Solana and Ethereum Stablecoins Gain Traction in Europe Amid Regulatory Scrutiny

SOL/USDT

$4,203,361,175.30

$82.37 / $77.12

Change: $5.25 (6.81%)

-0.0056%

Shorts pay

Contents

Ethereum and Solana stablecoins have achieved significant adoption in Europe in 2025, with transaction volumes reaching 113.3 million despite regulatory pressures. On-chain data from Artemis reveals a 150% year-over-year surge, highlighting robust traction amid ECB concerns over financial stability risks.

-

Transaction volumes in Europe hit 113.3 million for Ethereum and Solana stablecoins in 2025, up more than 150% from 44.1 million in 2024.

-

On-chain analytics show consistent monthly activity, peaking at 14.9 million in January despite regulatory hurdles.

-

80% of global crypto trades involve stablecoins like USDT and USDC, fueling DeFi and trading on these networks.

Ethereum and Solana stablecoins surge in Europe: 150% transaction growth in 2025 despite MiCAR regulations. Explore on-chain data, ECB warnings, and bank-backed projects. Stay ahead in crypto—read now!

What Drives Ethereum and Solana Stablecoin Adoption in Europe?

Ethereum and Solana stablecoins are experiencing robust adoption in Europe, propelled by high crypto trading volumes and demand for efficient on-ramps. On-chain data from Artemis indicates transaction counts climbed to 113.3 million through November 2025, a more than 150% increase from 2024’s 44.1 million. This growth persists amid stringent regulations like MiCAR, underscoring stablecoins’ critical role in DeFi and cross-border payments.

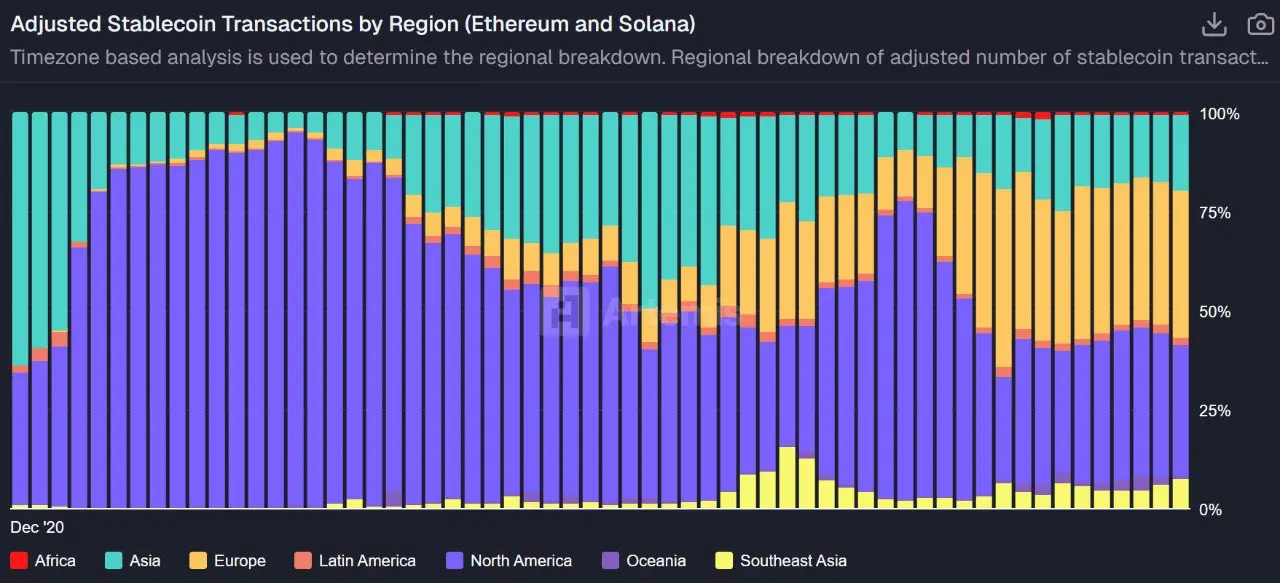

Source: Artemis. Adjusted Stablecoin Transactions by Region (Ethereum and Solana)

Source: Artemis. Adjusted Stablecoin Transactions by Region (Ethereum and Solana)How Has Stablecoin Transaction Activity Evolved in European Time Zones?

Stablecoin transactions on Ethereum and Solana in European time zones demonstrated remarkable resilience throughout 2025. Artemis data shows November activity at 7.8 million transactions, up slightly from October’s 7.7 million but down from September’s 8.8 million peak. August recorded 10 million, following July’s 10.1 million, while June and May logged 7.6 million and 8.1 million, respectively. Earlier months saw higher volumes: April at 10.5 million, March at 14.1 million, February at 13.7 million, and January leading with 14.9 million.

Year-over-year comparisons paint an even stronger picture of growth. Total 2025 volume through November reached 113.3 million, dwarfing 2024’s 44.1 million—a surge exceeding 150%. This follows exponential progress from 3.8 million in 2023 and just 1.5 million in 2022, reflecting maturing infrastructure and rising user confidence.

Stablecoins like USDT and USDC dominate, facilitating about 80% of trades on centralized exchanges. Their pegged value minimizes volatility exposure, making them ideal for trading and DeFi applications. Investor demand, coupled with global regulatory clarity, has accelerated this trend, even as local scrutiny intensifies.

Frequently Asked Questions

What Are the Main Risks of Stablecoin Growth in Europe According to the ECB?

The European Central Bank’s November 2025 Financial Stability Review, authored by Senne Aerts, flags risks like de-pegging, bank runs, and retail deposit outflows from traditional banks. These could heighten funding volatility and threaten financial stability, particularly if platforms offer interest on holdings, prompting banking disintermediation.

Why Are Ethereum and Solana Stablecoins Popular for Trading in Europe?

Ethereum and Solana stablecoins enable seamless crypto trading by providing stable value bridges. They support quick conversions without fiat volatility, powering 80% of global exchange volumes. In Europe, their efficiency shines for 24/7 operations, despite MiCAR restrictions on interest-bearing accounts.

Key Takeaways

- Explosive Growth: Ethereum and Solana stablecoin transactions in Europe jumped over 150% in 2025 to 113.3 million, per Artemis data.

- Regulatory Tension: ECB warns of stability risks from deposit shifts, yet adoption surges amid MiCAR compliance efforts.

- Future Outlook: Nine European banks advance Qivalis, a euro-pegged stablecoin launching in 2026 for faster cross-border settlements.

Conclusion

Ethereum and Solana stablecoins continue to drive adoption in Europe, with transaction volumes soaring 150% in 2025 despite regulatory scrutiny from MiCAR and ECB concerns over financial stability. On-chain metrics from Artemis underscore their integral role in trading and DeFi, while initiatives like the Qivalis project by nine banks signal broader institutional embrace. As stablecoin infrastructure strengthens, investors should monitor evolving regulations for sustained opportunities in this dynamic market.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

3/1/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/28/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/27/2026

DeFi Protocols and Yield Farming Strategies

2/26/2026