Solana On-Chain Surge May Herald Price Alignment as BTC Faces Pressure

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

Solana is diverging from Bitcoin as on-chain activity surges despite market pressures, with RWA TVL reaching $800 million and new ETF launches signaling strong institutional interest. This could mark a cycle where SOL price aligns with robust fundamentals, unlike BTC’s speculative challenges.

-

Solana’s on-chain growth outpaces price declines, with 13% monthly RWA TVL increase.

-

BTC faces institutional selling pressure, exemplified by MicroStrategy’s 50% drop in Q4.

-

New Solana ETFs from Fidelity, 21Shares, VanEck, and Canary Capital boost adoption, alongside Coinbase’s Vector acquisition.

Discover how Solana’s fundamentals drive divergence from Bitcoin amid 2025 market FUD. Explore RWA growth and ETF inflows for investment insights. Stay ahead in crypto—read now!

What is driving Solana’s potential price divergence from Bitcoin?

Solana’s price divergence from Bitcoin stems from surging on-chain metrics and institutional developments contrasting BTC’s weakening catalysts. While Bitcoin grapples with reduced institutional accumulation, Solana reports $800 million in RWA TVL and multiple ETF launches. This setup positions SOL for fundamentals-led recovery in the current cycle.

How are institutional moves influencing Solana adoption?

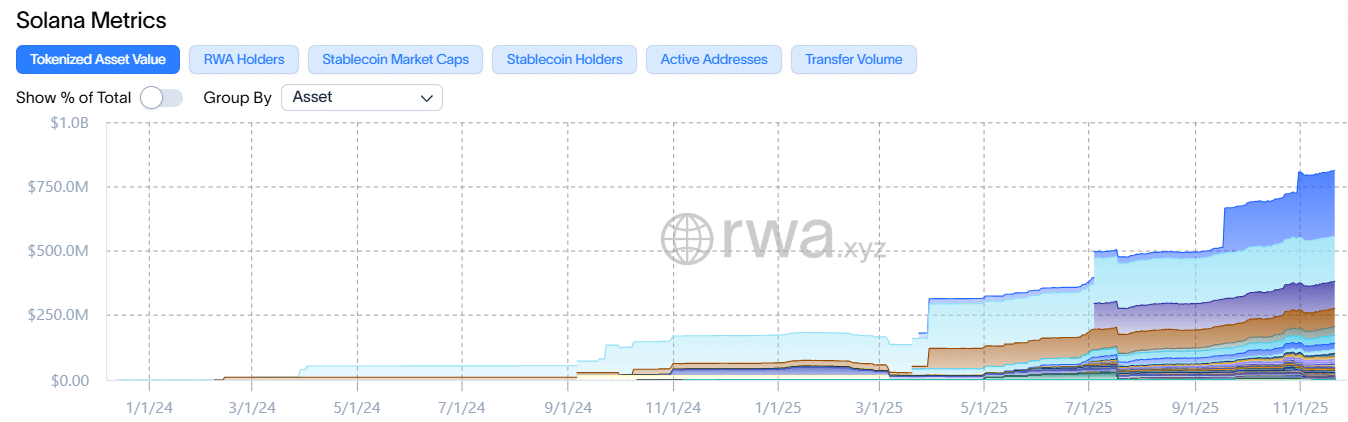

Institutional interest in Solana remains resilient amid broader market uncertainty. Coinbase’s acquisition of Vector, a Solana-based on-chain platform, underscores growing enterprise integration. Recent ETF approvals, including Fidelity’s FSOL, 21Shares’ TSOL, VanEck’s VSOL, and Canary Capital’s SOLC, have facilitated easier access for investors. According to data from RWA.xyz, Solana’s real-world asset TVL climbed 13% in November, reaching $800 million, with Circle minting $6.75 billion in USDC on the network. BlackRock’s BUIDL fund also expanded 768% quarter-over-quarter. These metrics highlight Solana’s utility in tokenizing assets, differentiating it from Bitcoin’s primarily store-of-value narrative. Experts note this on-chain momentum as a key signal for sustained growth.

Frequently Asked Questions

What factors are causing Bitcoin’s recent underperformance?

Bitcoin’s underperformance ties to cooling institutional demand, with treasury firms like MicroStrategy facing significant losses after aggressive Q2 and Q3 buys. This led to a 36% rally but a subsequent 50% Q4 decline, amplifying market FUD and exposing BTC’s reliance on speculation over practical use cases.

Is Solana’s on-chain activity a reliable indicator for price recovery?

Solana’s on-chain activity, including heightened RWA adoption and stablecoin issuance, suggests building momentum that could support price recovery. As daily active users and TVL rise, this fundamental strength often precedes market alignment, making it a promising gauge for investors seeking alternatives to Bitcoin’s volatility.

Key Takeaways

- Fundamentals overtaking speculation: Solana’s RWA TVL surge to $800 million indicates real utility, contrasting Bitcoin’s challenges.

- Institutional backing for SOL: ETF launches and acquisitions like Coinbase-Vector reinforce Solana’s growth trajectory.

- Watch for cycle alignment: Monitor on-chain metrics as they may drive SOL price to catch up, signaling broader altcoin recovery.

Conclusion

The ongoing Solana price divergence from Bitcoin highlights a shift toward networks with tangible on-chain adoption and institutional support. With RWA growth and ETF momentum, Solana exemplifies resilience in a FUD-heavy environment. As 2025 progresses, investors should track these fundamentals for opportunities in a maturing crypto landscape—consider diversifying portfolios to capitalize on emerging leaders.

BTC under pressure, SOL divergence in focus

Market uncertainty is prompting a reassessment of core drivers across cryptocurrencies. Institutional flows, once Bitcoin’s powerhouse, are now faltering, impacting top assets broadly.

Bitcoin’s recent gains were propelled by substantial corporate buys. MicroStrategy, for instance, executed 21 BTC purchases in Q2 and Q3, contributing to a 36% price increase and new peaks. Yet, entering Q4, the firm’s value has halved, reflecting broader capital outflows from treasury strategies.

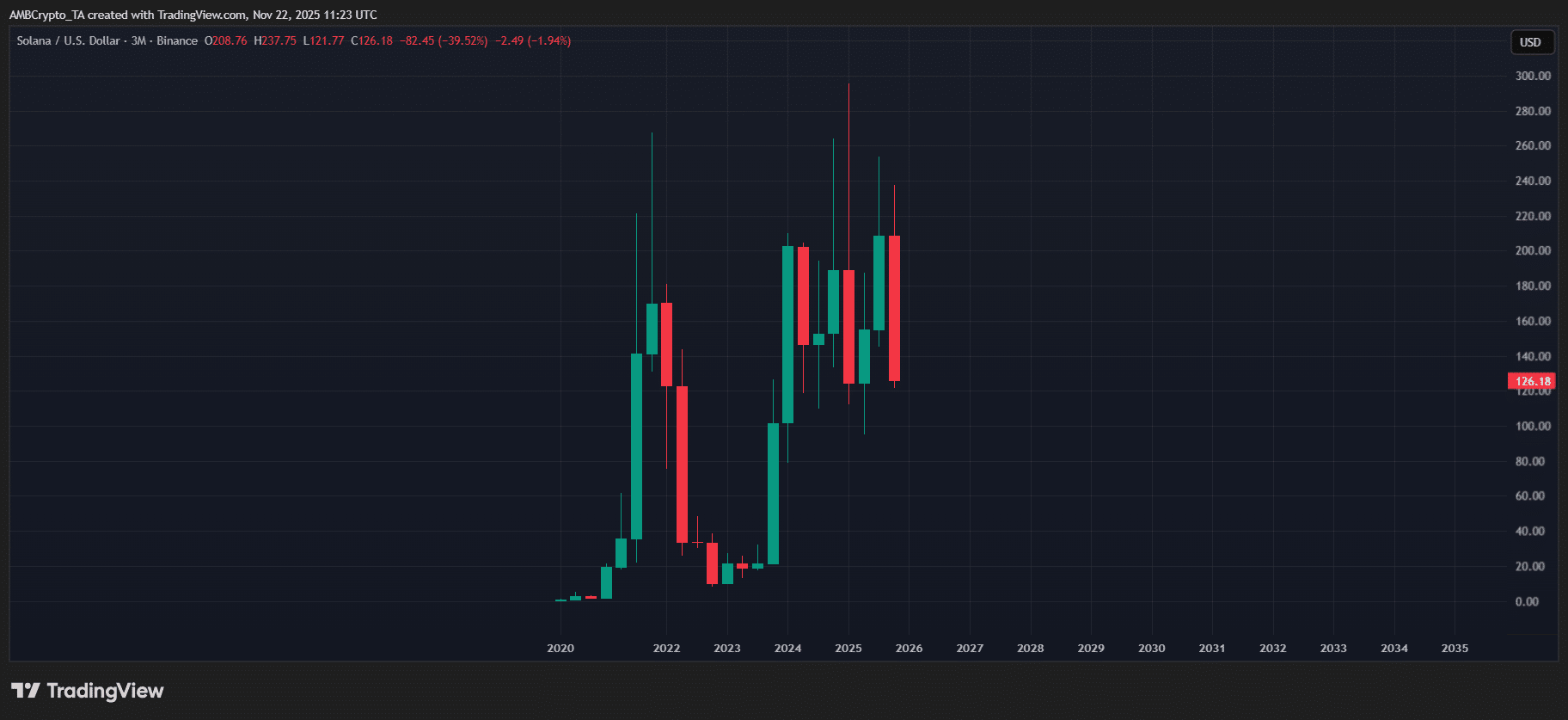

Source: TradingView (SOL/USDT)

This pressure extends to altcoins, with Solana experiencing a 40% quarterly drop—twice Bitcoin’s decline. Despite this, Solana’s network shows vitality.

On-chain indicators for Solana are accelerating. Daily transactions and user engagement remain elevated, even as prices lag. Analysts from COINOTAG suggest this pattern may reverse, with Solana emerging as a benchmark for fundamental-driven rallies.

Solana gains momentum amid macro FUD

Solana’s ecosystem continues to evolve positively despite external headwinds. Key announcements this week bolster its position.

Coinbase’s move to acquire Vector enhances Solana’s infrastructure for on-chain applications. Complementing this, fresh ETF products from major issuers—Fidelity’s FSOL, 21Shares’ TSOL, VanEck’s VSOL, and Canary Capital’s SOLC—have debuted, broadening investor access.

Network fundamentals are equally compelling. November opened with RWA TVL at $800 million, a 13% monthly gain. Circle’s $6.75 billion USDC mint on Solana’s layer-1 supports liquidity, while BlackRock’s BUIDL fund grew 768% from the prior quarter.

Source: RWA.xyz

These developments affirm Solana’s appeal to institutions. ETF inflows and RWA expansion counter Bitcoin’s narrative as a speculative asset lacking everyday utility. On-chain data from sources like DefiLlama corroborates this trend, with Solana’s TVL metrics outpacing peers.

In summary, Solana’s trajectory points to a convergence of price and performance. As Bitcoin contends with FUD, Solana’s ecosystem fortifies its case for long-term value, potentially reshaping market dynamics in 2025. Investors monitoring these signals may find strategic entry points in this evolving landscape.