Solana and XRP ETFs Draw Inflows in Market Downturn, Suggesting Institutional Accumulation

XRP/USDT

$2,480,132,667.31

$1.3653 / $1.27

Change: $0.0953 (7.50%)

-0.0099%

Shorts pay

Contents

Solana and XRP ETFs are attracting significant inflows amid a crypto market downturn, with over $600 million and $800 million in net assets respectively, signaling institutional accumulation of discounted assets through regulated channels.

-

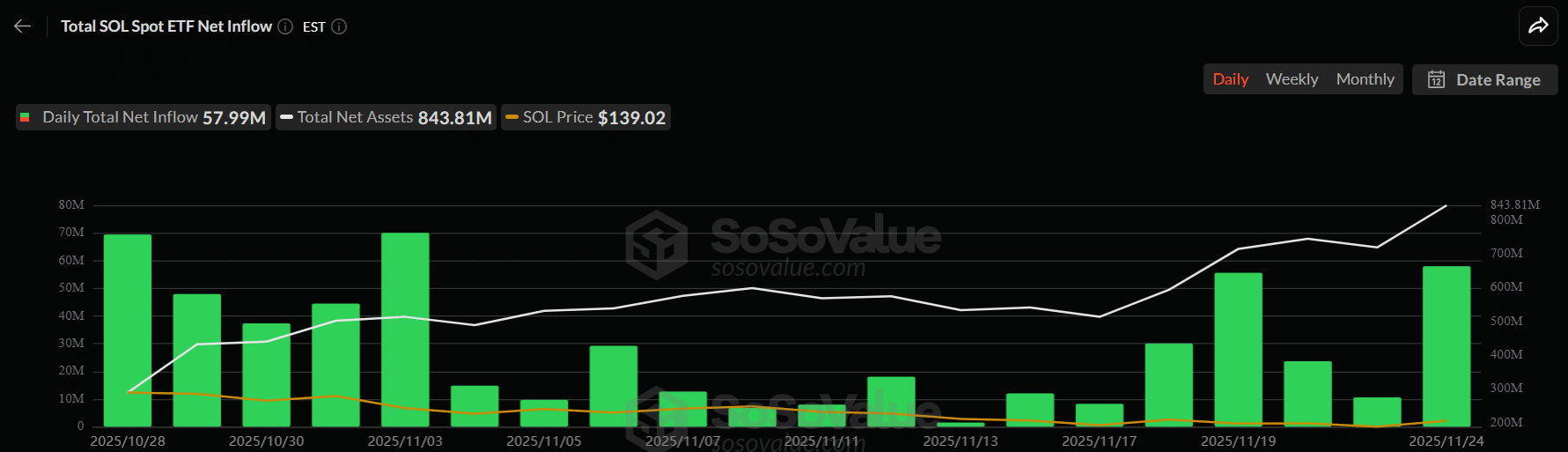

Solana ETF records steady $50-70 million daily inflows despite SOL trading near $139.

-

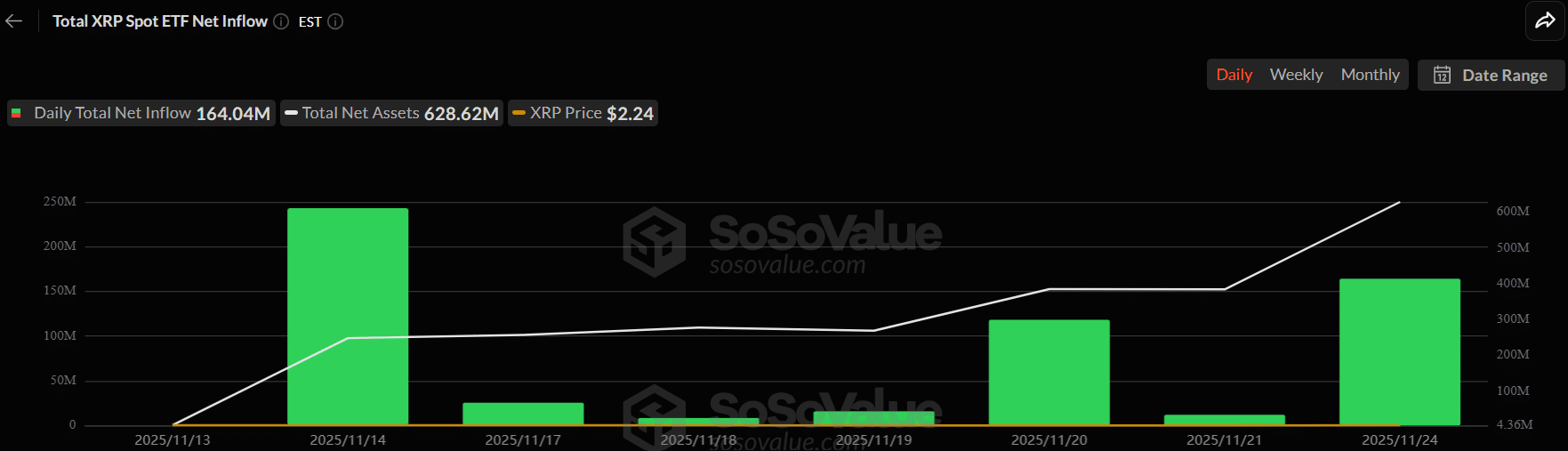

XRP ETF debuts with $250 million on day one, building to $628 million in assets as XRP hovers at $2.24.

-

These trends, per SoSoValue data, highlight reduced market panic and ETF stabilization effects during volatility.

Discover why Solana and XRP ETFs thrive in a crypto downturn: institutional inflows signal buying opportunities. Explore key insights and future implications for investors now.

What Are Solana and XRP ETFs Doing During the Crypto Market Downturn?

Solana and XRP ETFs are experiencing robust inflows even as broader cryptocurrency prices decline, indicating strong institutional interest in regulated access to these assets. Launched amid thinned liquidity and low confidence, these products have amassed hundreds of millions in assets, suggesting investors are using the dip to build positions without direct exposure to spot volatility. This counterintuitive performance underscores ETFs’ role as market stabilizers.

How Do These ETF Inflows Reflect Institutional Strategies?

The inflows into Solana and XRP ETFs reveal a deliberate approach by large investors, who are accumulating shares to gain exposure to high-potential altcoins at reduced valuations. Data from SoSoValue shows XRP’s ETF starting with $250 million on its debut day, the year’s strongest, and sustaining gains to reach $628.62 million in net assets, while Solana’s climbed to $843.81 million through consistent $50-70 million daily additions. This pattern, building steadily over days, aligns with institutional position-building rather than retail panic selling.

Ray Youssef, CEO of NoOnes, emphasized the significance in comments to financial analysts: “…but this time, the launches are colliding with tight liquidity, low investor confidence and pronounced market underperformance.” He noted that such timing acts as a stress test, potentially unlocking capital from traditional sources that previously shunned direct token holdings. “For the first time, retail and institutional investors can gain brokerage-integrated exposure to a diversified set of high-beta altcoins at scale,” Youssef added, highlighting how these ETFs bridge traditional finance with digital assets.

In contrast to Bitcoin ETFs’ launch in an optimistic 2021 environment or Ethereum futures in steadier times, Solana and XRP products entered a fragile market. Yet, their success points to a divergence: while retail sentiment wavers, institutions view the downturn as an entry point. ETF flows provide public visibility into these moves, absorbing sell pressure and fostering stability. For XRP, the focus appears on its regulatory clarity post-legal wins, drawing conservative allocators. Solana, meanwhile, benefits from its high-throughput ecosystem, appealing to those betting on scalability solutions.

These developments carry broader implications. Sustained inflows could pressure prices upward if macro conditions improve, with Solana eyeing $150 and XRP $3 as near-term targets, contingent on Bitcoin stabilizing. However, persistent outflows from other areas underscore uneven recovery. Authoritative sources like Bloomberg and CoinDesk have reported similar patterns in ETF data, reinforcing that regulated products are reshaping altcoin investment dynamics.

Source: SoSoValue

Source: SoSoValue

The charts illustrate measured, day-over-day growth, underscoring a lack of frenzy and more calculated entries. This resilience amid declining prices—SOL at $139 and XRP at $2.24—suggests ETFs are decoupling from spot market fear, offering a buffer for diversified portfolios.

Frequently Asked Questions

Why Are Solana and XRP ETFs Attracting Inflows in a Bearish Crypto Market?

Solana and XRP ETFs draw inflows because they provide regulated, brokerage-accessible exposure to altcoins during price dips, appealing to institutions seeking value. With net assets surpassing $600 million for XRP and $800 million for Solana per SoSoValue, these products enable accumulation without direct volatility risks, as noted by market analysts.

What Impact Do These ETF Launches Have on Overall Market Sentiment?

These launches boost sentiment by demonstrating institutional confidence, countering retail panic with steady capital entry. As Ray Youssef of NoOnes observed, they integrate high-beta assets into traditional channels, potentially stabilizing the market and encouraging broader adoption through familiar investment vehicles.

Key Takeaways

- Institutional Accumulation: Solana and XRP ETFs see consistent inflows, indicating big players buying discounted assets via regulated means.

- Market Stabilization: Despite downturns, these products absorb selling pressure, reducing overall panic as shown in SoSoValue inflow data.

- Future Outlook: Persistent demand could support price recoveries for SOL above $150 and XRP toward $3, if Bitcoin holds key supports.

Conclusion

In summary, the strong performance of Solana and XRP ETFs during a crypto downturn highlights shifting institutional strategies toward regulated altcoin exposure. With inflows defying broader market weakness, as evidenced by SoSoValue metrics and expert insights from figures like Ray Youssef, these developments signal resilience and potential for renewed capital inflows. Investors should monitor ongoing flows and macro trends, positioning for opportunities as the market evolves toward greater integration with traditional finance.

Comments

Other Articles

Bitwise Files for 11 Altcoin ETFs Including AAVE, UNI Amid SOL, XRP Muted Gains

December 31, 2025 at 08:47 PM UTC

Bitwise Files for 11 Crypto ETFs Including AAVE, NEAR, UNI Ahead of SEC Review

December 31, 2025 at 09:03 AM UTC

ETH Remains the Largest Long Position Despite ~$39.4M Unrealized Losses, Led by BTC OG Insider Whale on Hyperliquid

December 31, 2025 at 02:36 AM UTC