Signs of Growing Institutional Interest in Ethereum Amid Mixed Whale Activity

ETH/USDT

$15,764,184,570.61

$1,937.17 / $1,835.36

Change: $101.81 (5.55%)

-0.0004%

Shorts pay

Contents

Institutions are increasingly engaging with Ethereum through staking rewards and equity investments, with SharpLink Gaming accumulating 7,846 ETH since June 2025. Whale activities show mixed signals, including sales and purchases, while ETH price maintains stability despite weak momentum indicators.

-

SharpLink Gaming’s staking strategy yields 443 ETH last week, highlighting growing institutional yields from Ethereum.

-

ETH holders via equities surged 245% in Q3, indicating indirect interest unaffected by price fluctuations.

-

Whale transactions include a 20,000 ETH sale by an early investor, balanced by new buys and withdrawals totaling over 4,000 ETH recently.

Ethereum sees rising institutional staking rewards and whale activity in 2025. Discover how SharpLink’s 7,846 ETH accumulation and mixed signals impact ETH stability. Stay informed on crypto trends today.

What is driving renewed institutional interest in Ethereum?

Ethereum is experiencing a surge in institutional involvement primarily through staking mechanisms and linked equity investments, as evidenced by recent corporate strategies. SharpLink Gaming, for instance, has actively staked its Ethereum holdings, generating substantial rewards that underscore the network’s yield potential. This trend reflects broader confidence in Ethereum’s long-term value amid network upgrades and economic incentives.

How are Ethereum staking rewards influencing corporate treasuries?

Ethereum’s proof-of-stake model allows participants to earn rewards by locking up ETH, providing a passive income stream that appeals to institutions seeking stable returns. SharpLink Gaming reported earning 443 ETH in staking rewards during the last week of October 2025, bringing its total to 7,846 ETH since initiating the strategy in June 2025. According to on-chain data analyzed by blockchain trackers, this accumulation follows a pattern of steady growth initially, accelerating notably in October, demonstrating the strategy’s effectiveness in capitalizing on Ethereum’s annual yield rates, which hover around 3-5% based on network participation levels.

Source: X

Indirect institutional exposure is also on the rise, particularly through equities tied to Ethereum holdings. SharpLink Gaming’s SBET stock saw its holder count increase from 40 in the second quarter to 138 in the third quarter of 2025, marking a 245% growth. This expansion suggests larger investors are gaining Ethereum yield exposure without direct price risk, as noted in financial reports from market analysts. BitMine, recognized as the largest corporate holder of Ethereum treasury, added 69,822 ETH in a single week recently, elevating its total to 3.63 million ETH and contributing to a 20% uptick in its stock value. Such moves indicate a coordinated institutional shift toward Ethereum as a foundational asset in diversified portfolios.

Frequently Asked Questions

What recent whale transactions are affecting Ethereum’s market dynamics?

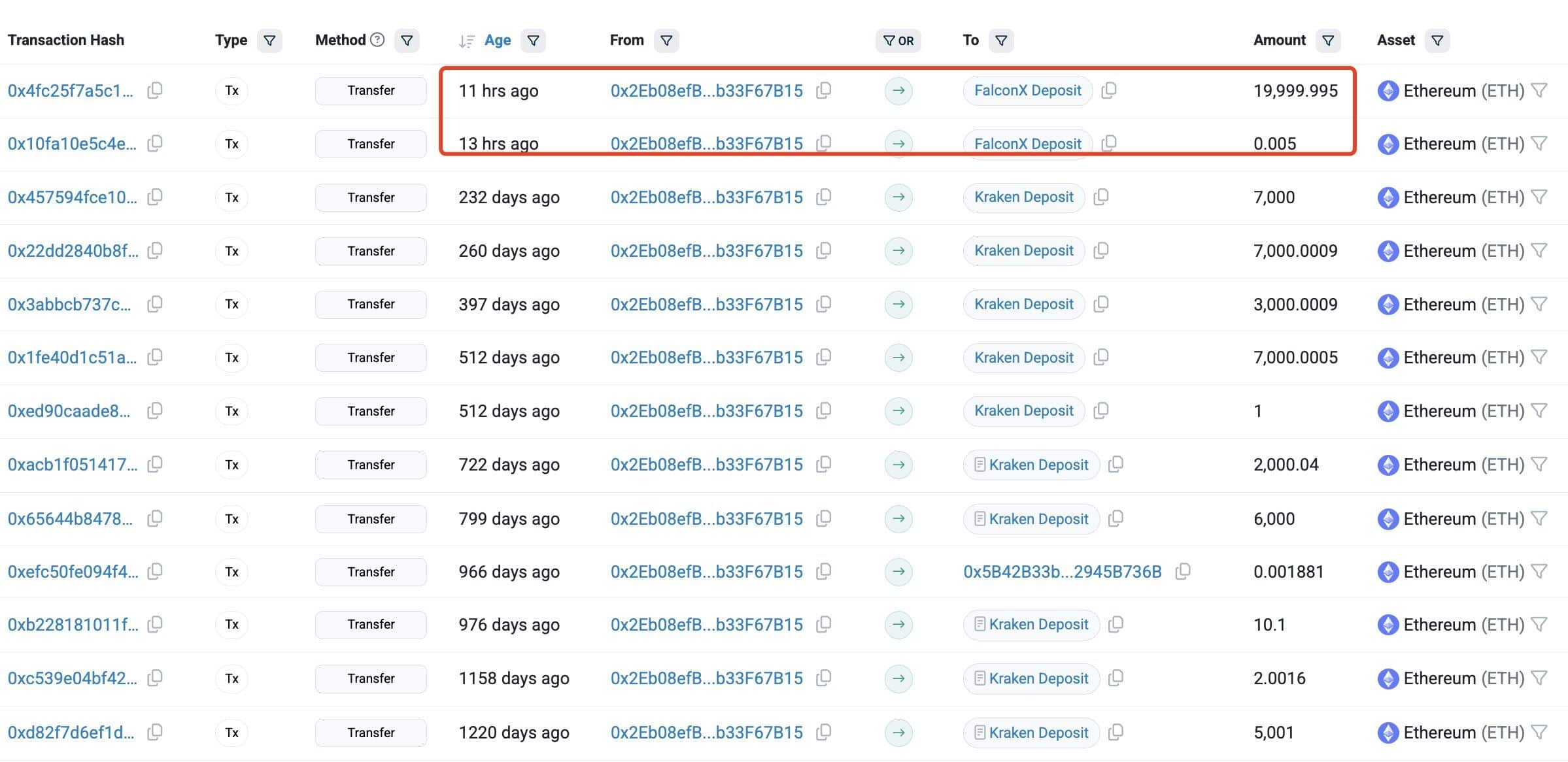

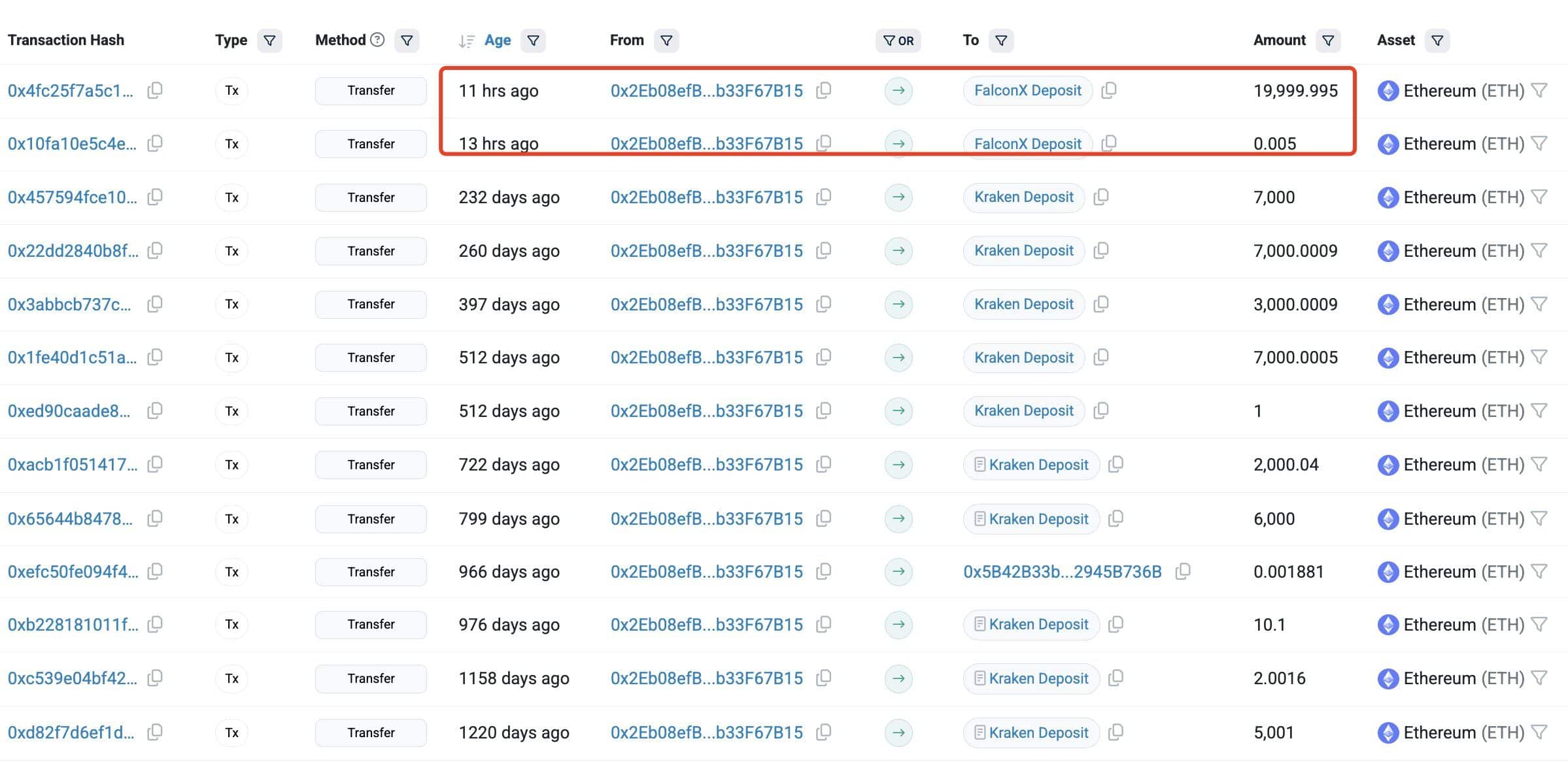

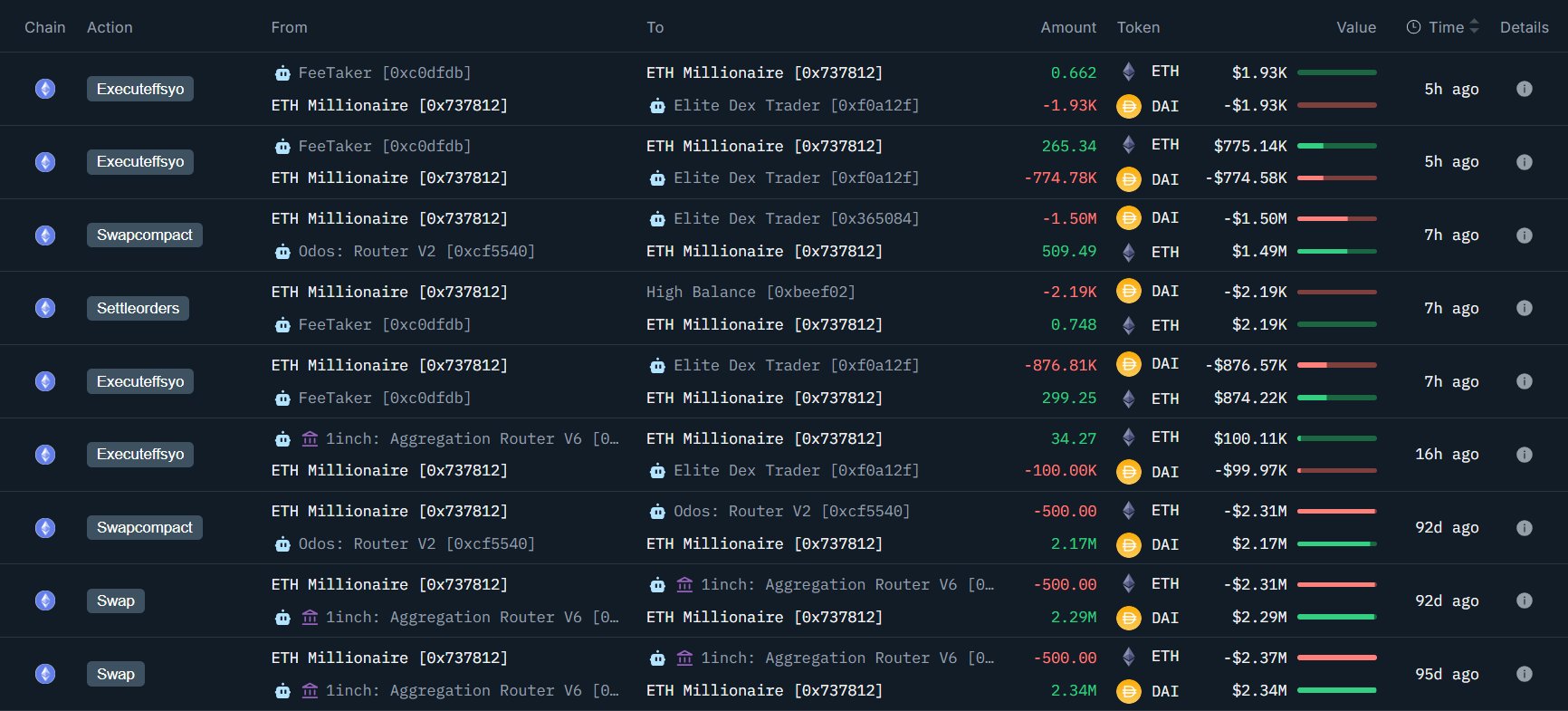

Recent on-chain data reveals diverse whale behaviors, including an early Ethereum investor offloading 20,000 ETH via FalconX, representing a fraction of their ICO-era holdings now valued at approximately $757 million. Concurrently, another wallet extracted 3,089 ETH from Bybit for potential long-term storage, while a dormant whale repurchased 1,110 ETH despite prior sales, retaining $67.8 million in DAI for further opportunities. These actions, tracked by blockchain explorers, highlight varied strategies among large holders but maintain overall network stability.

How stable is Ethereum’s price amid these institutional and whale activities?

Ethereum’s price has shown resilience despite mixed signals from institutions and whales. Technical indicators like the Relative Strength Index (RSI) reflect subdued momentum with potential for recovery if buying pressure increases, while the Moving Average Convergence Divergence (MACD) remains below zero but with converging lines signaling easing sell-offs. This setup, as observed in recent charts from trading platforms, points to a consolidation phase rather than a sharp decline, supporting Ethereum’s role as a reliable blockchain asset for investors.

Key Takeaways

- Institutions are prioritizing Ethereum staking: SharpLink Gaming’s recent 443 ETH rewards exemplify how corporate treasuries are leveraging yields, accumulating over 7,846 ETH since mid-2025.

- Whale movements indicate strategic diversification: Sales of 20,000 ETH by early holders contrast with buys and withdrawals totaling more than 4,000 ETH, suggesting ongoing accumulation amid market caution.

- Price stability persists: Despite weak RSI and MACD readings, converging indicators offer hope for a rebound, reinforcing Ethereum’s foundational position in the crypto ecosystem.

Whales are moving, but not together

An early Ethereum participant recently liquidated 20,000 ETH through the over-the-counter platform FalconX. This transaction represents only a small portion of their substantial ICO allocation, which has appreciated to a value exceeding $757 million based on current market rates. Such selective sales by long-term holders often reflect profit-taking strategies rather than a lack of faith in the network.

Source: X

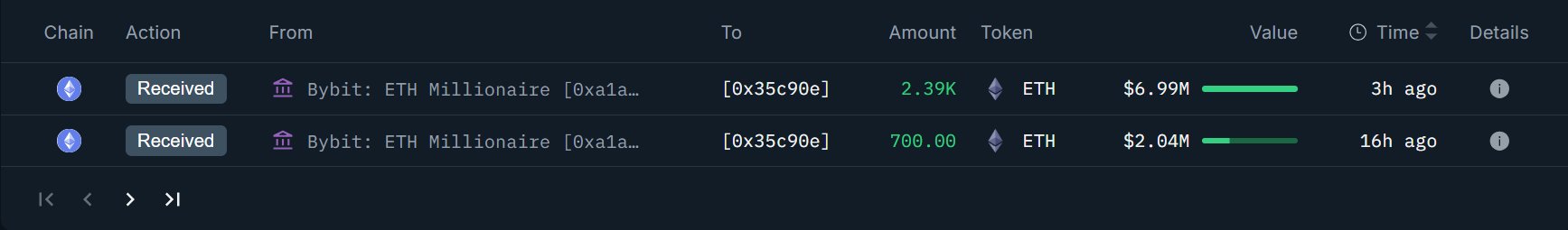

In parallel, a separate address withdrew 3,089 ETH from the Bybit exchange, a move typically associated with transferring assets to secure, non-custodial wallets for extended holding periods. This action aligns with patterns observed in on-chain analytics, where large transfers from exchanges signal confidence in Ethereum’s future utility and security.

Source: X

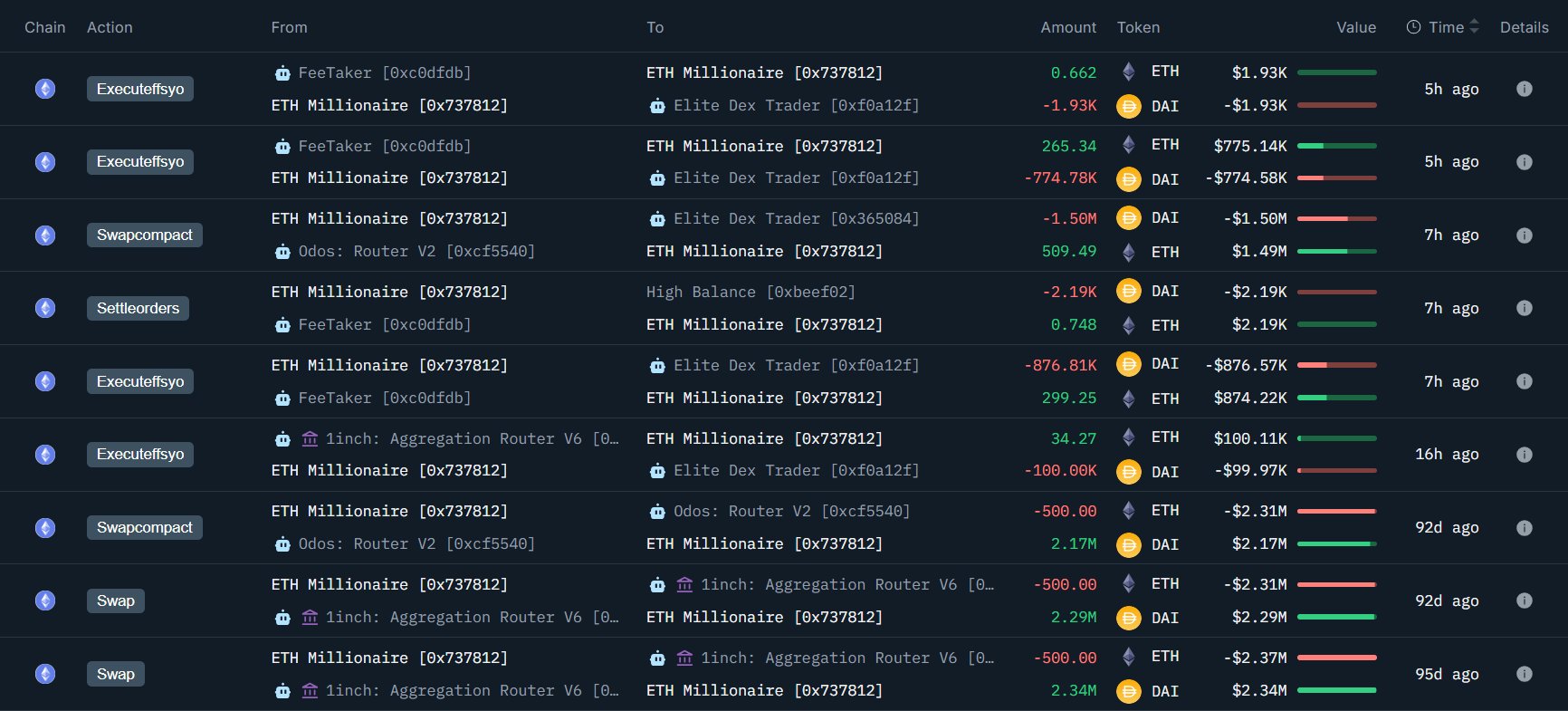

Additionally, a whale that had been inactive for months re-entered the market by acquiring 1,110 ETH. This purchase follows previous sales during periods of elevated prices, and the entity maintains a significant $67.8 million balance in DAI stablecoin, positioning it for additional Ethereum investments as market conditions evolve.

Source: X

These divergent whale activities—ranging from sales to strategic accumulations—contribute to Ethereum’s market liquidity while underscoring the asset’s appeal to sophisticated investors.

Price looks weak, but there is stability

Ethereum’s price chart in late 2025 displays signs of consolidation rather than outright decline. The Relative Strength Index (RSI) indicates reduced buying momentum, yet it remains above oversold levels, leaving space for potential upward movement should institutional inflows intensify. Meanwhile, the Moving Average Convergence Divergence (MACD) histogram lingers in negative territory, but the signal and MACD lines are inching closer, a precursor to diminished downward pressure.

This technical profile, derived from data across major exchanges, suggests Ethereum is stabilizing after recent volatility. Institutional staking rewards and equity gains provide a supportive undercurrent, mitigating risks from whale sales. As Ethereum continues to process a high volume of transactions—over 1 million daily as per network statistics—the asset’s utility in decentralized finance and smart contracts bolsters its resilience.

Market observers, including those from Glassnode and Santiment, note that on-chain metrics like active addresses and staking participation remain robust, with over 30% of ETH supply staked. This foundation positions Ethereum favorably for future growth, particularly with upcoming scalability enhancements.

Conclusion

In summary, Ethereum staking rewards and institutional investments are fueling renewed interest, as seen in SharpLink Gaming’s steady accumulation and the 245% rise in equity holders. Whale movements, though mixed, reflect strategic positioning rather than panic, while price indicators point to emerging stability. As Ethereum solidifies its role in the blockchain landscape, investors should monitor these trends for opportunities in Ethereum institutional interest, potentially leading to sustained appreciation in 2025 and beyond.