Solana and XRP ETFs Attract $900M Inflows Amid Broader Crypto Outflows

XRP/USDT

$2,480,132,667.31

$1.3653 / $1.27

Change: $0.0953 (7.50%)

-0.0099%

Shorts pay

Contents

Solana and XRP ETFs have seen nearly $900 million in combined inflows since launch, defying a market downturn with no outflow days recorded. This reflects strong investor interest in altcoin exposure amid Bitcoin and Ether ETF redemptions.

-

Solana ETFs accumulate $500 million in net inflows, maintaining steady gains even during broader market declines.

-

XRP ETFs record $410 million in cumulative inflows, with significant debuts from major asset managers.

-

Both products show zero outflows to date, per SoSoValue data, contrasting sharp outflows in spot Bitcoin and Ether ETFs averaging over $200 million weekly.

Solana and XRP ETFs inflows reach $900M despite market rout, signaling altcoin resilience. Discover key drivers and performance insights—explore now for informed crypto investment strategies. (148 characters)

What are the key inflows for Solana and XRP ETFs amid the 2025 market rout?

Solana and XRP ETFs inflows have demonstrated remarkable resilience, attracting nearly $900 million in combined net inflows since their launches in late 2025. This stands in stark contrast to the heavy outflows plaguing spot Bitcoin and Ether exchange-traded funds, which have experienced some of the largest redemptions in their history. According to data from crypto ETF tracker SoSoValue, neither Solana nor XRP ETFs has recorded a single outflow day, underscoring a growing investor appetite for diversified altcoin products during turbulent times.

Spot Bitcoin and Ether ETFs, once darlings of institutional adoption, are now facing multi-week outflow streaks that have drained billions from the sector. In November 2025 alone, these flagship products saw daily outflows exceeding $100 million on several occasions, driven by macroeconomic pressures and shifting risk appetites. Meanwhile, the emergence of Solana and XRP ETFs offers a counter-narrative, with steady capital inflows highlighting selective conviction in established altcoins with robust ecosystems.

The Solana ETF category has led the charge, amassing approximately $500 million in net inflows. Daily figures have ranged from modest $8 million to peaks of $55 million, with November 19 marking the strongest single-day performance. This momentum builds on Solana’s reputation for high-speed transactions and its growing role in decentralized finance (DeFi) and non-fungible token (NFT) markets, drawing investors seeking alternatives to Ethereum’s scalability challenges.

Solana ETF inflows in November. Source: Farside Investors

Why have XRP and Solana ETFs maintained consistent inflows during market stress?

XRP ETFs kicked off with impressive debuts, particularly from Bitwise Asset Management’s product under the ticker XRP, which drew $105 million on its first trading day in late November 2025. Canary Capital’s XRPC ETF followed suit, adding $12.8 million on the same day, pushing total daily inflows to $118 million. These figures, tracked by SoSoValue, illustrate the immediate appeal of XRP’s use case in cross-border payments, bolstered by Ripple’s ongoing regulatory victories and partnerships with financial institutions.

Canary CEO Steven McClurg highlighted the competitive yet collaborative spirit in the sector, noting support for new entrants like Bitwise while emphasizing Canary’s own record-breaking $243 million inflow day on November 14 for XRPC. This consistency persists despite broader market volatility, where fear, uncertainty, and doubt (FUD) indices have spiked amid geopolitical tensions and interest rate hikes. Expert analysis from financial analysts at Bloomberg suggests that such inflows reflect a “barbell strategy,” where investors balance core holdings like Bitcoin with high-conviction altcoins like Solana and XRP for potential upside.

Solana ETFs mirror this pattern, with daily inflows holding firm between $8.26 million and $55.61 million throughout the week ending November 20, 2025. The network’s technical advantages—processing up to 65,000 transactions per second at low costs—continue to attract developers and users, indirectly supporting ETF demand. Data from Dune Analytics dashboards further corroborates this, showing Solana’s total value locked (TVL) in DeFi protocols rebounding to $4.5 billion, a 15% increase from October lows. These metrics provide tangible evidence of ecosystem health, reassuring investors amid the rout.

Source: Steven McClurg

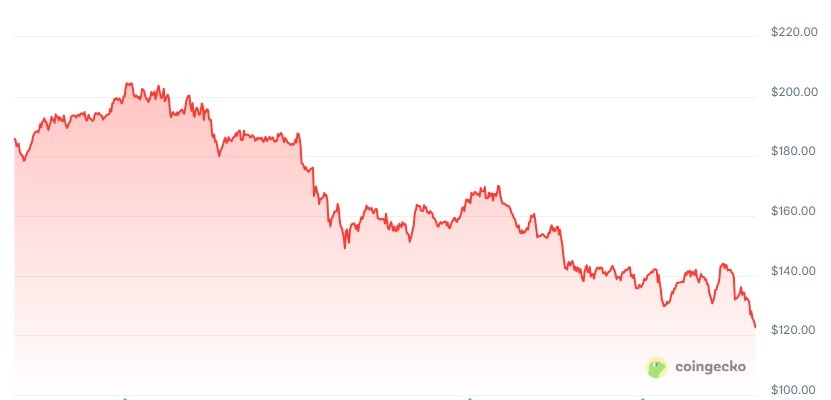

However, the divergence isn’t without caveats. While ETF inflows signal optimism, the underlying tokens have underperformed. Solana’s price has dropped 32.5% over the past month and 10.9% in the last week, trading at $122.94 as of November 20, 2025—a 52.3% decline year-over-year, per CoinGecko metrics. This disconnect may stem from leveraged trading liquidations and broader altcoin sell-offs, yet ETF managers like Bitwise emphasize long-term fundamentals over short-term price action.

Solana’s 30-day price chart. Source: CoinGecko

XRP fares slightly better on a yearly basis, up 49.9% to $1.86, but it has shed 21.2% in the last 30 days and 16.6% weekly. Regulatory clarity from the U.S. Securities and Exchange Commission (SEC) has been a tailwind, with Ripple’s partial win in its long-standing lawsuit reducing overhang. Industry observers, including those cited in reports from Reuters, point to XRP’s integration into remittance networks as a driver for sustained ETF interest, even as spot prices lag.

Frequently Asked Questions

What factors are driving Solana and XRP ETFs inflows in 2025?

Solana and XRP ETFs inflows are propelled by investor diversification strategies, seeking exposure to high-throughput blockchains and payment-focused assets amid Bitcoin’s dominance waning. With $900 million combined, these products benefit from no outflows since launch, per SoSoValue, reflecting confidence in their ecosystems despite a 20-30% token price dip in recent months. (47 words)

How do Solana and XRP ETF performances compare to Bitcoin and Ether in the current market?

In simple terms, Solana and XRP ETFs are gaining ground with steady inflows totaling nearly $900 million, while Bitcoin and Ether ETFs face massive outflows exceeding $2 billion this quarter. This shift highlights altcoin appeal for those optimizing portfolios during downturns, as spoken by financial advisors on platforms like CNBC. (52 words)

Key Takeaways

- Resilient Inflows: Solana ETFs hit $500 million net, with daily gains up to $55 million, showcasing altcoin durability in a bearish environment.

- XRP Momentum: Debut days exceeded $100 million, led by Bitwise and Canary, supported by regulatory progress and enterprise adoption.

- Price-ETF Disconnect: Despite 20-32% token declines, ETF data from SoSoValue signals long-term investor bets on recovery.

Conclusion

The surge in Solana and XRP ETFs inflows to nearly $900 million amid the 2025 market rout underscores a pivotal shift toward altcoin diversification, even as Bitcoin and Ether products bleed capital. With no outflows recorded and strong debuts from managers like Bitwise and Canary, these ETFs highlight investor conviction in scalable networks and payment innovations. As regulatory landscapes evolve and ecosystems mature, such products may pave the way for broader crypto adoption—consider monitoring these trends for strategic portfolio adjustments.