SEC Plans Privacy Roundtable as Zcash Surges Amid Crypto Legal Concerns

ZEC/USDT

$444,176,201.48

$223.96 / $203.50

Change: $20.46 (10.05%)

+0.0004%

Longs pay

Contents

The U.S. Securities and Exchange Commission’s Crypto Task Force is hosting a roundtable on privacy and financial surveillance in the cryptocurrency sector on December 15, 2025, addressing growing concerns over developer prosecutions and the resurgence of privacy-focused technologies amid recent legal precedents.

-

SEC Roundtable Focus: Privacy in Crypto – Scheduled for December 15, this discussion will involve industry executives and officials tackling surveillance challenges without proposing new policies.

-

Recent Legal Developments: Cases like the Tornado Cash verdict and Samourai Wallet sentencing have heightened alarms in the crypto community about open-source privacy tools.

-

Market Response: Privacy tokens such as Zcash have surged over 80% in value since October 2025, reflecting investor interest in anonymity amid regulatory scrutiny.

Explore the SEC’s upcoming crypto privacy roundtable on December 15, 2025, amid rising concerns over financial surveillance. Learn key insights from legal experts and industry leaders on protecting innovation. Stay informed on privacy trends in cryptocurrency.

What is the SEC Crypto Privacy Roundtable All About?

The SEC crypto privacy roundtable is an upcoming forum organized by the U.S. Securities and Exchange Commission’s Crypto Task Force, set for December 15, 2025, to examine privacy issues and financial surveillance within the cryptocurrency ecosystem. This event aims to foster dialogue between crypto industry executives and SEC officials on shared challenges, drawing from recent high-profile cases that underscore tensions between innovation and regulation. Participants will explore solutions to balance privacy protections with compliance needs, reflecting a broader resurgence in the sector’s emphasis on cypherpunk principles.

The slated roundtable discussion comes as privacy experiences a renewed focus from crypto industry executives and civil liberties activists.

The US Securities and Exchange Commission’s Crypto Task Force has scheduled a roundtable discussion centered on privacy and financial surveillance for December, as a renewed focus on privacy grips the cryptocurrency industry.

The privacy roundtable is slated for Dec. 15. Like other SEC roundtables, crypto industry executives and SEC officials will discuss common pain points and solutions, but no hard policy proposals will be submitted.

Privacy has become a hot-button topic following several developments, including the partial guilty verdict in Tornado Cash developer Roman Storm’s trial in June, the Samourai Wallet developer sentencing in November and the privacy token price rally over the last two months.

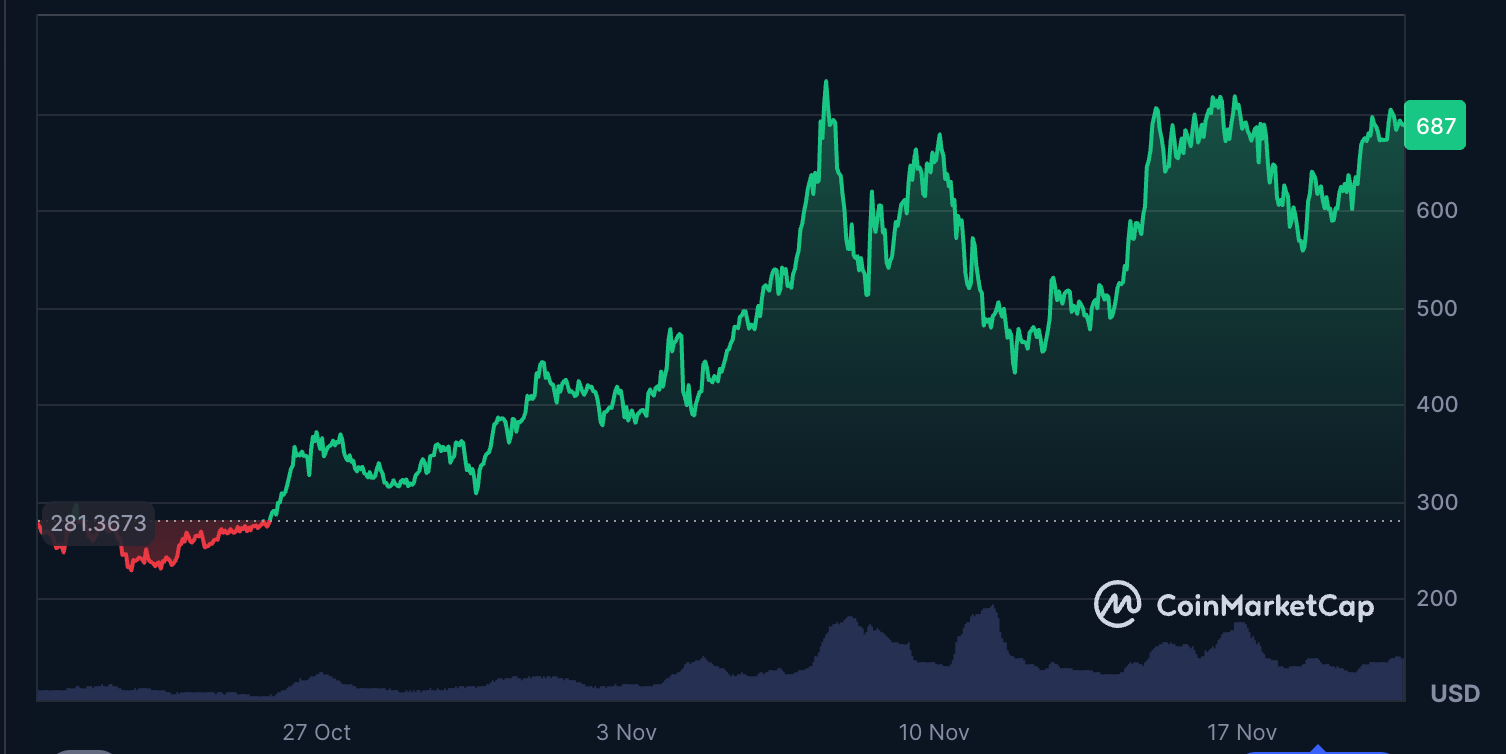

Privacy tokens like Zcash experienced a price surge beginning in October. Source: CoinMarketCap

“Authoritarians thrive when people have no privacy. When those in charge start being hostile to privacy protections, it is a major red flag,” said Naomi Brockwell, founder of the Ludlow Institute, an organization advocating for liberty through technology.

The renewed interest in privacy hearkens back to crypto’s cypherpunk roots, and one of the core reasons the cryptographic technology that underpins crypto was invented — to ensure secure communication channels between parties in hostile environments.

Related: Crypto investors flee visibility for anonymity as privacy coins surge 80%

How Are Recent Legal Cases Impacting Crypto Privacy Development?

The crypto community is raising significant alarms regarding privacy following precedent-setting legal actions against developers of open-source software. In the case of Roman Storm, the partial guilty verdict from his June 2025 trial related to Tornado Cash has sparked debates over the criminalization of non-custodial privacy protocols. Similarly, the November 2025 sentencing of Samourai Wallet developers has been criticized by legal experts as establishing a risky benchmark that could stifle innovation in privacy-preserving technologies across the United States.

Industry executives and advocates contend that these prosecutions serve to deter developers from creating tools that enhance user anonymity, potentially undermining the foundational ethos of cryptocurrency. For instance, comparisons have been drawn to unrelated industries, with journalist and crypto advocate Lola Leetz likening the Samourai Wallet case to holding a car manufacturer accountable for criminal misuse of vehicles. “People should not be held accountable for what other people do with the tools they build,” Leetz emphasized in her analysis.

Addressing these concerns, Matthew Galeotti, acting assistant attorney general for the Department of Justice’s criminal division, clarified in August 2025 that the agency would refrain from prosecuting developers solely for writing open-source code without malicious intent. “Our view is that merely writing code, without ill intent, is not a crime,” Galeotti stated. “The department will not use indictments as a law-making tool. The department should not leave innovators guessing as to what could lead to criminal prosecution.” This position offers some reassurance, though experts note ongoing uncertainties in how privacy features in blockchain applications will be treated under U.S. law.

These developments coincide with a notable market shift: privacy coins have seen an 80% surge in value since October 2025, as reported by market data aggregators like CoinMarketCap. Tokens such as Zcash and Monero are leading this trend, driven by investors seeking greater anonymity in transactions amid heightened regulatory oversight. According to blockchain analytics from Chainalysis, transaction volumes involving privacy-enhanced protocols increased by 45% in the third quarter of 2025 alone, indicating a practical demand for such features.

Legal scholars from organizations like the Electronic Frontier Foundation have warned that without clearer guidelines, the U.S. risks pushing privacy innovation offshore, where jurisdictions with more lenient stances on cryptography could dominate. The SEC roundtable provides a critical platform to address these issues, potentially shaping future enforcement approaches that support both investor protection and technological progress.

Crypto industry executives and advocates argue that the prosecutions are meant to dissuade developers from building privacy-preserving tools.

The verdict in the Samourai Wallet case is analogous to the US government accusing car manufacturer Toyota of a conspiracy because terrorists and criminals also use their cars, according to journalist and crypto advocate Lola Leetz.

“People should not be held accountable for what other people do with the tools they build,” Leetz said.

In August, Matthew Galeotti, the acting assistant attorney general for the Department of Justice’s criminal division, signaled the agency would no longer prosecute open-source software developers for writing code.

“Our view is that merely writing code, without ill intent, is not a crime,” Galeotti said. “The department will not use indictments as a law-making tool. The department should not leave innovators guessing as to what could lead to criminal prosecution.”

Magazine: 2026 is the year of pragmatic privacy in crypto: Canton, Zcash, and more

Frequently Asked Questions

What triggered the renewed focus on privacy in the crypto industry?

The surge in privacy concerns stems from key legal outcomes, including the June 2025 partial guilty verdict against Tornado Cash developer Roman Storm and the November 2025 sentencing of Samourai Wallet creators, alongside an 80% rally in privacy token prices since October 2025, highlighting tensions between regulation and innovation.

Why is the SEC hosting a roundtable on crypto privacy and surveillance?

This December 15, 2025, event allows crypto executives and SEC officials to openly discuss challenges in privacy and financial monitoring, building on the sector’s cypherpunk heritage while addressing recent developer prosecutions and the need for balanced policies that protect users without hindering technological advancement.

Key Takeaways

- Event Significance: The SEC crypto privacy roundtable on December 15, 2025, fosters essential dialogue on surveillance without advancing formal policies, responding to industry-wide privacy revival.

- Legal Precedents: Cases like Tornado Cash and Samourai Wallet illustrate risks to open-source developers, with DOJ assurances aiming to protect code-writing without intent to harm.

- Market Dynamics: Privacy tokens’ 80% price increase since October 2025 signals growing demand for anonymity, urging regulators to support innovation amid global competition.

Conclusion

As the SEC crypto privacy roundtable approaches on December 15, 2025, it underscores the evolving intersection of financial surveillance and privacy protections in the cryptocurrency landscape. Drawing from authoritative insights by figures like Naomi Brockwell of the Ludlow Institute and legal clarifications from the Department of Justice, this discussion highlights the sector’s return to its cypherpunk origins while navigating modern regulatory hurdles. Stakeholders should monitor these conversations closely, as they could influence future developments in privacy technologies, ensuring the U.S. remains a hub for secure, innovative blockchain solutions—stay tuned for outcomes that may redefine crypto privacy standards.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

3/1/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/28/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/27/2026

DeFi Protocols and Yield Farming Strategies

2/26/2026