Solana Holds $119 Support, May Target $145 Amid Mixed Signals

SOL/USDT

$4,203,361,175.30

$82.37 / $77.12

Change: $5.25 (6.81%)

-0.0056%

Shorts pay

Contents

Solana price reached $127.5 on December 29, 2025, up 2.45% in 24 hours for its fourth straight daily gain. It rebounded from $119 support amid a 161% trading volume surge to $4.15 billion, per CoinMarketCap data, signaling strong market interest.

-

Solana held $119 support, enabling steady recovery and potential upside to $145.

-

Trading volume spiked 161% to $4.15 billion, reflecting heightened participation.

-

ADX at 25.62 indicates strengthening trend, though CMF at -0.13 shows lingering selling pressure.

Solana price surges 2.45% to $127.5 on Dec 29, 2025, rebounding from key support with massive volume. Analyze SOL trends, trader views, and next targets. Track crypto moves now!

What is the current Solana price?

Solana price stood at $127.5 as of December 29, 2025, reflecting a 2.45% increase over the past 24 hours. This marked the asset’s fourth consecutive daily gain, driven by a rebound from the critical $119 support zone. Broader market improvements supported the move, with CoinMarketCap reporting a sharp 161% rise in 24-hour trading volume to $4.15 billion.

Why is Solana price recovering from support?

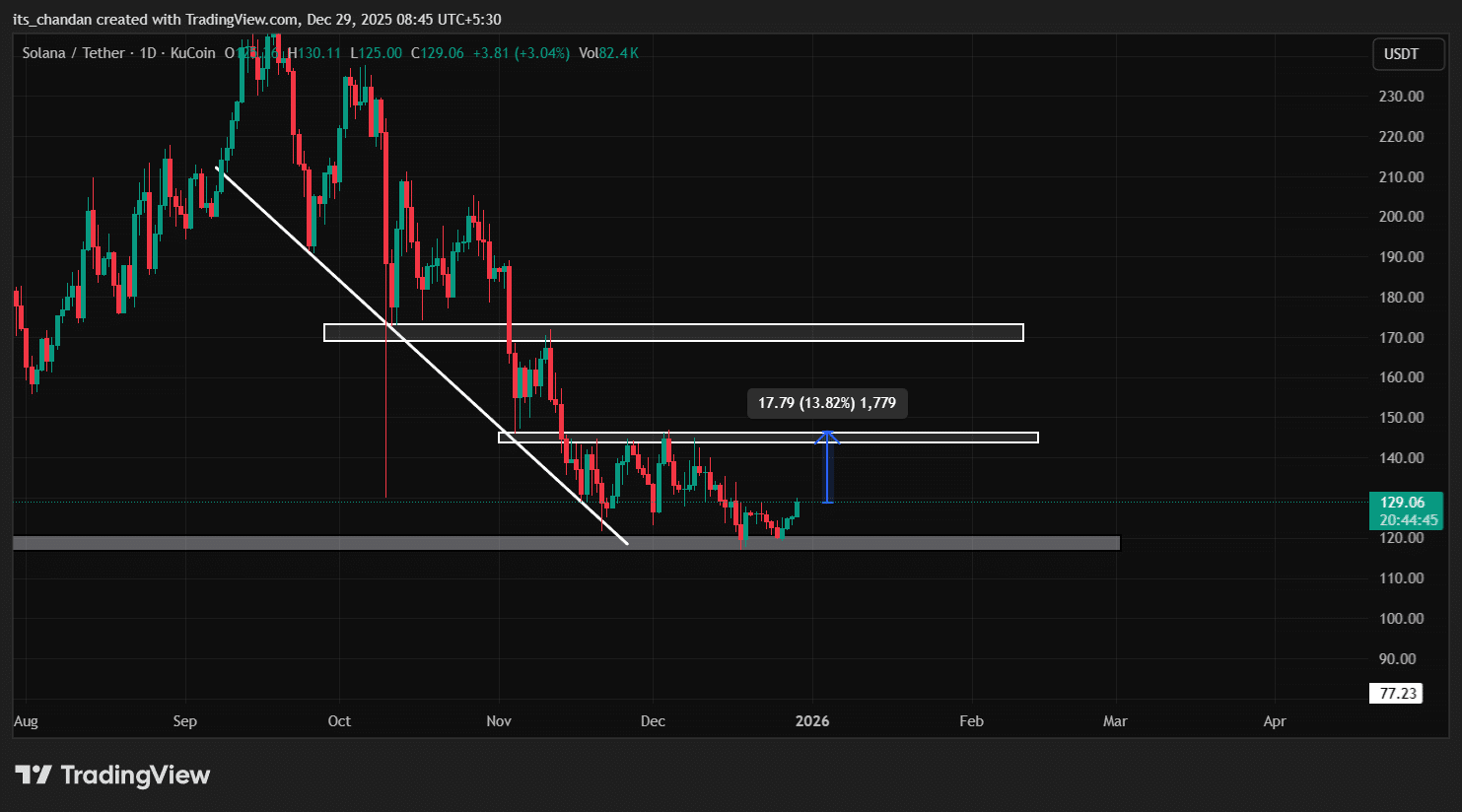

Solana’s daily chart illustrated a successful retest of the $119 support zone, which had previously served as a reversal point over the prior four sessions. A sustained hold above this level could propel the price toward $145, representing approximately 13.8% upside potential. Data from TradingView highlighted this structure clearly.

Source: TradingView

Technical indicators presented mixed signals. The Average Directional Index (ADX) climbed to 25.62, crossing the key threshold of 25, which suggests the ongoing trend is gaining momentum and could sustain a directional move. Conversely, the Chaikin Money Flow (CMF) remained negative at -0.13, pointing to dominant selling pressure and subdued buying interest at current levels. Traders on X expressed optimism, with projections targeting $144, $147, or even above $150 in the near term. These views underscore growing confidence despite the mixed on-chain data.

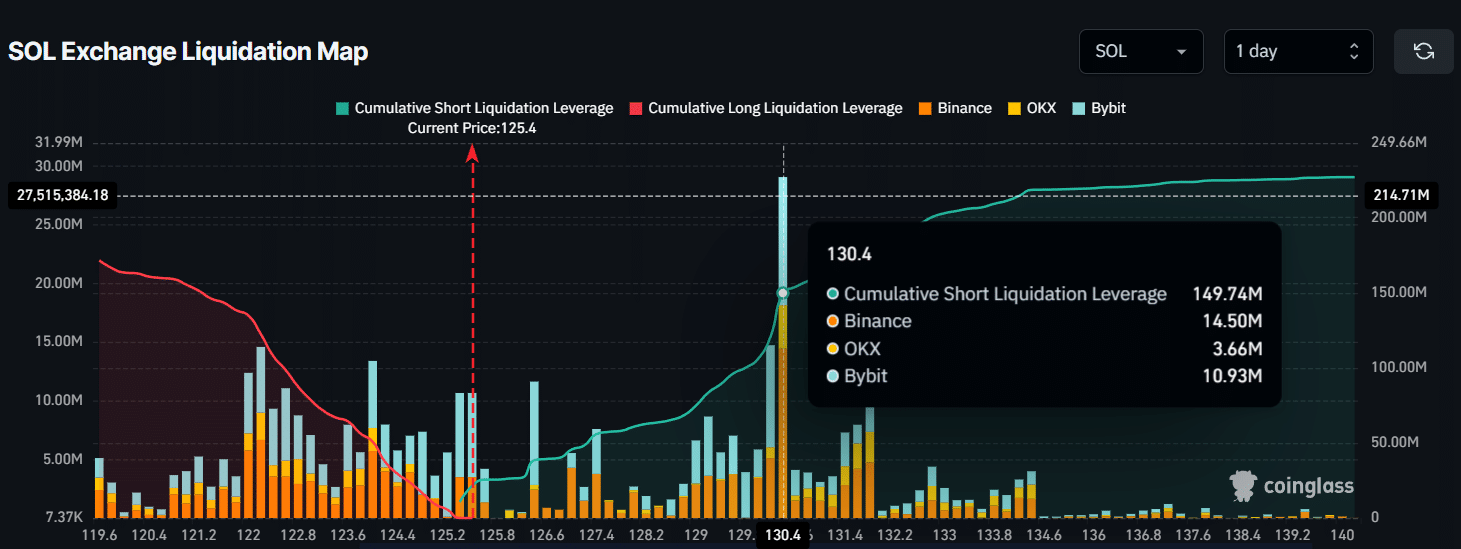

Intraday dynamics added complexity. Leverage data revealed major liquidation clusters at $122.2 (support) and $130.4 (resistance). CoinGlass metrics showed $114.12 million in long positions and $149.74 million in short positions concentrated there, indicating a bearish tilt among short-term traders who doubt a break above $130.4 soon.

Source: CoinGlass

This imbalance highlights caution around leverage-heavy zones, where volatility could trigger cascading liquidations. Solana’s recovery aligns with improved broader market sentiment, yet sustained buying is essential to overcome resistance and validate upside targets.

Frequently Asked Questions

What is Solana’s key support level after the recent recovery?

Solana’s key support sits at $119, where price successfully retested and rebounded on December 29, 2025. Holding this level across multiple sessions has stabilized the asset, per TradingView analysis, paving the way for potential gains if buying persists.

Can Solana price break above $130 amid high leverage?

Solana price faces resistance at $130.4, backed by $149.74 million in short positions according to CoinGlass data. A decisive close above this could liquidate shorts and propel toward $145, but current bearish leverage suggests intraday challenges ahead.

Key Takeaways

- Solana price up 2.45% to $127.5: Fourth straight gain after defending $119 support.

- Volume surges 161% to $4.15B: CoinMarketCap data shows elevated participation boosting momentum.

- Mixed signals demand caution: Monitor ADX strength versus CMF selling pressure for next moves.

Conclusion

Solana price demonstrated resilience on December 29, 2025, with a rebound from $119 support, surging volume, and optimistic trader targets up to $150. While ADX signals trend strength, CMF and leverage data highlight risks around $130 resistance. Investors should watch price action closely for confirmation of upside, staying informed on evolving Solana trends.

Comments

Other Articles

Solana Leads 2025 Revenue as Bulls Test $130 Resistance

January 1, 2026 at 10:32 AM UTC

Bitwise Files for 11 Altcoin ETFs Including AAVE, UNI Amid SOL, XRP Muted Gains

December 31, 2025 at 08:47 PM UTC

Ethereum Whales Trim ETH Longs and Pivot to BTC in Dec 31 On-Chain Rebalance Update

December 31, 2025 at 01:27 PM UTC