Securitize Plans 2026 Launch of Compliant Onchain Tokenized Stocks

JST/USDT

$7,530,661.71

$0.04813 / $0.04602

Change: $0.002110 (4.58%)

-0.0180%

Shorts pay

Contents

Securitize is set to launch compliant, natively tokenized stocks in early 2026, allowing investors to trade real equity shares fully onchain 24/7. This innovation eliminates synthetic exposure by issuing regulated tokens directly on the blockchain, ensuring true ownership without traditional market hour restrictions.

-

Natively tokenized stocks represent actual share ownership, not just price mirrors, reducing counterparty risks.

-

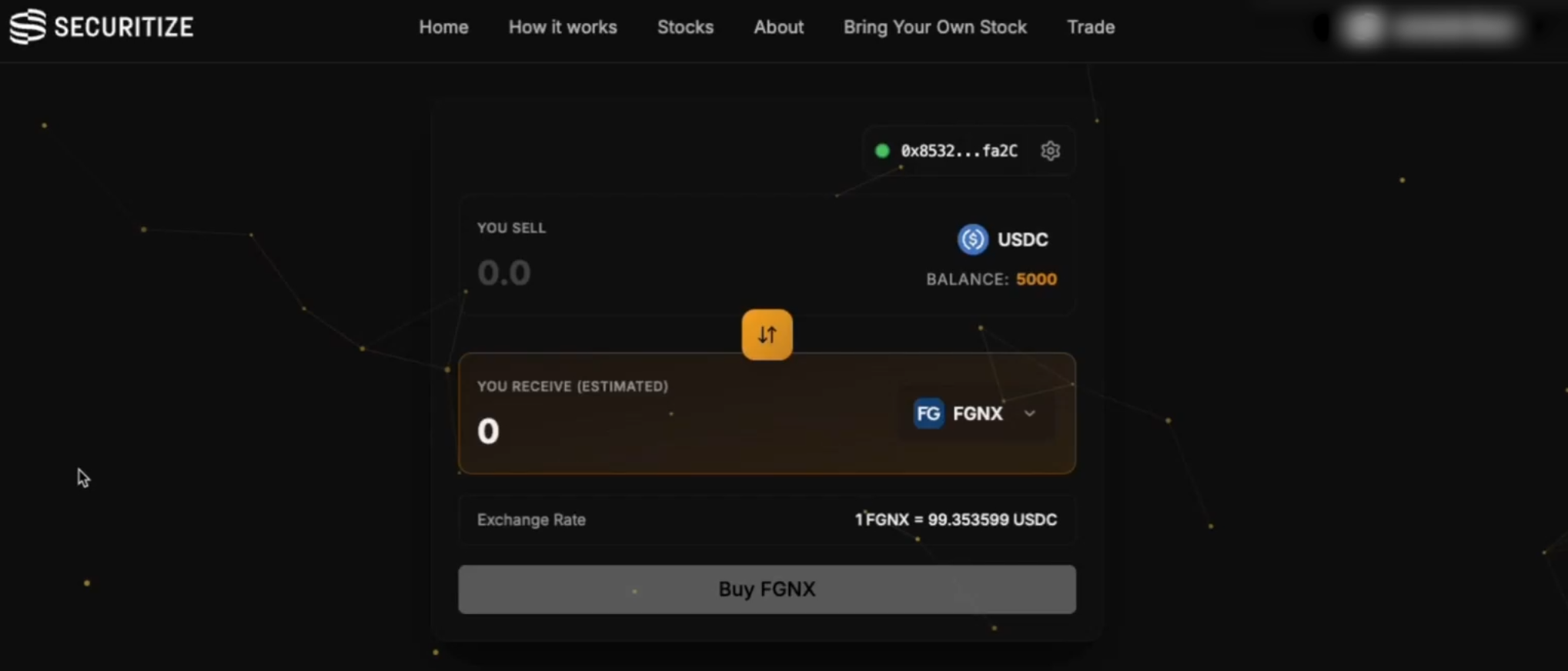

Trading will occur in a swap-style DeFi interface, enabling seamless, real-time transactions.

-

As a SEC-registered transfer agent, Securitize ensures compliance with KYC and AML standards, with launches planned for Q1 2026.

Discover how Securitize’s natively tokenized stocks revolutionize equity trading with 24/7 onchain access and true ownership. Explore compliant blockchain securities set for 2026 launch—stay ahead in tokenized finance today.

What Are Natively Tokenized Stocks by Securitize?

Natively tokenized stocks are digital representations of actual equity shares issued and traded directly on the blockchain, providing genuine ownership rather than synthetic exposure. Securitize, a leader in securities tokenization, plans to introduce these in early 2026, allowing 24/7 trading fully onchain through a compliant DeFi interface. This approach integrates regulated shares with blockchain programmability, bypassing traditional settlement delays and market closures.

Securitize’s announcement highlights the limitations of current tokenized products, which often use offshore structures or permissionless assets lacking proper investor protections. In contrast, their tokens will be recorded directly on the issuer’s cap table, ensuring legal recognition and compliance. As a registered transfer agent with the U.S. Securities and Exchange Commission, Securitize maintains shareholder records and processes ownership changes securely onchain.

Securitize’s tokenized stock trading user interface. Source: Securitize

How Does Securitize Ensure Compliance in Tokenized Stock Trading?

Securitize builds its ecosystem around strict regulatory adherence, criticizing non-compliant tokenized products for evading KYC and AML requirements. Their natively tokenized stocks incorporate whitelisted wallet controls to restrict transfers to verified users only, minimizing risks associated with permissionless assets. According to industry experts, such as those from the Digital Securities Association, this model aligns blockchain innovation with traditional finance safeguards, potentially reducing settlement times from days to near-instantaneous.

The company emphasizes that traditional stock systems, with their T+1 settlement and infrequent direct ownership, are outdated. Securitize’s solution leverages blockchain for programmability, enabling tokenized shares to interact with smart contracts in DeFi applications without sacrificing compliance. “If tokenization is going to matter at public-market scale, it must deliver ownership, real securities, and maintain investor protections,” states a Securitize representative. Supporting data from blockchain analytics firms like Chainalysis indicates that compliant onchain assets could capture up to 10% of global equity markets by 2030, driven by enhanced liquidity and accessibility.

By acting as the official transfer agent, Securitize ensures tokens are legally binding shares, not proxies. This setup allows investors to hold shares in their own name onchain, eliminating intermediaries and associated fees. Experts from financial regulatory bodies, including the SEC’s Division of Corporation Finance, have noted the growing acceptance of such hybrid models, provided they meet disclosure and reporting standards.

Frequently Asked Questions

What Is the Launch Timeline for Securitize’s Natively Tokenized Stocks?

Securitize anticipates launching its compliant, natively tokenized stocks in the first quarter of 2026. This timeline allows for final regulatory alignments and platform testing, ensuring a seamless rollout of 24/7 onchain trading for real equity shares. Investors can prepare by monitoring updates from Securitize’s official channels for early access opportunities.

How Will Natively Tokenized Stocks Integrate with DeFi Platforms?

Natively tokenized stocks from Securitize will integrate with DeFi platforms through smart contract compatibility, allowing compliant trading in a familiar swap-style interface. This enables real-time, 24/7 transactions while upholding KYC and AML protocols, making it ideal for voice searches on blockchain-based equity access that sounds straightforward: trade real shares anytime, anywhere onchain.

Key Takeaways

- True Ownership Model: Securitize’s tokens represent actual regulated shares on the issuer’s cap table, avoiding synthetic risks and ensuring legal validity.

- 24/7 Onchain Trading: Unlike traditional markets, these stocks enable continuous real-time swaps in a DeFi-friendly interface, enhancing global accessibility.

- Compliance First: As an SEC-registered entity, Securitize prioritizes KYC, AML, and whitelisted transfers to protect investors and meet regulatory standards.

Conclusion

Securitize’s upcoming launch of compliant, natively tokenized stocks in 2026 marks a pivotal step in bridging traditional finance with blockchain innovation, offering true equity ownership through secure onchain trading. By addressing the shortcomings of existing tokenized products—such as exposure-only structures and compliance gaps—this initiative promises greater programmability and efficiency for investors. As the tokenized securities landscape evolves, staying informed on developments like these will position market participants to capitalize on emerging opportunities in decentralized equities.