Robinhood Eyes 2026 Derivatives Exchange Launch as Prediction Markets Surge

Contents

Robinhood prediction markets have seen nine billion contracts traded by over one million users since launching in March 2025, marking rapid growth in this innovative trading segment. The platform is expanding with a new futures and derivatives exchange set for 2026, enhancing offerings for retail investors interested in event-based betting.

-

Robinhood’s prediction markets launched in partnership with Kalshi, driving nine billion contracts traded by more than one million users in under a year.

-

These markets represent one of Robinhood’s fastest-growing revenue streams, fueled by increasing user demand for accessible prediction trading.

-

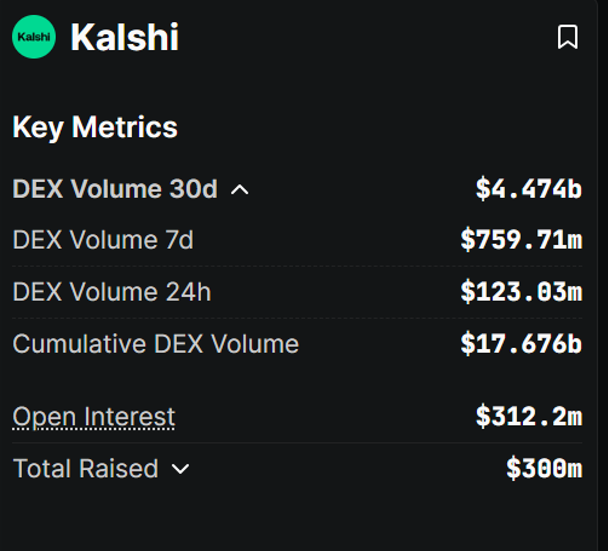

Trading volumes on platforms like Kalshi reached $4.47 billion in the last 30 days, per data from DeFiLlama, highlighting surging interest in prediction markets.

Discover how Robinhood prediction markets exploded to nine billion contracts since March 2025. Learn about the upcoming futures exchange launch in 2026 and its impact on crypto trading. Stay ahead with key insights on this booming sector today.

What Are Robinhood Prediction Markets?

Robinhood prediction markets allow users to bet on the outcomes of real-world events, such as elections or economic indicators, through contracts that settle based on verified results. Launched in March 2025 in partnership with the regulated platform Kalshi, these markets have quickly gained traction, with over one million users trading nine billion contracts. This feature integrates seamlessly with Robinhood’s commission-free trading model, providing retail investors a new way to engage with probabilistic forecasting without traditional stock investments.

Since Robinhood launched its prediction markets in March, nine billion contracts have been traded by more than one million users, according to the platform.

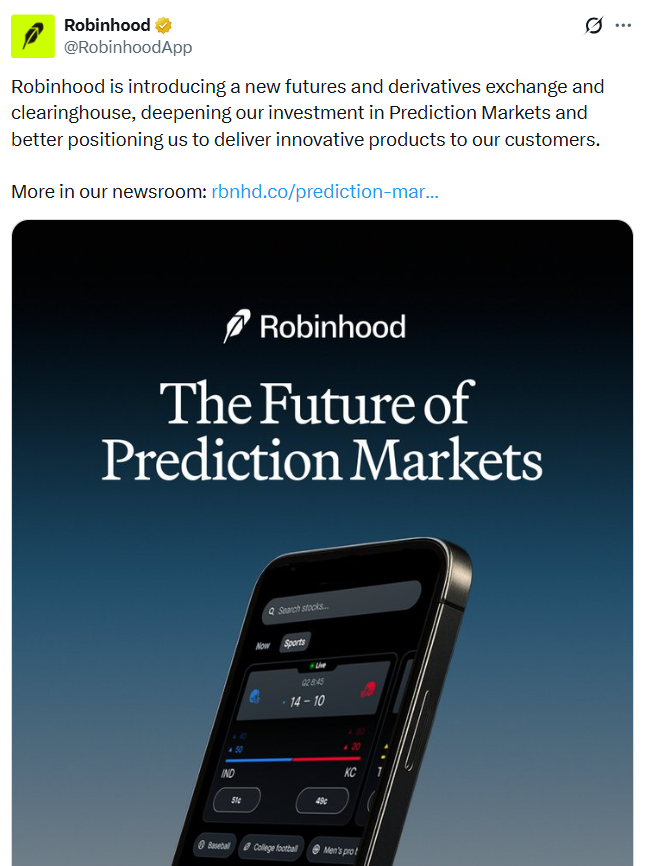

Trading platform Robinhood says prediction markets have emerged as one of its fastest-growing product lines in terms of revenue, and is now set to expand its business with a futures and derivatives exchange and clearinghouse.

Since launching its prediction markets in March in partnership with prediction market platform Kalshi, nine billion contracts have been traded by more than one million users, Robinhood said in a statement on Tuesday.

JB Mackenzie, the general manager of futures and international at Robinhood, said the platform is “seeing strong customer demand for prediction markets, and we’re excited to build on that momentum.”

Robinhood said it is also planning to grow its investment in prediction markets, with a futures and derivatives exchange and clearinghouse, to deepen its investment in prediction markets.

Source: Robinhood

“Our investment in infrastructure will position us to deliver an even better experience and more innovative products for customers,” Mackenzie added.

How Will Robinhood’s Derivatives Exchange Launch in 2026?

The upcoming Robinhood derivatives exchange, slated for launch in 2026, will operate with Robinhood as the controlling partner and market maker, alongside Susquehanna International Group providing initial liquidity. This venture includes acquiring MIAXdx, a Commodity Futures Trading Commission (CFTC)-licensed derivatives clearing organization and swap execution facility, ensuring regulatory compliance and robust infrastructure. According to Robinhood’s announcements, this expansion aims to support a broader range of derivative products, including those tied to prediction markets, allowing for more sophisticated trading strategies.

The exchange will have Robinhood as the controlling partner and market maker, Susquehanna International Group as the day-one liquidity provider.

As part of the venture, Robinhood will also acquire MIAXdx, a Commodity Futures Trading Commission (CFTC) licensed derivatives clearing organization and swap execution facility. Robinhood said the derivatives exchange is expected to begin operations in 2026.

Prediction markets function as financial instruments where participants purchase contracts representing yes or no outcomes on future events. Regulated under the CFTC, platforms like Kalshi provide a legal framework for U.S. users, distinguishing them from unregulated crypto alternatives. Robinhood’s integration democratizes access, appealing to its 20 million-plus user base by combining familiar stock trading interfaces with event-based opportunities. Data from DeFiLlama indicates that prediction market volumes have surged, with Kalshi alone recording $4.47 billion in trades over the past 30 days as of November 2025. This growth reflects broader market interest, driven by high-profile events like U.S. elections and economic forecasts.

In contrast, Polymarket, a cryptocurrency-based platform, reported $3.58 billion in volume over the same period, underscoring the competitive landscape. Experts note that prediction markets offer hedging tools against uncertainty, with accuracies often surpassing traditional polls—studies from academic sources like the University of Iowa’s prediction market research show resolutions within 1-2% of actual outcomes in many cases. JB Mackenzie’s comments highlight Robinhood’s strategy to capitalize on this demand, investing in clearinghouses to handle increased volumes securely.

The derivatives exchange will facilitate futures contracts on commodities, indices, and potentially crypto assets, broadening Robinhood’s scope beyond equities. With CFTC oversight, it addresses concerns over counterparty risk through dedicated clearing mechanisms. Financial analysts from sources like Bloomberg have observed that such expansions could boost retail participation in derivatives, a market traditionally dominated by institutions, potentially increasing overall trading activity by 20-30% in the first year based on similar launches.

Frequently Asked Questions

What Is the Trading Volume of Robinhood Prediction Markets Since Launch?

Since their March 2025 debut, Robinhood prediction markets have facilitated nine billion contracts traded by more than one million users, as reported in the platform’s official statement. This volume positions them as a leading product in revenue growth, reflecting strong adoption among retail traders seeking event-based investments.

Why Is Robinhood Expanding Into Futures and Derivatives?

Robinhood is launching a futures and derivatives exchange in 2026 to meet surging demand for advanced trading tools, building on the success of its prediction markets. Partnering with entities like Susquehanna for liquidity and acquiring CFTC-licensed MIAXdx ensures a regulated, efficient platform that enhances user experience with innovative products.

Prediction market interest surging

Prediction markets have become one of the hottest crypto offerings this year, with volumes on platforms such as Kalshi and Polymarket holding firm amid increased mainstream media attention.

Kalshi is a regulated prediction market platform in the US that operates under the oversight of the CFTC and has a trading volume of $4.47 billion over the last 30 days, according to DeFi data aggregator DefiLlama.

Prediction market Kalshi has recorded a trading volume of $4.47 billion over the last 30 days. Source: DefiLlama

In comparison, Polymarket, a US-based cryptocurrency-based prediction market, has recorded $3.58 billion in trading volume over the last 30 days.

Crypto exchanges are also expanding into prediction markets

Crypto.com recently started offering a prediction markets platform, which is set to be integrated with Trump Media.

Crypto exchange Gemini is also planning to launch a prediction markets platform as part of an initiative to create a “super app,” and said on Nov. 11 it filed to become a designated contract market with the Commodity Futures Trading Commission to offer the platform.

Meanwhile, tech researcher Jane Manchun Wong, claimed on Nov.19 to have found website data indicating Coinbase was working on creating a prediction markets platform.

Key Takeaways

- Explosive Growth: Robinhood prediction markets achieved nine billion contracts traded by over one million users since March 2025, signaling robust retail interest in event-based trading.

- Strategic Expansion: The 2026 launch of a CFTC-regulated derivatives exchange, including MIAXdx acquisition, will provide liquidity and innovative products to support this momentum.

- Market Trends: With Kalshi’s $4.47 billion and Polymarket’s $3.58 billion in recent volumes, prediction markets are a key growth area for both traditional and crypto platforms—consider diversifying portfolios with these tools.

Conclusion

Robinhood’s foray into prediction markets and the forthcoming derivatives exchange in 2026 underscore the platform’s commitment to evolving retail trading landscapes. By partnering with regulated entities like Kalshi and leveraging CFTC oversight, Robinhood positions itself as a leader in accessible, innovative financial products. As prediction market volumes continue to rise, investors should monitor these developments for opportunities to engage in forward-looking strategies that blend traditional finance with emerging trends in crypto and beyond.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

3/1/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/28/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/27/2026

DeFi Protocols and Yield Farming Strategies

2/26/2026