RWA and BTC Companies Shine Amid Crypto Downturn

BTC/USDT

$17,272,160,469.17

$68,476.22 / $66,621.06

Change: $1,855.16 (2.78%)

+0.0011%

Longs pay

Contents

Crypto markets have lost approximately 1 trillion dollars in value over the past month, while sectors like infrastructure and tokenized real-world assets (RWAs) are showing a positive picture. Tokenized Treasury bills are expanding, venture capital funds are being raised, and Bitcoin-focused companies are growing. BTC price is at 67.597,61 USD level, up +0,85% in 24 hours, but the overall downtrend continues (RSI: 36,38).

Nakamoto (NAKA) stock. Source: Yahoo Finance

Nakamoto's $107 Million Acquisition of BTC Inc

Nakamoto has signed an agreement to acquire BTC Inc and UTXO Management for a total of 107 million dollars. Under the agreement, the BTC detailed analysis platform Bitcoin Magazine, the annual Bitcoin Conference, and UTXO's asset management operations are joining Nakamoto's portfolio. Investors will receive Nakamoto shares. This move accelerates the institutionalization of the BTC ecosystem.

Dragonfly Capital Turns to RWAs with $650 Million Fund

Dragonfly Capital closed its fourth fund at 650 million dollars and is focusing on blockchain-based financial products and tokenized RWAs. The firm states it is targeting payment systems, stablecoin networks, and lending markets. This fund will support RWA growth.

Source: Rob Hadick

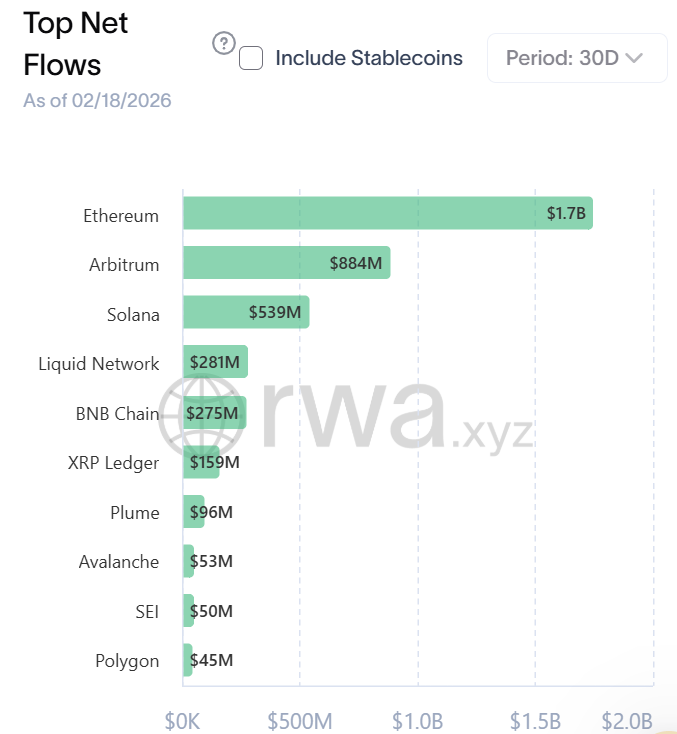

13.5% Growth in RWA Market: ETH, ARB, SOL Lead

The tokenized RWA market experienced a 13.5% value increase over the past 30 days. The growth stems from tokenized US Treasury bills and private credits, with Ethereum recording the largest increase, followed by Arbitrum and Solana. Innovations like Peter Thiel's ETHZ tokenized jet engine project are igniting the sector.

Ethereum recorded the largest increase in tokenized asset value over the past 30 days, followed by Arbitrum and Solana. Source: RWA.xyz

| Chain | 30-Day Increase |

|---|---|

| ETH | %15,2 |

| ARB | %12,8 |

| SOL | %11,9 |

Bitcoin Miners Can Balance the Energy Grid

Paradigm emphasizes that Bitcoin miners can contribute to balancing the energy grid as flexible loads. Miners can absorb excess energy during low-demand periods and scale down under load. This makes BTC mining sustainable.

BTC Technical Analysis: Strong Supports Nearby

BTC is in a downtrend (Supertrend: Bearish, EMA20: 71.281 USD). Main supports:

- S1: 65.071 USD (⭐ Strong, -3,85% distance)

- S2: 67.425 USD (⭐ Strong, -0,37% distance)

Resistances: R1 71.675 USD (+5,91%), R2 69.448 USD (+2,62%). Monitor for BTC futures. RSI at 36 is giving an oversold signal.

Institutional BTC Accumulation Despite Market Decline

Despite searches claiming Bitcoin will go to zero, institutional buyers are accumulating BTC. Acquisitions like Nakamoto's and the Dragonfly fund reflect long-term confidence. According to BIP-360, BTC quantum security may take 7 years, making the transition plan critical.

ARB detailed analysis plays a key role in RWA growth.

Comments

Other Articles

Institutional Interest May Shift From Layer 2 Tokens to BTC and ETH Amid Market Momentum Changes

July 28, 2025 at 03:02 PM UTC

Robinhood Europe Launches Crypto Trading, Excludes XRP and Other Major Tokens From Transfers

October 1, 2024 at 09:32 AM UTC

Fed Rate Cut Hopes Boost DeFi Yields: Ethereum Primed for Revival

September 16, 2024 at 12:09 PM UTC