SEC Halts High-Leverage Crypto ETF Filings, Capping Exposure at 200% for Bitcoin and Ethereum

ETH/USDT

$15,764,184,570.61

$1,937.17 / $1,835.36

Change: $101.81 (5.55%)

-0.0004%

Shorts pay

Contents

The U.S. Securities and Exchange Commission (SEC) has halted ETF filings proposing 3-5 times leverage on crypto assets, citing violations of the Investment Company Act of 1940 that limit exposure to 200% of value-at-risk. This move aims to protect investors from excessive risks in volatile markets.

-

SEC issues warnings to major ETF providers like Direxion, ProShares, and Tidal for exceeding leverage limits on crypto ETFs.

-

The decision follows a surge in crypto liquidations, highlighting concerns over amplified market volatility.

-

Liquidations in the current cycle average $68 million daily for long positions, nearly triple the previous cycle’s levels, per Glassnode data.

SEC halts leveraged crypto ETFs: Regulators cap exposure at 200% to curb risks amid rising liquidations. Learn how this impacts investors and the market—stay informed on crypto regulations today.

What is the SEC’s Decision on Leveraged Crypto ETFs?

SEC halts leveraged crypto ETFs by sending warning letters to issuers seeking approval for products offering 3-5 times exposure to underlying assets like Bitcoin or Ethereum. Under the Investment Company Act of 1940, funds are restricted to 200% leverage based on a reference portfolio of unleveraged assets. This regulatory action requires issuers to revise applications to comply, delaying launches of high-leverage crypto ETFs in the U.S. market.

The SEC emphasized that the reference portfolio serves as the baseline for measuring leverage risk, ensuring funds do not exceed safe exposure levels. By publicly releasing these letters promptly, the agency underscores its commitment to investor protection in the rapidly evolving crypto sector.

SEC warning letter sent to Direxion. Source: SEC

This intervention comes at a time when demand for such products has grown, particularly after the 2024 U.S. presidential election, as investors anticipated a more favorable regulatory environment for digital assets. However, the SEC’s stance prioritizes stability over innovation in leveraged offerings.

How Does Leverage Impact the Crypto Market?

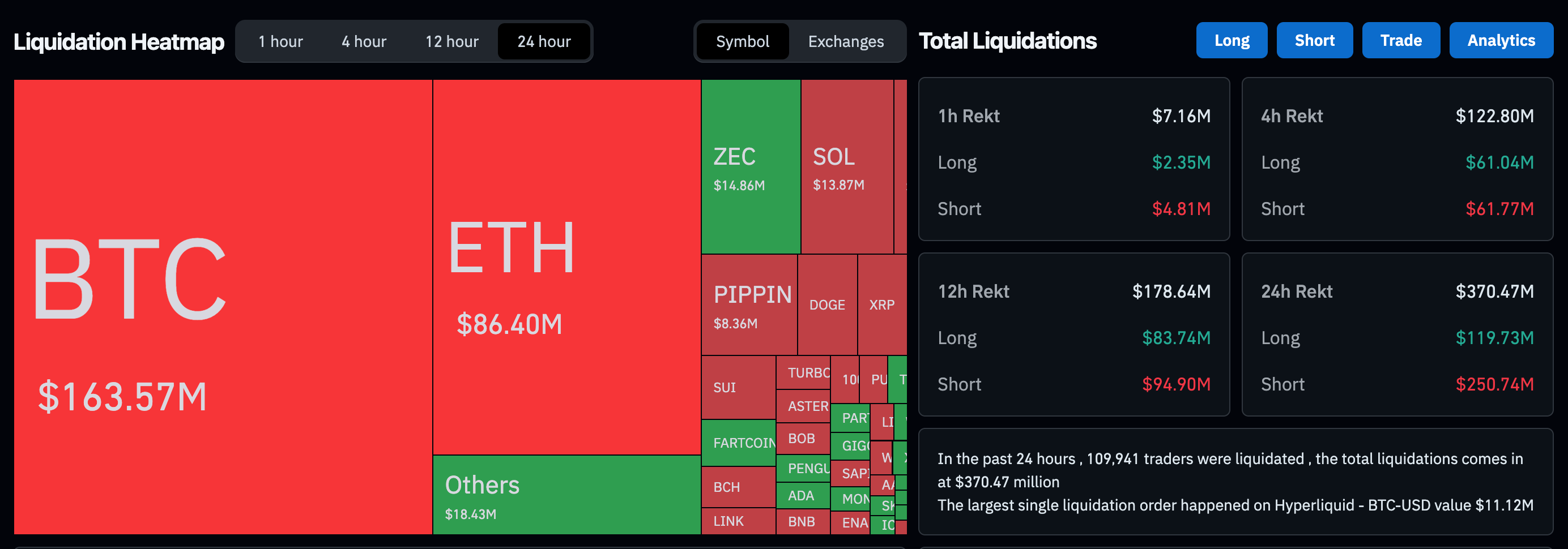

Leverage in crypto trading and ETFs magnifies both gains and losses, contributing to heightened market volatility. In October, a flash crash triggered $20 billion in leveraged liquidations—the largest single-day event in crypto history—prompting widespread discussions on risk management. Analysts at The Kobeissi Letter noted, “Leverage is clearly out of control,” reflecting concerns over its destabilizing effects.

According to Glassnode, a leading crypto analytics platform, daily liquidations in the current market cycle have surged to about $68 million for long positions and $45 million for shorts, compared to $28 million and $15 million in the prior cycle. This tripling of activity underscores how leveraged positions can suppress overall market health by amplifying downturns.

24-hour liquidations in the crypto derivatives market. Source: Coinglass

While leveraged ETFs avoid margin calls seen in derivatives, they still compound losses in bearish or sideways markets, potentially eroding investor capital faster than unleveraged funds. Bloomberg analysts described the SEC’s rapid publication of warning letters as an “unusually speedy move,” signaling a proactive approach to educating the public on these risks.

The crypto futures market has seen increased participation, but regulators view excessive leverage as a threat to financial stability. Direxion, ProShares, and Tidal must now adjust their proposals to align with the 200% cap, which could temper enthusiasm for high-risk crypto investment vehicles.

Frequently Asked Questions

What Are the Implications of the SEC Halting Leveraged Crypto ETF Filings?

The SEC’s halt on leveraged crypto ETF filings limits options for investors seeking amplified exposure to assets like Bitcoin and Ethereum, enforcing a 200% leverage cap under the Investment Company Act of 1940. This protects against extreme volatility but may slow innovation in the U.S. crypto space, pushing some activity to less regulated markets.

Why Is Leverage a Concern in Crypto Markets?

Leverage amplifies trading outcomes in crypto, leading to rapid gains or devastating losses, especially during events like flash crashes. With daily liquidations hitting $113 million on average per Glassnode data, it creates feedback loops that suppress prices and heighten systemic risks, making it a focal point for regulators like the SEC.

Key Takeaways

- Regulatory Cap on Leverage: The SEC enforces a 200% limit on ETF exposure to prevent excessive risk, requiring issuers to revise high-leverage proposals.

- Rising Liquidation Trends: Crypto markets now face triple the daily liquidations compared to previous cycles, totaling over $100 million, which underscores leverage’s volatility.

- Investor Protection Focus: Public disclosure of warnings signals the SEC’s priority on transparency, urging caution with leveraged products amid post-election optimism.

Conclusion

The SEC’s decision to halt leveraged crypto ETFs reinforces safeguards against overexposure in a market prone to sharp swings, integrating SEC halts leveraged crypto ETFs into ongoing efforts to balance innovation with stability. As liquidations continue to rise and regulatory scrutiny intensifies, investors should prioritize diversified, unleveraged strategies. Looking ahead, compliance with these rules may foster a more sustainable crypto ecosystem—consider reviewing your portfolio to align with evolving U.S. financial regulations.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/28/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/27/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/26/2026

DeFi Protocols and Yield Farming Strategies

2/25/2026