SEC Approves 2x Leveraged SUI ETF as Regulators Caution on Crypto Volatility Risks

SUI/USDT

$453,037,566.90

$0.9058 / $0.8262

Change: $0.0796 (9.63%)

-0.0067%

Shorts pay

Contents

The U.S. Securities and Exchange Commission has approved a 2x leveraged exchange-traded fund tied to the SUI token, enabling investors to achieve twice the daily performance of SUI through derivatives, amid ongoing regulatory concerns about leverage amplifying volatility in cryptocurrency markets.

-

SEC Approval for SUI Leveraged ETF: The regulator greenlit 21Shares’ 2x SUI ETF, trading as TXXS on Nasdaq, marking a shift toward more accessible leveraged crypto products.

-

The fund uses swaps and financial contracts rather than direct token holdings, providing amplified exposure to the Sui ecosystem’s growth.

-

Leverage risks highlighted: Recent market data shows $19 billion in liquidations from excessive borrowing, with Bitcoin dropping from $126,000 to below $80,000 in late 2025.

Discover how the SEC’s approval of the 2x SUI leveraged ETF opens new investment avenues in crypto. Learn the risks of leverage and why regulators are issuing warnings—explore now for informed decisions on volatile markets.

What is the 2x Leveraged SUI ETF Approved by the SEC?

The 2x leveraged SUI ETF is an investment product launched by 21Shares that seeks to deliver twice the daily return of the SUI token, the native cryptocurrency of the Sui blockchain ecosystem. Approved by the U.S. Securities and Exchange Commission, this ETF trades under the ticker TXXS on the Nasdaq and allows investors to gain amplified exposure to SUI’s price movements without directly purchasing the token. By employing derivatives like swaps, the fund magnifies both gains and losses, offering a regulated pathway into leveraged crypto investing amid a landscape of heightened volatility.

The Sui Foundation announced the ETF’s launch on Thursday, emphasizing its role in broadening access to the innovative Sui network, known for its high-throughput, scalable architecture designed for decentralized applications. This approval comes as the SEC continues to scrutinize leveraged products, balancing innovation with investor protection.

Source: Sui Network

How Does Leverage in Crypto ETFs Impact Market Volatility?

Leverage in cryptocurrency exchange-traded funds, such as the newly approved 2x SUI ETF, can significantly heighten market volatility by amplifying price swings for investors. In essence, these products use borrowed capital or derivatives to double—or more—the daily performance of an underlying asset like SUI, meaning a 5% rise in SUI could yield a 10% gain in the ETF, but a similar drop would result in doubled losses. Regulators, including the SEC, have issued warnings about excessive leverage, noting its potential to exacerbate rapid sell-offs in the crypto space.

Historical data underscores these risks: On October 10, 2025, the cryptocurrency market experienced its largest leverage-induced liquidation event, with approximately $19 billion in positions wiped out as prices plummeted. This event, driven by high-leverage perpetual futures on platforms like Binance and Bybit, not only affected derivatives traders but also pressured spot market participants. For instance, Bitcoin’s value declined from a peak near $126,000 in October to under $80,000 by November, illustrating how leveraged trading can cascade into broader market instability.

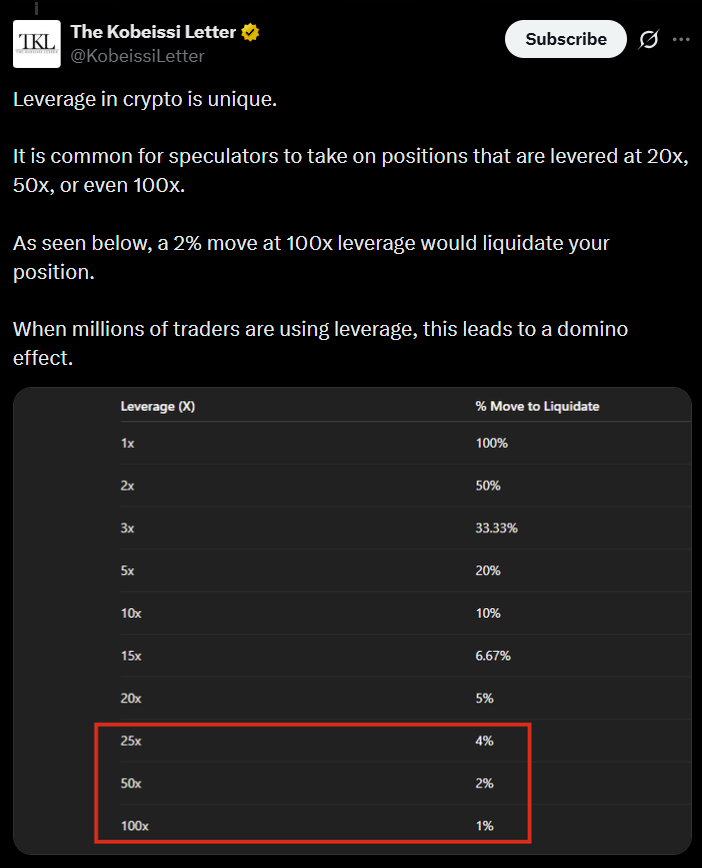

Experts from traditional finance, such as those cited in reports by The Kobeissi Letter, highlight that crypto’s leverage ratios—often 10x to 50x on futures contracts—far exceed those in stock or commodity markets, where limits are stricter. The SEC’s recent letters to fund issuers reinforce this, stating that products with three-times or five-times leverage may fail to meet standards due to their amplification of risks in inherently volatile digital assets. Despite these concerns, the approval of the 2x SUI ETF signals a cautious progression, provided investors understand the daily reset mechanism, which can lead to compounding effects over time, potentially eroding returns in sideways markets.

Source: The Kobeissi Letter

The Sui Foundation’s announcement positions the ETF as a tool for sophisticated investors seeking to capitalize on the ecosystem’s growth, driven by Sui’s object-centric data model that enables faster and more efficient transactions compared to traditional blockchains. However, financial advisors recommend limiting exposure to such products to a small portion of a diversified portfolio to mitigate downside risks.

Frequently Asked Questions

What Are the Risks of Investing in the 2x SUI Leveraged ETF?

Investing in the 2x SUI leveraged ETF involves heightened risks due to its use of derivatives to double daily returns, which can lead to substantial losses during market downturns. The SEC has emphasized that leverage amplifies volatility, as seen in the $19 billion liquidation event in October 2025, and daily compounding may cause performance to deviate from SUI’s long-term trends over extended periods.

Why Did the SEC Approve the SUI ETF Now?

The SEC’s approval of the 2x SUI leveraged ETF reflects a measured approach to crypto innovation, allowing regulated access to Sui’s ecosystem while maintaining oversight on leverage levels. This decision follows the regulator’s review of similar products and comes after warnings on higher leverage ratios, aiming to protect investors by capping amplification at 2x for this fund.

Key Takeaways

- Regulatory Milestone: The SEC’s nod to the 2x SUI ETF from 21Shares introduces a new avenue for leveraged exposure to the Sui blockchain, trading as TXXS on Nasdaq.

- Leverage Dynamics: While offering potential for doubled gains, the ETF’s structure via swaps heightens volatility risks, mirroring broader crypto market patterns like the October 2025 liquidations.

- Investor Caution Advised: Approach leveraged crypto products with diversified strategies and awareness of daily resets to avoid compounded losses in fluctuating markets.

Conclusion

The approval of the 2x leveraged SUI ETF by the SEC marks a pivotal development in cryptocurrency investment options, providing amplified access to the Sui ecosystem’s potential while underscoring the persistent debate over leverage in crypto markets. As regulators continue to warn against excessive borrowing that fuels volatility, as evidenced by recent $19 billion liquidations and Bitcoin’s sharp declines, investors must prioritize risk management. Looking ahead, this ETF could signal further maturation of regulated crypto products, encouraging broader adoption if balanced with prudent strategies—stay informed to navigate these evolving opportunities effectively.

Comments

Other Articles

Bitwise Files for 11 Altcoin ETFs Including AAVE, UNI Amid SOL, XRP Muted Gains

December 31, 2025 at 08:47 PM UTC

Bitwise Seeks SEC Approval for 11 Altcoin Strategy ETFs Including Bittensor

December 31, 2025 at 05:21 PM UTC

Bitwise Seeks SEC Approval for 11 Crypto ETFs Targeting AAVE, UNI, TAO

December 31, 2025 at 01:17 PM UTC