Solana Eyes Consolidation Amid Brazil Institutional Access and ETF Inflows

SOL/USDT

$4,203,361,175.30

$82.37 / $77.12

Change: $5.25 (6.81%)

-0.0056%

Shorts pay

Contents

Solana’s institutional access expanded with Valour’s approval to list its Solana ETP on Brazil’s B3 exchange, alongside continued ETF inflows of $3.64 million daily. Despite this, SOL price remains fragile, trading near $128 within a $122–$145 range amid Bitcoin’s weakness.

-

Valour Solana ETP listing on B3 boosts regulated access for Brazilian institutions.

-

Solana Spot ETFs see steady net inflows, totaling $926.33 million in assets.

-

Exchange supply declines as tokens move to wallets, signaling accumulation; however, liquidity clusters at $123 heighten downside risks with 15-20% potential drop if support breaks.

Solana institutional adoption grows with B3 listing and ETF inflows, yet price hovers at $128 amid market caution. Explore how this impacts SOL’s future trajectory and investment strategies today.

What does Valour’s B3 approval mean for Solana institutional adoption?

Solana institutional adoption received a significant boost on December 16 when Valour received approval to list its Valour Solana ETP on Brazil’s B3 exchange. This development provides BRL-denominated, regulated access to Solana through established brokerage and custody channels, making it easier for Latin American institutions to invest. It positions Solana alongside major assets like Bitcoin and Ethereum, enhancing its visibility in a rapidly growing market.

How are Solana ETF inflows influencing market dynamics?

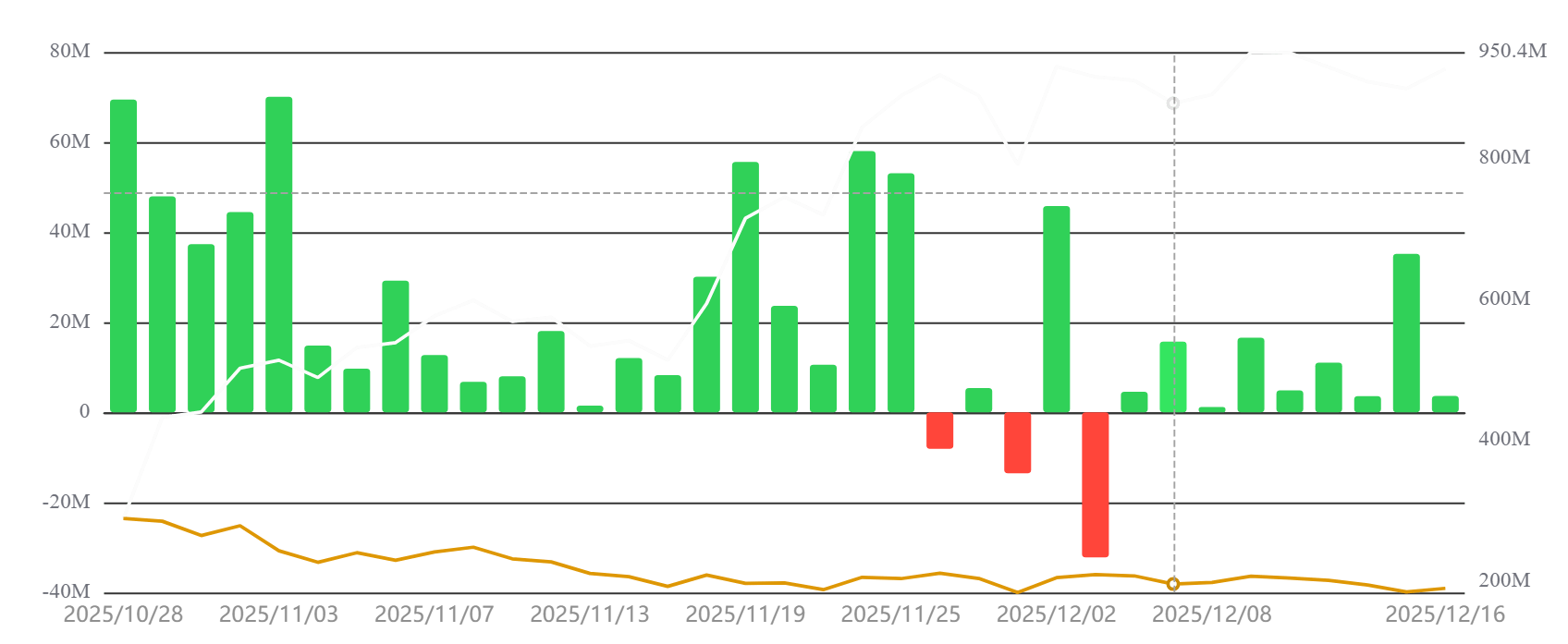

Solana Spot ETFs have maintained positive momentum, with daily net inflows reaching approximately $3.64 million and total net assets approaching $926.33 million, according to data from SoSoValue. This sustained interest from institutional investors coincides with a reduction in exchange-held SOL tokens, indicating potential accumulation as holders move assets to secure wallets. Such trends suggest building confidence in Solana’s ecosystem, even as broader market pressures from Bitcoin’s volatility create short-term challenges. Experts note that these inflows could stabilize SOL if they persist beyond current levels, potentially supporting a recovery above key resistance zones.

Source: SoSoValue

The combination of ETF activity and declining exchange supply points to a divergence from immediate price movements, where accumulation occurs quietly amid sideways trading. This pattern has been observed in previous cycles for high-throughput blockchains like Solana, where institutional entry precedes retail-driven rallies.

Institutional interest in Solana stems from its high-speed transaction capabilities, processing up to 65,000 transactions per second at low costs, which appeals to DeFi and NFT projects. Brazil, as a leading crypto adoption hub in Latin America with over 10 million users, represents untapped potential. Valour’s move aligns with global trends, where regulated products bridge traditional finance and blockchain assets. Data from Chainalysis highlights Latin America’s 11% share of global crypto transaction volume in 2024, underscoring the region’s importance.

Frequently Asked Questions

What is the current price range for Solana and what factors are driving it?

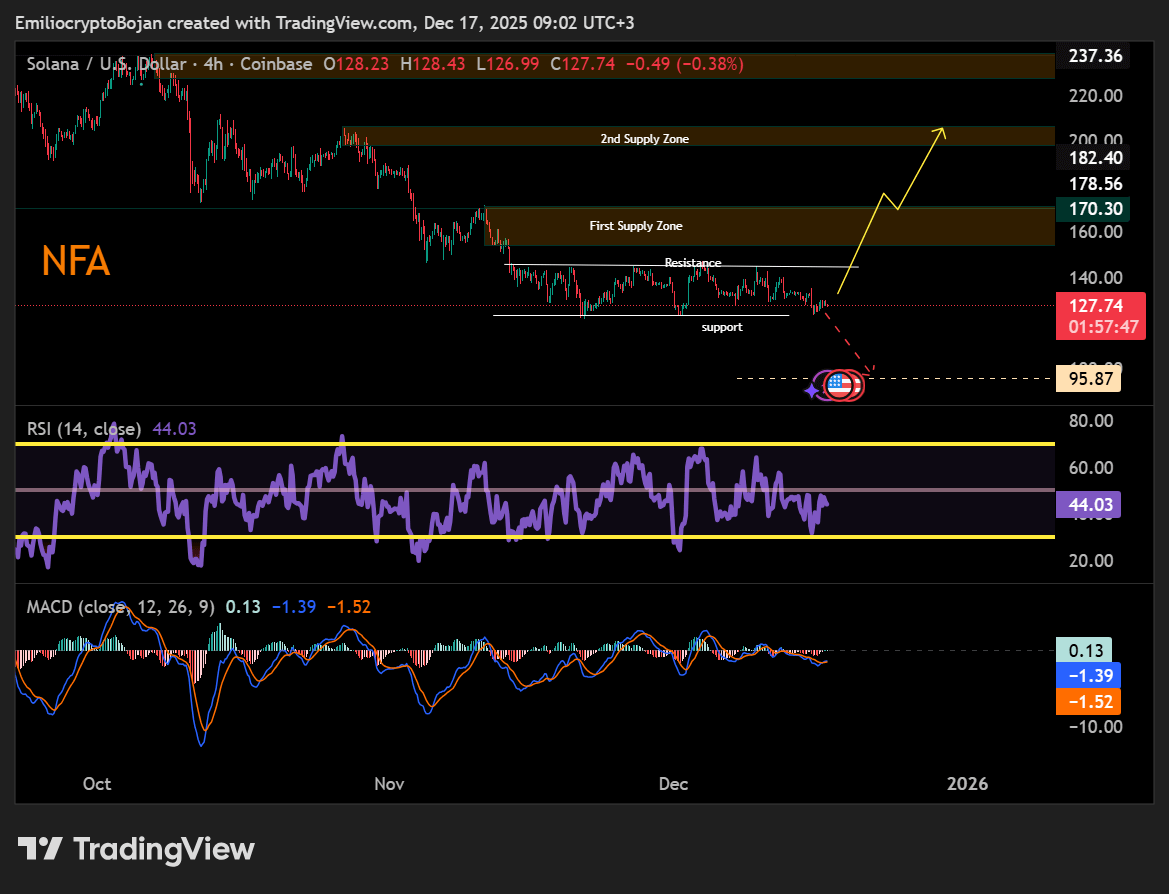

Solana is currently trading near $128, confined to a $122–$145 range as of recent market data. Bitcoin’s dips and overall sentiment weakness are primary drivers, limiting upward momentum despite positive institutional developments. Consolidation here suggests a potential breakout if ETF inflows accelerate.

How might Bitcoin’s performance affect Solana’s price in the short term?

If Bitcoin continues its decline, Solana could test lower supports around $95, influenced by correlated market movements. However, Solana’s unique ecosystem strengths, including recent institutional approvals, may provide some resilience. Investors should monitor Bitcoin’s $90,000 level for broader altcoin cues, as a stabilization there could lift SOL toward $145 resistance.

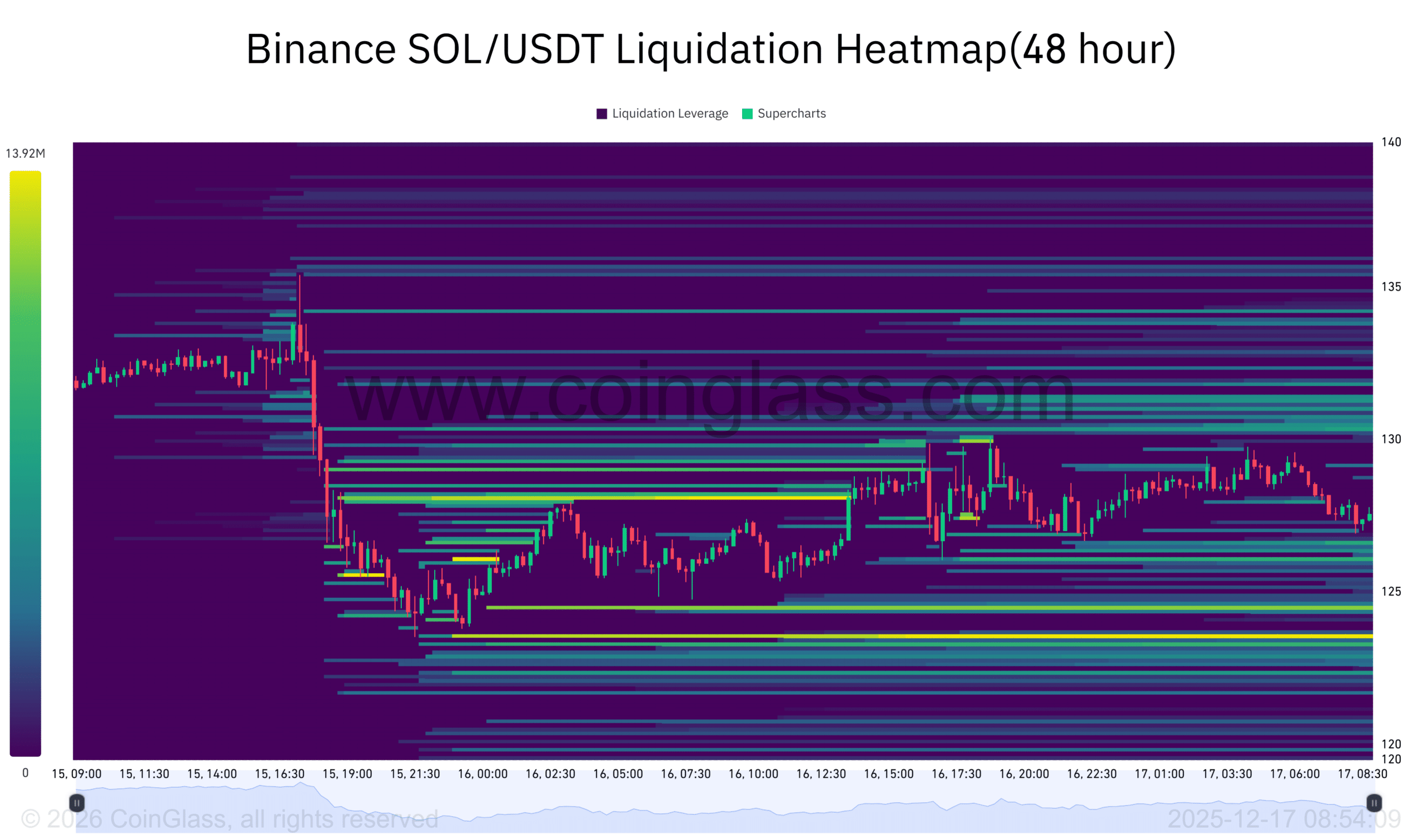

Liquidity analysis from tools like Binance’s Liquidation Heatmap reveals dense clusters at $123, increasing the risk of short-term sweeps in volatile conditions. This setup implies that while downside protection exists from accumulating holders, any broad sell-off could trigger liquidations and amplify drops.

Source: CoinGlass

Technical indicators further illustrate this cautious stance. The Relative Strength Index (RSI) at 44.03 indicates subdued demand below the neutral 50 mark, while the Moving Average Convergence Divergence (MACD) remains compressed, hinting at easing bearish forces but no clear bullish shift yet.

Source: TradingView

For bulls to regain control, Solana must surpass $145 to target $170 and eventually $200. These levels represent historical supply zones where selling pressure has previously capped gains. Solana’s network upgrades, including enhanced scalability features, continue to attract developers, with over 1,000 active projects reported by ecosystem trackers. This foundational growth supports long-term optimism, independent of short-term price fragility.

Institutional expansions like the B3 listing not only diversify access but also comply with local regulations, fostering trust. Brazil’s central bank has been proactive in crypto frameworks, approving stablecoin pilots and exchange licenses, which bodes well for further integrations. Analysts from firms like Messari emphasize Solana’s role in emerging markets, citing its cost-efficiency over competitors.

Key Takeaways

- Expanded Access in Brazil: Valour’s B3 approval highlights Solana’s appeal to institutional players in Latin America, potentially increasing adoption and liquidity.

- ETF Momentum Builds: Steady inflows and reduced exchange supply indicate accumulation, countering current price stagnation for future upside potential.

- Monitor Downside Risks: Liquidity at $123 and Bitcoin correlation suggest preparing for volatility; breaking $145 could signal a bullish reversal.

Conclusion

Solana’s institutional adoption advances through milestones like the Valour Solana ETP on Brazil’s B3 and robust ETF inflows, even as price action navigates a $122–$145 range amid broader market headwinds. These developments underscore Solana’s resilient ecosystem, driven by technical strengths and growing global interest. As sentiment stabilizes, investors may see opportunities for gains—stay informed on ETF trends and technical breakouts to position accordingly.

Comments

Other Articles

Solana Leads 2025 Revenue as Bulls Test $130 Resistance

January 1, 2026 at 10:32 AM UTC

Bitwise Files for 11 Altcoin ETFs Including AAVE, UNI Amid SOL, XRP Muted Gains

December 31, 2025 at 08:47 PM UTC

Ethereum Whales Trim ETH Longs and Pivot to BTC in Dec 31 On-Chain Rebalance Update

December 31, 2025 at 01:27 PM UTC