Solana ETF Hits 21-Day Inflow Record Despite Price Drop, Signaling Potential Long-Term Confidence

SOL/USDT

$4,203,361,175.30

$82.37 / $77.12

Change: $5.25 (6.81%)

-0.0056%

Shorts pay

Contents

The Solana ETF has set a record with 21 consecutive days of net inflows, the longest streak for any newly launched cryptocurrency exchange-traded fund. This surpasses the 20-day marks of Bitcoin and Ethereum ETFs, as reported by SoSoValue data. Despite a 29% decline in SOL’s price, institutional demand remains robust.

-

Solana ETF achieves 21-day inflow streak: First crypto ETF to outlast Bitcoin and Ethereum launches.

-

Institutions buy through volatility: Continued inflows even as SOL price fell from $195 to $137.

-

Cumulative inflows hit $621 million: Represents 1.15% of SOL’s market cap, per SoSoValue metrics.

Solana ETF inflows reach record 21 days amid SOL price drop. Strong institutional buying signals long-term potential. Explore key data and implications for crypto investors today.

What record has the Solana ETF set with its inflows?

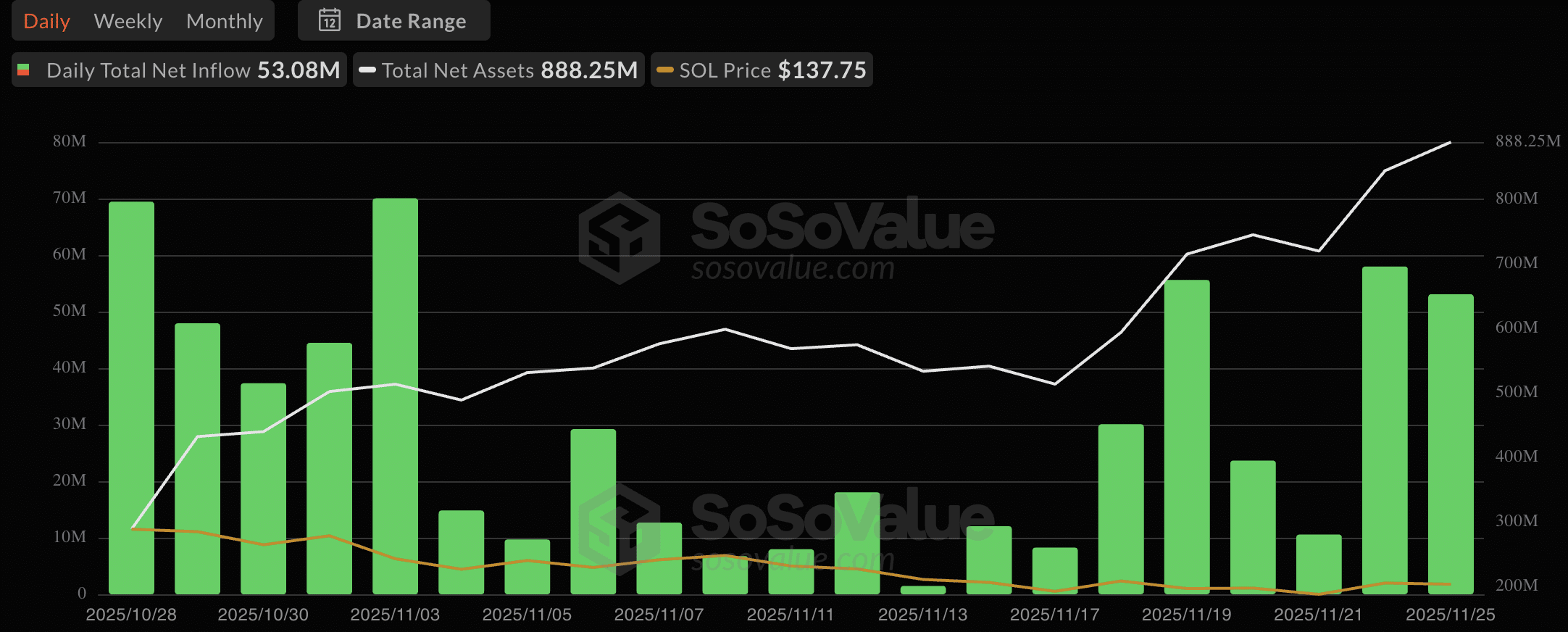

Solana ETF inflows have marked a historic milestone by recording 21 straight days of net positive investments since its U.S. launch. This achievement, tracked by SoSoValue, began on October 28, 2025, and positions the fund ahead of similar streaks for Bitcoin and Ethereum ETFs, which topped out at 20 days. The sustained activity underscores growing institutional adoption of Solana-based products in traditional finance.

Why are Solana ETF inflows continuing despite recent price declines?

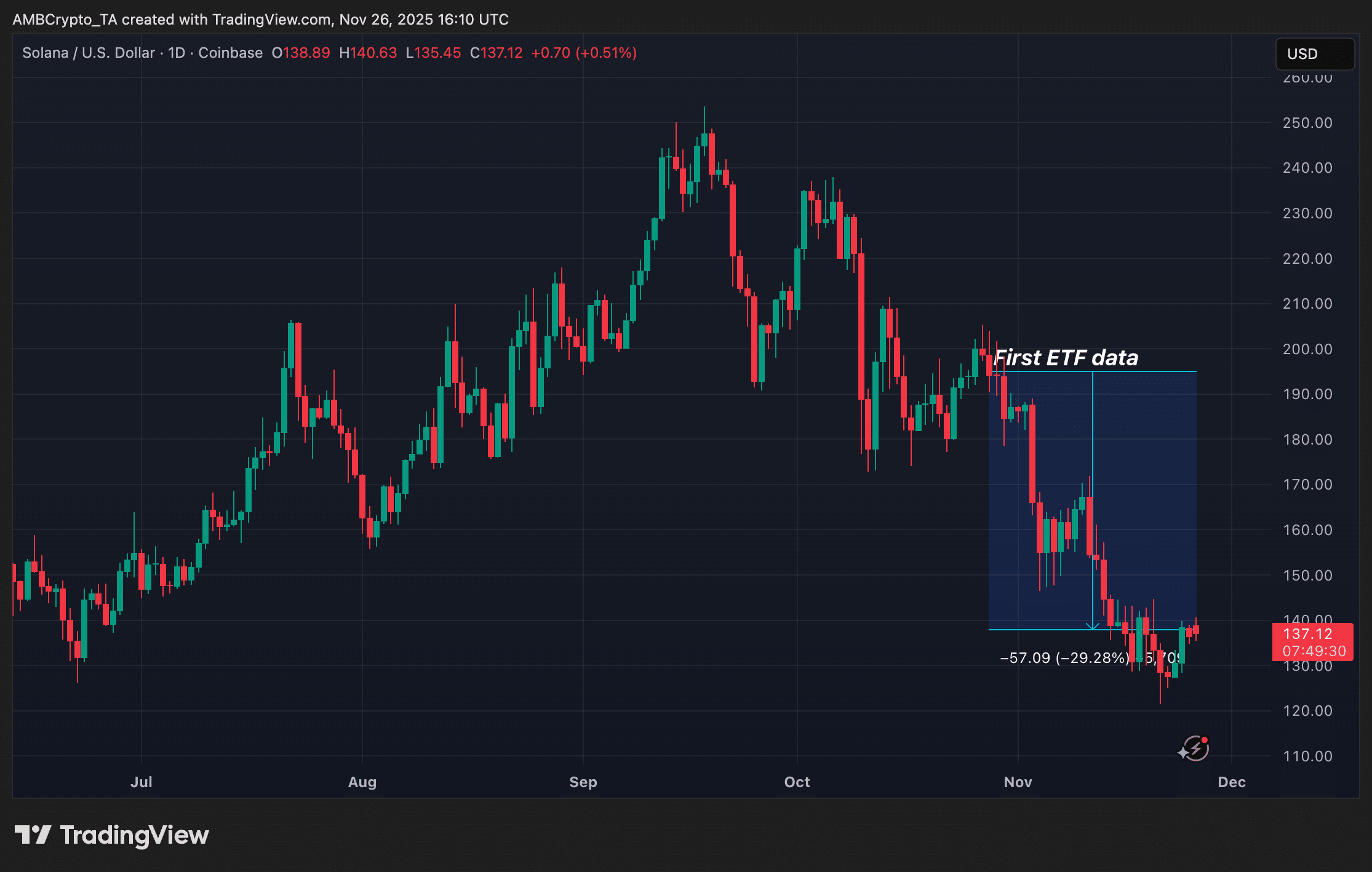

The Solana ETF’s inflows persisted through a challenging period for SOL’s price, which declined approximately 29% from $195 to $137 between late October and late November 2025. According to TradingView charts, this downward trend did not deter investors, with daily net inflows averaging strong figures even on pullback days. Experts from financial analytics firms note that such behavior indicates a strategy of dollar-cost averaging by institutions, focusing on Solana’s underlying network strengths like high transaction speeds and developer ecosystem growth. Data from SoSoValue shows no single day of outflows during this stretch, a rarity in volatile crypto markets where retail sentiment often drives quick reversals. This resilience could stem from Solana’s staking yields, which remain attractive at levels above 6% annually, drawing yield-seeking portfolios. Blockchain metrics further support this, with Solana maintaining top rankings in daily active users and transaction volume among layer-1 networks, as per reports from Dune Analytics.

Solana’s U.S. spot ETF has quietly achieved something neither Bitcoin nor Ethereum managed at launch: 21 consecutive days of net inflows, according to fresh data from SoSoValue.

The streak began on 28 October, making Solana the first crypto ETF to sustain inflows for this long without interruption.

Source: SoSoValue

For context, the highest consecutive streaks recorded by Bitcoin and Ethereum ETFs since launch have been 20 days — a threshold Solana has now surpassed.

Institutions kept buying even during a steep price decline

What makes the streak more notable is the timing. While inflows continued daily, SOL’s price dropped sharply, falling from around $195 to $137, representing a drawdown of roughly 29% over the same period.

The price chart shows that from late October to late November, Solana experienced consistent downward pressure.

Source: TradingView

Yet institutional demand through the ETF did not pause once, signalling that ETF buyers were averaging in despite short-term volatility.

This divergence, persistent inflows against a falling market, is unusual for newly launched crypto ETFs.

Historically, drawdowns tend to slow the momentum of inflow. Instead, Solana’s ETF continued absorbing capital.

Daily inflows remain strong

The latest SoSoValue data shows:

- Daily net inflow (25 November): $53.08 million

- Cumulative net inflow: $621.32 million

- Total net assets: $888.25 million

- Total value traded (25 November): $37.51 million

Solana ETFs now hold 1.15% of SOL’s market cap. However, Bitcoin and Ethereum ETFs still have higher market penetration, at 6.54% and 5.16%, respectively.

Why institutions may be accumulating

Analysts point to several factors:

- High staking yields continue to attract risk-tolerant institutional strategies.

- Strong developer traction has kept Solana near the top of blockchain activity metrics.

- The long-term view that Solana is still one of the fastest-growing L1 networks, despite recent price weakness.

ETF flows alone cannot dictate price in the short term, but they offer a clearer view of institutional sentiment, and right now that sentiment appears resilient.

What comes next?

If the inflow streak extends further into December, Solana could set a new benchmark for early-stage ETF demand in crypto.

Whether price eventually catches up to ETF accumulation remains the key question — but the behaviour of ETF buyers suggests they are positioning for the long term, not trading the daily chart.

Frequently Asked Questions

How long is the current Solana ETF inflow streak?

The Solana ETF has maintained net inflows for 21 consecutive days as of late November 2025, according to SoSoValue. This period started on October 28 and includes daily positive investments totaling over $621 million cumulatively, marking it as the longest such run for a new crypto ETF.

What does the Solana ETF inflow record mean for investors?

The record 21-day streak of Solana ETF inflows indicates sustained institutional interest in SOL, even during price corrections. It reflects confidence in Solana’s network fundamentals, such as speed and scalability, potentially supporting long-term price stability as more capital enters the ecosystem through regulated channels.

Key Takeaways

- Solana ETF sets inflow record: Achieved 21 consecutive days of net positives, exceeding Bitcoin and Ethereum ETF launches per SoSoValue data.

- Institutional resilience amid declines: Buyers added positions during SOL’s 29% drop, suggesting strategies focused on accumulation over short-term trading.

- Future implications for SOL: Cumulative inflows of $621 million highlight growing adoption; monitor for extended streaks into December to gauge broader market sentiment.

Conclusion

The Solana ETF’s record 21-day inflow streak exemplifies the maturing integration of cryptocurrencies into mainstream finance, with Solana ETF inflows demonstrating institutional commitment despite volatility in SOL prices. As data from sources like SoSoValue and TradingView illustrate, this trend points to a foundation of steady capital entry. Investors should watch for continued momentum, as it could bolster Solana’s position among leading layer-1 blockchains in the evolving digital asset landscape.

Comments

Other Articles

Solana Leads 2025 Revenue as Bulls Test $130 Resistance

January 1, 2026 at 10:32 AM UTC

Bitwise Files for 11 Altcoin ETFs Including AAVE, UNI Amid SOL, XRP Muted Gains

December 31, 2025 at 08:47 PM UTC

Ethereum Whales Trim ETH Longs and Pivot to BTC in Dec 31 On-Chain Rebalance Update

December 31, 2025 at 01:27 PM UTC