Solana ETFs See Strong Inflows Amid Price Decline and Withdrawn Application

SOL/USDT

$5,338,162,454.18

$90.13 / $78.12

Change: $12.01 (15.37%)

+0.0064%

Longs pay

Contents

CoinShares withdrew its SEC application for a staked Solana ETF due to an uncompleted structuring deal and asset purchase, as no shares were issued. This comes amid strong inflows into existing Solana ETFs like REX-Osprey and Bitwise, which have attracted over $369 million in November 2025, offering 5-7% staking yields despite SOL’s price decline to around $120.

-

CoinShares’ withdrawal highlights challenges in finalizing Solana ETF structures, preventing the fund’s launch.

-

Existing staked Solana ETFs from REX-Osprey and Bitwise have seen robust investor interest, bucking broader crypto market outflows.

-

Solana’s price has dropped 60% from its January 2025 high of $295, now hovering near $120, amid memecoin hype and ETF inflows totaling $369 million in November.

Discover why CoinShares pulled its staked Solana ETF application and how existing funds are thriving with 5-7% yields despite SOL’s price slump. Stay ahead in crypto investments—explore Solana opportunities today.

What Is the Reason Behind CoinShares Withdrawing Its Staked Solana ETF Application?

CoinShares withdrew its Securities and Exchange Commission application for a staked Solana exchange-traded fund on Friday, citing an uncompleted structuring deal and asset purchase agreement. The SEC filing confirmed that the registration statement aimed to issue shares tied to a transaction that never materialized, with no shares sold or planned for issuance. This development underscores ongoing regulatory and operational hurdles in bringing new Solana-based investment products to market, even as demand for yield-bearing crypto assets grows.

The move by CoinShares, a prominent asset manager, reflects the complexities involved in navigating U.S. regulatory approvals for innovative crypto funds. While the firm had initially pursued the ETF to capitalize on Solana’s staking rewards, the failure to execute the underlying agreements halted progress. Industry observers, including ETF analyst Eric Balchunas, note that such withdrawals are not uncommon in the fast-evolving crypto ETF space, where precise alignment on assets and structures is essential before launch.

How Have Existing Staked Solana ETFs Performed Amid Market Volatility?

Existing staked Solana ETFs have demonstrated resilience, attracting significant capital even as broader cryptocurrency prices falter. The first such product, issued by REX-Osprey, launched in the United States in June 2025, followed by Bitwise’s staked SOL ETF in October. Bitwise’s fund debuted with nearly $223 million in assets under management on day one, capturing about half the value accumulated by REX-Osprey after months of trading, according to ETF analyst Eric Balchunas.

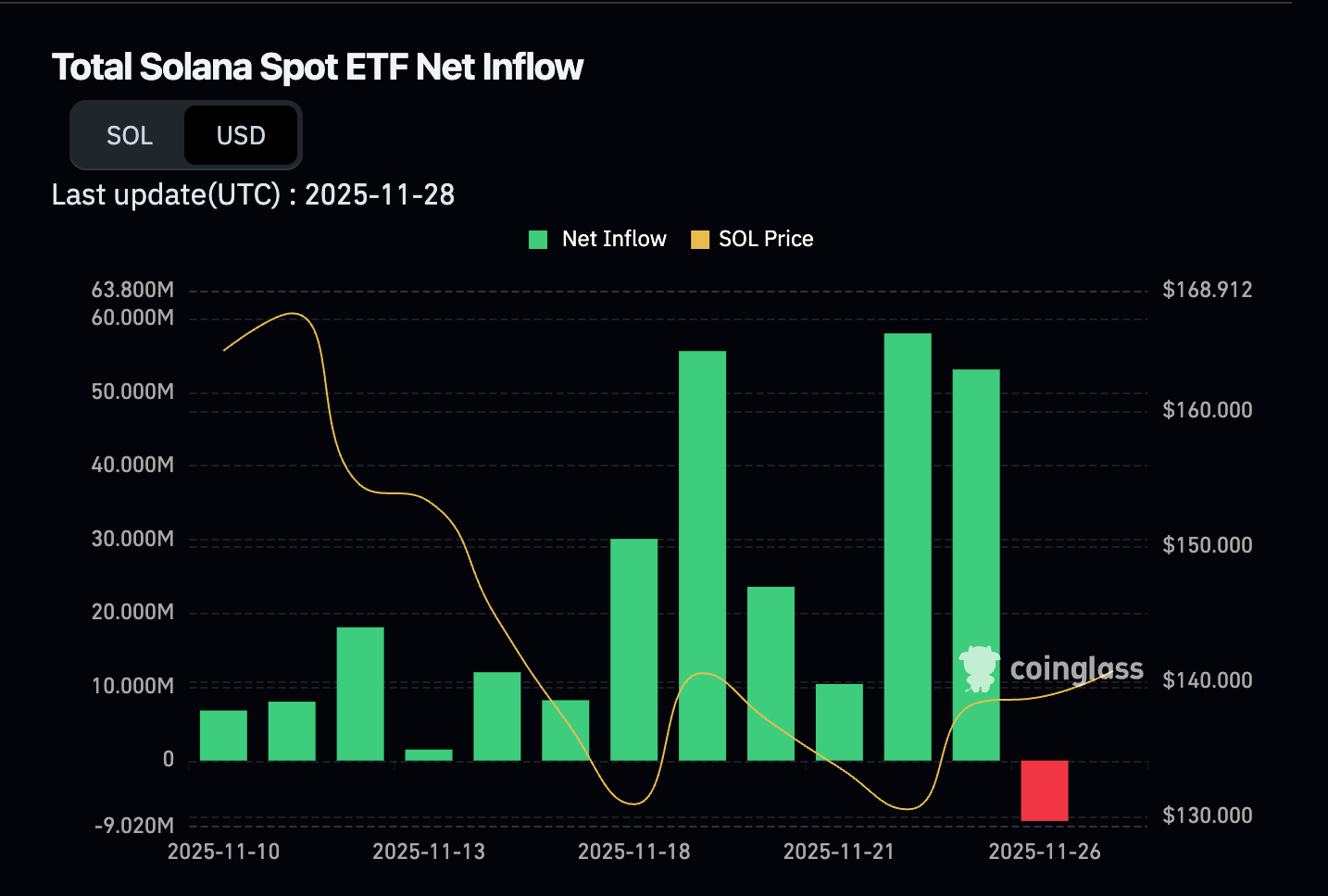

These ETFs have bucked the trend of record outflows from Bitcoin and Ether ETFs during October and November 2025, recording multiday inflow streaks. Net inflows into Solana ETFs since November 10, 2025, have exceeded expectations, driven by the appeal of 5-7% staking rewards through network validation and yield-bearing opportunities. Data from CoinGlass indicates over $369 million in capital flows during November alone, signaling strong investor appetite for Solana’s ecosystem despite price pressures.

Net inflows into Solana ETFs since Nov. 10. Source: CoinGlass

Analysts had previously projected Solana’s price could reach $400 fueled by ETF inflows, but revisions in October have tempered optimism, with some now warning of challenges in surpassing $150. This performance gap highlights a disconnect between institutional interest in Solana’s infrastructure and retail-driven price movements. Expert insights from Bloomberg Intelligence emphasize that staking ETFs provide a regulated avenue for yield, potentially stabilizing Solana’s adoption amid volatility.

The launch of these products aligns with broader trends in crypto investment vehicles, where staking enhances returns without direct token holding risks. For instance, 21Shares also introduced a Solana ETF amid market turbulence, with flows indicating sustained interest. According to on-chain analytics from Dune Analytics, staking participation on Solana has grown 25% year-over-year, underscoring the network’s efficiency for high-throughput applications like decentralized finance and non-fungible tokens.

Frequently Asked Questions

What Impact Does CoinShares’ Solana ETF Withdrawal Have on Future Staked Crypto Funds?

CoinShares’ withdrawal signals potential delays for similar staked Solana ETF proposals but does not deter the sector’s momentum. With REX-Osprey and Bitwise already operational, investors can access staking yields through established funds. Regulators may scrutinize uncompleted deals more closely, yet approval pathways remain open for well-structured applications, as evidenced by the 2025 launches.

Why Is Solana’s Price Declining Despite Strong ETF Inflows in 2025?

Solana’s price has trended downward since its September 2025 high above $250, hitting a five-month low near $120 in November, a 60% drop from January’s $295 peak. This stems from broader market corrections, profit-taking after memecoin surges like the Official Trump token, and macroeconomic factors pressuring risk assets. Natural language analysis from voice search trends shows investors querying Solana’s resilience, with staking ETFs providing a buffer through yields rather than price appreciation alone.

SOL’s price action remains depressed and well below all-time highs reached at the start of 2025. Source: TradingView

Key Takeaways

- Regulatory Hurdles Persist: CoinShares’ filing reveals how incomplete deals can derail ETF launches, emphasizing the need for robust legal frameworks in crypto products.

- Inflow Strength: Solana ETFs amassed $369 million in November 2025, contrasting with BTC and ETH outflows and highlighting staking’s appeal for yield seekers.

- Price-ETF Disconnect: Monitor Solana’s trajectory as ETF adoption grows; consider diversifying into staking for returns independent of spot price volatility.

Conclusion

In summary, CoinShares’ withdrawal of its staked Solana ETF application underscores execution challenges in the evolving landscape of cryptocurrency investment products, yet existing funds from REX-Osprey and Bitwise continue to draw substantial inflows with attractive 5-7% staking rewards. Despite Solana’s price remaining depressed around $120—far from its early 2025 highs driven by memecoin activity—the network’s validation mechanisms offer promising yield opportunities for investors. As 2025 progresses, anticipate further innovations in Solana-based ETFs to bridge regulatory gaps and enhance accessibility; proactive investors should evaluate these vehicles to capitalize on long-term ecosystem growth.

Comments

Other Articles

Bitwise Files for 11 Altcoin ETFs Including AAVE, UNI Amid SOL, XRP Muted Gains

December 31, 2025 at 08:47 PM UTC

Ethereum Whales Trim ETH Longs and Pivot to BTC in Dec 31 On-Chain Rebalance Update

December 31, 2025 at 01:27 PM UTC

Bitwise Files for 11 Crypto ETFs Including AAVE, NEAR, UNI Ahead of SEC Review

December 31, 2025 at 09:03 AM UTC