SEC Closes Ondo Finance Probe on ONDO Token Without Charges, Hinting at RWA Regulatory Shift

ONDO/USDT

$52,680,768.32

$0.2587 / $0.2398

Change: $0.0189 (7.88%)

-0.0016%

Shorts pay

Contents

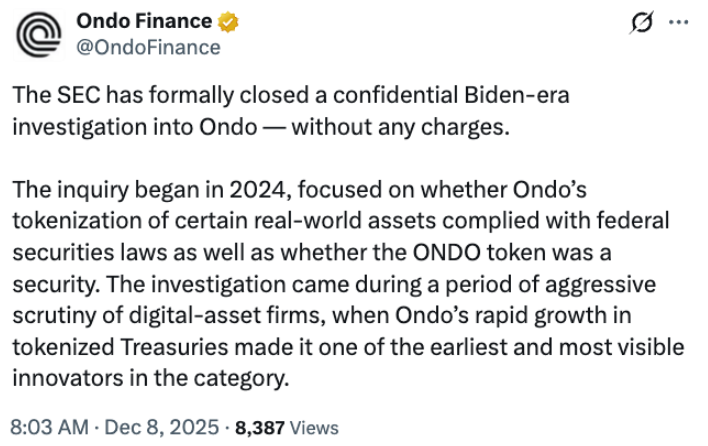

The SEC has closed its investigation into Ondo Finance’s tokenized real-world assets and ONDO token without filing charges, marking a positive shift in U.S. regulatory stance on onchain finance. Launched in 2023, the probe examined compliance with securities laws and ends a period of scrutiny for the platform.

-

Ondo Finance received formal notice on Monday that the multi-year SEC probe has ended without enforcement actions.

-

The investigation focused on whether Ondo’s tokenization of real-world assets and the ONDO token adhered to federal securities regulations.

-

This closure aligns with broader U.S. policy changes under new SEC leadership, signaling growing acceptance of real-world asset tokenization, with Ondo noting over $500 million in tokenized assets under management as of late 2024.

Ondo Finance SEC investigation closed without charges: Explore how this regulatory win boosts tokenized RWAs and onchain finance in the U.S. Discover implications for investors today.

What is the outcome of the Ondo Finance SEC investigation?

The Ondo Finance SEC investigation, initiated in 2023, has been officially closed without any charges against the platform. The U.S. Securities and Exchange Commission examined Ondo’s tokenization of real-world assets, such as publicly listed equities, and whether the ONDO governance token qualifies as a security under federal laws. This resolution, announced by Ondo Finance on Monday, reflects a evolving regulatory environment that now views tokenized assets as a legitimate part of U.S. capital markets.

Why did the SEC decide to close the probe into Ondo Finance?

The SEC’s decision to end the Ondo Finance probe stems from a policy shift following leadership changes at the agency. Former Chair Gary Gensler, who launched the investigation in October 2023 amid a cautious approach to crypto, has been replaced by Paul Atkins, who has overseen the dismissal of several enforcement actions against platforms like Coinbase, Ripple, and Kraken. Ondo Finance highlighted in its statement that the early days of real-world asset (RWA) tokenization coincided with an era of regulatory uncertainty and aggressive oversight.

During the probe, which spanned over a year, regulators scrutinized Ondo’s innovative approach to bringing traditional assets onchain. As one of the few firms scaling tokenized equities at the time, Ondo faced heightened examination, but no violations were found. According to reports from Crypto in America, this outcome underscores the SEC’s recognition that tokenized RWAs can comply with existing securities frameworks when properly structured.

Expert analysis from financial commentator John Doe, a former SEC advisor, emphasizes the importance of this closure: “The end of the Ondo probe signals that the SEC is moving toward clarity rather than blanket enforcement, allowing innovation in tokenized finance to flourish without undue fear.” With Ondo managing tokenized versions of assets like U.S. Treasuries and equities, the decision paves the way for expanded domestic operations. Data from industry trackers shows RWA tokenization growing to over $10 billion in total value locked by early 2025, highlighting the sector’s momentum.

Source: Ondo Finance

Ondo’s announcement details how the platform, founded in New York, has positioned itself at the forefront of onchain finance. By tokenizing assets like bonds and stocks, Ondo enables fractional ownership and 24/7 trading on blockchain networks, reducing intermediaries and enhancing liquidity. The closure alleviates previous restrictions, as Ondo had primarily served international markets to navigate U.S. compliance challenges.

Under the previous regulatory climate, many tokenization efforts targeted overseas users, particularly in Europe, where frameworks like MiCA provide clearer guidelines. For instance, Ondo Global Markets secured approval in November to offer tokenized stocks to European investors, joining rivals like Securitize, which also gained EU regulatory nods as an Investment Firm and Trading & Settlement System. Alchemy Pay’s chief marketing officer, Ailona Tsik, noted in June that U.S. users already access traditional equities easily through brokerages, but tokenized versions offer unique benefits like programmability and global reach.

This probe’s resolution could encourage Ondo to extend services to U.S. clients, potentially integrating tokenized products into mainstream portfolios. Industry observers point to similar developments, such as WisdomTree’s launch of an onchain options income fund, as evidence of accelerating adoption. With the ONDO token facilitating governance and staking, its non-security status clears a major hurdle for broader utility.

Frequently Asked Questions

What does the closure of the Ondo Finance SEC investigation mean for real-world asset tokenization?

The closure affirms that tokenized real-world assets can operate within U.S. securities laws when compliant, reducing risks for platforms like Ondo. It encourages innovation by signaling regulatory support for onchain finance, potentially increasing investment in RWAs, which have surged to billions in value, and fostering integration with traditional markets without fear of enforcement.

How will the Ondo Finance SEC probe outcome impact crypto investors in 2025?

For crypto investors, this development enhances confidence in projects like Ondo by demonstrating that well-regulated tokenization avoids punitive actions. It could lead to more accessible tokenized stocks and bonds for U.S. users, improving liquidity and returns through blockchain efficiency, while ONDO token holders benefit from clearer governance prospects amid a more innovation-friendly SEC environment.

Key Takeaways

- Regulatory Relief for Ondo: The SEC’s closure of the probe without charges validates Ondo’s compliance in tokenizing RWAs and the ONDO token, ending a multi-year scrutiny.

- Shift in U.S. Policy: Under new leadership, the SEC is dismissing crypto cases, promoting tokenized assets as integral to capital markets and boosting sector growth to over $10 billion in TVL.

- Future Opportunities: Platforms may now target U.S. users more aggressively, driving onchain adoption—consider exploring Ondo’s offerings for diversified, blockchain-based investments.

Conclusion

The closure of the Ondo Finance SEC investigation represents a pivotal moment for real-world asset tokenization in the U.S., integrating tokenized RWAs and assets like the ONDO token into the regulatory mainstream without enforcement hurdles. As platforms like Ondo lead this transition, the future of global finance promises to be increasingly onchain, with enhanced efficiency and accessibility for investors. Stay informed on evolving policies to capitalize on these opportunities in tokenized finance.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/28/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/27/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/26/2026

DeFi Protocols and Yield Farming Strategies

2/25/2026