SCOTUS Overturns Trump's Tariffs: BTC Drops

BTC/USDT

$17,272,160,469.17

$68,476.22 / $66,621.06

Change: $1,855.16 (2.78%)

+0.0011%

Longs pay

Contents

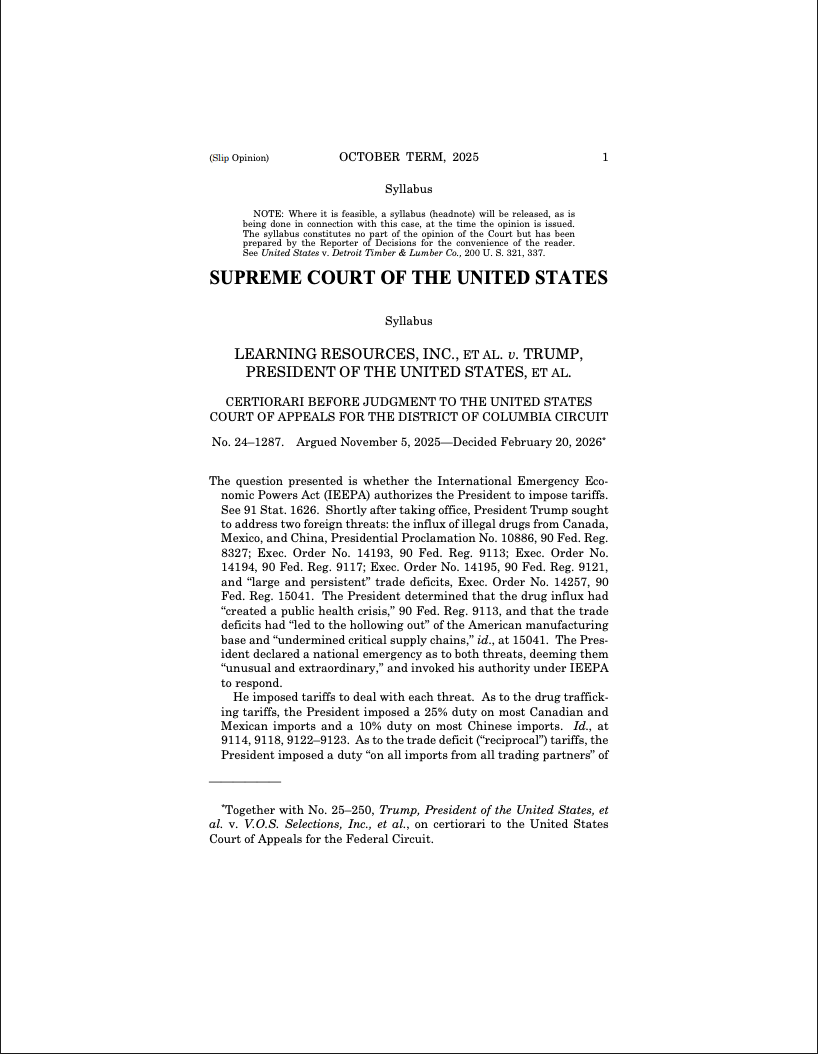

The U.S. Supreme Court (SCOTUS) annulled most of the tariffs imposed by U.S. President Donald Trump under the International Emergency Economic Powers Act (IEEPA) on Friday. Six out of nine justices ruled that the executive branch has no authority to impose tariffs in peacetime under this law. The decision stated that IEEPA had not been used by any president for tariffs in half a century and that Trump's claims exceeded the limits of authority. Trump had defended drug inflows from Canada, China, and Mexico, along with the erosion of the U.S. industrial base, as a national emergency, but the court rejected this.

The SCOTUS opinion explaining the rationale behind the decision to strike down Trump’s ability to levy tariffs under IEEPA. Source: The Supreme Court

Trump's Reaction and the Shock Drop in BTC Price

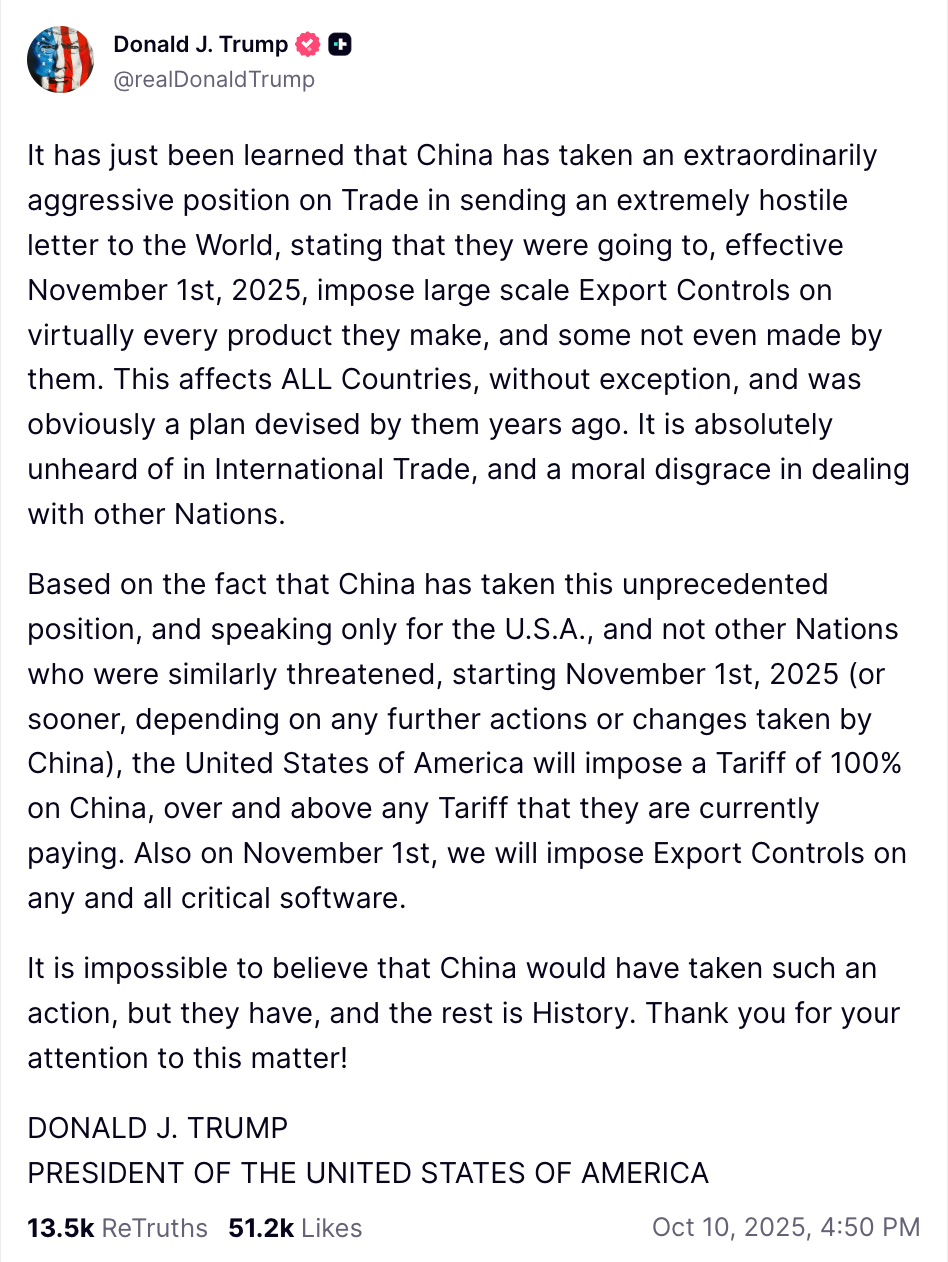

Following the decision, Trump criticized the court members in a press briefing and announced that he would bring back the tariffs "with other alternatives." Trump's announced 100% China tariffs in October 2025 caused a shock effect in crypto markets; Bitcoin (BTC) price fell from 122,000 dollars to 107,000 dollars. BTC is trading about 50% below its October peak. Trump had stated that tariffs could replace federal income tax and reduce the budget deficit.

Source: Truth Social

BTC Technical Analysis: Strong Supports and Bearish Signals

Currently, BTC price is at 67.653,71 USD level, showing a +1,03% change in the last 24 hours. RSI at 37.08 is near the oversold region, trend is downtrend, and Supertrend is bearish. EMA 20: resistance above 71.305 USD. Main supports: S1 65.071 USD (strong, 74% score), S2 62.909 USD. Resistances: R1 69.491 USD (71% score), R2 71.333 USD. Investors should monitor these levels for detailed BTC analysis. Check the BTC futures page for detailed charts.

Institutional BTC Accumulation Amid 'Zeroing Out' Searches

According to recent news, although Google searches for 'Will Bitcoin go to zero?' are increasing, institutional buyers continue to accumulate BTC. Despite macro uncertainties, ETFs and institutions are hunting for bottoms; this could be a recovery signal after the tariff annulment. ALT coins are also declining in parallel with BTC.

Bitcoin's Future Plan Against the Quantum Threat

BIP-360 co-author Ethan Heilman stated that Bitcoin's transition to post-quantum security will take 7 years. This is critical for long-term BTC investors; although tariff uncertainty creates short-term pressure, the fundamentals are solid.