Solana ETF Hits First Outflow After Record 21-Day Inflow Streak

SOL/USDT

$4,203,361,175.30

$82.37 / $77.12

Change: $5.25 (6.81%)

-0.0056%

Shorts pay

Contents

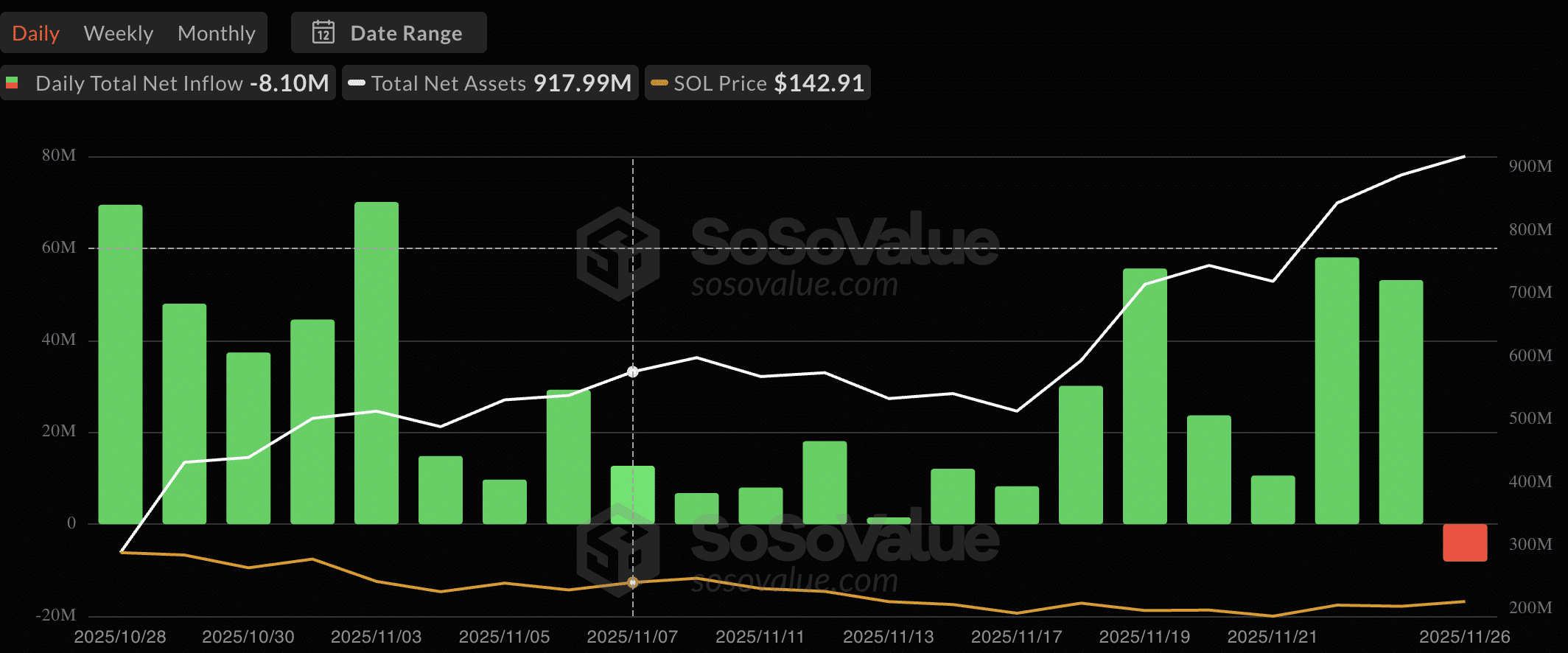

Solana’s spot ETF experienced its first daily outflow of $8.1 million on November 26, 2025, ending a record 21-day streak of inflows that exceeded those of Bitcoin and Ethereum ETFs. This minor pullback does not alter the fund’s strong overall growth trajectory.

-

Solana ETF’s 21-day inflow streak set a new benchmark, surpassing Bitcoin and Ethereum’s 20-day records.

-

The $8.1 million outflow is small relative to prior inflows exceeding $40 million on multiple days.

-

Total net assets stand at $918 million, highlighting sustained institutional interest in Solana despite the dip.

Solana ETF outflow: First red day ends 21-day inflow streak. Discover impacts on SOL price and institutional trends. Stay informed on crypto ETF developments for smart investment decisions.

What is the significance of Solana ETF’s first outflow?

Solana ETF outflow marks a pivotal moment as the fund records its initial net withdrawal of $8.1 million on November 26, 2025, following an unprecedented 21 consecutive days of inflows since its launch on October 28, 2025. This streak had already outpaced the debut performances of Bitcoin and Ethereum ETFs, which peaked at 20 days. Despite this single-day reversal, the ETF’s total assets remain robust at $918 million, underscoring ongoing institutional enthusiasm for Solana’s ecosystem.

Source: SoSoValue

How has Solana’s ETF performance compared to other cryptocurrencies?

The Solana spot ETF’s launch has been a standout in the cryptocurrency investment landscape, achieving 21 straight days of inflows that propelled its net assets to nearly $1 billion. Data from SoSoValue indicates that this performance eclipses the initial runs of Bitcoin and Ethereum ETFs, which recorded maximum consecutive inflows of 20 days during their respective debuts. In its opening month, the Solana ETF saw several high-volume days, with inflows topping $40 million on multiple occasions and reaching over $55 million twice. This aggressive accumulation by institutional investors reflects Solana’s appeal as a high-throughput blockchain alternative, even amid market fluctuations.

Analysts note that such inflows signify a maturing market for altcoin exposure through regulated products. For instance, the ETF’s growth has been driven by demand from portfolio managers seeking diversification beyond Bitcoin and Ethereum. According to market observers, this trend aligns with broader adoption of layer-1 solutions like Solana, which processes transactions at speeds far exceeding traditional networks. Despite the recent outflow, the fund’s trajectory remains positive, with experts like those from financial research firms emphasizing that isolated outflows are common in early ETF stages as investors fine-tune allocations.

The comparison extends to asset under management figures: Solana’s ETF has quickly approached the $1 billion threshold, a feat that took longer for some established funds. This rapid scaling demonstrates Solana’s competitive edge in the DeFi and NFT sectors, bolstered by its low fees and scalability. Historical data from similar launches shows that early volatility in flows does not preclude long-term success, as seen with Ethereum’s ETF stabilizing after initial swings.

The first outflow of $8.1 million, while notable, pales in comparison to the cumulative inflows that built the fund’s foundation. Institutional rebalancing at month-end often triggers such movements, and data suggests no immediate erosion of confidence. Solana’s ETF continues to rank among the top performers in 2025’s crypto investment vehicles, with potential for renewed inflows as market conditions evolve.

Frequently Asked Questions

What caused Solana’s ETF first outflow in November 2025?

The $8.1 million outflow on November 26, 2025, likely stems from institutional portfolio rebalancing at the end of the month, a common practice in financial markets. Data from SoSoValue attributes this to short-term adjustments rather than a loss of faith in Solana, as the amount is modest compared to prior inflows exceeding $50 million.

Will the Solana ETF outflow impact SOL’s price long-term?

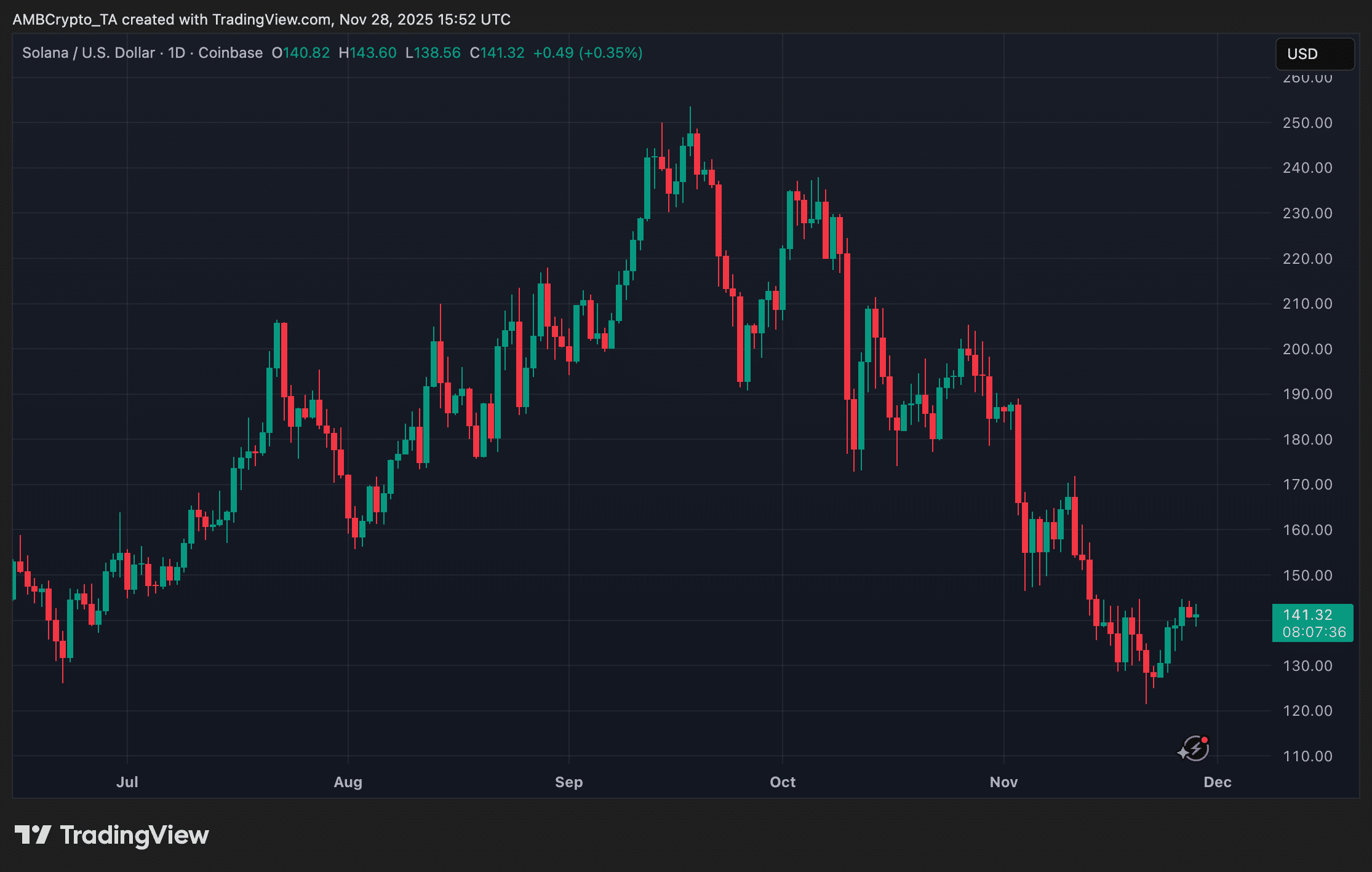

No, the outflow appears to have minimal long-term effects on SOL’s price, which has stabilized above $140 after a dip to $125 earlier in November. Spot market activity shows buyers stepping in, and the ETF’s overall net-positive flows indicate sustained demand that could support price recovery in the coming weeks.

Key Takeaways

- Record-Breaking Streak: Solana’s ETF achieved 21 consecutive inflow days, outlasting Bitcoin and Ethereum benchmarks and driving assets to $918 million.

- Minor Setback: The $8.1 million outflow is a small blip amid strong prior performance, possibly due to routine rebalancing by institutions.

- Price Resilience: SOL’s recovery above $140 suggests the outflow did not trigger significant selling, pointing to broader market support.

Source: TradingView

Conclusion

The Solana ETF outflow on November 26, 2025, represents a brief pause in an otherwise impressive launch, with the fund’s 21-day inflow record solidifying its position as a leader in crypto ETFs. Secondary factors like institutional rebalancing explain this event without undermining the Solana spot ETF‘s growth potential. As SOL price stabilizes and assets hover near $1 billion, investors should monitor upcoming flows for signs of renewed momentum. This development highlights the dynamic nature of cryptocurrency markets, encouraging diversified strategies amid evolving regulatory and economic landscapes.

Comments

Other Articles

Bitwise Files for 11 Altcoin ETFs Including AAVE, UNI Amid SOL, XRP Muted Gains

December 31, 2025 at 08:47 PM UTC

Over 100 Crypto ETFs, Including Bitcoin, Could Launch in 2026 But Many May Close by 2027

December 18, 2025 at 04:37 AM UTC

Over 100 Crypto ETFs, Including Bitcoin, Could Launch in 2026 But Many May Close by 2027

December 18, 2025 at 04:22 AM UTC