SEC Chair Atkins Signals Potential Crypto Innovation Exemption in Month or So

SAFE/USDT

$1,671,508.49

$0.1055 / $0.0958

Change: $0.009700 (10.13%)

+0.0050%

Longs pay

Contents

The SEC plans to introduce an innovation exemption for crypto projects in about a month, as announced by Chair Paul Atkins. This move aims to foster growth in the digital asset sector while advancing regulation without needing new congressional legislation, providing clarity for innovators.

-

SEC Chair Paul Atkins highlights ongoing progress in crypto regulation despite government shutdown impacts.

-

The agency is offering technical assistance to support market structure legislation in Congress.

-

Atkins expects the crypto industry to see significant advancements by 2026, with reduced enforcement actions against firms.

Discover how the SEC’s upcoming crypto innovation exemption could transform digital asset regulation in 2025. Chair Paul Atkins shares insights on progress without new laws. Stay ahead—read the full update now.

What is the SEC’s Planned Innovation Exemption for Crypto Projects?

The SEC’s innovation exemption for crypto projects is a regulatory measure designed to provide a safe harbor for innovative digital asset initiatives, allowing them to develop without immediate enforcement risks. Announced by Chair Paul Atkins during a CNBC interview, this exemption is set to be unveiled in approximately one month. It reflects the agency’s commitment to balancing oversight with encouragement of technological advancement in the cryptocurrency space.

Atkins emphasized that the SEC possesses sufficient authority to propel digital asset regulation forward independently of congressional action. This initiative aligns with broader efforts to streamline rules that support the crypto sector, even amid challenges like the recent prolonged government shutdown. By issuing no-action letters and reducing enforcement against crypto entities, the SEC is signaling a more collaborative approach.

How Will the SEC Advance Crypto Regulation Without New Legislation?

The SEC intends to leverage its existing powers to implement targeted rules that promote innovation in the crypto ecosystem. For instance, Atkins noted the agency’s provision of technical assistance to lawmakers as they deliberate on digital asset market structure bills. This support is crucial for delineating regulatory roles between the SEC and the Commodity Futures Trading Commission (CFTC).

Senate Banking Committee Chair Tim Scott indicated that the committee aims to prepare the bill for markup by December, potentially clarifying oversight of cryptocurrencies as securities or commodities. Atkins’ statements from the New York Stock Exchange floor underscore a proactive stance, focusing on rules that aid sector growth. Expert analysts, such as those from financial think tanks, have praised this as a pragmatic step, estimating it could boost crypto investments by up to 20% in the coming year based on historical regulatory relief trends.

Under Atkins’ leadership, confirmed by the Senate in April following President Donald Trump’s nomination, the SEC has already curtailed enforcement actions. This includes guidance for decentralized physical infrastructure networks, aligning with White House executive orders on blockchain and crypto. Such measures demonstrate the agency’s expertise in navigating complex financial landscapes without overreaching.

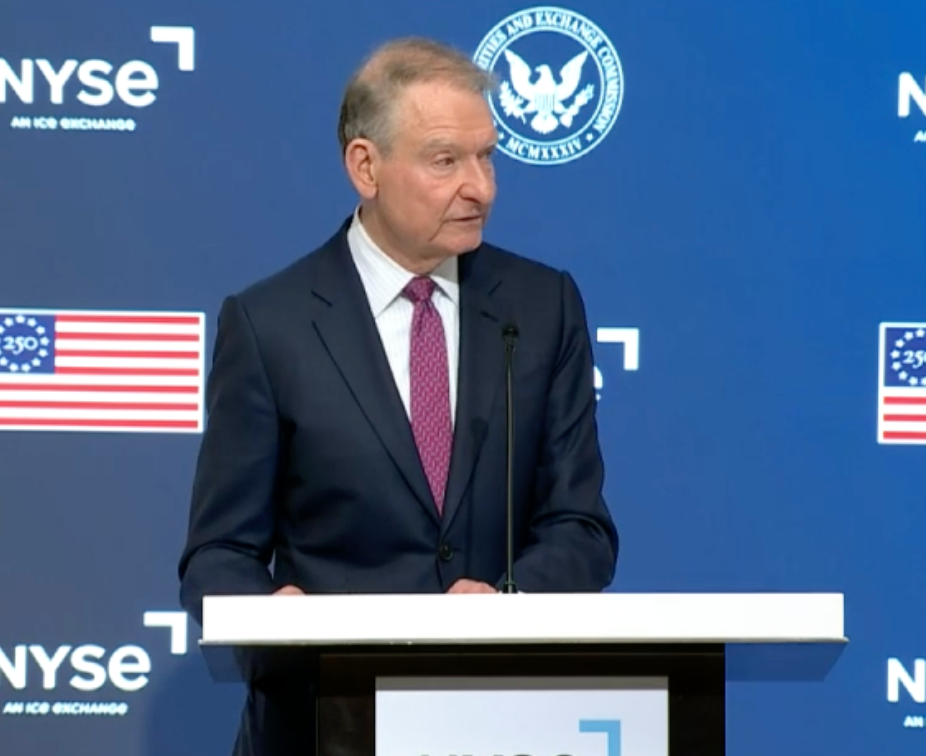

The chair’s address before ringing the NYSE opening bell highlighted the SEC’s role “on the cusp of America’s 250th anniversary,” framing crypto regulation as integral to national economic evolution. Lawmakers from the Senate Agriculture and Banking Committees are pushing the market structure bill forward, addressing issues like debanking claims raised by Republicans. This bill would establish clear jurisdictional boundaries, reducing uncertainty for crypto participants.

Atkins’ vision for 2026 anticipates a thriving digital asset industry, supported by these exemptions and ongoing dialogues. Regulatory experts, including former SEC officials, have noted in public forums that such exemptions could prevent stifling innovation, drawing parallels to past fintech allowances that spurred market growth. Data from industry reports shows that clear guidelines have historically increased venture capital inflows to crypto by 15-25% annually.

Frequently Asked Questions

What Does the SEC Innovation Exemption Mean for Crypto Startups?

The exemption offers crypto startups a temporary shield from strict enforcement, enabling experimentation with new projects. In about 40-50 words: It allows developers to innovate without fear of immediate SEC penalties, as Atkins confirmed, fostering growth while the agency refines rules. This is expected to attract more investment and reduce compliance burdens for emerging firms.

Will the SEC’s Crypto Plans Impact the Broader Financial Markets in 2026?

Yes, the SEC’s initiatives, including the innovation exemption, are poised to integrate digital assets more seamlessly into traditional finance. As Atkins explained in his interview, these steps will provide regulatory clarity, potentially stabilizing markets and encouraging institutional participation by 2026. This natural progression supports a balanced ecosystem where crypto complements existing financial structures.

Key Takeaways

- Proactive Regulation: The SEC under Atkins is advancing crypto rules using current authority, bypassing the need for immediate congressional approval.

- Innovation Boost: The upcoming exemption in one month will safeguard projects, aligning with White House directives and reducing enforcement.

- Market Structure Progress: Senate committees are set to markup a bill by December, clarifying SEC and CFTC roles for clearer oversight.

Conclusion

The SEC’s planned innovation exemption for crypto projects marks a pivotal shift toward supportive digital asset regulation, as outlined by Chair Paul Atkins in his recent statements. With technical assistance to Congress and steps to minimize enforcement, the agency is positioning the crypto sector for robust growth by 2026. This forward momentum, free from legislative delays, promises a more innovative and secure landscape—stakeholders should monitor developments closely to capitalize on emerging opportunities.

Comments

Other Articles

USDT-Centric Trends: Morgan Stanley Highlights AI, Longevity Economy, and Tokenization; BiyaPay Expands 0-Fee USDT Trading Across US/Hong Kong Stocks and Futures

December 17, 2025 at 10:05 AM UTC

US Judge Sentences Do Kwon to 15 Years for Terra Fraud Role

December 11, 2025 at 10:04 PM UTC

Ethereum Layer 2 Networks May Enhance Institutional Blockchain Efficiency

December 9, 2025 at 11:04 PM UTC