Solana (SOL) Shows Accumulation Amid Weak Market, Potential Support at $144 Could Influence Recovery

SOL/USDT

$3,875,175,794.90

$89.20 / $86.02

Change: $3.18 (3.70%)

-0.0160%

Shorts pay

Contents

-

Solana (SOL) faces weak market conditions but continues to see accumulation, indicating strong investor confidence and potential for recovery.

-

The Network Value to Transactions (NVT) ratio declines, signaling balanced network activity, which may support future price growth.

-

Solana holds at $146, with $144 support crucial for a rebound; a drop below $144 could push SOL to $136, invalidating bullish outlook.

Solana’s accumulation trend and declining NVT ratio suggest potential recovery as $144 support remains key for SOL price stability and growth.

Solana Investors Stick To Accumulation

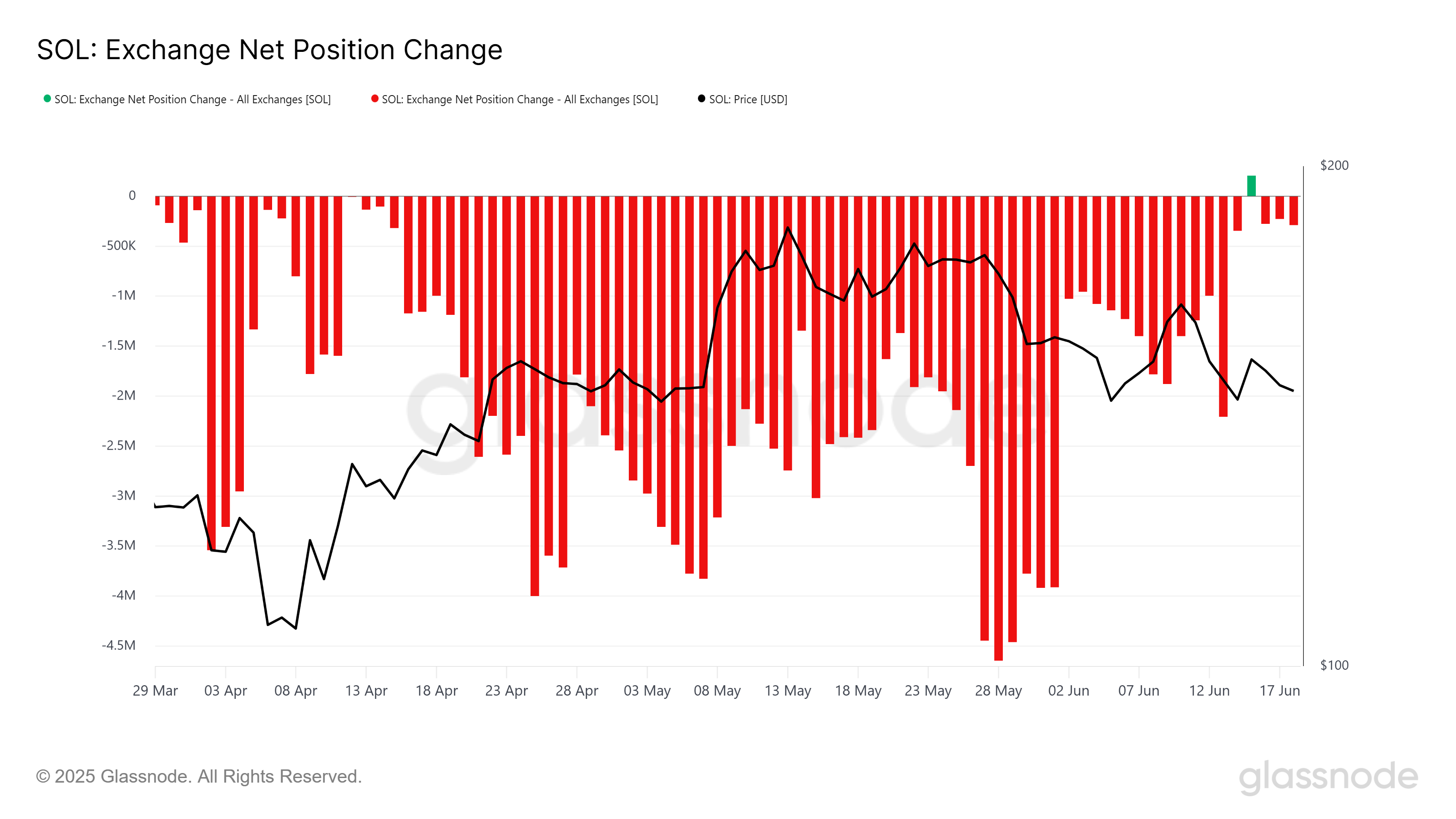

Solana’s market sentiment remains strong, with exchange net position changes indicating a trend of accumulation among investors. In nearly three months, there has been only one instance where selling surpassed accumulation.

This accumulation trend also highlights a shift in investor behavior, with many choosing to hold rather than liquidate their positions. Such a stance indicates confidence in the long-term prospects of Solana, suggesting that SOL could see a recovery once market conditions improve.

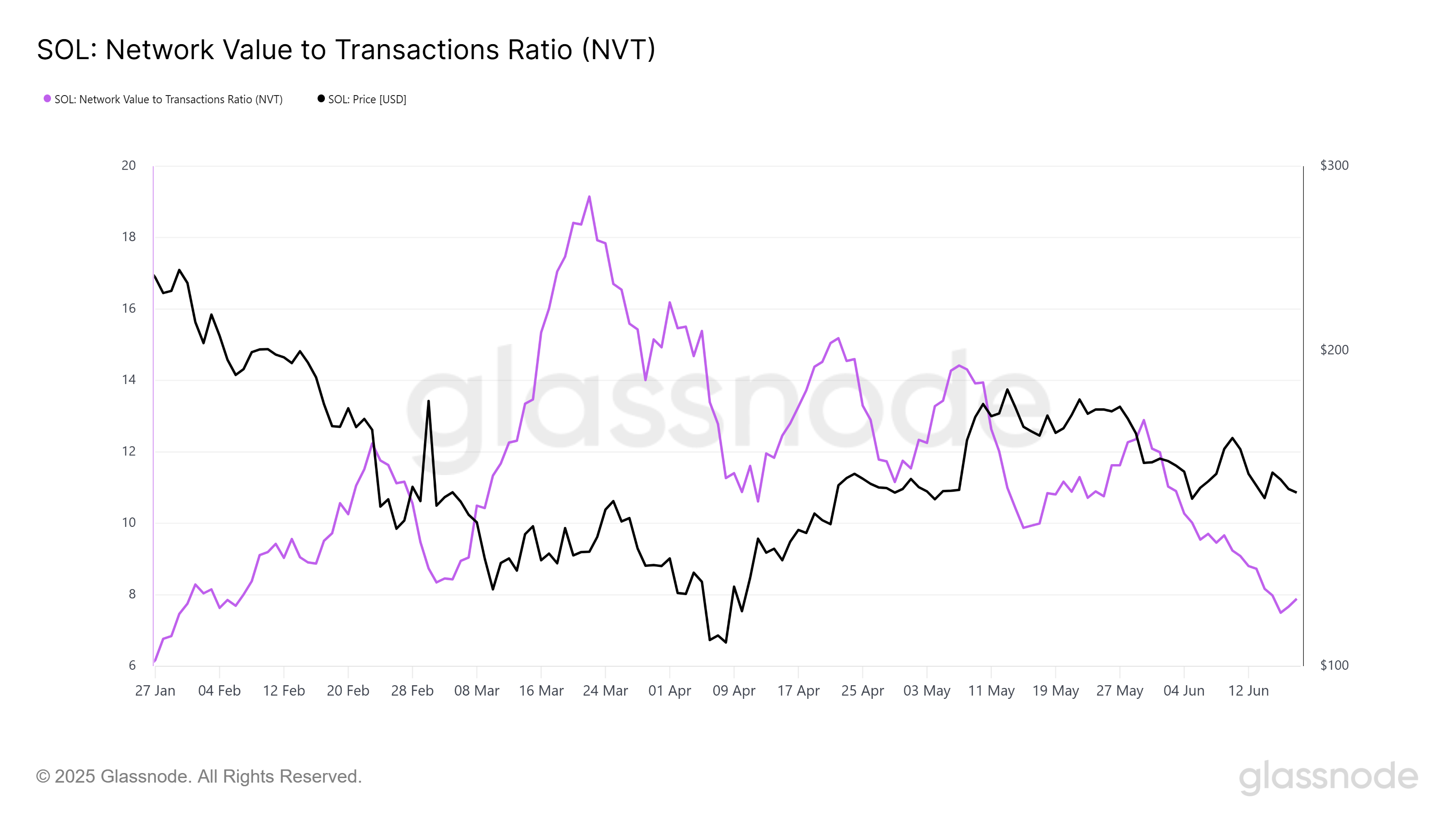

The overall macro momentum for Solana appears promising, with the Network Value to Transactions (NVT) ratio showing a downward trend. A declining NVT ratio signals that the network value is aligning with transaction activity, meaning that the asset is not overheated.

As Solana’s NVT ratio declines, it could help the asset recover from its recent price challenges. A lower NVT ratio typically points to the potential for price growth, as it suggests that the network’s value and user activity are balanced.

SOL Price Awaits Bounce Back

Solana’s price is currently holding at $146, staying above the critical support level of $144. This support has been crucial in preventing a sharp decline this month. The continued ability to hold above $144 signals that SOL has some bullish momentum despite the broader market challenges.

The bullish signals emerging from Solana at this time suggest a potential price rise. If SOL successfully bounces off the $144 support, it could aim for the $152 resistance, with a clear path to $161.

However, if the bullish momentum fades and bearish pressures increase, Solana could see a drop below the $144 support level. In this case, the price could slide to $136, invalidating the current bullish outlook.

Conclusion

In summary, Solana’s current market dynamics reflect a cautious yet optimistic investor base, underscored by steady accumulation and a favorable NVT ratio trend. Maintaining the $144 support level is critical for SOL to sustain its bullish trajectory and potentially reach higher resistance levels. Traders and investors should monitor these key price points closely to gauge Solana’s near-term momentum and adjust strategies accordingly.

Comments

Other Articles

Solana Leads 2025 Revenue as Bulls Test $130 Resistance

January 1, 2026 at 10:32 AM UTC

Bitwise Files for 11 Altcoin ETFs Including AAVE, UNI Amid SOL, XRP Muted Gains

December 31, 2025 at 08:47 PM UTC

Ethereum Whales Trim ETH Longs and Pivot to BTC in Dec 31 On-Chain Rebalance Update

December 31, 2025 at 01:27 PM UTC