Q3 Crypto VC Funding Hits $4.65B, Led by Revolut Amid Bitcoin ETF Shifts

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

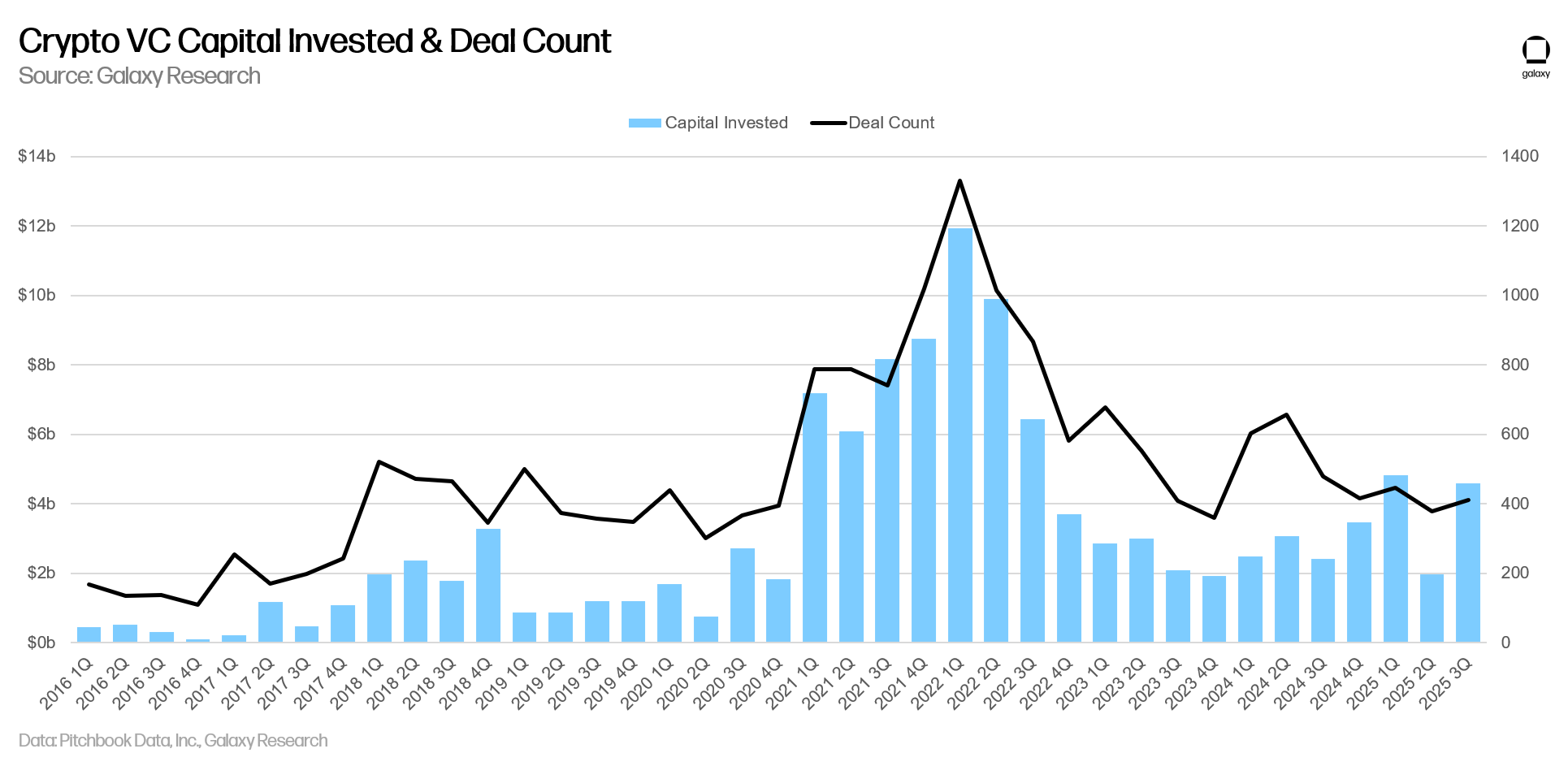

Crypto venture capital investment surged to $4.65 billion in Q3 2025, marking the second-highest level since the FTX collapse in late 2022. This 290% quarter-on-quarter increase highlights renewed interest in sectors like stablecoins, AI, and blockchain infrastructure, driven by major deals including Revolut’s $1 billion raise.

-

Seven major deals accounted for half of Q3’s total funding, with Revolut securing $1 billion.

-

Overall, 414 deals were completed, showing a healthy pipeline despite maturing industry dynamics.

-

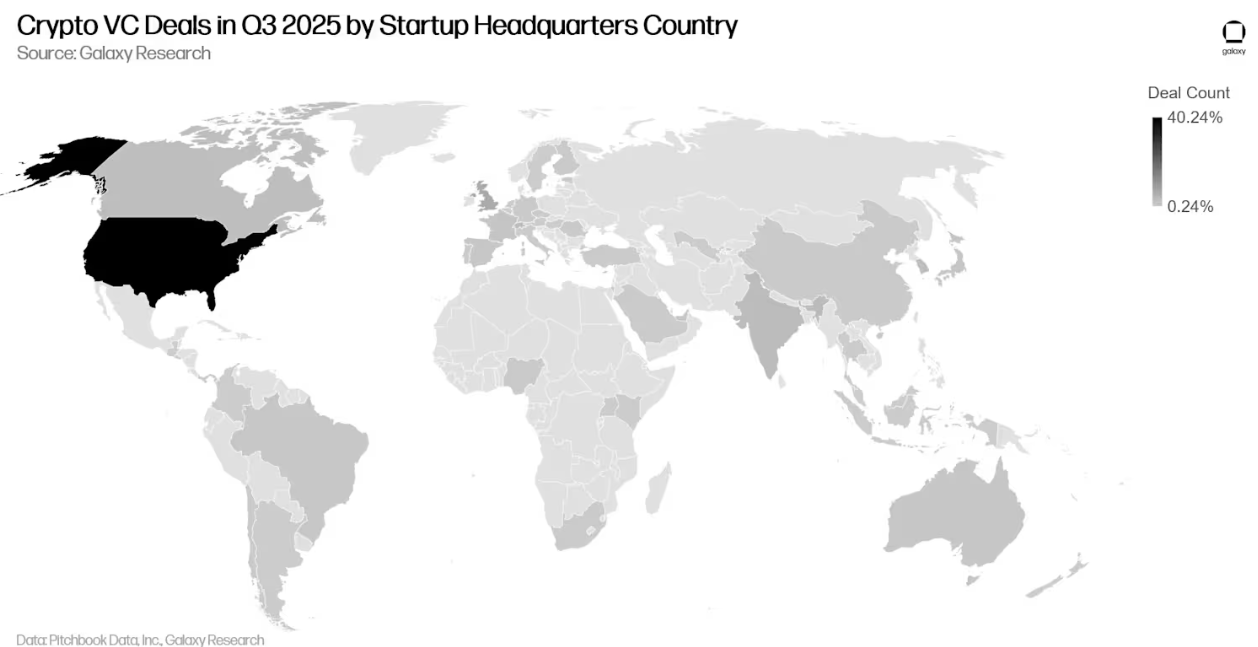

The US dominated with 47% of capital invested, followed by the UK at 28%, per Galaxy Digital’s analysis.

Crypto venture capital hit $4.65B in Q3 2025, second-highest post-FTX. Discover key deals, trends, and US dominance driving blockchain growth. Stay ahead—explore now!

What drove the surge in crypto venture capital investment in Q3 2025?

Crypto venture capital investment in Q3 2025 reached $4.65 billion, a 290% increase from the previous quarter and the highest since Q1’s $4.8 billion. According to a report from Galaxy Digital’s head of research, Alex Thorn, this rebound reflects active interest in stablecoins, AI integration, blockchain infrastructure, and trading platforms. Despite not matching 2021-2022 bull market peaks, the activity signals a healthy recovery post-FTX.

Venture capital funding for blockchain-focused startups has reached the second-highest level of the year. Source: Galaxy Digital

How did deal concentration impact Q3 2025 crypto funding?

A small number of high-value deals dominated Q3 2025, with seven ventures capturing half of the $4.65 billion total. Revolut led with $1 billion, followed by Kraken at $500 million and Erebor at $250 million, as detailed in Galaxy Digital’s quarterly analysis. Overall, 414 deals occurred, but established firms founded around 2018 absorbed most capital, while newer 2024 startups led in deal volume. Thorn notes that pre-seed activity has declined as the sector matures, with traditional players entering and market-fit companies scaling. “Pre-seed deal count as a percentage has trended down consistently as the overall industry has matured,” Thorn stated. This shift indicates a move away from the early-stage frenzy of past cycles.

The post-FTX lull had cooled investments after the exchange’s fraud revelation and bankruptcy in November 2022, but Q3 signals stabilization. Sectors like gaming, NFTs, and Web3 saw waning interest, compounded by AI’s pull on capital and elevated interest rates. However, spot Bitcoin exchange-traded products (ETPs) and corporate crypto treasuries are drawing institutional attention, potentially diverting from early-stage ventures.

In previous cycles, capital invested in cryptocurrency startups has followed the Bitcoin price. Source: Galaxy Digital

Thorn explains that unlike the 2017 and 2021 bull runs, where VC inflows tightly correlated with rising crypto prices, recent years show subdued activity amid price gains. “The venture stagnation is due to a number of factors, such as waning interest in previously hot crypto VC sectors like gaming, NFTs, and Web3; competition from AI startups for investment capital; and higher interest rates, which disincentivize venture allocators broadly,” he added. Large investors, including pension and hedge funds, are opting for liquid Bitcoin ETPs over risky startups. Regulatory headwinds persist, but Thorn anticipates a boost from evolving policies.

Frequently Asked Questions

What was the total crypto venture capital investment in Q3 2025?

In Q3 2025, crypto venture capital investment totaled $4.65 billion across 414 deals, per Galaxy Digital’s report. This figure represents a 290% jump from Q2 and the second-highest quarterly amount since the FTX collapse, with focus on infrastructure and AI-driven blockchain projects.

Which regions led in crypto VC deals during Q3 2025?

The United States topped Q3 2025 crypto VC activity, capturing 47% of invested capital and 40% of deals, according to Galaxy Digital. The United Kingdom followed with 28% of funding, while Singapore held 3.8% of capital and 7.3% of deals. This US lead persists despite past regulatory challenges and is expected to grow under friendlier policies.

The US has historically accounted for the most deals and capital invested, a trend that has continued into Q3 2025. Source: Galaxy Digital

Thorn highlights the US’s historical dominance and predicts further gains with the GENIUS Act in place and potential crypto market structure legislation. “We expect US dominance to increase, particularly now that the GENIUS Act is law and especially if Congress can pass a crypto market structure bill, which would further entice traditional US financial services firms to enter the space in earnest,” he said. Macro factors like interest rates remain hurdles, but the quarter’s performance underscores resilience.

For context, earlier 2025 data shows cumulative crypto funding climbing to $13.6 billion year-to-date, with projections nearing $18 billion by year-end, based on Galaxy Digital’s ongoing tracking.

Key Takeaways

- Major Deals Drove Growth: Seven ventures, including Revolut’s $1 billion raise, secured half of Q3’s $4.65 billion, highlighting concentration in fintech and exchanges.

- Sector Shifts in Focus: Stablecoins, AI, and infrastructure attracted most dollars, while pre-seed stages declined amid industry maturation and competition from AI and ETPs.

- US Leads the Way: With 47% of capital, the US continues to dominate; regulatory advancements could spur even more traditional finance entry.

Conclusion

The Q3 2025 crypto venture capital investment surge to $4.65 billion, as analyzed by Galaxy Digital’s Alex Thorn, demonstrates robust recovery in blockchain and AI-integrated sectors following the FTX fallout. While challenges like regulatory uncertainty and competing asset classes persist, the concentration of deals in established players and US dominance point to sustained momentum. As policies evolve, investors should monitor opportunities in infrastructure and trading innovations to capitalize on this upward trajectory.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

3/1/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/28/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/27/2026

DeFi Protocols and Yield Farming Strategies

2/26/2026