RWAs Reach $17B TVL on Ethereum, Emerging as DeFi’s Fifth-Largest Sector

ETH/USDT

$15,764,184,570.61

$1,937.17 / $1,835.36

Change: $101.81 (5.55%)

-0.0004%

Shorts pay

Contents

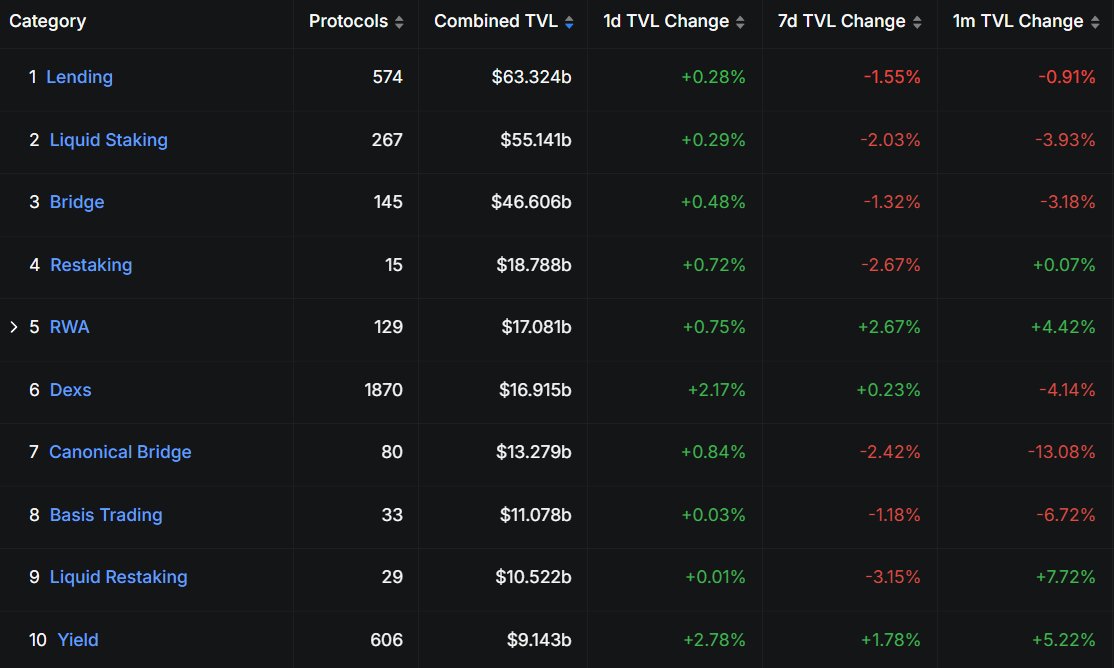

Real-world assets (RWAs) in DeFi have exploded in 2025, surging from outside the top ten to the fifth-largest category with over $17 billion in TVL, surpassing DEXs. Ethereum dominates with more than $12 billion, driven by gold-backed tokens and institutional-grade protocols offering redeemability and liquidity.

-

RWAs hold $17B+ TVL, ranking fifth in DeFi per DeFiLlama data.

-

Ethereum captures over 50% market share at $12B+.

-

185.8% year-to-date returns, leading all sectors according to CoinGecko.

Real-world assets (RWAs) in DeFi hit $17B TVL in 2025, topping DEXs on Ethereum. Top protocols like Tether Gold lead amid stellar returns. Explore growth drivers and key stats today!

Source: DeFiLlama

What is the growth status of real-world assets (RWAs) in DeFi?

Real-world assets (RWAs) have transitioned from a niche segment to a cornerstone of DeFi in 2025, amassing over $17 billion in total value locked (TVL) and overtaking DEXs to become the fifth-largest category by TVL, according to DeFiLlama. This growth reflects increasing institutional interest in tokenized traditional assets like gold and equities on blockchain. Ethereum remains the primary hub, hosting more than half of all RWA value.

Source: DeFiLlama

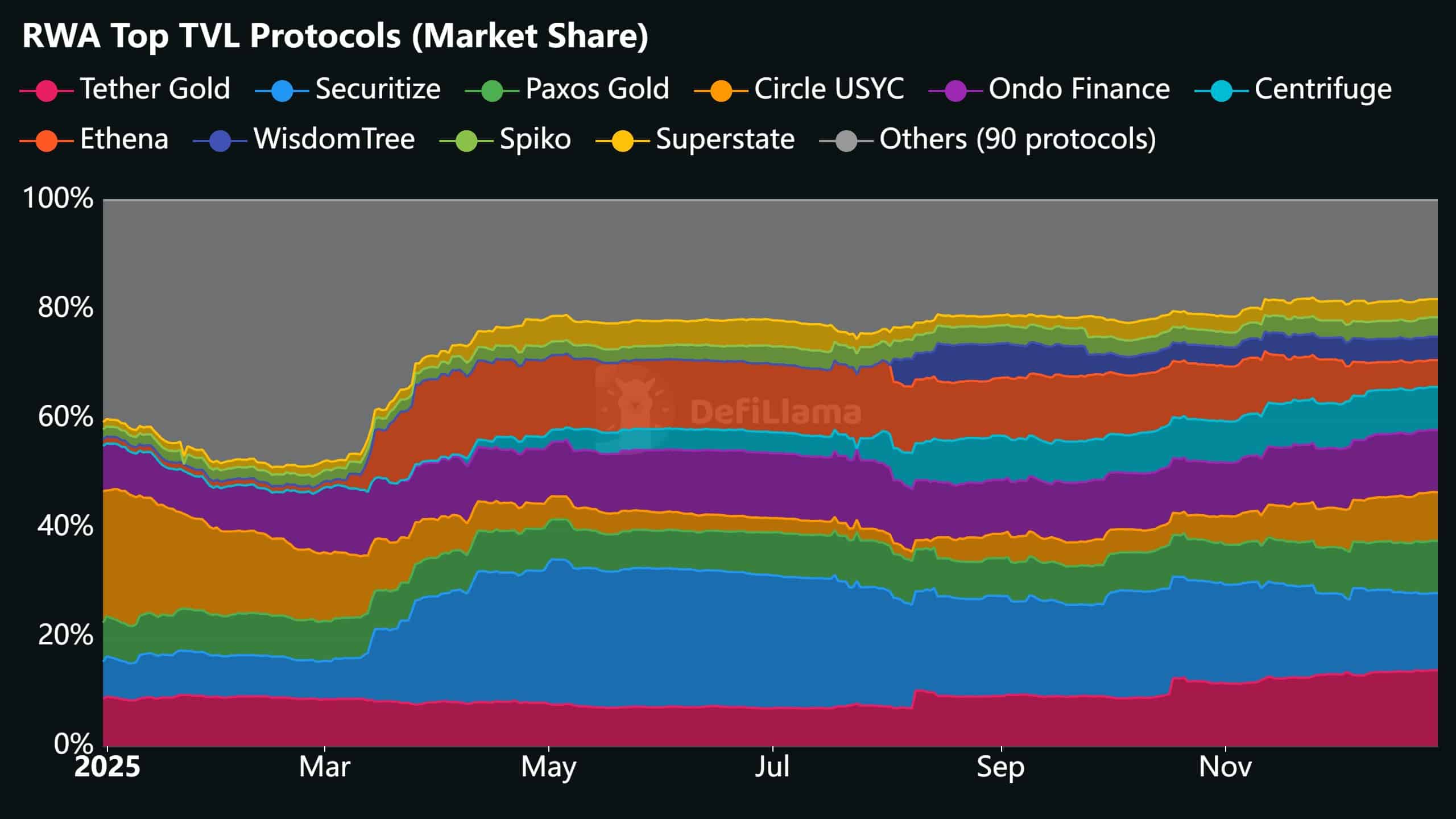

Which protocols and chains lead the RWA market?

The RWA sector shows consolidation among leading protocols. Tether Gold, Securitize, Paxos Gold, Circle’s USYC, and Ondo control the majority of TVL, with their share growing since early 2025. Smaller protocols’ influence is declining. Ethereum leads chains decisively, securing over $12 billion on its mainnet—more than half the total RWA market—per rwa.xyz data. Newer chains gained ground briefly but Ethereum has reclaimed dominance through superior liquidity and infrastructure.

Source: rwa.xyz

Institutions favor these RWAs for key attributes: redeemability for underlying assets, regular attestations, trusted custody solutions, and deep liquidity pools. Gold-backed tokens exemplify this, with Tether Gold at $2.29 billion and Paxos Gold at $1.6 billion TVL.

Source: CoinGecko

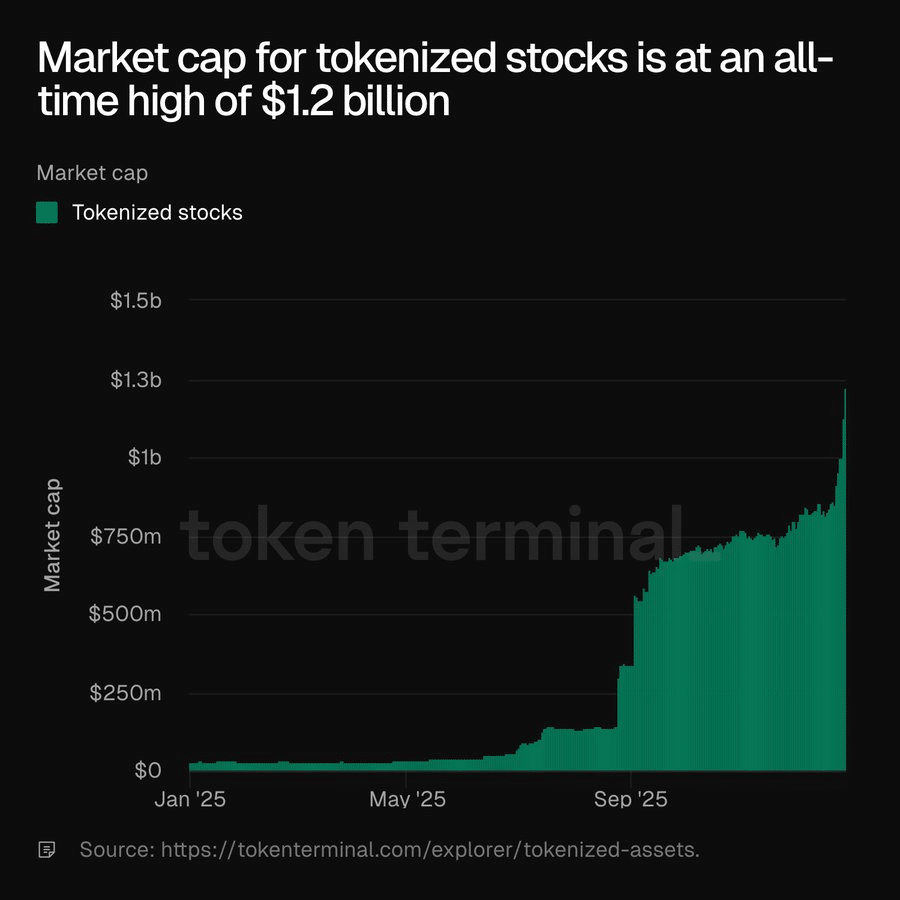

This consolidation boosts efficiency and trust in the ecosystem. Meanwhile, tokenized equities have accelerated, pushing market capitalization beyond $1.2 billion to an all-time high, signaling broader adoption of tokenized securities.

Source: Token Terminal

RWAs delivered the highest returns in crypto narratives for 2025 at 185.8% year-to-date, per CoinGecko, outpacing Layer 1s (80.3%) and other green sectors while DeFi, AI, and gaming recorded losses. Standouts include Keeta Network (+1,794.9%), Zebec (+217.3%), and Maple Finance (+123%), though overall gains trail 2024’s 819% surge, indicating sector maturation.

Frequently Asked Questions

What is the current TVL of real-world assets (RWAs) in DeFi?

The TVL for RWAs in DeFi exceeds $17 billion as of late 2025, per DeFiLlama, placing it fifth among DeFi categories ahead of DEXs. This figure encompasses tokenized gold, equities, and other assets across major protocols.

Why does Ethereum dominate RWAs over other blockchains?

Ethereum hosts over $12 billion in RWAs, more than 50% of the total, thanks to its mature infrastructure, high liquidity, and trusted ecosystem ideal for institutional tokenized assets like gold and USYC, according to rwa.xyz.

Key Takeaways

- RWAs now fifth-largest DeFi sector: Over $17B TVL surge in 2025 eclipses DEXs.

- Ethereum’s lead: $12B+ dominance driven by top protocols like Tether Gold and Paxos Gold.

- Top returns: 185.8% YTD per CoinGecko; tokenized equities hit $1.2B ATH.

Conclusion

Real-world assets (RWAs) in DeFi have solidified their position in 2025 with $17 billion TVL, Ethereum’s commanding share, and leading returns per CoinGecko and DeFiLlama data. Gold-backed tokens and tokenized equities underscore institutional appeal through redeemability and liquidity. As protocols mature, RWAs promise sustained integration of traditional finance with blockchain—monitor Ethereum and key players for ongoing developments.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/27/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/26/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/25/2026

DeFi Protocols and Yield Farming Strategies

2/24/2026