Signs of Ethereum-Led Altcoin Rotation as 2026 Looms

ETH/USDT

$15,764,184,570.61

$1,937.17 / $1,835.36

Change: $101.81 (5.55%)

-0.0004%

Shorts pay

Contents

Ethereum’s recent performance against Bitcoin signals an early rotation in the altcoin market, potentially kicking off a 2026 rally. With ETH/BTC bottoming around 0.30 and dominance rising toward 13%, investors are shifting focus from BTC’s stagnation to ETH’s catalysts like whale buys and institutional partnerships.

-

Ethereum dominance has posted three higher highs weekly, approaching 13% resistance amid Bitcoin’s choppy 60% level.

-

Whale activity shows a major player selling $132.5 million in BTC to buy $140.2 million in ETH over two weeks.

-

ETH has surged 15% in three weeks, outpacing BTC’s 7% gain, supported by nine new institutional partnerships.

Ethereum altcoin rotation 2026: As ETH outperforms BTC, spot early signs of altcoin season. Discover whale moves, dominance shifts, and key catalysts driving this market shift—position your portfolio for potential gains now.

What is Ethereum’s role in the 2026 altcoin rally?

Ethereum altcoin rotation 2026 refers to the shifting investor focus from Bitcoin to Ethereum and other altcoins, historically preceding broader altcoin rallies. In late 2025, Ethereum’s price action against Bitcoin has stabilized after a mid-year downtrend, with the ETH/BTC ratio potentially bottoming at 0.30, indicating a reversal. This movement, coupled with rising Ethereum dominance, suggests ETH is leading the charge into a new cycle, driven by institutional adoption and whale accumulation.

How are whale activities influencing Ethereum dominance?

Ethereum dominance, tracked via metrics like ETH.D, has shown resilience in Q4 2025, forming three consecutive higher highs on weekly charts and nearing key resistance at 13%. Meanwhile, Bitcoin dominance has hovered below 60%, creating space for altcoins to gain traction. Data from on-chain analytics platforms, such as those monitoring large transactions, reveal a significant whale rotation: one entity liquidated $132.5 million worth of Bitcoin while accumulating $140.2 million in Ethereum over the past two weeks. This shift underscores growing confidence in Ethereum’s ecosystem, particularly with its scalability upgrades and layer-2 solutions attracting more developers and users. Experts from firms like Glassnode note that such whale behaviors often precede retail interest, amplifying price momentum. Ethereum’s 15% gain over the last three weeks—compared to Bitcoin’s modest 7%—further validates this trend, as capital inflows into ETH exceed BTC by over twofold. Institutional players have announced nine new partnerships integrating Ethereum for payments and DeFi applications, bolstering its position as the backbone of altcoin innovation. These developments, according to blockchain research from Chainalysis, position Ethereum to capture a larger market share in 2026, potentially sparking an altcoin season where tokens built on ETH thrive.

Frequently Asked Questions

Is the Ethereum altcoin rotation 2026 already underway?

The Ethereum altcoin rotation 2026 appears to be in its early stages as of late 2025. Key indicators include the ETH/BTC pair stabilizing at around 0.30 after a Q2 decline, alongside Ethereum’s dominance climbing toward 13%. Whale accumulations and institutional inflows support this shift, though full altcoin season may depend on Bitcoin’s recovery from its recent 30% crash.

What factors could accelerate Ethereum’s outperformance against Bitcoin?

To understand Ethereum’s potential outperformance, consider its upcoming network upgrades, rising DeFi TVL exceeding $100 billion, and ETF approvals drawing institutional capital. Voice search queries often highlight how Ethereum’s proof-of-stake efficiency and smart contract versatility make it ideal for the next bull phase, naturally positioning it ahead of Bitcoin in a diversifying market.

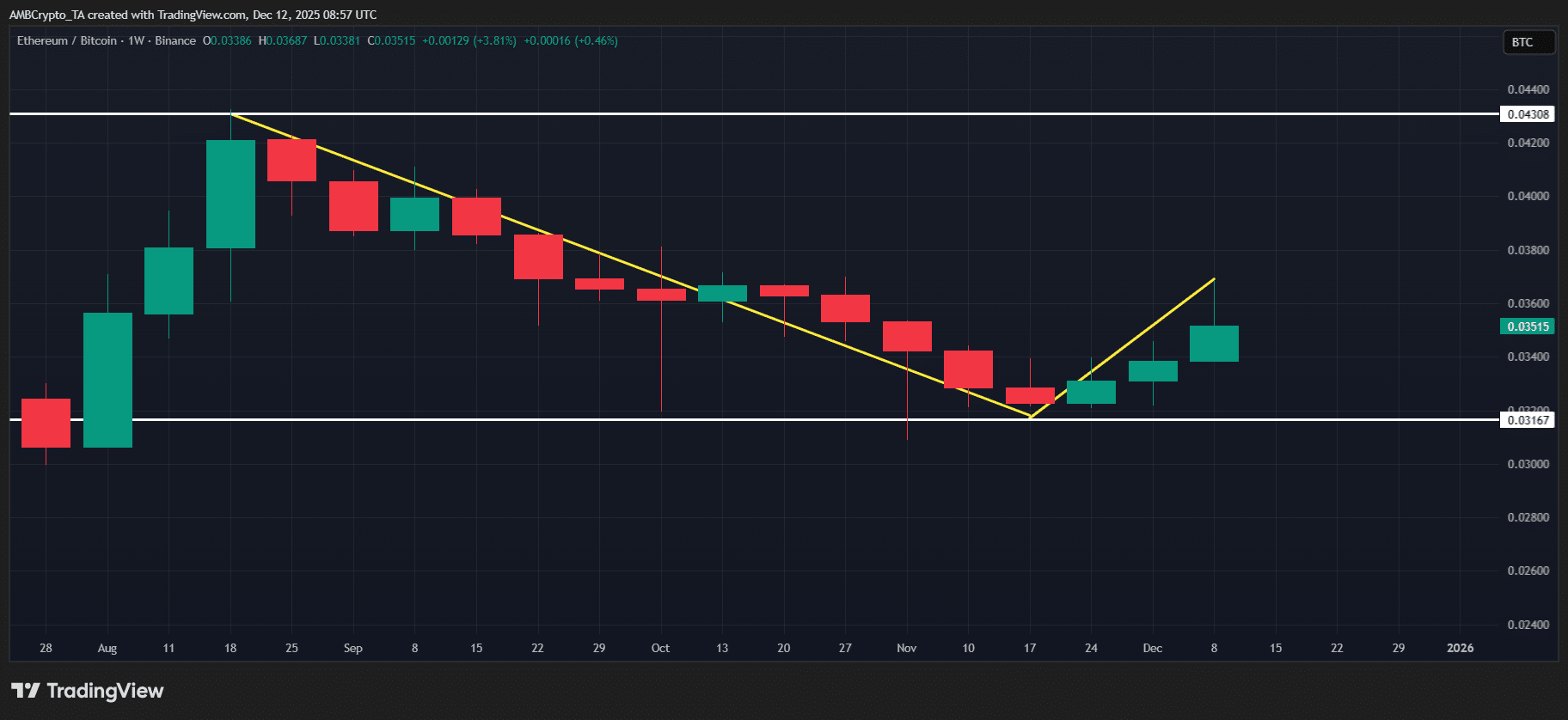

Source: TradingView (ETH/BTC)

As 2025 draws to a close, the cryptocurrency market shows subtle yet significant shifts that could define investment strategies for the coming year. Investors, reflecting on a year where altcoins largely underperformed, are turning their attention to 2026 with renewed optimism. Historical patterns indicate that Ethereum’s leadership often precedes a broader altcoin surge, and current data suggests this rotation may already be underway.

Since the middle of the second quarter, the Ethereum-to-Bitcoin ratio has been on a downward trajectory, dragging the Altcoin Season Index to a low of 33. However, in the final quarter, promising signals have emerged. The ETH/BTC pair appears to have found support near 0.30, hinting at a possible turnaround that could favor altcoins.

Supporting this observation, Ethereum’s dominance metric is gaining momentum. On weekly timeframes, it has achieved three higher highs, inching closer to the critical 13% resistance level. In contrast, Bitcoin’s dominance has remained range-bound below 60%, which historically allows capital to flow into alternative assets.

Although the Altcoin Season Index has not yet reflected these changes fully—still indicating a Bitcoin-led environment—the relative performance metrics are telling. Ethereum’s return on investment in Q4 is approaching parity with Bitcoin’s roughly -18% decline, raising questions about whether this is an Ethereum-specific rotation rather than a broad market recovery. Strategic investors may be positioning themselves accordingly for 2026.

Ethereum catalysts driving early market rotation

The overall market remains delicate, with key support zones under pressure. Bitcoin, for instance, continues to grapple with the aftermath of a sharp 30% drop two months prior. While opportunistic buying has provided some relief, Bitcoin’s failure to reclaim higher levels points to persistent caution among market participants.

In this uncertain landscape, Ethereum’s strength relative to Bitcoin on weekly charts suggests that sophisticated capital is reallocating. On-chain data corroborates this, with a prominent whale divesting $132.5 million in Bitcoin and acquiring $140.2 million in Ethereum within the last two weeks. Such moves by large holders often serve as leading indicators for wider trends.

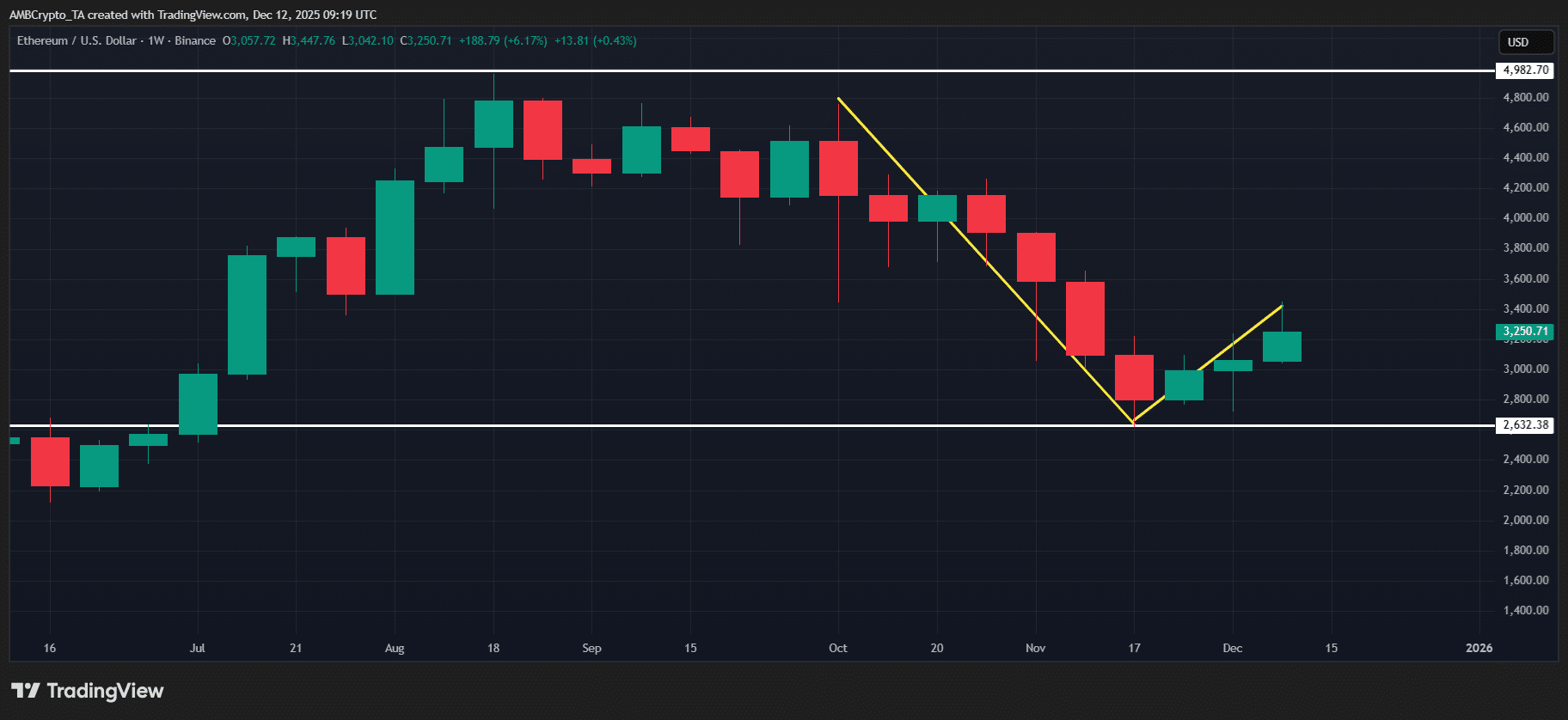

Source: TradingView (ETH/USDT)

This rotation is manifesting in tangible price movements. Over the past three weeks, Ethereum has advanced approximately 15%, significantly surpassing Bitcoin’s 7% increase during the same period. This disparity aligns with the observed whale activity, directing over twice the capital toward Ethereum.

Furthermore, institutional interest is accelerating Ethereum’s momentum. Recent announcements detail nine partnerships that integrate Ethereum into traditional financial services, from cross-border payments to tokenized assets. Reports from Deloitte highlight how Ethereum’s robust developer community and ongoing improvements in transaction speeds are making it indispensable for enterprise blockchain solutions. As per insights from Messari, these factors could propel Ethereum’s market cap growth, fostering an environment where altcoins benefit from increased liquidity and innovation on its network.

Looking deeper, Ethereum’s ecosystem metrics paint an encouraging picture. The total value locked in DeFi protocols on Ethereum has stabilized above $90 billion, demonstrating resilience despite market volatility. Layer-2 scaling solutions like Optimism and Arbitrum have reduced gas fees by up to 90%, drawing more users and dApps. Analysts from CryptoQuant emphasize that this efficiency edge over competitors positions Ethereum favorably for the next growth phase.

Bitcoin’s role as a store of value remains unchallenged, but its slower innovation pace allows Ethereum to capture speculative and utility-driven investments. The Altcoin Season Index, while lagging, could surge if Ethereum breaks its dominance resistance, historically triggering 20-50% gains in major altcoins within months.

Key Takeaways

- Ethereum’s reversal against Bitcoin: The ETH/BTC ratio’s stabilization at 0.30 after a Q2 downtrend signals the start of capital rotation, potentially benefiting altcoins in 2026.

- Whale and institutional support: Large-scale BTC sales funding ETH buys, plus nine new partnerships, indicate strong backing for Ethereum’s leadership in the altcoin space.

- Monitor dominance metrics: Watch ETH.D approaching 13% and BTC.D below 60%—a breakout could confirm an Ethereum-led altcoin rally; adjust portfolios accordingly.

Conclusion

In summary, the Ethereum altcoin rotation 2026 is gaining traction through rising dominance, whale accumulations, and institutional catalysts that differentiate it from Bitcoin’s current consolidation. As Q4 2025 closes, these trends position Ethereum as the vanguard for altcoin growth, with historical precedents suggesting substantial upside for ecosystem tokens. Investors should stay vigilant on key levels and on-chain data, preparing for a dynamic year ahead where Ethereum’s innovations drive broader market participation.

Comments

Other Articles

Bitwise Files for 11 Altcoin ETFs Including AAVE, UNI Amid SOL, XRP Muted Gains

December 31, 2025 at 08:47 PM UTC

Ethereum Stablecoins Reach 2025 Peaks Led by USDT, Amid Sustained Activity

December 31, 2025 at 07:01 PM UTC

Ethereum Could Target $8,500 as Bullish Momentum Builds Near $4,811

December 31, 2025 at 02:39 PM UTC