PUMP Token May Extend Declines Amid Pump.fun Lawsuit and Bearish Indicators

XRP/USDT

$2,480,132,667.31

$1.3653 / $1.27

Change: $0.0953 (7.50%)

-0.0099%

Shorts pay

Contents

A federal court has approved an expanded class-action lawsuit against Pump.fun and related entities over allegations of insider trading and market manipulation, leading to massive investor losses estimated at $4-5.5 billion. The PUMP token has dropped 39.3% since December 9, 2025, amid heightened legal scrutiny.

-

Pump.fun faces serious legal challenges from a whistleblower’s revelation of internal messages suggesting unfair practices.

-

The platform is criticized for enabling 98.6% of launched memecoins to fail, wiping out retail investments.

-

PUMP token price analysis shows bearish trends, with a 39.3% decline and potential support breaks, backed by technical indicators like CMF below -0.05.

Pump.fun lawsuit escalates with court approval for class action against Solana Foundation and executives. Discover PUMP token price impacts and trading insights in this detailed analysis. Stay informed on crypto legal risks today.

What is the Pump.fun lawsuit about?

The Pump.fun lawsuit centers on allegations of insider trading and market manipulation by the memecoin launch platform’s team. A federal court recently approved an expanded class-action suit involving the Solana Foundation, Jito Labs, Pump.fun, and its executives, following a whistleblower’s disclosure of 5,000 internal chat messages. These documents reportedly highlight practices that disadvantaged retail investors, contributing to significant financial losses across the ecosystem.

How has the Pump.fun lawsuit affected the PUMP token price?

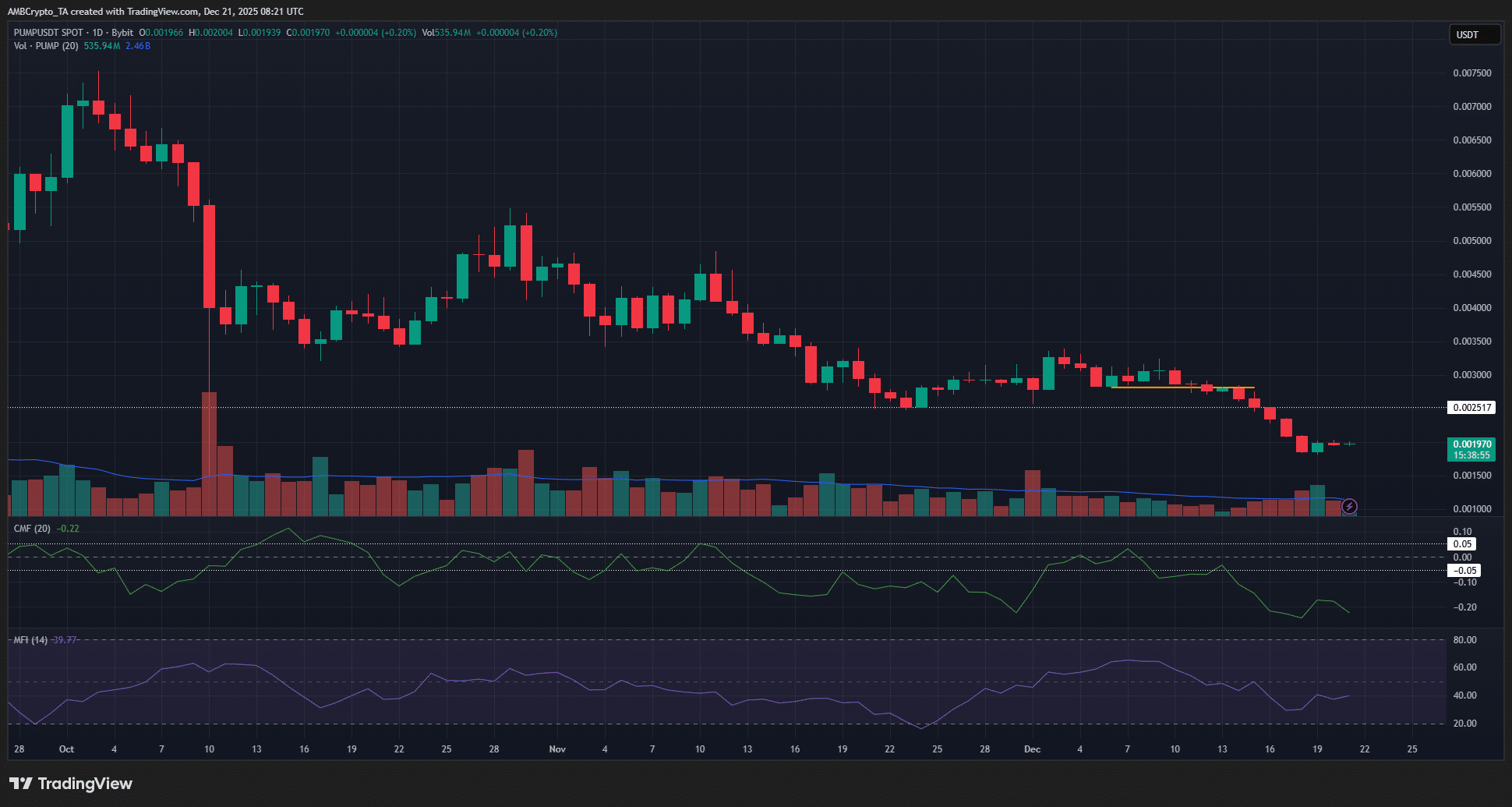

The lawsuit has intensified bearish pressure on the PUMP token price, which has fallen 39.3% from $0.0032 to $0.00196 since December 9, 2025. Technical analysis from TradingView indicates the token breached a key support at $0.0025, tested multiple times since July but ultimately overcome by sustained selling. The Chaikin Money Flow (CMF) on the daily chart remains below -0.05, signaling strong seller dominance over the past six weeks, while the Money Flow Index (MFI) at 40 underscores ongoing bearish momentum. Industry experts, including analysts from CoinGlass, note that such legal developments often erode investor confidence in utility tokens tied to controversial platforms, leading to accelerated sell-offs.

Investigating the most recent PUMP price moves

The PUMP token, native to the Pump.fun ecosystem, has experienced sharp declines amid the unfolding legal saga. Data from TradingView reveals a consistent downtrend, with the token losing its long-held support level at $0.0025. This zone, defended three times since July 2025, could not withstand the intensified selling pressure triggered by the lawsuit news.

Source: PUMP/USDT on TradingView

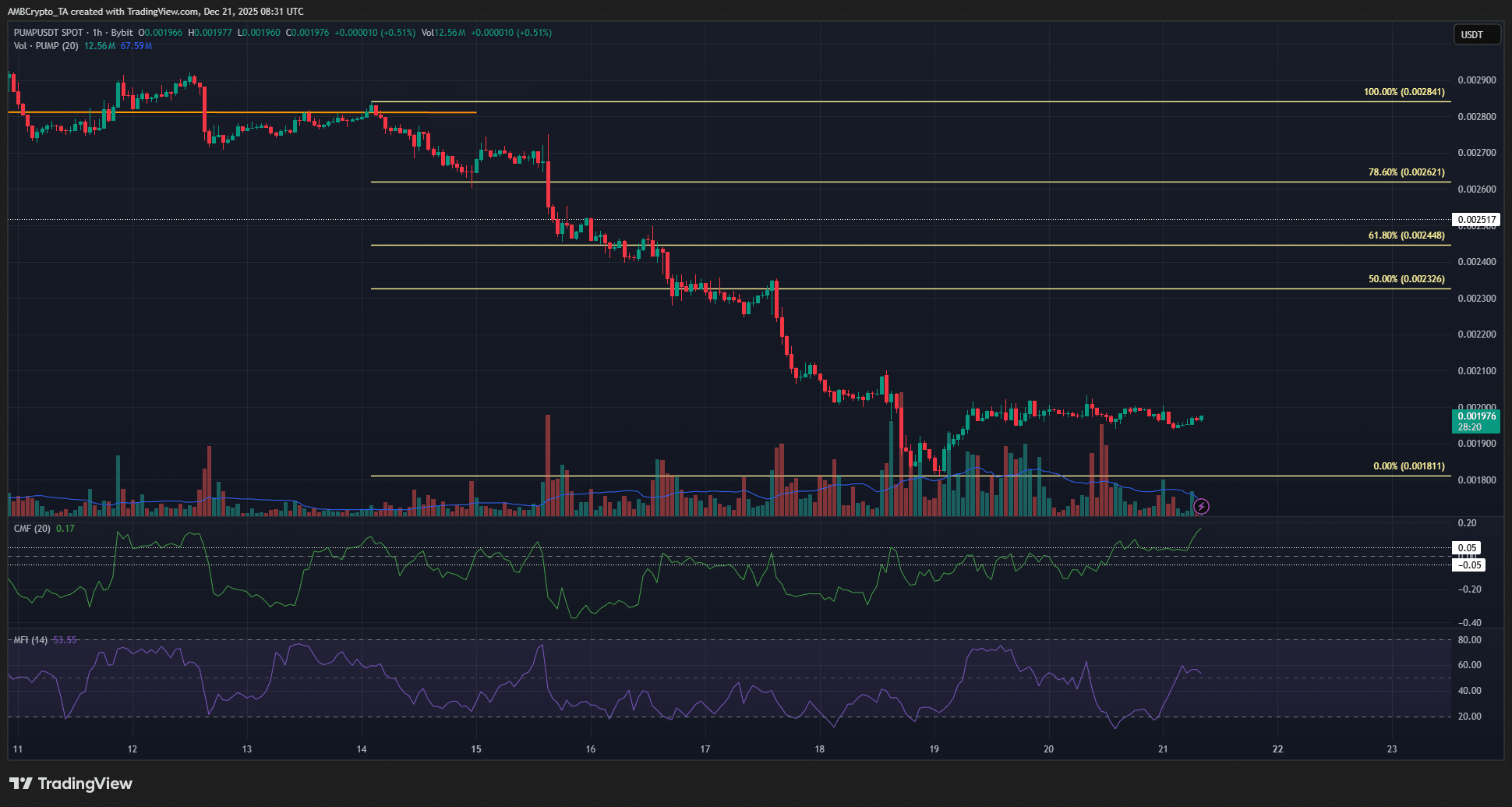

In the shorter term, the one-hour chart further illustrates the bearish structure. Fibonacci retracement levels applied to the latest swing low suggest potential bounces to $0.0025 or $0.0026, corresponding to the 61.8% and 78.6% levels. However, the overall market sentiment remains cautious, influenced by the platform’s operational controversies.

Source: PUMP/USDT on TradingView

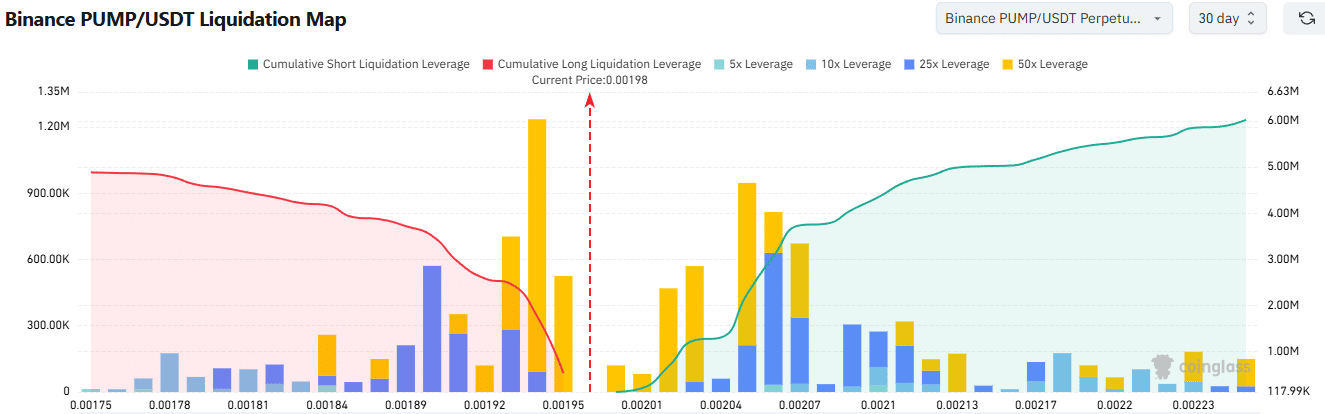

Broader market data from CoinGlass highlights a 4% rise in open interest over the last 24 hours, despite a 1.57% price drop. This divergence indicates growing trader participation, potentially amplifying volatility. The Liquidation Map identifies $0.00193 and $0.00207 as critical levels where leveraged positions are concentrated, which could drive short-term price swings toward these zones before any reversal.

Source: CoinGlass

What is PUMP likely to do next?

Current price structures on both daily and hourly timeframes point to continued bearish bias for the PUMP token price. The interplay of legal risks and technical indicators suggests limited upside potential in the near term. According to on-chain analytics from platforms like CoinGlass, the increase in open interest amid falling prices often precedes further liquidations, exacerbating downward moves. Legal experts monitoring the case, as cited in court filings, emphasize that whistleblower evidence could prolong the uncertainty, deterring new investments.

Retail investors have reportedly suffered between $4 billion and $5.5 billion in losses, with 98.6% of the 14 million memecoins launched on Pump.fun collapsing to zero value. This statistic, derived from platform data reviewed in the lawsuit, underscores the high-risk nature of such ecosystems. Financial regulators have taken note, with statements from the U.S. Securities and Exchange Commission (SEC) highlighting the need for greater transparency in decentralized finance projects.

Frequently Asked Questions

What caused the expanded class-action lawsuit against Pump.fun?

The lawsuit stems from a whistleblower’s release of 5,000 internal chat messages alleging insider trading and market manipulation by Pump.fun executives and affiliates like the Solana Foundation and Jito Labs. Filed in federal court, it claims the platform’s design favored insiders, leading to widespread retail losses estimated at billions. The court’s approval expands the plaintiff class to include affected investors globally.

Is the PUMP token a good investment right now?

Given the ongoing lawsuit and bearish technical signals, the PUMP token faces significant downside risks. Traders should monitor key levels like $0.00207 for potential short opportunities, but always with strict risk management. Consulting licensed financial advisors is recommended before any investment decisions in volatile assets like memecoin tokens.

Key Takeaways

- Pump.fun’s legal troubles intensify bearish sentiment: The approved class-action suit, backed by internal communications, has eroded trust and driven PUMP prices down 39.3% since early December 2025.

- Technical indicators confirm seller dominance: CMF below -0.05 and MFI at 40 on daily charts signal ongoing pressure, with broken support at $0.0025 increasing reversal risks.

- Traders should prepare for volatility: Watch $0.00193-$0.00207 liquidation zones for price swings; consider short positions on resistance retests with tight stops above $0.0021.

Conclusion

The Pump.fun lawsuit and its ripple effects on the PUMP token price highlight the vulnerabilities in the memecoin sector, where rapid innovation often outpaces regulatory oversight. As the case progresses, investors must prioritize due diligence to navigate these turbulent waters. Looking ahead, clearer legal frameworks could foster a more stable crypto environment—stay vigilant and informed on developments in decentralized platforms.

Traders’ call to action- Maintain bearish bias but…

A move toward $0.00207–$0.0021 could signal bearish continuation for PUMP. However, Fibonacci analysis indicates possible bounces to $0.0026, so resistance at $0.0023-$0.0025 warrants caution. Short entries on retests of these levels, with stop-losses above local highs like $0.0021, offer strategic opportunities amid the downtrend.

Final Thoughts

- The Pump.fun platform’s legal woes have strengthened the bearish sentiment around its native token.

- The $0.00207 and $0.0023 supply zones are short-term resistances that could initiate the next bearish price move.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.