SEC's Support for Tokenized Securities Regulation

BTC/USDT

$17,272,160,469.17

$68,476.22 / $66,621.06

Change: $1,855.16 (2.78%)

+0.0011%

Longs pay

Contents

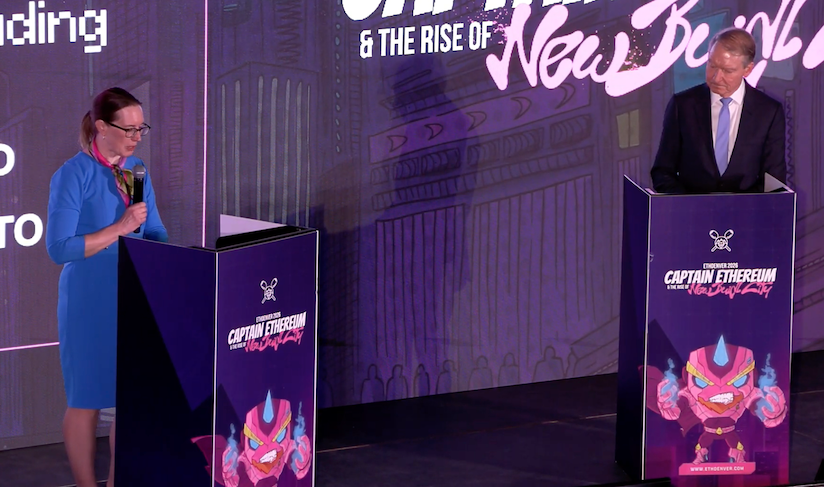

SEC Leaders to Clarify Tokenized Securities Regulation at ETHDenver

U.S. Securities and Exchange Commission (SEC) Chairman Paul Atkins and crypto task force chair Hester Peirce stated that they will provide clarity on how tokenized securities interact with existing regulations at the ETHDenver conference. This statement is seen as a significant step toward reducing uncertainty in the crypto sector. Atkins emphasized that regulators must provide investors with the necessary information for buy, sell, or hold decisions.

Sharp Drops in BTC and ETH Prices Over the Last 30 Days

Addressing the recent declines in cryptocurrency prices, Atkins noted that Bitcoin (BTC) and Ether (ETH) have lost 28% and 40% respectively over the last 30 days. According to current data, BTC is at $67,014.80, with a 24-hour change of +0.98%. RSI at 34.47 is in oversold territory, the overall trend is downward, and Supertrend is giving a bearish signal. EMA 20: $71,662.

BTC Technical Analysis: Critical Support and Resistance Levels

| Level | Price | Score | Distance | Sources |

|---|---|---|---|---|

| S1 Support | $65,085 | 80/100 ⭐ | -2.89% | Fibo 0.114, Swing Low |

| S2 Support | $62,910 | 63/100 ⭐ | -6.13% | POC, S3, Keltner Lower |

| R1 Resistance | $68,411 | 74/100 ⭐ | +2.08% | R2, Prev Day High |

| R2 Resistance | $70,612 | 64/100 ⭐ | +5.36% | ATR Upper, HVN |

These levels will determine BTC's short-term recovery potential. S1 stands out as strong support. Visit our BTC detailed analysis page for a detailed review.

Market Structure Bill and Shift of Authority to CFTC

Peirce stated that the SEC is providing technical assistance for the market structure bill in Congress. The bill could shift most digital asset authority to the Commodity Futures Trading Commission (CFTC). CFTC Chairman Michael Selig is serving as the sole member; the agency's five-member structure is not yet complete. This change could bring clarity to futures trading for altcoins like ETH and SOL. Follow updates for ETH futures.

Institutional BTC Accumulation and 'Zeroing Out' Panic Searches

According to recent news, despite rising Google searches for 'Will Bitcoin go to zero?', institutional buyers are accumulating BTC. Accumulation continues despite macro uncertainties. Additionally, BIP-360 author Ethan Heilman stated that BTC's transition to post-quantum security will take 7 years. Peter Thiel's tokenized jet engine project is departing from ETHZ; this could trigger innovations in tokenized assets. Check coins related to SOL detailed analysis.