Real Finance Secures $29M for RWA Tokenization as Market Growth Looms

ONDO/USDT

$52,680,768.32

$0.2587 / $0.2398

Change: $0.0189 (7.88%)

-0.0016%

Shorts pay

Contents

Real Finance, a real-world asset (RWA) tokenization network, has raised $29 million in private funding to develop infrastructure for tokenized assets, targeting institutional adoption. The round includes $25 million from Nimbus Capital and aims to tokenize $500 million in RWAs, representing 2% of the current market.

-

The funding will expand compliance and operational infrastructure for a full-stack RWA platform.

-

Tokenization market is dominated by US Treasuries, private credit, and institutional funds, with emerging growth in public equities.

-

Money market funds have grown tenfold since 2023, according to Bank for International Settlements data, with institutions like Goldman Sachs entering the space.

Discover how Real Finance’s $29M RWA tokenization funding accelerates institutional adoption. Explore growth in tokenized assets and money market funds. Stay ahead in crypto innovations today!

What is Real Finance’s $29 Million Funding for RWA Tokenization?

Real Finance, a leading real-world asset (RWA tokenization) network, has secured $29 million in private funding to build a robust infrastructure layer for tokenized assets. This investment, led by a $25 million capital commitment from Nimbus Capital and participation from Magnus Capital and Frekaz Group, will enhance compliance and operational capabilities as the company develops a full-stack RWA platform. In the near term, Real Finance targets tokenizing $500 million in RWAs, which equates to approximately 2% of the existing tokenized asset market.

How Does This Funding Impact the RWA Tokenization Market?

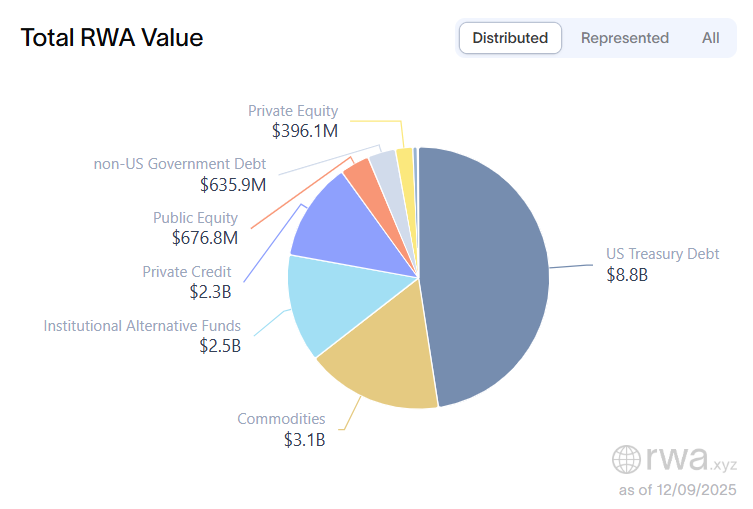

The influx of capital into Real Finance underscores the accelerating momentum in RWA tokenization, where institutions are increasingly integrating traditional assets with blockchain technology. According to industry data from RWA.xyz, the current RWA market is primarily driven by US Treasury products, private credit, and institutional alternative funds, though tokenized public equities and other asset classes are gaining ground. This funding enables Real Finance to streamline adoption for institutions, addressing key challenges in compliance and scalability.

To date, the tokenization market has been dominated by US Treasury products, private credit and institutional alternative funds, although tokenized public equities and other asset types are also beginning to gain traction, according to industry data.

The existing RWA market by asset type. Source: RWA.xyz

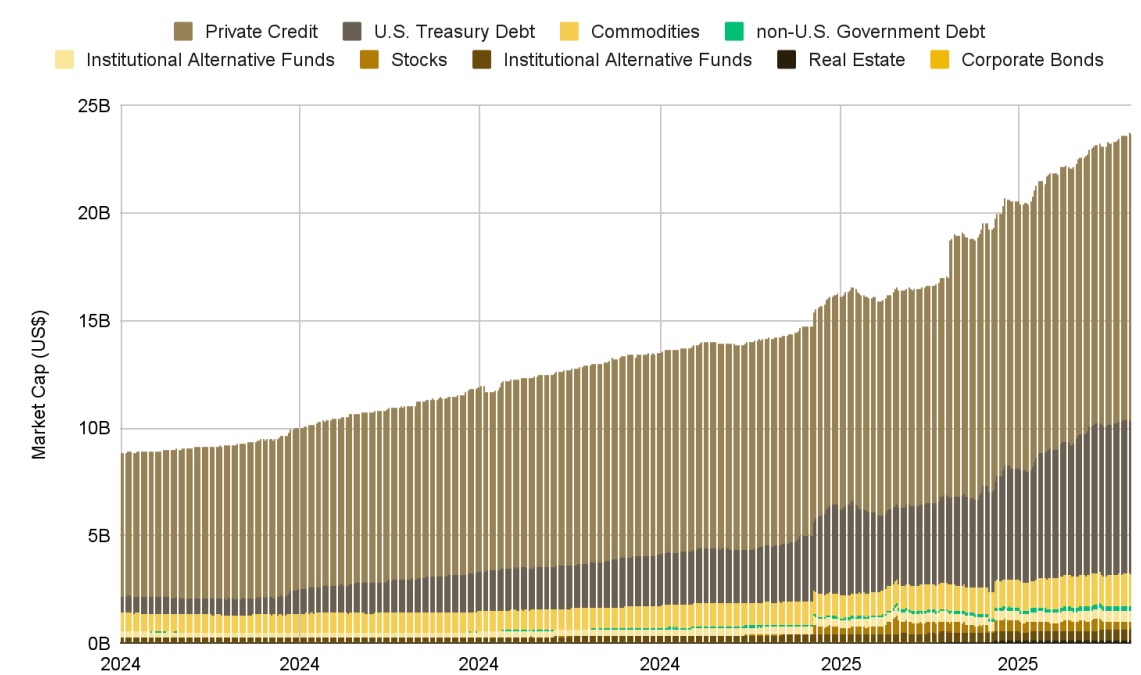

Money market funds, which are low-risk investment vehicles that invest in short-term, highly liquid assets, often hold some of the same instruments, such as Treasury bills. Tokenized money market funds have also been expanding quickly, with their market size growing roughly tenfold since 2023, according to data from the Bank for International Settlements. Goldman Sachs and BNY Mellon are among the largest institutions to enter the tokenized money market fund space, adding further momentum to one of the fastest-growing segments of the RWA sector.

This development aligns with broader trends in the financial industry, where tokenization offers benefits like improved liquidity, fractional ownership, and 24/7 trading. Real Finance’s platform will focus on creating seamless bridges between traditional finance and blockchain, potentially unlocking trillions in value from illiquid assets. Experts note that regulatory clarity in the United States, as highlighted in a June report from Binance Research, could further propel institutional involvement.

Frequently Asked Questions

What is the purpose of Real Finance’s $29 million RWA tokenization funding?

The funding will be used to expand Real Finance’s compliance and operational infrastructure while developing a full-stack platform for RWA tokenization. This initiative aims to facilitate easier adoption of tokenized assets by institutions, targeting $500 million in tokenized RWAs in the short term, as stated by the company.

How fast is the tokenized money market fund market growing?

The tokenized money market fund market has expanded approximately tenfold since 2023, driven by institutional interest from firms like Goldman Sachs and BNY Mellon. These funds invest in short-term, liquid assets such as Treasury bills, providing stable yields in a blockchain format that enhances accessibility and efficiency.

Key Takeaways

- RWA Tokenization Acceleration: Real Finance’s $29 million raise highlights surging institutional interest in tokenizing real-world assets, with a focus on compliance to drive broader adoption.

- Market Dominance Shifts: US Treasuries lead the RWA space, but private credit, equities, and money market funds are emerging rapidly, backed by data from sources like the Bank for International Settlements.

- Future Growth Potential: Industry leaders predict over 10x growth in RWA holders by year-end, urging investors to monitor regulatory developments for new opportunities in tokenized assets.

The tokenized RWA market has experienced significant growth since 2024. Source: Binance Research

Tokenized RWA Market Poised for Major Expansion

With 2025 marking a pivotal year for tokenized real-world assets amid rising institutional participation, 2026 promises even stronger growth, according to Chris Yin, co-founder and CEO of Plume, an RWA-focused layer-2 blockchain. “Currently, we are tracking to over 10x the RWA holders number since the start of the year,” Yin stated, adding that “we think it’s not crazy to imagine another banner year with 25x+ in user growth numbers.” Beyond US government debt, the market is seeing rising interest in private credit, mineral rights, energy assets, GPUs, and other nontraditional categories.

His outlook aligns with a June report from Binance Research, which noted that clearer regulatory expectations in the United States could draw even more major institutions into tokenization. The SEC’s recent closure of a probe into tokenized equity platform Ondo Finance further signals a maturing regulatory environment supportive of RWA innovation.

Conclusion

Real Finance’s $29 million funding round represents a significant milestone in RWA tokenization, bolstering infrastructure for institutional-grade tokenized assets and capitalizing on the explosive growth of segments like money market funds. As institutions such as Goldman Sachs deepen their involvement, the broader RWA ecosystem is set to transform traditional finance. Investors and stakeholders should watch for continued regulatory progress and platform launches, positioning themselves for the next wave of blockchain-driven asset innovation.