Solana Holds Key $125 Support Amid Rising Network Activity

SOL/USDT

$4,203,361,175.30

$82.37 / $77.12

Change: $5.25 (6.81%)

-0.0056%

Shorts pay

Contents

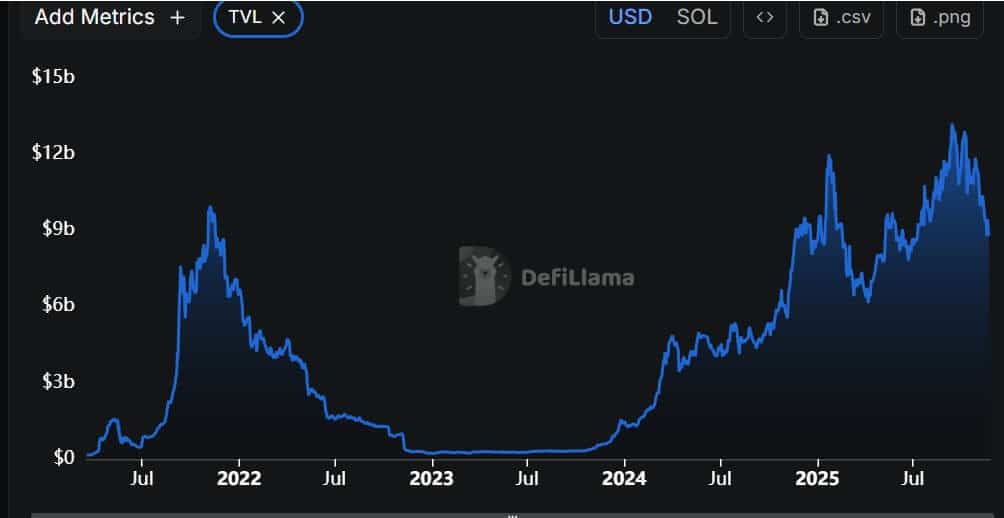

Solana price has stabilized above the $125 support level after testing the $120 zone, showing resilient structure with higher lows and increasing network activity. Key metrics indicate steady TVL at $8.788 billion and over 1.9 million active addresses, signaling potential for upward momentum toward long-term targets.

-

SOL forms higher lows in the $118–$125 demand zone, reclaiming structural levels like $129.57 for bullish confirmation.

-

Network fundamentals remain robust, with rising total value locked and active addresses supporting price stability.

-

Weekly charts confirm support above $125, backed by data showing $2.676 billion in DEX volume and $446,564 in daily fees.

Solana price analysis reveals strong structure above $125 amid rising network metrics. Discover key support levels, TVL growth, and what it means for SOL’s future trajectory in this detailed update.

What is the Current Solana Price Structure?

Solana price currently exhibits a bullish structure after pulling back to the $120 zone and rebounding above $125, forming higher lows on the 4-hour chart. This resilience is evident in rejection wicks within the $118–$125 demand area, followed by a recovery to $131–$134. According to analysis from Crypto Pulse, the controlled price action post-pullback, with lighter volume compared to mid-range zones, underscores the asset’s strength throughout the year.

How Do Network Metrics Support Solana’s Price Stability?

Solana’s network demonstrates consistent activity that bolsters its price foundation. Data from DeFiLlama indicates total value locked (TVL) at approximately $8.788 billion, with stablecoins surpassing $12.9 billion. Daily fees total $446,564, while active addresses exceed 1.9 million, reflecting sustained user engagement. DEX volume stands at $2.676 billion, perps volume at $1.537 billion, and daily inflows reach $12.91 million. These figures, as reported in recent market overviews, highlight Solana’s operational efficiency despite market fluctuations. Expert observers, including those from Crypto Curb, note that such metrics provide a solid base for price recovery, with no signs of weakening liquidity. Short sentences like this emphasize the data’s reliability: TVL growth signals investor confidence, active addresses show real usage, and fee generation proves network viability. This combination positions Solana favorably against broader market pressures.

#SOL just tapped into that lower volume zone near 120, exactly where we wanted it. For the next few days we stay patient and wait for clean confirmations. SOL has been one of the strongest assets all year, and this type of pullback is usually where the real setups form.

Bigger… pic.twitter.com/yjfhNoLyCJ

— CryptoPulse (@CryptoPulse_CRU) November 24, 2025

Solana’s price movement aligns closely with these on-chain indicators. After the recent dip, the asset reclaimed the $129.57 level, a pivotal structural point from prior rotations. Candles in the $131–$134 range showed compact consolidation, suggesting accumulation rather than distribution. Market participants view this as a healthy correction within an overall uptrend, where pullbacks to lower volume nodes like $120 refine the chart’s setup for future gains. Professional analysts emphasize that Solana’s performance this year, driven by its high-throughput blockchain, differentiates it from peers facing similar volatility. The interplay between price action and network health creates a narrative of enduring potential, with structure building methodically.

Source: DeFiLlama

Delving deeper into the weekly timeframe, Solana maintains firm support around $125, tested multiple times without breach. This zone coincides with the yearly open, offering a reliable anchor for long-term traders. Observations from Crypto Curb highlight repeated rebounds from this level, extending projections into 2026. Momentum hovers steadily near $129, with clean signals awaited as price distances from the $120 area. The broader outlook remains constructive, targeting extended levels beyond $400, contingent on holding these key supports. Solana’s ecosystem, known for its speed and low costs, continues to attract developers and users, reinforcing the price’s technical foundation. Data underscores this: inflows of $12.91 million daily reflect ongoing capital deployment, while perps volume indicates active hedging and speculation in a balanced market. Such metrics, drawn from established platforms like DeFiLlama, affirm Solana’s position as a leading layer-1 blockchain. Traders are advised to monitor volume for confirmation, as lighter activity in pullback phases often precedes stronger advances.

Solana moves away from the $120 zone as structure holds above $125, with rising activity metrics and steady network strength across key levels.

- SOL reacts strongly to the $118–$125 zone, forming higher lows and reclaiming key structural levels.

- Network data shows steady activity with rising TVL, active addresses, and firm liquidity metrics.

- Weekly structure holds above $125 as SOL moves away from the $120 tap toward broader long-term targets.

Solana has entered an important area on the chart after tapping the lower volume zone near $120, exactly where traders expected it based on earlier structure. Market observers note that SOL has been one of the strongest assets this year, and this type of pullback is often where clearer setups form as the broader structure continues to build toward higher targets.

Frequently Asked Questions

What Factors Are Driving Solana’s Recent Price Recovery Above $125?

Solana’s recovery stems from robust network fundamentals and technical support in the $118–$125 zone. Higher lows formed post-dip, reclaiming $129.57, while TVL at $8.788 billion and 1.9 million active addresses signal strong demand. Analysts from Crypto Pulse confirm this pullback aligns with historical patterns for setup refinement.

Is Solana’s Network Activity Sustainable for Long-Term Price Growth?

Yes, Solana’s network activity appears sustainable, with daily fees of $446,564, DEX volume at $2.676 billion, and stablecoin holdings over $12.9 billion. These metrics, as tracked by DeFiLlama, demonstrate efficient operations and user growth, positioning SOL for steady appreciation when read in context with market cycles.

Key Takeaways

- Bullish Structure Confirmed: SOL’s higher lows above $125 and rejection at $120 indicate resilient demand, setting up for potential advances.

- Strong Network Metrics: TVL of $8.788 billion and rising active addresses provide a solid foundation, countering short-term volatility.

- Monitor Weekly Supports: Holding $125 opens paths to $400+ targets; watch for volume spikes as confirmation signals.

Conclusion

In summary, Solana price structure remains intact above $125, supported by steady network metrics like $8.788 billion TVL and $2.676 billion DEX volume. This positions SOL favorably amid ongoing ecosystem development. As 2025 progresses, investors should track key levels for entry opportunities and stay informed on blockchain advancements to capitalize on Solana’s growth potential.

Comments

Other Articles

Solana Leads 2025 Revenue as Bulls Test $130 Resistance

January 1, 2026 at 10:32 AM UTC

Bitwise Files for 11 Altcoin ETFs Including AAVE, UNI Amid SOL, XRP Muted Gains

December 31, 2025 at 08:47 PM UTC

Ethereum Whales Trim ETH Longs and Pivot to BTC in Dec 31 On-Chain Rebalance Update

December 31, 2025 at 01:27 PM UTC