Solana Faces Rebound Potential After Forward Transfer as Whales Accumulate

SOL/USDT

$4,203,361,175.30

$82.37 / $77.12

Change: $5.25 (6.81%)

-0.0056%

Shorts pay

Contents

Forward Industries transferred 1.727 million SOL worth $219.32 million, contributing to Solana’s recent price drop amid a 45% unrealized loss on its holdings. Despite this, whale accumulation and rising active addresses near $130 support a potential rebound for SOL.

-

Solana experienced downward pressure from Forward’s large SOL transfer while holding significant unrealized losses.

-

Whale buying accelerated, with spot average order sizes indicating sustained interest despite market volatility.

-

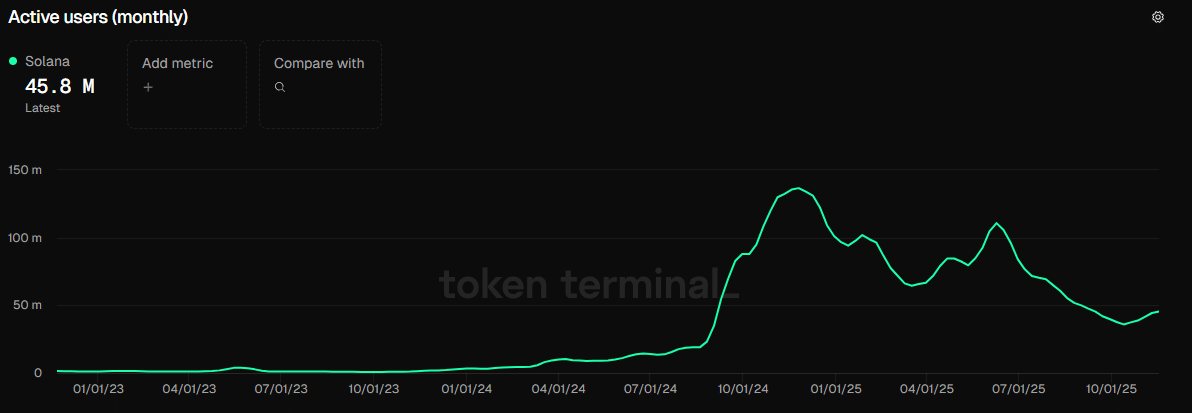

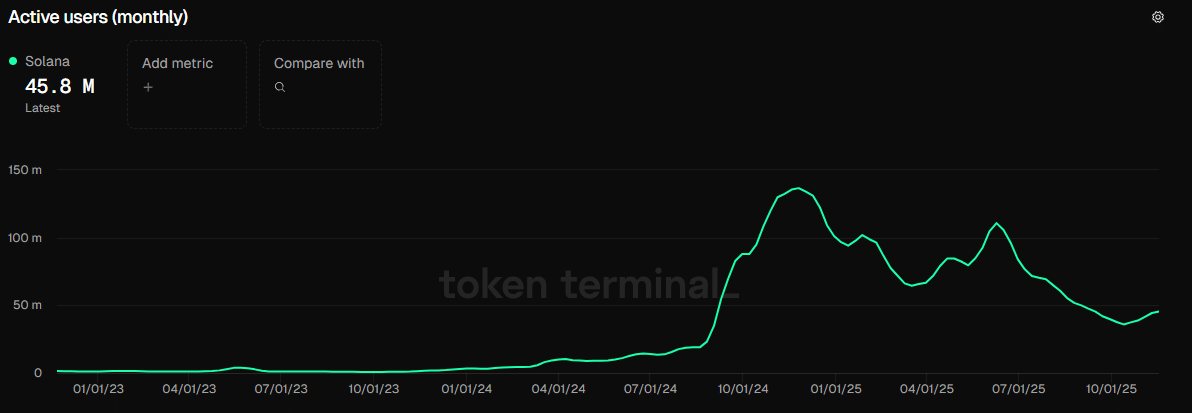

Active addresses surged 21% to 45.8 million, bolstering network demand and recovery prospects near key support levels.

Solana price drops after Forward transfer: Analyze institutional moves, whale activity, and rebound signals for SOL investors. Stay informed on crypto trends—discover recovery drivers now.

What Caused the Solana Price Drop After Forward’s Transfer?

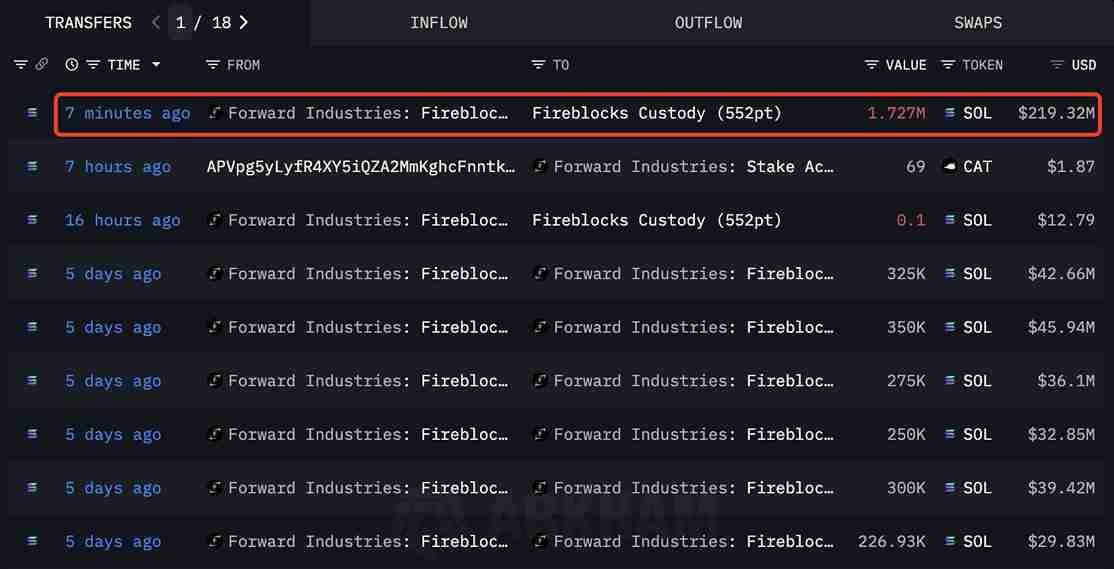

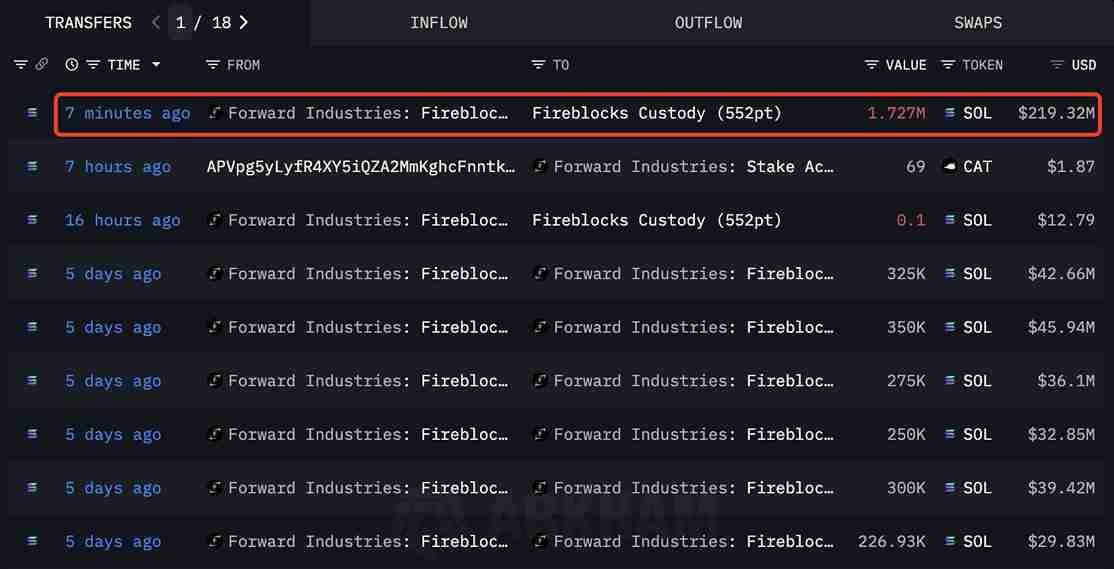

Solana price dipped following Forward Industries’ transfer of 1.727 million SOL valued at $219.32 million to a specific wallet, as reported by Lookonchain data. This move occurred while the firm held a substantial position at a 45% unrealized loss, amplifying market sensitivity to large institutional flows. The transfer ranked among the largest Solana movements this quarter, contributing to short-term selling pressure and a broader drawdown in SOL’s value.

How Does Institutional Activity Impact Solana’s Market Dynamics?

Arkham data reveals Forward Industries accumulated 6.834 million SOL for approximately $868 million at an average price of $232.08, positioning the holdings underwater by about $150 million at the time of the transfer. Even after the move, the firm retained nearly 5 million SOL, signaling a persistent long-term bias amid reactive sentiment. Institutional actions like this often trigger volatility in Solana’s ecosystem, as traders interpret large transfers as potential profit-taking or repositioning. Expert analysis from blockchain intelligence platforms underscores that such flows can exacerbate drawdowns but also highlight underlying strength when countered by organic demand. For instance, historical patterns show Solana recovering from similar events when network fundamentals remain robust, with transaction volumes and developer activity providing a buffer against isolated sales.

Forward Industries transferred 1.727 million SOL worth $219.32 million to wallet 552ptg, according to Lookonchain. The move ranked among the largest Solana transfers this quarter.

Arkham data showed the firm accumulated 6.834 million Solana [SOL] for $868 million at an average entry of $232.08. The position sat at a 45% unrealized loss, leaving roughly $718 million underwater at the time of transfer.

Even so, Forward Industries still held nearly 5 million SOL. That remaining size suggested long-bias positioning, even as sentiment around Solana turned highly reactive to institutional flows.

Source: Arkham

Institutions Pulled Back as Whales Added Size

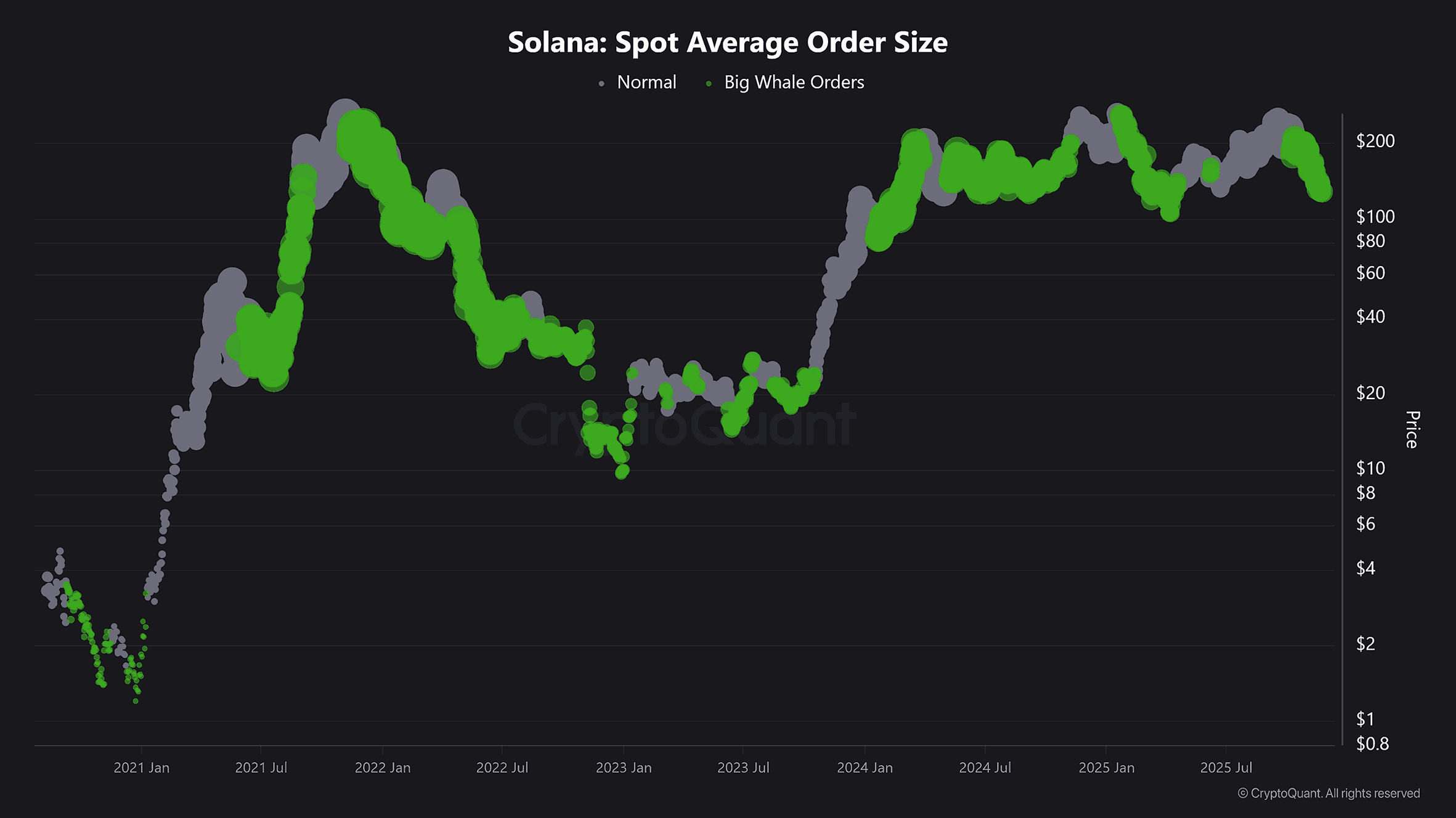

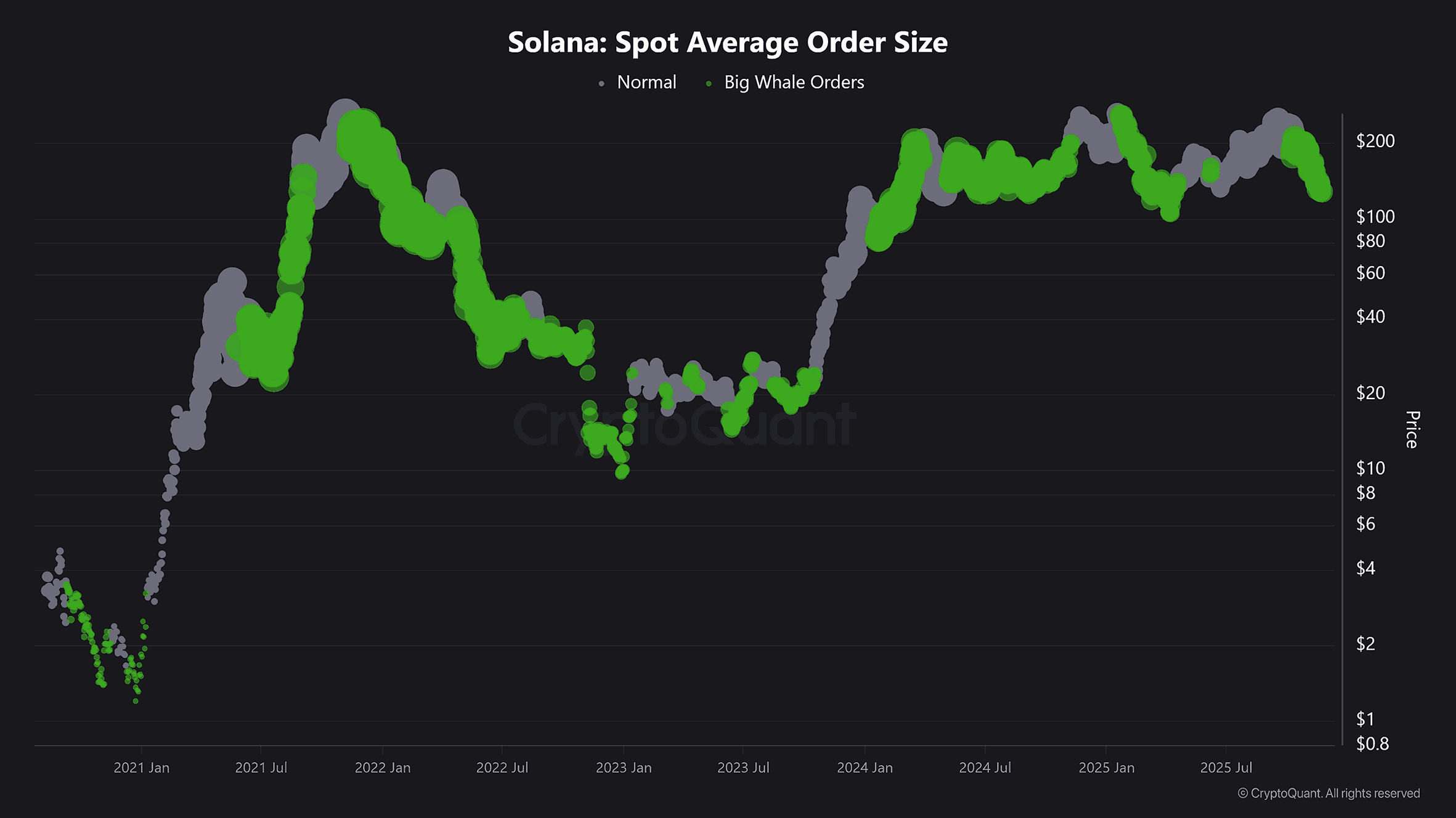

Solana whales moved aggressively during the same window. By contrast, large Spot buyers continued to accumulate, even as institutional flows weakened.

CryptoQuant’s Spot Average Order Size showed accelerated big-ticket buying near current prices. That alignment revealed sustained whale interest despite Solana’s broader drawdown.

Source: CryptoQuant

On top of that, Solana’s monthly Active Addresses climbed to 45.8 million, up 21% over the past month. The rebound reinforced persistent network usage, giving traders a counterweight to institutional selling.

Source: Token Terminal

This uptick in active addresses demonstrates Solana’s resilience, as higher engagement often correlates with increased transaction throughput and decentralized application usage. According to on-chain metrics from Token Terminal, such growth counters bearish narratives from single events like major transfers. Market observers note that Solana’s proof-of-history consensus mechanism continues to drive efficiency, attracting more users even during price corrections. In comparison to other layer-1 blockchains, Solana’s user base expansion by 21% outperforms many peers, underscoring its competitive edge in scalability and cost-effectiveness.

Key Level Holds as Traders Watch for a Rebound

Solana bounced from a key daily demand zone near $130, creating short-term stability. That zone cushioned the recent sell-off and kept downside pressure contained.

Having said that, Solana still faced overhead pressure. The next objective sat near $170, the immediate resistance shown on the chart.

Source: TradingView

That level marked previous breakdown structure and aligned with failed retests in early November. A break above $170 could shift momentum toward the $190–$210 band, where supply remains heavier. Technical indicators from TradingView illustrate this resistance as a confluence of moving averages and prior highs, suggesting traders monitor volume for confirmation. Solana’s price action at $130 has historically served as a strong support, with past bounces leading to 20-30% gains in subsequent weeks. As of recent data, trading volume stabilized around 15-20% above average, indicating building interest for an upward move. Analysts from reputable firms emphasize that combining on-chain metrics with price levels provides a comprehensive view, reducing reliance on isolated events like the Forward transfer.

Frequently Asked Questions

Why did Solana’s price drop after the Forward Industries transfer?

The transfer of 1.727 million SOL by Forward Industries, valued at $219.32 million, occurred amid a 45% unrealized loss on their 6.83 million SOL position, sparking sell-off fears and contributing to immediate downward pressure on Solana’s price.

Is Solana poised for a rebound following whale activity?

Yes, with whales accumulating through higher spot order sizes and active addresses rising 21% to 45.8 million, Solana shows strong network demand. The hold at $130 support further enhances recovery potential, as spoken in natural market updates.

Key Takeaways

- Forward’s Transfer Impact: The move of 1.727 million SOL highlighted institutional losses but left substantial holdings intact, limiting long-term bearish signals.

- Whale and Network Strength: Accelerated buying and a 21% rise in active addresses to 45.8 million counter institutional pullbacks, supporting demand.

- Price Outlook: Stability at $130 paves the way for a push toward $170 resistance—monitor volume for breakout confirmation.

Conclusion

The Solana price drop after Forward transfer underscores the influence of institutional flows on cryptocurrency markets, yet underlying metrics like whale accumulation and surging active addresses point to resilience in Solana’s ecosystem. As on-chain data from sources such as Arkham and CryptoQuant illustrate, network fundamentals remain solid, positioning SOL for potential recovery above key resistance levels. Investors should track these developments closely, as sustained demand could drive Solana toward higher valuations in the coming weeks.

Comments

Other Articles

Solana Leads 2025 Revenue as Bulls Test $130 Resistance

January 1, 2026 at 10:32 AM UTC

Bitwise Files for 11 Altcoin ETFs Including AAVE, UNI Amid SOL, XRP Muted Gains

December 31, 2025 at 08:47 PM UTC

Ethereum Whales Trim ETH Longs and Pivot to BTC in Dec 31 On-Chain Rebalance Update

December 31, 2025 at 01:27 PM UTC