RedotPay Secures $107M Series B Funding Amid USDT-Led Stablecoin Market Surge

XRP/USDT

$2,480,132,667.31

$1.3653 / $1.27

Change: $0.0953 (7.50%)

-0.0099%

Shorts pay

Contents

RedotPay Series B funding: The stablecoin payments company raised $107 million in a Series B round led by Goodwater Capital, boosting its total 2025 funding to $194 million. This capital will fuel acquisitions, licensing, hiring, and market expansion for its stablecoin-based payment products.

-

Funding Details: $107 million Series B led by Goodwater Capital with participation from Pantera Capital, Blockchain Capital, and Circle Ventures.

-

Company Growth: Over 6 million users across 100+ markets, processing $10 billion in annualized payment volume and generating $150 million in revenue.

-

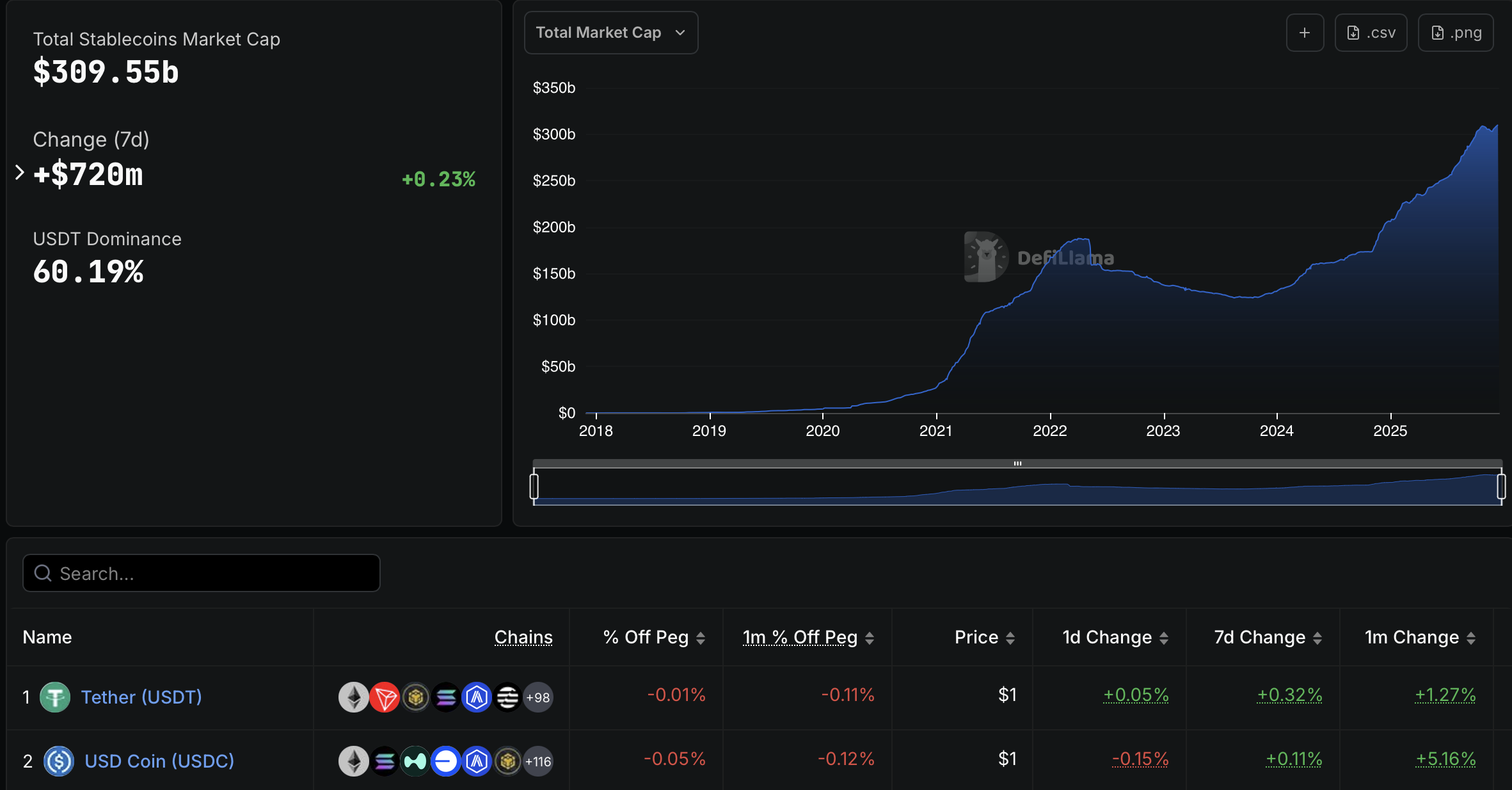

Stablecoin Market Surge: Post-GENIUS Act, the market cap has grown by $50 billion to $309.55 billion, with Tether’s USDT holding over 60% dominance, per DefiLlama data.

Discover how RedotPay’s $107M Series B funding accelerates stablecoin payments innovation. Explore growth strategies, market impact, and future plans in this in-depth analysis. Stay ahead in crypto finance.

What is RedotPay’s Series B Funding?

RedotPay Series B funding marks a significant milestone for the Hong Kong-based stablecoin payments company, which secured $107 million in a Series B round, elevating its total funding in 2025 to $194 million. Led by Goodwater Capital, the investment included contributions from prominent firms like Pantera Capital, Blockchain Capital, and Circle Ventures, along with ongoing support from existing backers such as HSG. This influx of capital underscores investor confidence in RedotPay’s role in bridging traditional finance and digital assets through its innovative payment solutions.

Founded in Hong Kong, RedotPay specializes in stablecoin-based products that simplify digital asset usage in everyday transactions. Its offerings include a versatile card for spending digital assets, efficient payout rails for cross-border transfers, and multicurrency accounts paired with a peer-to-peer marketplace for stablecoin access and holding. These features have propelled the company to serve more than 6 million registered users across over 100 global markets, according to the company’s Tuesday press release.

The funding announcement highlights RedotPay’s robust operational scale, with annualized payment volume exceeding $10 billion and revenue surpassing $150 million. This financial strength positions the company to navigate the evolving regulatory landscape in the stablecoin sector while expanding its footprint.

How Will RedotPay Utilize Its Series B Funding?

RedotPay plans to deploy the $107 million Series B funding toward strategic initiatives that enhance its competitive edge in the stablecoin payments arena. Primarily, the capital will support acquisitions to integrate complementary technologies and expand service capabilities, as stated in the company’s official release. Additionally, obtaining further licenses in key regions will ensure compliance amid tightening global regulations for digital assets.

Expanded hiring across engineering and product teams is another focal point, aiming to accelerate innovation in stablecoin infrastructure. According to company executives, these efforts will broaden compliance operations and facilitate entry into new markets. For instance, RedotPay’s recent partnership with Ripple in December launched a crypto-to-naira payout feature, enabling seamless conversion of digital assets into Nigerian naira for direct bank deposits—a model that could replicate in other emerging economies.

This strategic allocation aligns with broader industry trends, where stablecoin adoption is surging. Data from DefiLlama indicates the stablecoin market has expanded by over $50 billion since the U.S. GENIUS Act passed on July 18, reaching approximately $309.55 billion in total market capitalization. Tether’s USDT commands more than 60% of this market, reflecting the sector’s maturation and the demand for reliable digital dollar equivalents.

Expert insights from financial analysts, such as those shared in industry forums by representatives from Blockchain Capital, emphasize the importance of scalable infrastructure in stablecoin payments. “Investments like this not only validate the technology but also pave the way for mainstream adoption,” noted a Blockchain Capital partner in a recent statement. RedotPay’s focus on user-centric products, including its spending card and cross-border rails, addresses real-world pain points like high fees and slow settlements in traditional remittances.

To provide context, RedotPay’s previous funding round in September raised $47 million, valuing the company at over $1 billion and attracting investors like Coinbase Ventures, Galaxy Ventures, and Vertex Ventures. This unicorn status, combined with the latest raise, demonstrates sustained momentum. The company’s growth metrics—6 million users and billions in transaction volume—serve as tangible evidence of its market traction, bolstered by partnerships that enhance accessibility in regions with limited banking infrastructure.

In a landscape where stablecoins are increasingly viewed as a cornerstone of global finance, RedotPay’s funding strategy prioritizes regulatory adherence and technological advancement. Short sentences like this make the information scannable: Acquisitions will target fintech synergies. Licensing efforts will open doors to regulated markets. Hiring will drive product evolution. These steps collectively aim to solidify RedotPay’s position as a leader in stablecoin-enabled payments.

Frequently Asked Questions

What Are the Key Products Offered by RedotPay Following Its Series B Funding?

RedotPay provides stablecoin-based payment solutions including a digital asset spending card, cross-border payout rails, multicurrency accounts, and a peer-to-peer marketplace. With over 6 million users and $10 billion in annualized volume, these products facilitate easy stablecoin access and transactions in more than 100 markets, emphasizing security and efficiency in crypto payments.

How Has the Stablecoin Market Evolved Since the GENIUS Act, Impacting Companies Like RedotPay?

Since the GENIUS Act’s passage in July, the stablecoin market has grown by over $50 billion to around $309.55 billion, driven by clearer U.S. regulations that boost investor confidence. This expansion benefits firms like RedotPay by increasing adoption of stablecoin payments for global transfers and everyday spending, making digital assets more practical and widespread.

Key Takeaways

- Series B Milestone: RedotPay’s $107 million raise, led by Goodwater Capital, totals $194 million in 2025 funding and values the company as a unicorn in stablecoin payments.

- Growth Metrics: Serving 6 million users with $10 billion in volume and $150 million revenue, RedotPay demonstrates strong demand for its card, payout, and marketplace services across 100+ markets.

- Strategic Expansion: Funds will drive acquisitions, licensing, and hiring to enter new markets—explore RedotPay’s innovations to understand the future of crypto-finance integration.

Stablecoin market cap. Source: DefiLlama

Conclusion

RedotPay’s Series B funding of $107 million highlights the accelerating interest in stablecoin payments, positioning the company for robust growth through acquisitions, enhanced licensing, and team expansion. As the stablecoin market cap climbs to $309.55 billion under the influence of regulatory advancements like the GENIUS Act, RedotPay’s innovations in cross-border transfers and digital spending underscore its pivotal role. Investors and users alike should watch this space for further developments that could redefine global payments—consider integrating stablecoin solutions into your financial strategy today.

The company said the funds will support acquisitions, licensing efforts and expanded hiring as it enters new markets.

Stablecoin payments company RedotPay has raised $107 million in a Series B round, bringing its total funding in 2025 to $194 million.

The round was led by Goodwater Capital, with participation from Pantera Capital, Blockchain Capital and Circle Ventures, alongside continued backing from existing investors, including HSG.

Founded in Hong Kong, RedotPay offers stablecoin-based payment products, including a card that enables users to spend digital assets, stablecoin-powered payout rails for cross-border transfers, and services that allow users to access and hold stablecoins through multicurrency accounts and a peer-to-peer marketplace.

RedotPay has more than 6 million registered users in over 100 markets, processes more than $10 billion in annualized payment volume and generates over $150 million in annualized revenue, the company said in a Tuesday press release announcing the raise.

RedotPay said the funding will be used to pursue acquisitions, obtain additional licenses, expand its compliance operations and hire across engineering and product teams, as it moves into new markets and broadens its payments offering.

RedotPay last raised capital in September, a $47 million investment that it said valued the business at more than $1 billion. That round included participation from Coinbase Ventures, alongside continued backing from Galaxy Ventures and Vertex Ventures.

In December, RedotPay partnered with Ripple to launch a crypto-to-naira payout feature that allows users to convert digital assets into Nigerian naira and receive funds directly into local bank accounts.

Related: Visa launches USDC settlement for US banks on Solana blockchain

Stablecoin companies raise funds

Several stablecoin-focused companies have raised capital in 2025.

In August, venture investors committed nearly $100 million to stablecoin infrastructure companies. Switzerland-based M0 raised $40 million in a Series B led by Polychain Capital and Ribbit Capital, while US startup Rain secured $58 million to build tools for banks to issue regulated stablecoins.

In October, stablecoin payments company Coinflow raised $25 million in a Series A round led by Pantera Capital. The Chicago-based company said the funding would support the expansion of its cross-border payments infrastructure, which uses stablecoins to settle transactions globally.

In November, CMT Digital closed a $136 million fund to back blockchain startups, with a portion allocated to stablecoin companies. The crypto venture company said it had already deployed roughly a quarter of the fund, including investments in Coinflow and stablecoin company Codex.

Since the passage of the GENIUS Act in the US on July 18, the stablecoin market has risen by over $50 billion to about $309.55 billion, with over 60% of the market dominated by Tether’s USDt (USDT), according to DefiLlama data.

Magazine: Big questions: Would Bitcoin survive a 10-year power outage?

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

3/1/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/28/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/27/2026

DeFi Protocols and Yield Farming Strategies

2/26/2026