Memecoin launchpad Pump.fun has generated substantial earnings since its inception but now faces headwinds from market dynamics. According to data from blockchain analytics platform Lookonchain, the transfers began shortly after the $19 billion crypto market crash in October 2025, which throttled overall trading activity and particularly impacted high-risk memecoin investments. This cash-out move, totaling more than $436 million in stablecoins, has raised questions about the platform’s future strategy and its influence on market sentiment.

Source: Lookonchain

The decline in revenue is not isolated; it reflects a broader trend in the cryptocurrency space where speculative fervor has cooled. Pump.fun’s model relies heavily on the rapid creation and trading of memecoins, which surged in popularity earlier in 2025 but have since faltered. Monthly revenue dipped below $40 million for the first time since July 2025, underscoring the platform’s vulnerability to market corrections. Data from DeFiLlama indicates this 53% drop from September levels, painting a picture of a platform adapting to reduced user engagement.

Pump.fun, monthly earnings and revenue. Source: DeFiLlama.com

Efforts to understand the motivations behind these transfers have yielded limited official responses. When approached for comment on the cash-outs and potential future liquidations, a Pump.fun spokesperson indicated that the relevant team is reviewing the matter and will provide a statement when available. This opacity has fueled speculation among investors, though blockchain transparency offers some insights into the platform’s actions.

How has the October 2025 crypto crash impacted memecoin trading on Pump.fun?

The $19 billion market crash in October 2025 acted as a catalyst, accelerating an already downward trend in memecoin trading activity on Pump.fun. Prior to the event, retail investors had faced repeated losses from volatile memecoin plays, leading to a gradual pullback in participation. Nicolai Sondergaard, a research analyst at crypto intelligence firm Nansen, noted that the crash “accelerated” this slowdown, stating, “Retail got burned repeatedly over the past few months, so the drop-off we’re seeing now is a continuation of that.”

This expert perspective aligns with observable data: trading volumes on Pump.fun plummeted post-crash, contributing directly to the revenue slump. Memecoins, known for their speculative nature, thrive on hype but crumble under sustained market pressure. Sondergaard further observed that reports of large sell-offs from Pump.fun are not new, suggesting, “This also isn’t the first time we’ve seen reports of large sell-offs from Pump.fun, so it wouldn’t be surprising if they continued selling from their holdings.” Such actions could exacerbate selling pressure across the Solana ecosystem, where Pump.fun operates.

Blockchain data from platform Arkham reveals that despite the $436 million transfer, Pump.fun’s associated wallet still retains substantial assets: approximately $855 million in stablecoins and $211 million in Solana (SOL) tokens. Onchain analyst EmberCN analyzed these movements, concluding that the transfers likely represent withdrawals from earlier institutional private placements of the $PUMP token, sold in June 2025 at $0.004 per token, rather than an outright sell-off. This nuance suggests strategic liquidity management rather than panic selling, though it hasn’t quelled concerns among the community.

Pump.fun wallet address, holdings. Source: Arkham

Crypto investor SK echoed widespread sentiment in a public post on X, describing Pump.fun as “moving like a full-time liquidation machine while everyone else is out here ‘buying dips’ that never stop dipping.” This criticism highlights the disconnect between platform operators cashing out and retail investors holding through downturns. Overall, the crash has exposed the fragility of memecoin ecosystems, with Pump.fun’s experience serving as a case study in how external market shocks ripple through niche sectors.

Beyond immediate revenue impacts, the event underscores evolving dynamics in cryptocurrency markets. Institutional involvement in memecoins, once a growth driver, now appears to be recalibrating amid risk aversion. Data from various analytics platforms, including Nansen and Arkham, consistently show a contraction in speculative activity since October 2025, with daily launches on Pump.fun decreasing by over 40% compared to peak months. This trend could signal a maturation of the memecoin space or, alternatively, a temporary lull awaiting renewed hype.

Regulatory scrutiny and macroeconomic factors also play roles. As central banks tighten policies in 2025, risk assets like memecoins face heightened volatility. Pump.fun’s operators, by transferring funds to a major exchange like Kraken, may be positioning for diversified investments or operational needs, but the timing invites skepticism. Financial experts emphasize the importance of diversified portfolios in such environments, warning that over-reliance on speculative platforms can lead to amplified losses during corrections.

Frequently Asked Questions

What caused Pump.fun’s 53% revenue drop in November 2025?

The revenue decline to $27.3 million stemmed from reduced memecoin trading activity following the October 2025 crypto market crash, which wiped out $19 billion in value and dampened speculative investor interest. Pre-existing trends of retail investor fatigue from prior losses further contributed, as reported by analytics from DeFiLlama and Nansen.

Why did Pump.fun transfer $436 million in USDC to Kraken after the crash?

The transfers, starting a week after the October crash, likely represent withdrawals from institutional token placements rather than immediate sales, according to onchain analysis. This move provided liquidity amid falling revenues, with the platform’s wallet still holding over $1 billion in assets as of late 2025.

Key Takeaways

- Revenue Vulnerability: Pump.fun’s business model is highly sensitive to market sentiment, with a 53% drop illustrating the risks of speculative sectors like memecoins.

- Cash-Out Strategy: The $436 million transfer to Kraken signals proactive liquidity management, but it has sparked concerns over potential additional selling pressure on Solana-based assets.

- Market Maturation: Declining retail participation post-crash suggests a shift toward more sustainable crypto investments; investors should monitor onchain data for early warning signs.

Conclusion

Pump.fun’s revenue decline and substantial cash-outs in late 2025 highlight the ongoing volatility in the memecoin and broader crypto markets following the October crash. With trading activity slowed and speculative appetite waning, platforms like Pump.fun must navigate these pressures carefully. As the sector evolves, staying informed on blockchain trends and expert analyses from firms like Nansen and Arkham will be crucial for investors seeking to mitigate risks in this dynamic landscape—consider reviewing your portfolio strategies today for long-term resilience.