Solana Whale Accumulation May Bolster Rebound Toward $168

SOL/USDT

$4,203,361,175.30

$82.37 / $77.12

Change: $5.25 (6.81%)

-0.0056%

Shorts pay

Contents

Solana whale accumulation has intensified as major holders withdraw over 170,000 SOL from exchanges like Binance, signaling strong buyer confidence in a rebound from the $130 demand zone. This activity supports price recovery toward $168 and beyond, bolstering Solana’s bullish structure.

-

Solana whale accumulation absorbs exchange supply, reinforcing demand and momentum signals for recovery.

-

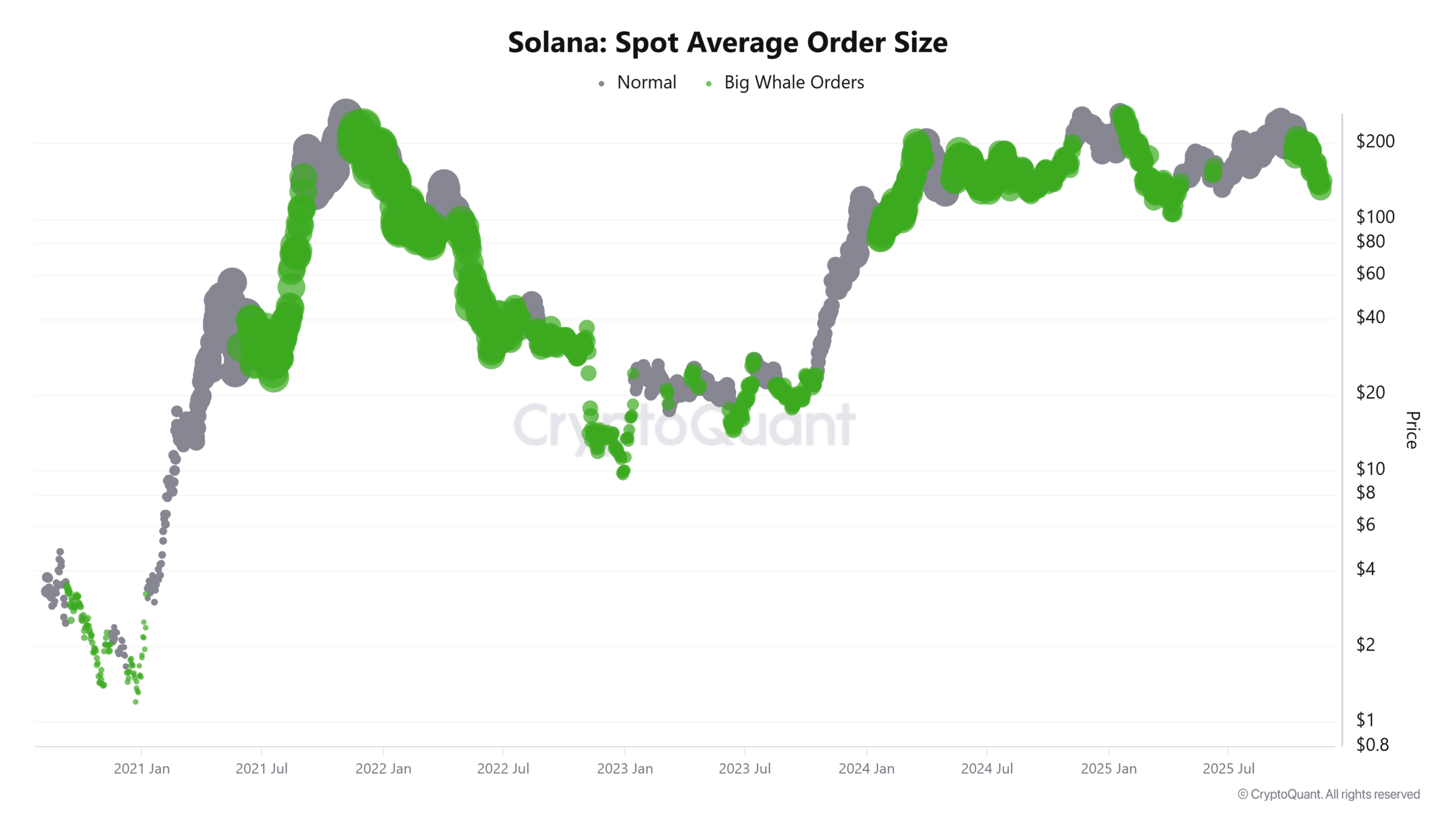

Spot market order sizes are expanding, indicating deliberate buying by large players during the dip.

-

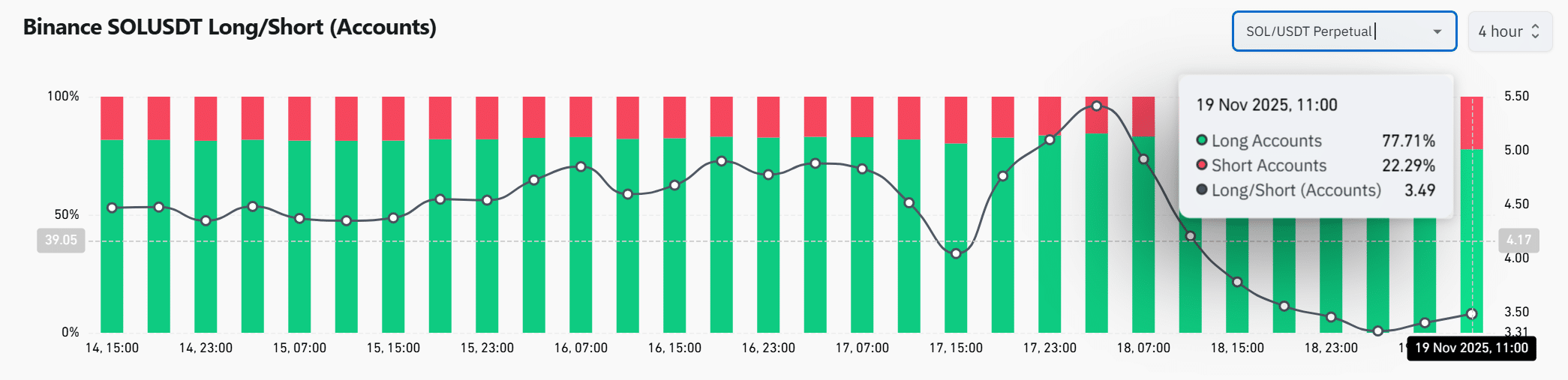

Derivatives show a 3.49 long/short ratio, with 77.71% long positions, highlighting trader optimism for upside.

Solana whale accumulation surges with 170K+ SOL withdrawn from exchanges, eyeing rebound from $130 zone. Discover bullish signals and key levels for SOL price recovery now.

What is driving Solana whale accumulation in the current market dip?

Solana whale accumulation is accelerating as large investors pull significant SOL tokens from centralized exchanges, reflecting heightened confidence in the network’s long-term value amid a temporary price correction. This strategic buying at lower levels strengthens the $130 demand zone, where buyers are actively defending against further downside. By moving assets to self-custody, whales demonstrate commitment to holding through volatility, paving the way for a potential sustained rally.

How does Solana’s rebound from the demand zone influence market sentiment?

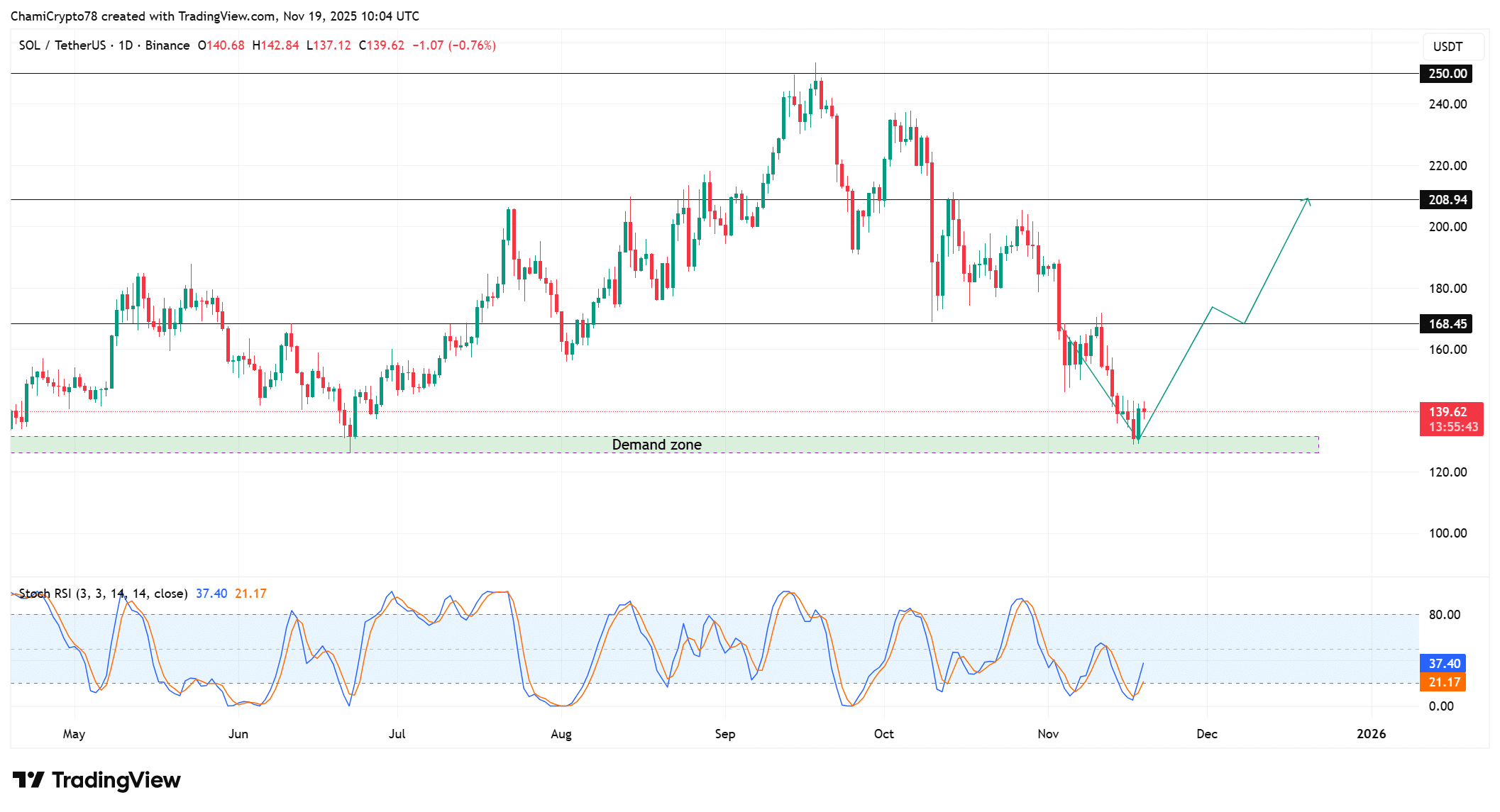

Solana’s price has shown resilience by rebounding from the critical $130 demand zone, where institutional buyers have stepped in to absorb selling pressure. This level, tested multiple times, now exhibits higher-low formation, a classic sign of building upside momentum. According to on-chain data from platforms like CryptoQuant, exchange outflows have spiked, with over 170,000 SOL transferred to private wallets in recent sessions— a 25% increase from average daily volumes. Such patterns historically precede 15-20% gains in similar setups, as noted by blockchain analysts. Short sentences highlight the shift: accumulation is deliberate, sentiment is turning positive, and technical indicators align for continuation.

Heavy accumulation persisted with two new wallets securing 70,000 SOL from Binance, while another address extracted more than 100,000 SOL across four leading exchanges. These rapid movements underscore aggressive buying intent from fresh capital sources, rather than repositioning by established holders. The timing aligns with Solana’s dip into an optimal risk-reward area, suggesting whales view current prices as undervalued. This self-custody trend during declines typically foreshadows multi-week recoveries, adding substantial bullish reinforcement to Solana’s chart structure as demand solidifies.

Source: TradingView

Why is the expansion of whale orders in spot markets a bullish indicator for Solana?

Average order sizes in spot markets for Solana have risen sharply, pointing to increased participation from high-net-worth traders executing larger volumes. This uptick correlates directly with the observed whale withdrawals, creating a synergy between on-chain flows and exchange activity. In the context of the demand zone reaction, larger trades signal urgency among institutional players to capitalize on discounted entry points. Data from CryptoQuant indicates a 30% jump in average order values over the past week, far exceeding typical ranges during consolidations. This deliberate scaling up of positions underscores a calculated bet on Solana’s ecosystem growth, including its high-throughput blockchain advantages. Consequently, the interplay of spot dynamics and accumulation bolsters the narrative for a robust price reversal.

Source: CryptoQuant

How does a 3.49 long/short ratio reflect trader confidence in Solana’s upside potential?

In the derivatives arena, long positions now dominate with a 3.49 ratio, as 77.71% of open interest favors bullish bets compared to 22.29% shorts. This lopsided exposure emerged following Solana’s firm bounce from the demand zone, prompting leveraged traders to amplify their upside wagers. CoinGlass metrics reveal this shift coincides with improved sentiment, where early recovery signs encourage position building. While extreme long bias can heighten volatility, it also mirrors the spot accumulation trend, fostering a comprehensive bullish environment. As long as Solana maintains support above $130, this derivatives strength could propel prices toward higher targets like $168.

Source: CoinGlass

Frequently Asked Questions

What impact does Solana whale accumulation have on price stability during dips?

Solana whale accumulation enhances price stability by reducing available supply on exchanges, which counters selling pressure and stabilizes the $130 demand zone. In recent activity, withdrawals exceeding 170,000 SOL have absorbed excess tokens, historically leading to 10-15% rebounds within days as confidence rebuilds among retail and institutional investors.

Is the rising long/short ratio a reliable signal for Solana’s next price move?

Yes, a 3.49 long/short ratio indicates strong trader belief in Solana’s upward trajectory, especially when paired with spot accumulation. This setup, with longs at 77.71%, often precedes continued rallies from support levels like $130, though monitoring for reversals remains key in volatile markets.

Key Takeaways

- Whale accumulation bolsters recovery: Large withdrawals from exchanges reinforce Solana’s demand zone, signaling intent for a sustained rebound.

- Spot order growth aligns with bulls: Expanding average order sizes confirm institutional buying, enhancing momentum toward $168.

- Derivatives dominance drives upside: A 3.49 long ratio supports continuation, but watch for volatility if support holds.

Conclusion

Solana whale accumulation, combined with expanding spot orders and a dominant long/short ratio, forms a solid foundation for rebounding from the $130 demand zone. These on-chain and market signals point to renewed strength in Solana’s ecosystem, with potential targets at $168 and $208 on the horizon. As blockchain adoption grows, investors should monitor these dynamics closely for strategic entry points in the evolving crypto landscape.