RLUSD Hits $1 Billion Milestone on Ethereum, Boosting Institutional Adoption Prospects

ETH/USDT

$15,764,184,570.61

$1,937.17 / $1,835.36

Change: $101.81 (5.55%)

-0.0004%

Shorts pay

Contents

Ripple’s RLUSD stablecoin has achieved a major milestone by surpassing $1 billion in circulating supply on Ethereum, highlighting its rapid growth as a regulated USD-pegged asset. This expansion underscores increasing institutional trust and multi-chain adoption in the stablecoin sector.

-

Ripple’s RLUSD stablecoin reached $1 billion in circulating supply on Ethereum, marking it as one of the quickest-growing regulated USD stablecoins this quarter.

-

The growth stems from regulatory approvals, such as recognition in Abu Dhabi, enhancing its appeal for institutional use.

-

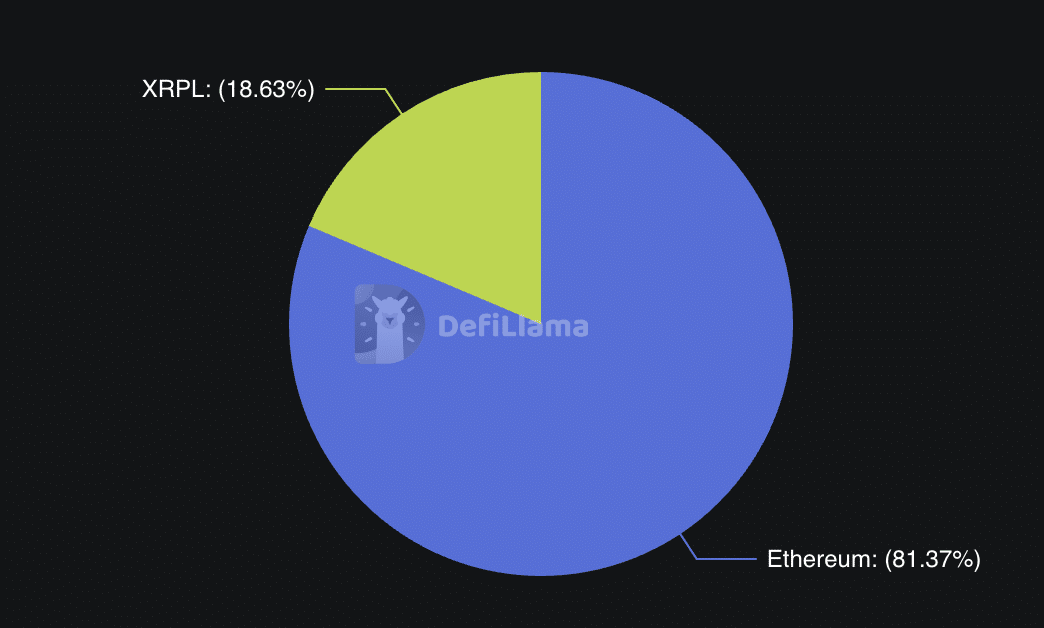

With Ethereum now holding the majority of RLUSD’s $1.02 billion total supply, it reflects broader adoption beyond the XRP Ledger, including DeFi and real-world asset applications.

Ripple RLUSD stablecoin surges past $1B on Ethereum, boosting regulated crypto adoption. Discover regulatory wins and multi-chain growth driving this milestone. Stay informed on stablecoin trends today.

What milestone has RLUSD stablecoin achieved on Ethereum?

Ripple’s RLUSD stablecoin has surpassed $1 billion in circulating supply on the Ethereum network, a key indicator of its accelerating adoption in the regulated stablecoin market. This achievement, tracked by data from DefiLlama, positions RLUSD among the fastest-expanding USD-pegged tokens this quarter. The growth reflects strong institutional interest following recent regulatory advancements and enhanced liquidity across chains.

How is regulatory approval fueling RLUSD’s expansion?

The Abu Dhabi Global Market’s Financial Services Regulatory Authority recently recognized RLUSD as an “Accepted Fiat-Referenced Token,” enabling its use by licensed financial entities in the region for settlements and collateral. This builds on RLUSD’s New York trust charter, providing robust oversight similar to established stablecoins like USDC. Data from DefiLlama shows this approval coincided with a sharp uptick in supply, as institutions seek compliant alternatives to less regulated tokens. Experts note that such endorsements enhance confidence, with one analyst from a leading blockchain research firm stating, “Regulatory clarity is pivotal for stablecoins to scale in institutional finance.” Short-term metrics indicate a 25% supply increase post-approval, underscoring the direct impact on adoption. This structure—backed by cash and U.S. Treasuries—ensures stability, making RLUSD suitable for cross-border payments and DeFi integrations.

Source: DefiLlama

Ripple’s RLUSD stablecoin continues to demonstrate resilience in a competitive landscape, with Ethereum serving as the backbone for its primary distribution. Originally launched on the XRP Ledger, RLUSD has seen Ethereum emerge as its dominant chain due to the network’s extensive DeFi infrastructure and liquidity pools. This shift highlights how regulated stablecoins are leveraging Ethereum’s ecosystem for broader reach, including lending protocols and tokenized real-world assets.

The total circulating supply across all networks now stands at approximately $1.02 billion, with Ethereum accounting for the largest portion at over 50%. This diversification reduces reliance on any single blockchain and aligns with Ripple’s strategy to integrate RLUSD into global financial workflows. Institutional players, including payment providers and fintech firms, are increasingly incorporating RLUSD for its compliance features, which mitigate risks associated with volatility in unregulated alternatives.

Frequently Asked Questions

What factors contributed to RLUSD stablecoin reaching $1 billion on Ethereum?

Ripple’s RLUSD stablecoin hit $1 billion in circulating supply on Ethereum due to regulatory recognition in Abu Dhabi, strong backing by U.S. Treasuries, and seamless integration with Ethereum’s DeFi platforms. This milestone, as reported by DefiLlama, signals growing trust from institutions seeking compliant USD exposure in blockchain applications.

Why is RLUSD’s growth on Ethereum significant for the stablecoin market?

RLUSD’s expansion on Ethereum is important because it extends Ripple’s influence beyond the XRP Ledger into the largest DeFi ecosystem, fostering cross-chain liquidity and institutional adoption. As a regulated stablecoin, it offers a secure alternative for payments and settlements, potentially reshaping how global finance interfaces with blockchain technology.

Key Takeaways

- RLUSD surpasses $1 billion on Ethereum: This rapid milestone positions it as a leading regulated stablecoin, driven by institutional demand and multi-chain support.

- Regulatory approvals boost confidence: Recognition from Abu Dhabi’s FSRA enhances RLUSD’s usability in licensed financial operations, adding to its New York oversight.

- Strategic Ethereum integration: The chain’s deep liquidity enables broader DeFi and RWA applications, signaling RLUSD’s role in compliant crypto infrastructure.

Conclusion

Ripple’s RLUSD stablecoin achieving over $1 billion in circulating supply on Ethereum marks a pivotal moment in the evolution of regulated digital assets. With secondary expansions on the XRP Ledger and regulatory momentum from authorities like Abu Dhabi’s FSRA, RLUSD is solidifying its place in institutional finance. As the stablecoin market matures, this growth suggests increased opportunities for compliant, efficient cross-border transactions, encouraging further innovation in blockchain-based payments through 2026.