Solana Price May Test $95-$105 Support Amid Bearish Momentum

SOL/USDT

$4,203,361,175.30

$82.37 / $77.12

Change: $5.25 (6.81%)

-0.0056%

Shorts pay

Contents

Solana’s price has declined 10% to $126.02 since its recent high of $140.19, influenced by the first spot ETF outflow ending a 21-day inflow streak and a proposed tokenomics change aimed at enhancing scarcity but reducing staking rewards.

-

Solana experienced its first daily ETF outflow on November 28, breaking a consistent inflow pattern and contributing to bearish sentiment.

-

Low weekend liquidity triggered a market-wide correction, exacerbating the price drop amid subdued trading activity.

-

The proposed tokenomics adjustment, if approved, would mark Solana’s most significant supply decision since inception, with 35% of circulating supply currently staked.

Discover how Solana price trends are shifting due to ETF outflows and tokenomics proposals. Stay informed on SOL’s technical analysis and key support levels for smarter crypto decisions.

What is the current impact of the Solana tokenomics proposal on SOL price trends?

Solana price trends have turned decisively bearish, with SOL dropping 10% from its November 30 high of $140.19 to $126.02 as of the latest data. This decline coincides with the network’s first spot exchange-traded fund (ETF) outflow on November 28, ending a 21-day streak of inflows, and a developer-proposed tokenomics change that seeks to improve long-term scarcity at the expense of staking rewards. The proposal, yet to be approved, has heightened uncertainty, amplifying selling pressure in a low-liquidity environment over the weekend.

The Solana ecosystem, known for its high-speed transactions and low fees, has seen robust growth in 2025, but recent events underscore vulnerabilities tied to market sentiment and structural adjustments. Data from on-chain analytics platforms indicate that the ETF outflow amounted to approximately $5.2 million, signaling reduced institutional interest amid broader crypto market corrections. This shift has not only pressured SOL’s price but also raised questions about the blockchain’s attractiveness for stakers, who currently earn around 7% annual yields.

How does Solana’s recent ETF outflow affect its price momentum?

The ETF outflow represents a pivotal shift for Solana, as spot ETFs have been instrumental in driving capital inflows since their approval earlier in 2025. According to reports from financial data aggregators like CoinMetrics, the 21-day inflow streak had injected over $150 million into SOL-linked products, bolstering price stability. The November 28 reversal, totaling $5.2 million, correlates directly with a 5% intraday drop, highlighting the ETF’s role as a sentiment barometer.

Experts in the crypto space, including analysts from Messari, note that such outflows often precede extended consolidations, especially when paired with macroeconomic factors like rising interest rate expectations. On-chain metrics reveal a 12% decrease in active addresses over the past week, further eroding momentum. Structurally, this event disrupts the positive feedback loop where ETF demand historically supported staking participation, now at 35% of the 470 million circulating SOL supply. Short-term recovery hinges on renewed inflows, but persistent outflows could test lower support levels, as evidenced by historical patterns during the 2024 downturns.

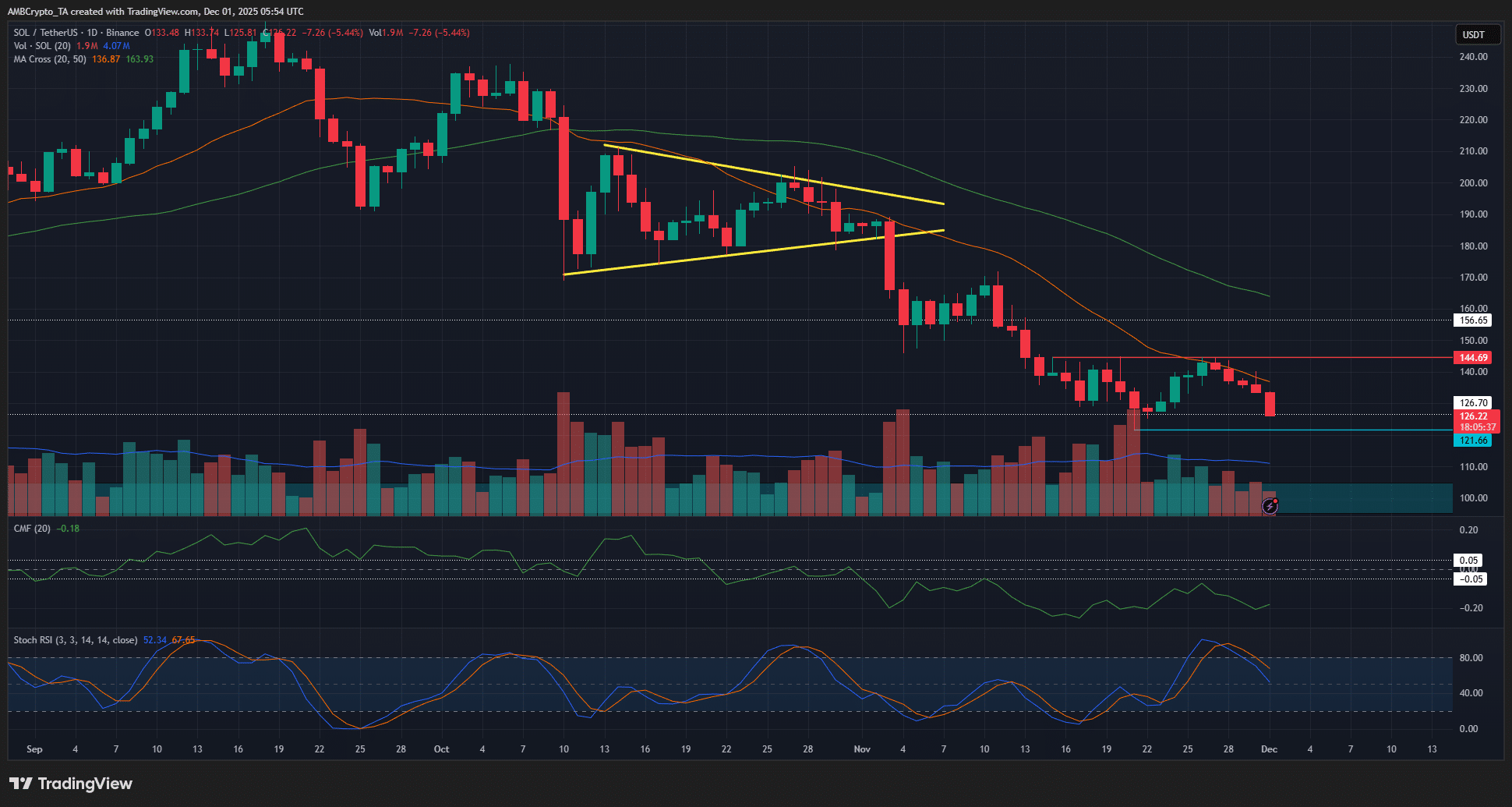

From a technical perspective, the daily chart shows SOL forming lower lows, with the Chaikin Money Flow (CMF) dipping below -0.05, indicating sustained capital outflows. The Stochastic RSI remains in oversold territory, suggesting potential for a rebound, but only if volume picks up. Trading volume has averaged 2.5 billion SOL in the last 24 hours, down 15% from prior weeks, per data from Kaiko, underscoring the liquidity crunch that amplified Sunday’s correction.

Source: SOL/USDT on TradingView

The trend on the daily timeframe has been decisively bearish, with a potential lower low at $121.66 signaling further downside if breached. Recent rejection at $144 reinforces this as a key supply zone. Solana’s price action mirrors broader altcoin weakness, influenced by Bitcoin’s stabilization around $90,000, but SOL’s unique factors like the proposal add layer-specific pressure.

Frequently Asked Questions

What caused Solana’s first ETF outflow after 21 days of inflows?

The November 28 ETF outflow of $5.2 million stemmed from profit-taking by investors following SOL’s rally to $140 and broader market caution amid U.S. regulatory discussions on crypto ETFs. This ended the inflow streak that had supported price stability, with data from ETF trackers showing a shift toward risk-off positioning in digital assets.

Is the Solana tokenomics proposal likely to be approved?

The proposal, focused on reducing inflation to enhance scarcity, is under community review and could take weeks for a vote. Proponents argue it will strengthen long-term value by lowering staking rewards from 7% to around 5%, but opposition from validators highlights potential liquidity risks. Solana Foundation statements indicate strong developer support, though final approval depends on governance participation.

Delving deeper, the proposal aims to adjust the network’s inflation schedule post the 2025 halving event, capping annual emissions at 1.5% compared to the current 5%. This mirrors Ethereum’s post-Merge adjustments, where reduced issuance led to a 20% supply contraction over six months. Solana’s validator network, comprising over 1,800 nodes, must achieve 66% quorum for passage, per the protocol’s rules.

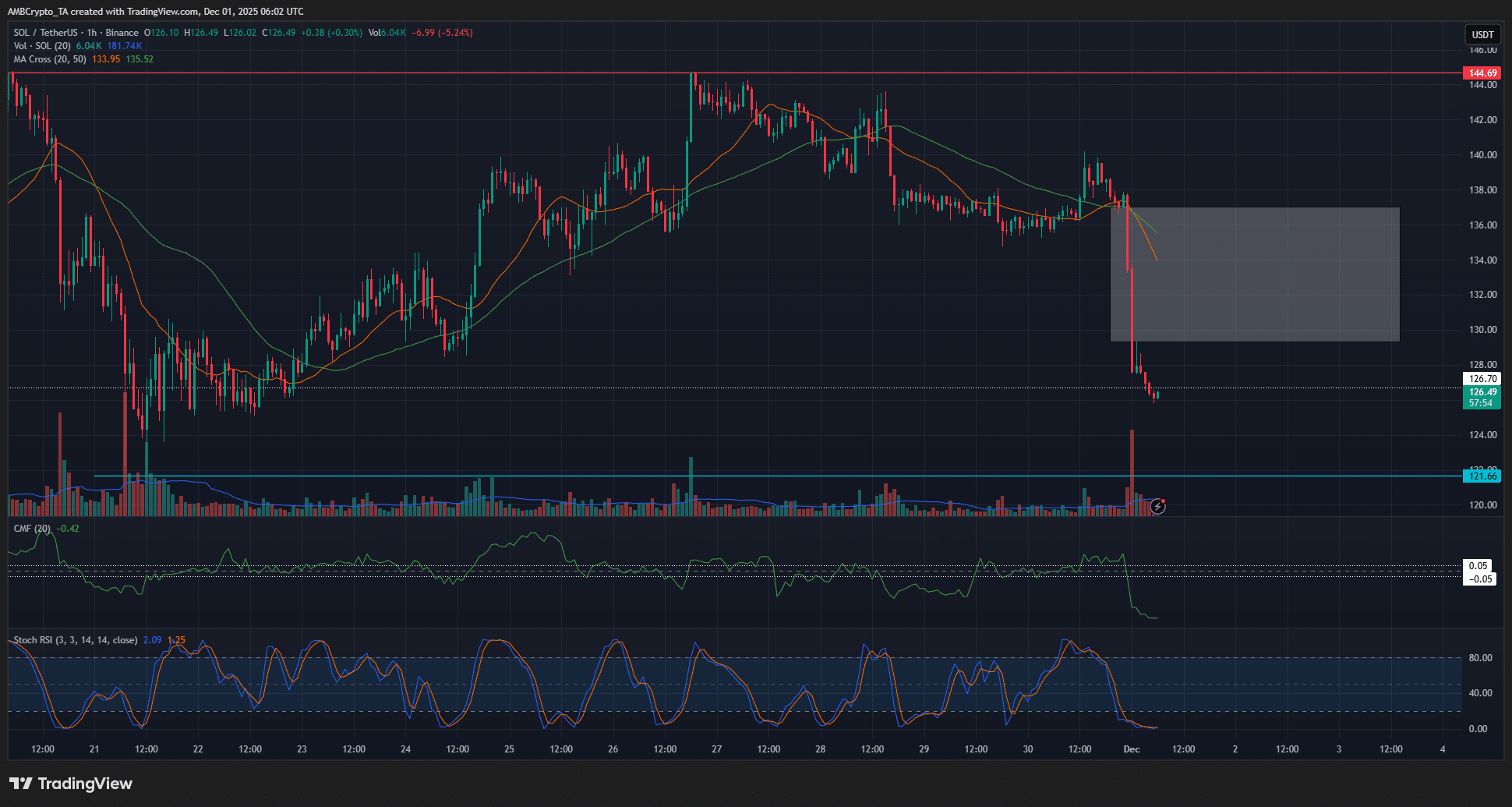

Source: SOL/USDT on TradingView

On the 1-hour chart, Solana has returned to the $126.7 long-term support, a demand zone holding firm over the past ten days. The $125-$127 region remains critical, while overhead supply from $129.7 to $137 poses a barrier to recovery. Indicators like the CMF below -0.05 and bearish Stochastic RSI confirm the prevailing momentum.

Key Takeaways

- SOL’s 10% decline reflects ETF outflow and proposal uncertainty: The break in inflows has fueled bearish trends, with price testing key supports amid low liquidity.

- Technical structure favors downside: Breaching $121.66 could target $95-$105, though $125-$127 may offer short-term relief, supported by historical data.

- Monitor proposal developments: Approval could stabilize long-term scarcity, but rejection might extend volatility—traders should watch validator votes for directional cues.

Conclusion

Recent Solana price trends underscore the interplay between ETF flows, market liquidity, and the pending tokenomics proposal, with SOL trading at $126.02 after a 10% pullback from $140.19. As developers push for scarcity enhancements that could reshape staking dynamics, the network’s fundamentals remain strong, evidenced by its 65,000 transactions per second capacity. Investors should track key levels like $121.66 support and $144.7 resistance, while preparing for potential volatility. For deeper insights into Solana’s evolving landscape, explore related analyses on en.coinotag.com to inform your strategy in this dynamic crypto market.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.