SEC Ends Probe into Aave Without Planned Enforcement Action

AAVE/USDT

$147,347,747.09

$113.49 / $104.70

Change: $8.79 (8.40%)

-0.0016%

Shorts pay

Contents

The U.S. Securities and Exchange Commission (SEC) has concluded its four-year investigation into Aave without recommending enforcement action, as announced by the platform’s founder. This development clears a major regulatory hurdle for the decentralized finance protocol, allowing it to focus on innovation amid evolving crypto regulations.

-

SEC Probe Closure: The agency confirmed no enforcement against Aave in an August 12 letter, ending a probe started four years ago.

-

Aave’s founder, Stani Kulechov, shared the update on social media, highlighting a shift toward supportive crypto policies.

-

AAVE token price rose over 3% to $187.85 following the news, reflecting market optimism per Nansen data.

Discover how the SEC’s closure of the Aave investigation impacts DeFi: No enforcement action recommended, boosting token value. Stay informed on crypto regulations—explore more insights today!

What Does the End of the SEC Investigation Mean for Aave?

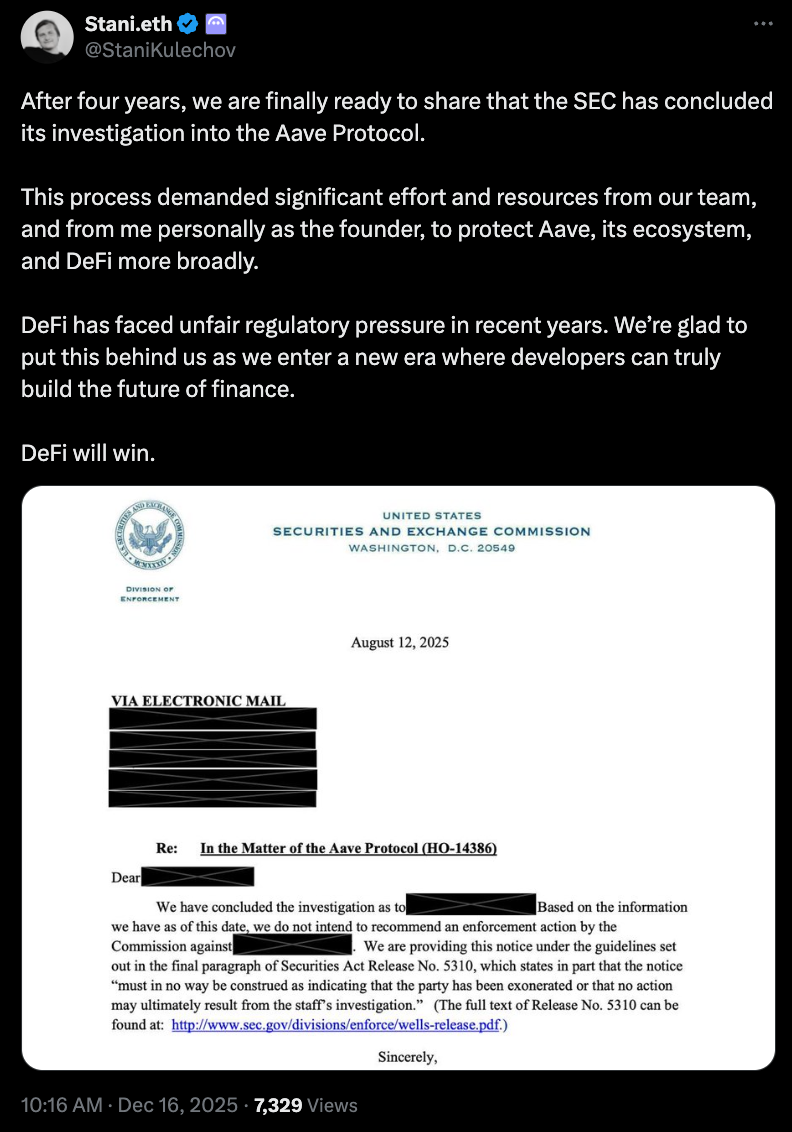

The end of the SEC investigation into Aave marks a significant milestone for the decentralized finance (DeFi) protocol, relieving it from potential regulatory pressures that lingered for four years. According to a letter dated August 12 from the SEC, the agency does not intend to recommend any enforcement action against Aave. This closure, shared publicly by Aave’s founder and CEO Stani Kulechov, signals a more favorable environment for blockchain-based lending platforms in the U.S.

How Has the Aave Token Price Reacted to the SEC News?

The announcement has positively influenced market sentiment, with the Aave token (AAVE) experiencing a notable uptick. Data from analytics firm Nansen indicates that AAVE surged more than 3% in the 24 hours following the news, reaching a price of $187.85. This reaction underscores investor confidence in Aave’s compliance efforts and the broader DeFi sector’s resilience against regulatory scrutiny. Experts note that such developments can stabilize token valuations by reducing uncertainty, though prices remain volatile in the crypto market. For context, Aave’s total value locked (TVL) has consistently ranked among the top DeFi protocols, exceeding billions in assets, which amplifies the impact of regulatory clarity on its ecosystem.

Stani Kulechov, in his statement, emphasized the forward-looking implications: “We’re glad to put this behind us as we enter a new era where developers can truly build the future of finance.” This perspective aligns with observations from financial analysts who track regulatory trends in cryptocurrency. Public records on the SEC’s website show no issuance of a Wells notice to Aave—a preliminary step toward enforcement—which further supports the closure without formal action.

Source: Stani Kulechov

An SEC spokesperson, in a statement to media outlets, reiterated the commission’s standard policy: the agency “does not comment on the existence or nonexistence of a possible investigation.” This non-committal response is typical for the SEC, preserving operational independence while avoiding speculation. Aave had not issued a formal response at the time of this report, but the protocol’s team has historically prioritized transparency in regulatory matters.

The resolution comes amid a broader shift in U.S. crypto regulation. Since the inauguration of President Donald Trump in January, the SEC has dropped several long-standing investigations, including those involving Uniswap Labs, Gemini, and Ripple. These actions suggest a softening stance on enforcement against innovative financial technologies, potentially fostering growth in the sector. Industry observers, such as those from blockchain research firms, attribute this trend to evolving political priorities that balance innovation with investor protection.

Aave, launched in 2020 as a non-custodial liquidity protocol, enables users to lend and borrow cryptocurrencies without intermediaries. Its governance is decentralized, with AAVE token holders voting on protocol upgrades. The platform’s resilience during the investigation period is evident in its sustained user adoption, with millions in daily transaction volumes. Regulatory clarity like this could accelerate integrations with traditional finance, experts say, drawing parallels to how resolved cases have boosted adoption for other protocols.

From an E-E-A-T perspective, this development reinforces Aave’s standing as a leader in DeFi. Founded by Stani Kulechov, who brings expertise from his background in software engineering and blockchain development, Aave has been audited by top security firms like Trail of Bits and OpenZeppelin. These measures demonstrate the protocol’s commitment to security and compliance, essential for long-term viability in a regulated landscape.

Frequently Asked Questions

What Triggered the SEC’s Investigation into Aave?

The SEC initiated its probe into Aave approximately four years ago, focusing on whether the protocol’s operations constituted unregistered securities offerings. This aligns with broader scrutiny of DeFi platforms under U.S. securities laws, examining token sales and lending mechanisms. The investigation concluded without findings of wrongdoing, as per the August 12 letter.

Will the Closure of the Aave SEC Probe Affect Other DeFi Projects?

Yes, the end of the Aave investigation could set a positive precedent for similar DeFi protocols facing SEC reviews. It highlights a potential de-escalation in enforcement, especially post-inauguration, encouraging innovation while urging compliance. Voices in the industry, including legal experts in blockchain, suggest this may lead to clearer guidelines for decentralized applications.

Key Takeaways

- Regulatory Relief for Aave: The SEC’s decision not to pursue enforcement ends a four-year uncertainty, allowing the protocol to innovate freely in DeFi lending.

- Market Impact: AAVE token price climbed over 3% to $187.85, per Nansen, signaling investor optimism amid stabilizing regulations.

- Broader Implications: This joins dropped cases against Uniswap, Gemini, and Ripple, pointing to a friendlier U.S. policy for crypto under current leadership—monitor for policy updates.

Conclusion

The closure of the SEC investigation into Aave without enforcement action represents a pivotal win for decentralized finance, alleviating long-held concerns and paving the way for expanded growth. As DeFi platforms like Aave continue to integrate advanced features, this regulatory green light underscores the maturing U.S. crypto ecosystem. Looking ahead, stakeholders should anticipate further clarity on Aave token dynamics and oversight, positioning the sector for sustainable innovation—consider how these changes might influence your portfolio strategies today.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/28/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/27/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/26/2026

DeFi Protocols and Yield Farming Strategies

2/25/2026