Solana and XRP Fundamentals Strong in 2025, Yet Prices May Lag Without Altcoin Flows

XRP/USDT

$2,480,132,667.31

$1.3653 / $1.27

Change: $0.0953 (7.50%)

-0.0099%

Shorts pay

Contents

Solana and XRP have shown strong bullish momentum in 2025, driven by institutional adoption, ETF launches, and network growth, despite recent price corrections. Both assets benefit from strategic partnerships and increasing liquidity, positioning them for potential breakouts if altcoin flows improve.

-

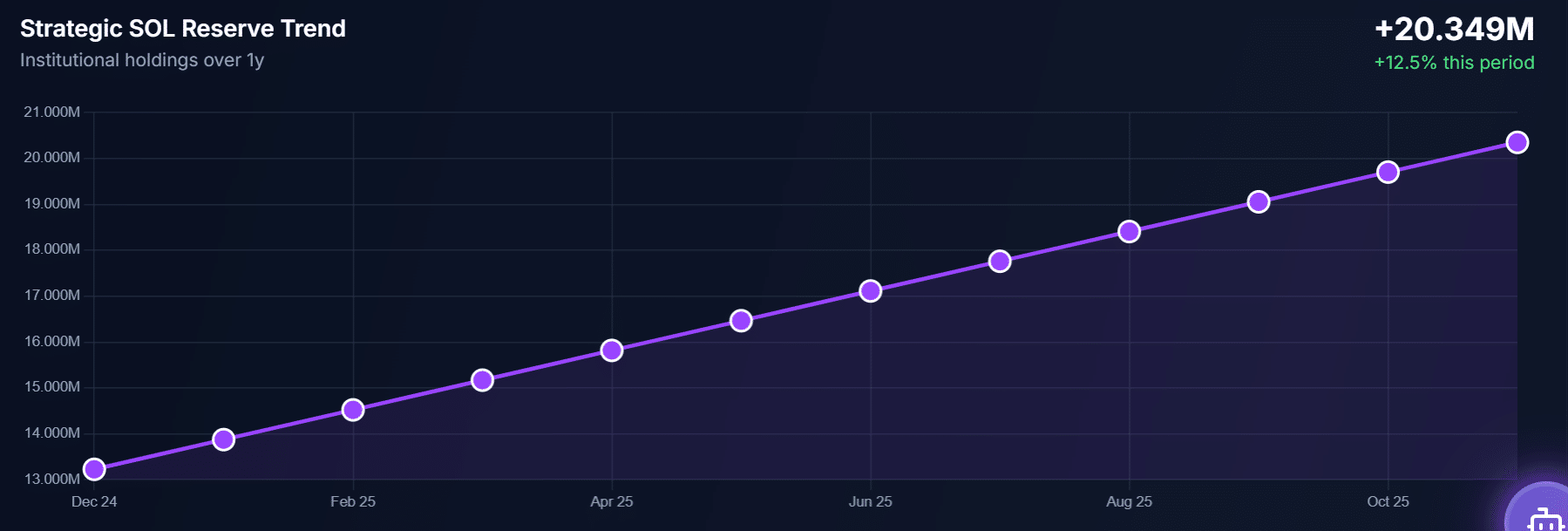

Solana’s institutional holdings surged 15% to 20.35 million SOL, tightening supply and enhancing legitimacy.

-

XRP’s fundamentals strengthened through payments-focused XRPL integrations and ETF activity with $21.7 million turnover.

-

Altcoin market lagged despite BTC dominance dips, with SOL and XRP down 30% this quarter amid broader risk-off sentiment; data from TradingView charts indicate support levels at risk.

Discover the bullish outlook for Solana and XRP in 2025 amid market challenges. Explore institutional inflows, ETF impacts, and price divergence for key insights and investment strategies.

What is the bullish outlook for Solana and XRP in 2025?

The bullish outlook for Solana and XRP in 2025 stems from robust institutional adoption and network advancements, even as prices face short-term pressures. Solana has seen its Digital Asset Treasury allocations rise significantly, while XRP benefits from Ripple’s payment ecosystem expansions and recent ETF approvals. These factors underscore long-term potential, with both assets drawing substantial capital inflows despite broader altcoin market volatility.

How have institutional flows impacted Solana and XRP performance?

Institutions have poured resources into Solana and XRP throughout 2025, bolstering their ecosystems. Solana’s total institutional holdings increased by approximately 15% to 20.35 million SOL, which has effectively reduced the circulating supply and highlighted growing confidence among large investors. This milestone, noted in reports from blockchain analytics platforms, aligns with back-to-back ETF launches that continue to attract steady capital. For XRP, the Bitwise ETF alone recorded $21.7 million in turnover shortly after launch, signaling strong demand in the payments sector. Experts like those from financial research firms emphasize that such inflows provide a foundation for scalability, with Solana focusing on stablecoin integrations and XRP on cross-border transactions. Short sentences reveal the data: Solana’s network processed record volumes, while XRP’s XRPL handled efficient remittances. These developments, supported by on-chain metrics, demonstrate resilience amid macroeconomic uncertainty.

Source: Strategic Solana Reserve

Despite these positives, price action has not fully reflected the underlying strength. Both Solana and XRP have declined over 30% in the current quarter, mirroring a risk-off environment across high-cap altcoins. Annualized yields remain negative, but analysts point to this as a temporary alignment with market trends rather than a fundamental weakness.

Frequently Asked Questions

Why haven’t Solana and XRP prices surged despite 2025’s institutional adoption?

In 2025, Solana and XRP experienced significant institutional adoption through ETF inflows and holdings growth, yet prices lagged due to broader altcoin market dynamics. Bitcoin dominance fluctuations suppressed rotational flows, keeping both assets correlated with the overall sector. Data from market indices shows the Altcoin Season Index far from signaling a full rally, leading to 30% quarterly drops despite solid fundamentals.

What factors could drive a breakout for Solana and XRP in late 2025?

Several factors could spark a breakout for Solana and XRP by late 2025, including increased altcoin investment flows and sustained network utility. If Bitcoin dominance dips below 60% as in mid-August patterns, capital rotation might favor high-beta assets like these. Strategic partnerships in stablecoins for Solana and payments for XRP, combined with ETF momentum, would amplify gains in a recovering market.

Key Takeaways

- Bullish Fundamentals in 2025: Solana and XRP benefited from institutional inflows, ETF launches, and partnerships, with Solana’s holdings up 15% and XRP’s ETF turning $21.7 million.

- Price Lag Amid Risk-Off: Despite momentum, both assets dropped 30% this quarter, aligning with altcoin weakness as BTC dominance hovers and rotational flows stall.

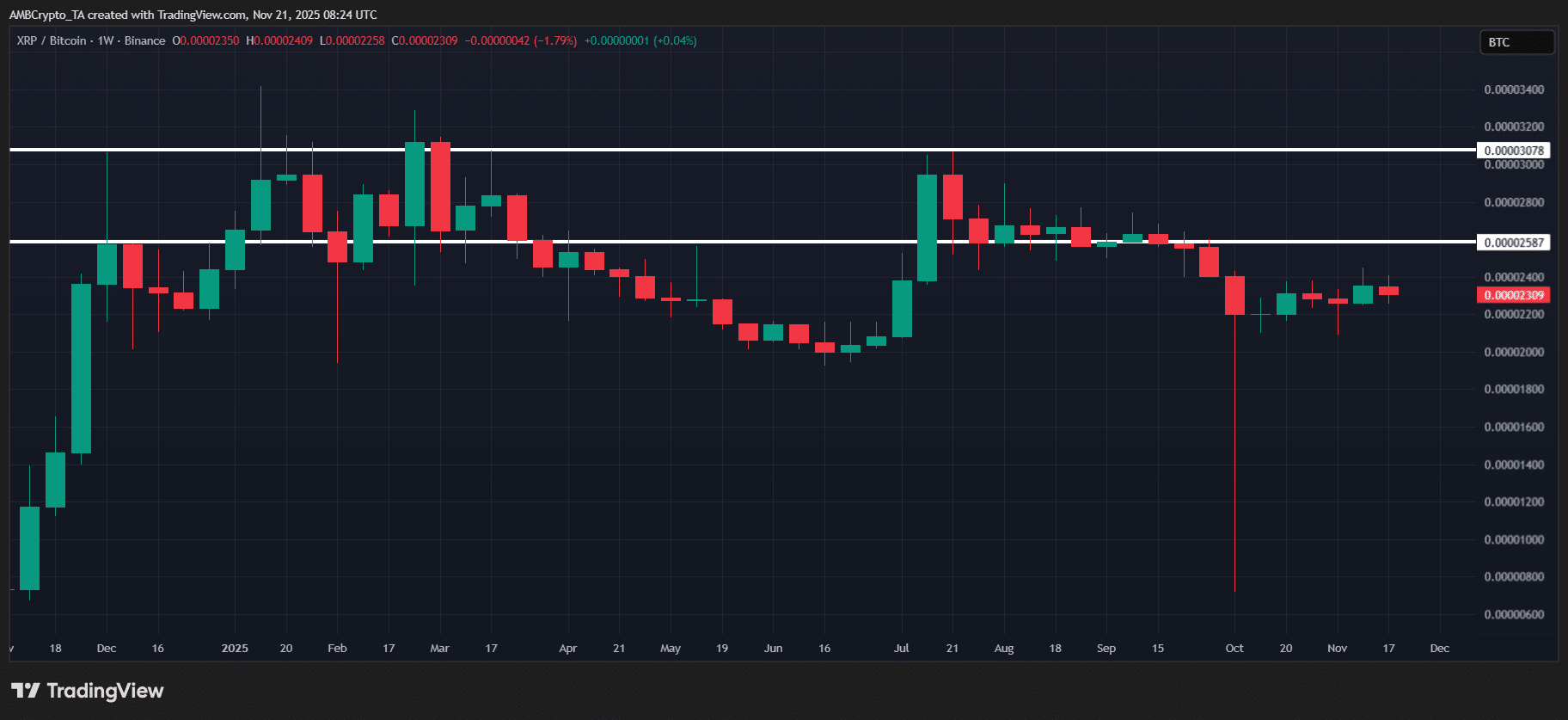

- Potential for Breakout: A pickup in altcoin season could enable independent rallies; monitor SOL/BTC at 0.0015 support and XRP/BTC near 0.000025 resistance for signals.

Source: TradingView (XRP/BTC)

Conclusion

The bullish outlook for Solana and XRP in 2025 highlights their resilience through institutional adoption, ETF successes, and ecosystem expansions, even as price actions reflect broader altcoin challenges. With Solana tightening supply via treasury allocations and XRP advancing in payments via XRPL, these layer-1 leaders are poised for divergence from market downturns. As altcoin flows potentially revive, investors should watch key ratios for breakout cues, positioning for sustained growth in the evolving crypto landscape.

Top Layer-1s Eye a Bullish Break, but Price Isn’t Catching Up

Despite ongoing macroeconomic fears, uncertainty, and doubt (FUD), 2025 has proven bullish for the blockchain sector at large. Solana and XRP, as leading layer-1 protocols, have reaped major rewards. They have capitalized on their infrastructures to forge key partnerships. The XRP Ledger (XRPL) has deepened its footprint in the global payments arena, whereas Solana has prioritized applications in stablecoins and high-throughput DeFi.

This strategic focus has yielded tangible results in terms of institutional validation. The year marked consecutive ETF introductions for both assets. The XRP Bitwise ETF, for instance, achieved $21.7 million in trading volume soon after debut. Meanwhile, Solana ETFs have maintained consistent inflows, underscoring sustained interest from traditional finance players.

Solana’s Digital Asset Treasury (DAT) reached a pivotal benchmark in 2025, with institutional SOL holdings expanding by about 15% to 20.35 million tokens. This development constricts the available liquid supply, potentially setting the stage for upward price pressure in favorable conditions.

Nevertheless, this foundational strength has yet to translate into robust price performance. Both XRP and SOL have shed more than 30% in value over the quarter, with yields annualized in negative territory. This mirrors a wider risk aversion affecting prominent altcoins, but it raises questions about whether these top layer-1s are merely tracking the altcoin index or primed for independent momentum.

Solana and XRP Face Risk-Off Market Despite Momentum

Market-wide volatility is evidently influencing the altcoin space. Although Bitcoin dominance (BTC.D) briefly fell below 60% in a pattern reminiscent of mid-August and declined 1.7% in recent weeks, the Altcoin Season Index remains distant from indicating a genuine altcoin surge—pointing to subdued capital rotation.

Chart patterns make this evident. The SOL/BTC pair has formed two successive lower lows since its mid-September high of 0.002, now testing the 0.0015 support zone. Similarly, XRP/BTC struggles to surpass overhead resistance levels.

As illustrated in the chart, XRP/BTC nears a short-term upper bound at 0.000025, marking a 1.14% monthly increase. Even so, XRP trades roughly 22% shy of the $2.50 barrier, underscoring ongoing downward pressures despite incremental progress.

This scarcity of rotational activity reveals a notable divergence in the current cycle. Solana and XRP have attained optimistic milestones in 2025—encompassing robust institutional uptake, pivotal alliances, enhanced liquidity, and vibrant ETF engagement—yet their prices have not matched this progress.

Fundamentals and momentum appear firm, but absent a surge in altcoin investments, SOL and XRP are likely to remain tethered to general market movements. This prevents them from forging distinct bullish trajectories at present.

Comments

Other Articles

Bitwise Files for 11 Altcoin ETFs Including AAVE, UNI Amid SOL, XRP Muted Gains

December 31, 2025 at 08:47 PM UTC

Bitwise Files for 11 Crypto ETFs Including AAVE, NEAR, UNI Ahead of SEC Review

December 31, 2025 at 09:03 AM UTC

ETH Remains the Largest Long Position Despite ~$39.4M Unrealized Losses, Led by BTC OG Insider Whale on Hyperliquid

December 31, 2025 at 02:36 AM UTC