Solana Shows Recovery Potential as Key Support and Positive Sentiment Align

SOL/USDT

$3,875,175,794.90

$89.20 / $86.02

Change: $3.18 (3.70%)

-0.0160%

Shorts pay

Contents

Solana indicates a potential rebound, with key technical signals and market sentiment aligning at critical support levels.

-

The TD Sequential buy signal aligns with bullish sentiment and critical support near $154.

-

Liquidation clusters and rising derivatives’ activity point to looming price volatility.

Solana shows signs of a recovery as sentiment, technical indicators, and derivatives align at a key support zone. Will this lead to a sustainable uptrend?

Is SOL’s cautious trading masking a buildup of breakout pressure?

The derivatives market presents an intriguing picture of increasing speculative interest in Solana. Volume surged nearly 30% to $10.18B, while Open Interest (OI) increased by 2.51% to $6.67 billion. Moreover, Options Volume jumped by 45.90%, and Options OI rose 27.35%, indicating aggressive positioning among traders.

These sharp increases suggest that market participants are gearing up for a volatility event, likely focusing on Solana’s current support area. As of now, Spot flows recorded $106.35 million in inflows against $116 million in outflows, reflecting a net difference of only $10 million. This marginal outflow illustrates a cautious market phase, where neither buyers nor sellers have established dominance.

Despite the net negative figure, the minimal gap highlights hesitation rather than a definitive trend. Investors are seemingly monitoring Solana’s price action at existing levels before making substantial commitments.

Source: CoinGlass

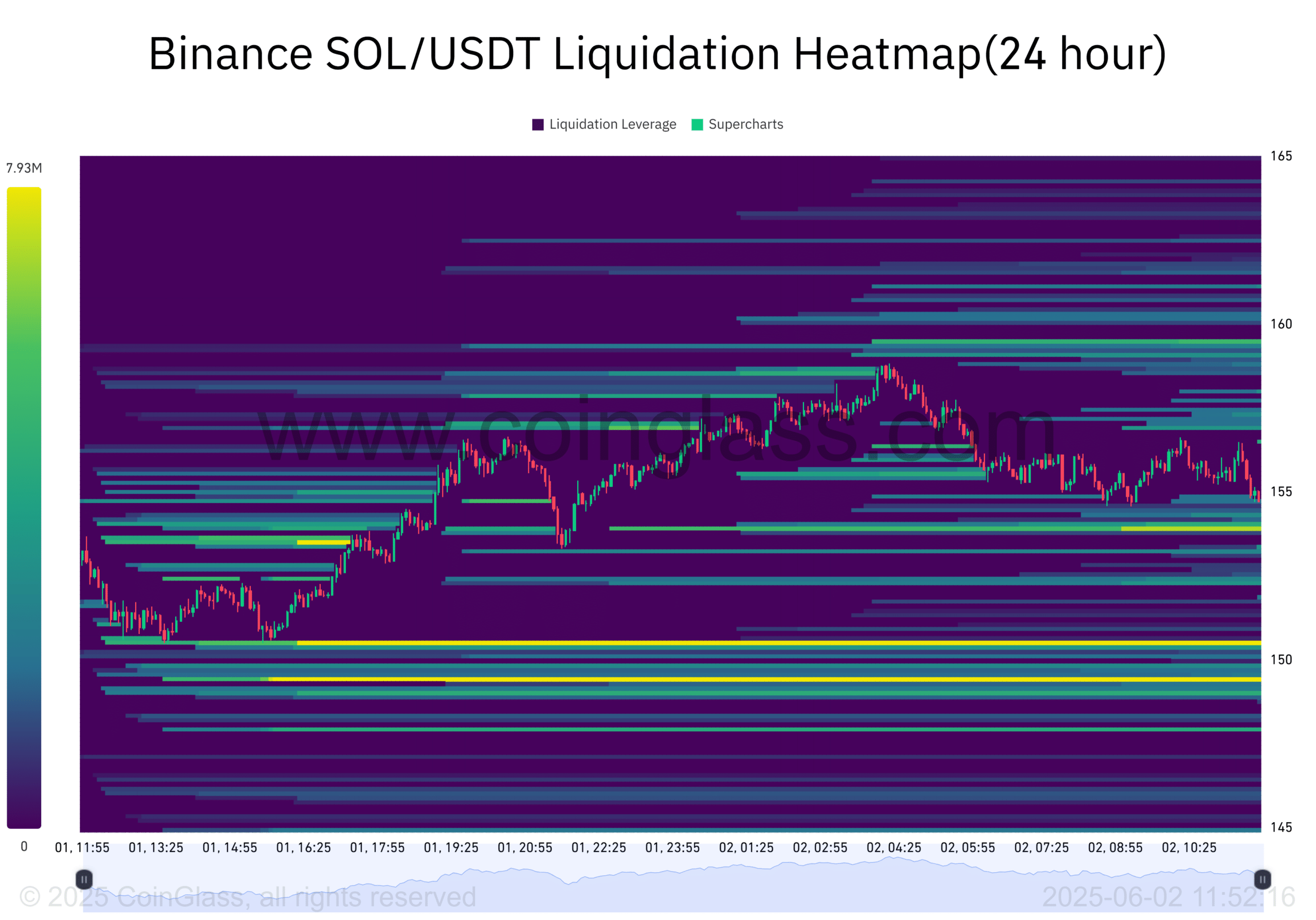

Will SOL liquidation clusters near $150 and $160 drive volatility?

The Binance liquidation heatmap reveals dense clusters near $150 and $160, where high-leverage positions are concentrated. These levels now represent short-term battlegrounds. A breakdown below $150 could prompt long liquidations, amplifying downward pressure.

On the flip side, a rise above $160 might trigger short liquidations, expediting any potential upward breakout. Therefore, these clusters function as volatility hotspots, and price movements around these levels are likely to determine whether SOL regains momentum or delves deeper into bearish territory.

Source: CoinGlass

Does the RSI support the case for a short-term rebound?

The daily RSI stands at approximately 40.57, inching closer to the oversold threshold, hinting at a potential decline in selling pressure. Although Solana has dipped below its ascending channel, it continues to hold above critical horizontal support. This pattern suggests the possibility of a higher low if buyers manage to defend this zone.

However, failure to maintain this support could extend losses toward $140 or lower. Therefore, the behavior of the RSI in the near term will be pivotal—should it reverse upwards, it could bolster the case for a relief rally toward $160.

Source: TradingView

Can Solana defend support and reclaim $160 momentum?

Solana stands in a feasible position to reclaim the $160 mark if current conditions hold. The convergence of the TD Sequential “buy” signal, increasing derivatives engagement, and optimistic sentiment from both smart investors and the general crowd suggests a solid short-term recovery potential. However, the price must decisively break and sustain above $160 to confirm upward momentum.

Until then, the support around $154 remains vital. A drop below $150 could negate this bullish outlook and return control to bearish sentiments. Therefore, the future direction hinges on how SOL maneuvers around these liquidity zones.

Comments

Other Articles

Solana Leads 2025 Revenue as Bulls Test $130 Resistance

January 1, 2026 at 10:32 AM UTC

Bitwise Files for 11 Altcoin ETFs Including AAVE, UNI Amid SOL, XRP Muted Gains

December 31, 2025 at 08:47 PM UTC

Ethereum Whales Trim ETH Longs and Pivot to BTC in Dec 31 On-Chain Rebalance Update

December 31, 2025 at 01:27 PM UTC