Ray Dalio: The World Has Collapsed, BTC and Gold Are Standing Out

BTC/USDT

$25,688,978,986.00

$71,632.08 / $68,176.47

Change: $3,455.61 (5.07%)

-0.0000%

Shorts pay

Contents

Ray Dalio's Wild Nature Warnings

Ray Dalio stated that the post-World War II order has officially collapsed and the world has entered a power-focused “wild nature” phase. The Bridgewater Associates founder wrote that major powers are facing a prisoner's dilemma in trade, technology, capital flows, and military tensions, and foolish wars can be easily triggered. He emphasized that amid economic stress and wealth inequality, governments are devaluing assets through tax increases and money supply expansion. In this environment, apolitical assets like BTC detailed analysis and gold stand out; crypto advocates argue that demand for assets that can be kept outside state control will increase.

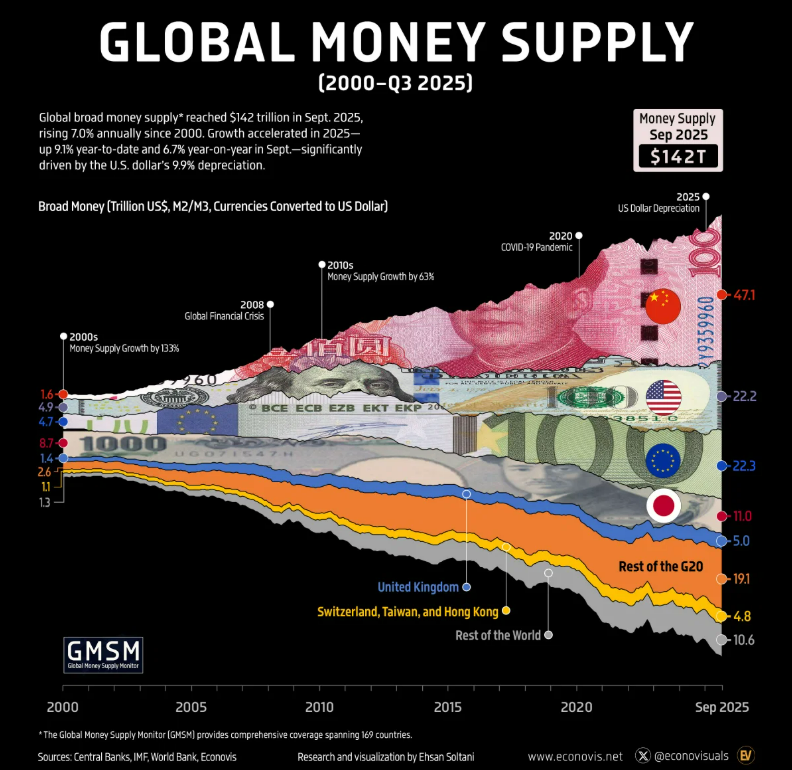

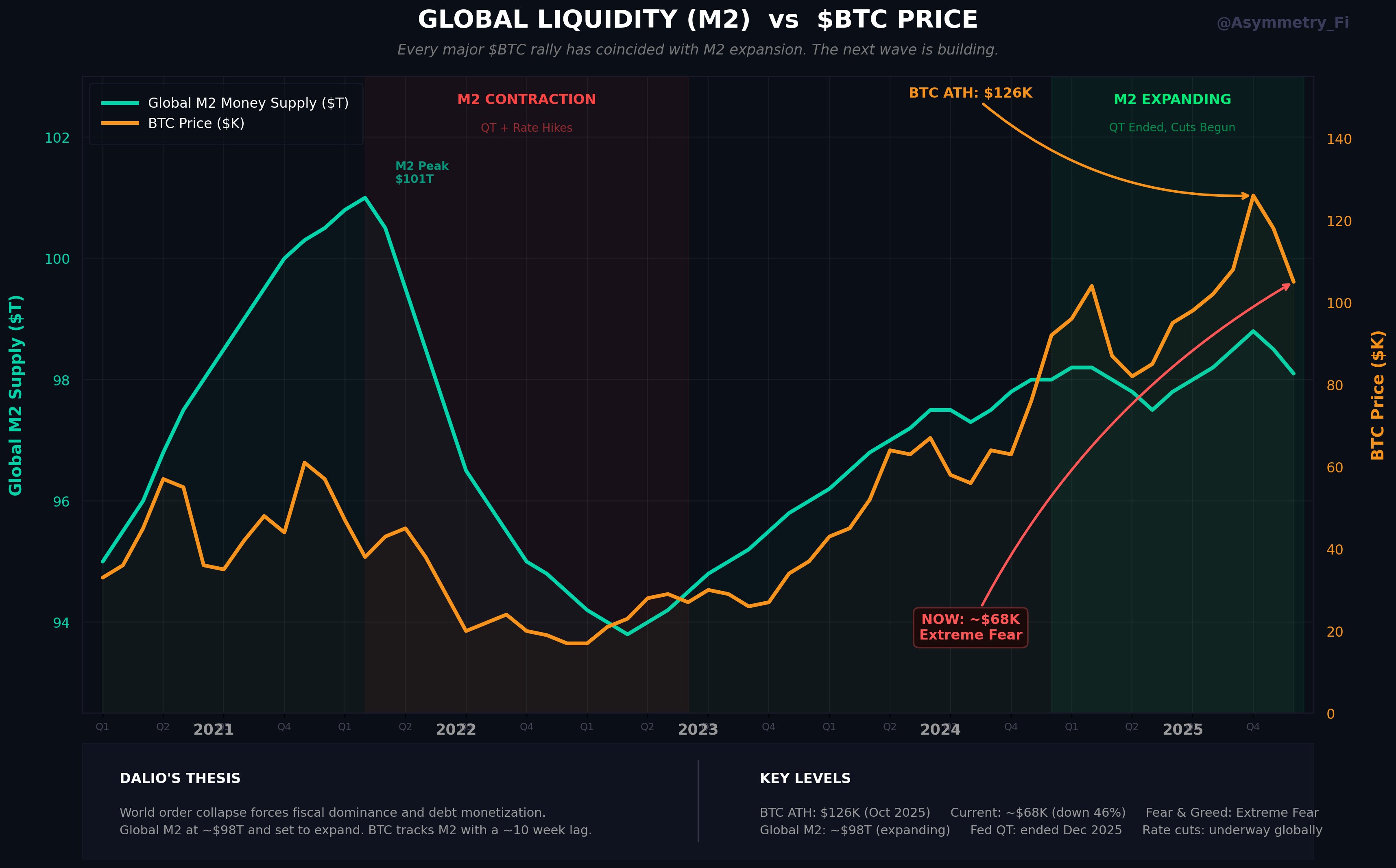

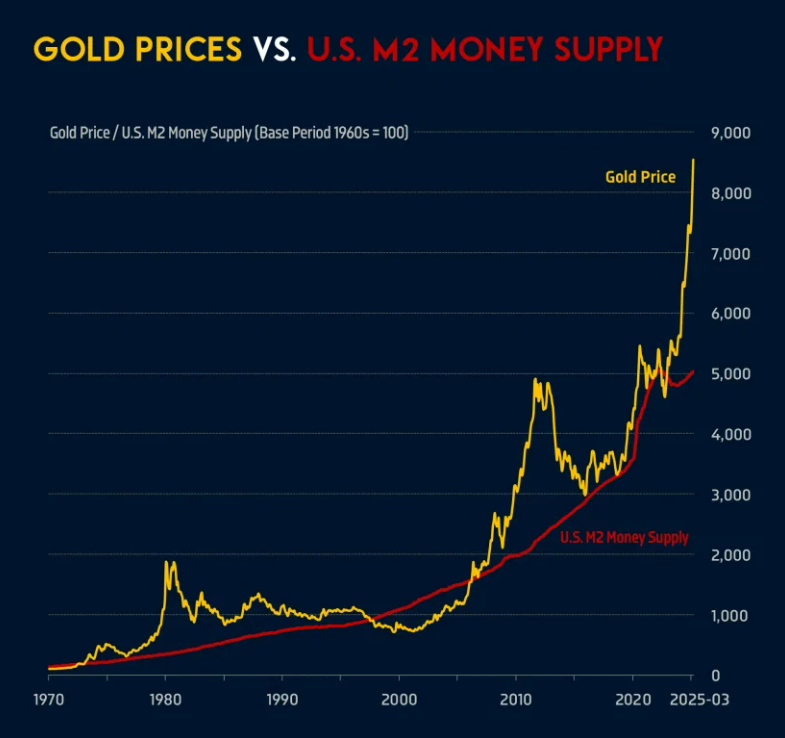

According to Econovis data, global broad money supply rose from 26 trillion dollars in 2000 to 142 trillion dollars in 2025. According to Asymmetry, every major BTC rally coincides with M2 expansion. Gold prices also follow US M2. Dalio's framework indicates that asset freezes and sanctions highlight the risks of traditional savings, potentially increasing the need for global, permissionless, and apolitical money assets, as Bitwise CEO Hunter Horsley said.

Global money supply. Source: Visual Capitalist

M2 vs. BTC price. Source: Asymmetry

Gold price vs. M2 expansion. Source: Visual Capitalist

BTC Technical Outlook and Supports

BTC price at 67.485 USD, down -%2.25 in 24 hours. RSI 35.48 (Oversold), downtrend continues. Strong supports: S1 65.656 USD (%3.94 distance, ⭐ STRONG), S2 60.000 USD. Resistances: R1 70.146 USD (%2.63), R2 78.145 USD. BTC futures should be monitored.

- EMA 20: 73.250 USD

- Supertrend: Bearish

Latest BTC Developments

Metaplanet announced a 619 million USD net loss in BTC valuation but assets reached 35.102 BTC. BTC weekly candle recovered %8 turning positive. NYSE American is listing options for multi-crypto ETFs – signal of increasing institutional demand.