Solana’s Revolut Partnership May Narrow Valuation Gap with Ethereum in 2026

SOL/USDT

$4,203,361,175.30

$82.37 / $77.12

Change: $5.25 (6.81%)

-0.0056%

Shorts pay

Contents

The Solana Revolut partnership enables cost-effective crypto transfers for over 65 million Revolut users via Solana’s high-throughput blockchain, highlighting its real-world payments potential in 2025 amid competition with Ethereum’s Fusaka upgrade.

-

Solana leads in transaction volume with 74 million non-vote transactions, outpacing Ethereum by a factor of 47 despite recent upgrades.

-

Solana’s developer activity ranks second to Ethereum, with 1,276 full-time developers driving innovation in payments and DeFi.

-

The SOL/ETH ratio has declined 20% in 2025, suggesting potential undervaluation for Solana ahead of its Alpenglow upgrade in Q1 2026.

Discover how the Solana Revolut partnership boosts blockchain adoption in payments, challenging Ethereum’s dominance. Explore on-chain metrics and 2026 outlook for SOL investors today.

What is the impact of the Solana Revolut partnership in 2025?

The Solana Revolut partnership integrates Solana’s blockchain into Revolut’s platform, allowing users to conduct crypto transactions with low fees and high speed. This move positions Solana as a key player in mainstream payments, serving Revolut’s vast user base and demonstrating practical blockchain utility. It comes at a time when Ethereum’s Fusaka upgrade aims to enhance scalability, intensifying competition between the two networks.

How does Solana compare to Ethereum in developer activity and transaction volume?

Solana trails Ethereum in developer numbers but excels in real-time performance. Ethereum boasts 3,778 full-time developers, fostering robust ecosystem growth, while Solana’s 1,276 developers focus on high-throughput applications. On-chain data from sources like The Block reveals Solana processing 74 million non-vote transactions monthly, compared to Ethereum’s 180,000 daily average increase post-upgrades. This disparity underscores Solana’s edge in handling high-volume payments, as noted by blockchain analysts who emphasize its low fees and large block limits for everyday use cases.

Beyond institutionalizing crypto assets, 2025 has shaped up to be a bullish year for bringing blockchain use-cases into the mainstream. Integration into the payments market and partnerships with financial firms are accelerating adoption across layer-1 networks.

No surprise that layer-1 blockchains are racing to capture market share. Developer activity has surged this year, with total monthly active developers reaching 30,000 and a double-digit rise in full-time contributors. These metrics signal a maturing ecosystem ready for broader implementation.

Among leading chains, Ethereum remains dominant with 3,778 full-time developers, while Solana secures second place with 1,276. Despite Ethereum’s Fusaka upgrade generating buzz for improved efficiency, Solana continues to innovate in scalability and cost-effectiveness.

Revolut partnership highlights Solana’s real-world use case

The payments sector has emerged as a prime arena for blockchain applications in 2025. Networks are increasingly targeting this space to unlock new revenue streams through DeFi and instant settlements.

For instance, Ripple has forged major alliances with financial institutions, enabling near-instant cross-border transfers. Projections from McKinsey indicate the global payments market could reach $3 trillion by 2029, making these integrations essential for growth.

Solana is actively entering this domain, with its recent collaboration with Revolut marking a significant step. This partnership embeds Solana into the neobanking ecosystem, facilitating seamless crypto movements.

Source: X

Revolut, Europe’s premier neobank, serves more than 65 million users, including 15 million with crypto accounts. Through Solana integration, these users benefit from efficient transfers leveraging Solana’s infrastructure.

Strategically, this partnership showcases Solana’s strengths in banking applications: superior throughput, minimal transaction costs, elevated transactions per second, and expanded block capacities. Experts in blockchain finance, such as those from Deloitte, highlight how such features make Solana ideal for high-demand financial services.

The timing adds intrigue, occurring shortly after Ethereum’s Fusaka upgrade activation. Whether coincidental or calculated, it amplifies Solana’s position in the evolving payments landscape.

Solana widens its usage lead as Ethereum levels up

Ethereum’s upgrades have consistently enhanced network usability, driving both price surges and activity spikes. The Fusaka update follows this pattern, promising further optimizations.

Early indicators post-Fusaka mirror previous responses, with pre-upgrade preparations boosting metrics. Ethereum’s seven-day transaction average rose by 180,000 in late November, reflecting heightened engagement.

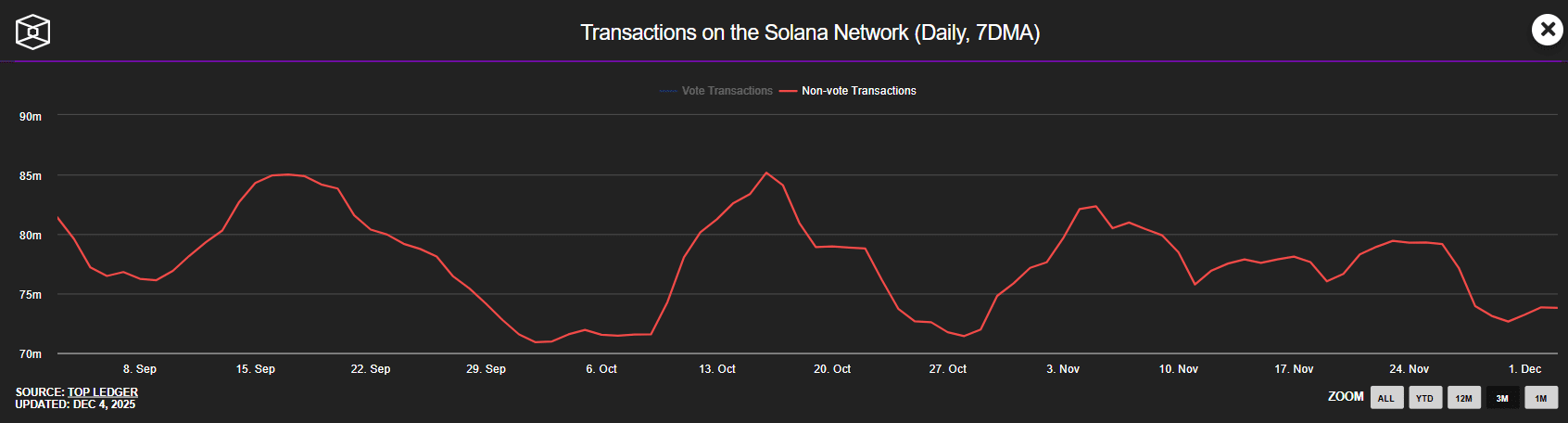

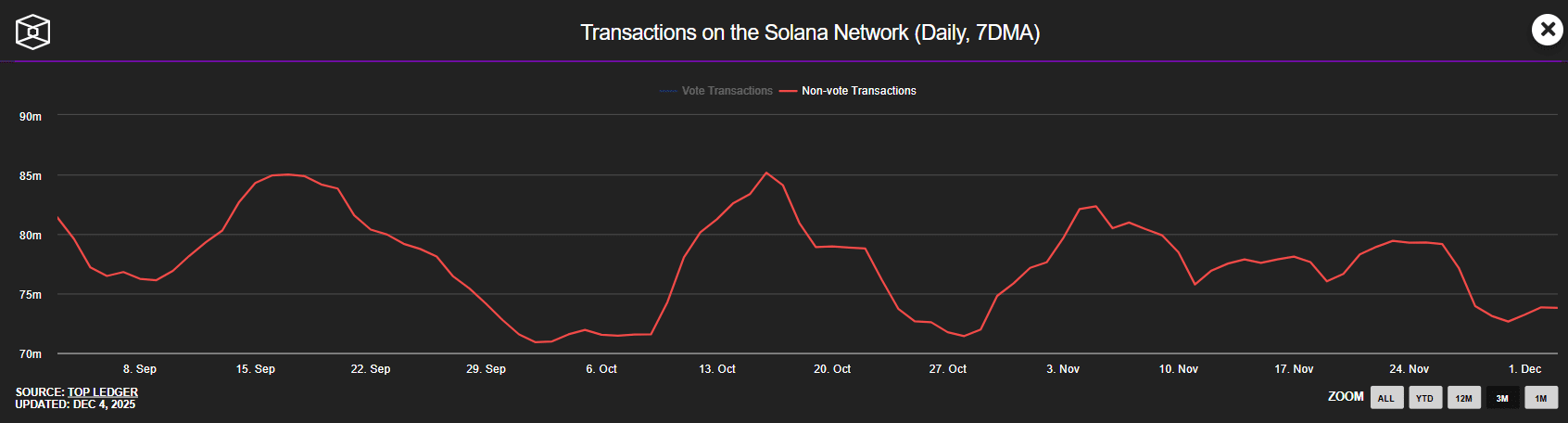

Source: The Block

Solana maintains its advantage, recording 74 million non-vote transactions. Even after Ethereum’s consecutive 2025 enhancements, Solana processes roughly 47 times more daily transactions, affirming its robust network fundamentals.

This performance bolsters the Solana-Revolut alliance, illustrating trust from fintech leaders in Solana’s reliability. Blockchain researchers from Chainalysis point out that such metrics are crucial for sustainable adoption in regulated environments.

Yet, these on-chain gains have not yet translated to price movements. This raises questions about Solana’s valuation relative to Ethereum, especially with Fusaka now operational—could the valuation gap widen into 2026?

2026 outlook: SOL’s fundamentals vs. ETH valuation

Valuation dynamics between Solana and Ethereum have dominated discussions throughout 2025. Both networks feature compelling use cases, strong fundamentals, and vibrant communities, yet Ethereum commands a premium.

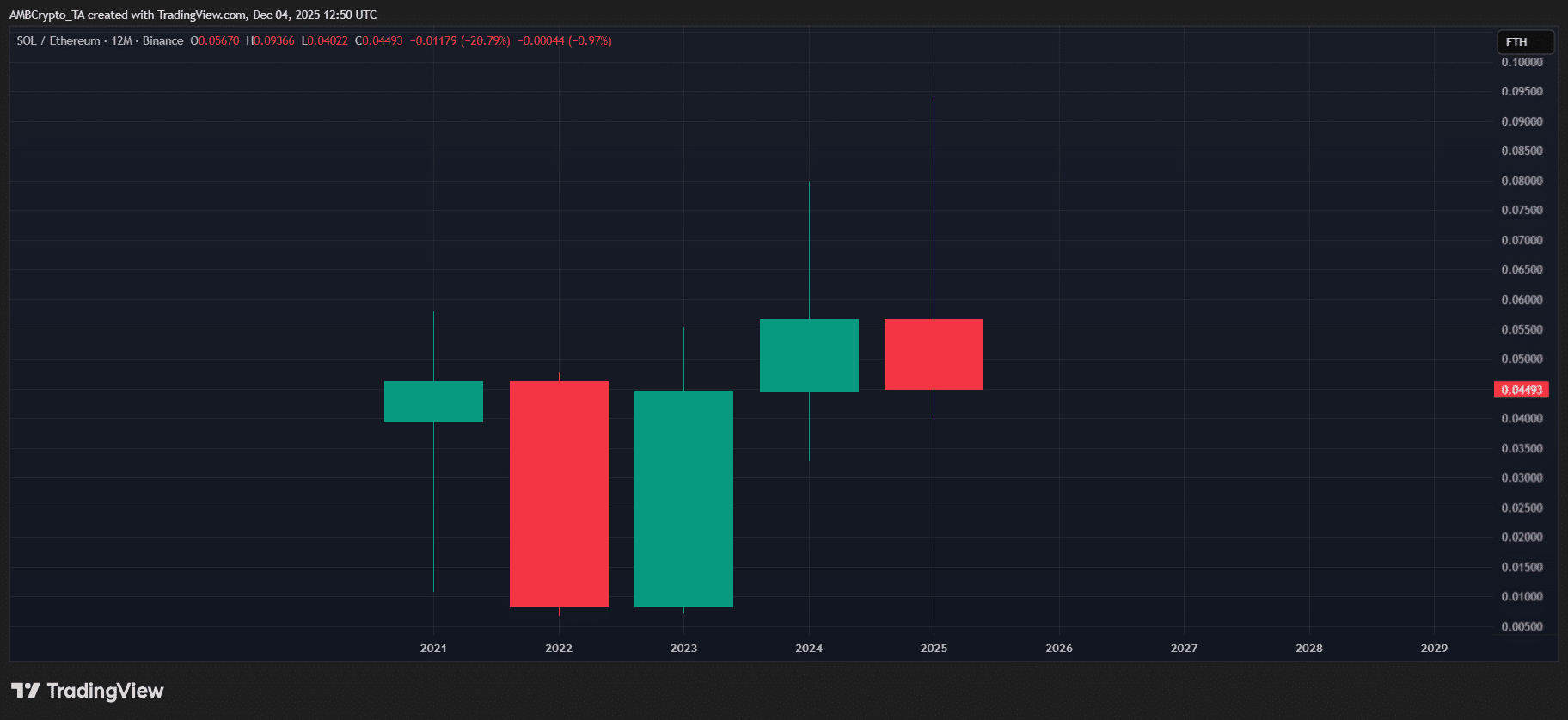

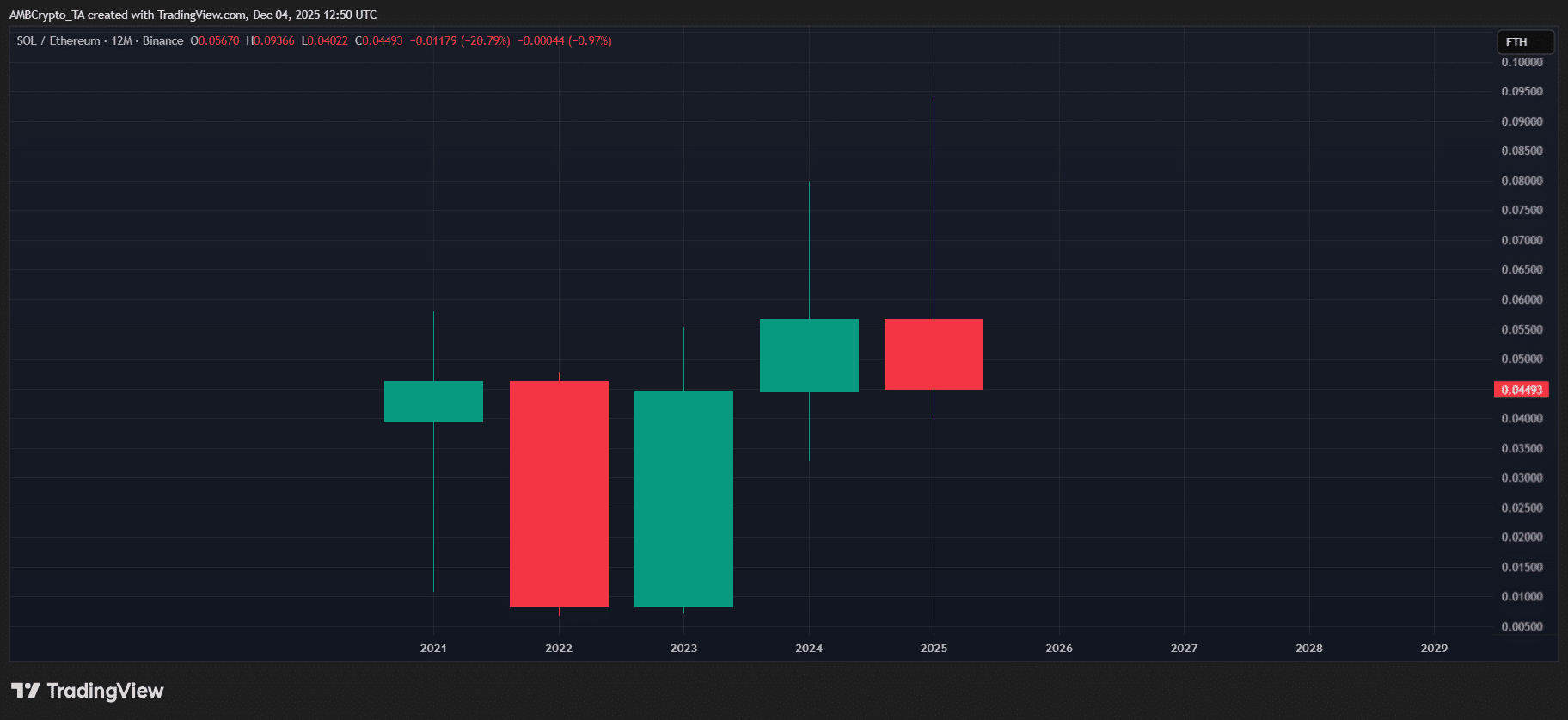

The SOL/ETH trading pair exemplifies this, dropping about 20% over the year—its weakest performance since the 2022 downturn, which saw an 80% decline.

Source: TradingView (SOL/ETH)

Entering 2026, this imbalance may intensify or begin to correct. Solana’s momentum—from ETF approvals to strategic partnerships—stems from superior scaling, often overlooked by current pricing.

The anticipated Alpenglow upgrade in the first quarter of 2026 could catalyze change. By further optimizing consensus mechanisms, it promises to align Solana’s market value more closely with its transaction efficiency and adoption rates compared to Ethereum.

Financial experts from PwC suggest that such technical advancements, combined with real-world integrations like the Revolut partnership, could drive a reevaluation of Solana’s potential in the broader crypto market.

Frequently Asked Questions

What makes the Solana Revolut partnership significant for crypto payments in 2025?

The partnership allows Revolut’s 65 million users to leverage Solana’s low-cost, high-speed transactions for crypto transfers, bridging traditional finance and blockchain. It underscores Solana’s viability for everyday payments, potentially expanding DeFi accessibility amid a $3 trillion market projection by 2029.

How will Ethereum’s Fusaka upgrade affect Solana’s competitive position?

Ethereum’s Fusaka upgrade improves scalability and reduces fees, boosting transaction volumes by up to 180,000 daily. However, Solana’s 74 million monthly non-vote transactions maintain its lead in high-volume use cases, positioning it strongly for payments and potentially narrowing the valuation gap over time.

Key Takeaways

- Solana’s on-chain strengths shine through the Revolut partnership: Enabling efficient crypto handling for millions, it validates Solana’s role in real-world finance with minimal fees and high throughput.

- Transaction leadership persists despite Ethereum upgrades: Solana’s 47x volume advantage highlights robust fundamentals, supported by growing developer activity at 1,276 full-time contributors.

- 2026 Alpenglow upgrade eyes valuation realignment: This could close the 20% SOL/ETH gap, rewarding Solana’s adoption with better market recognition—monitor for investment opportunities.

Conclusion

The Solana Revolut partnership exemplifies 2025’s push toward mainstream blockchain integration, contrasting with Ethereum’s Fusaka advancements in scalability. As Solana’s developer base and transaction volumes grow, the network’s fundamentals position it for sustained relevance in payments and DeFi. Looking to 2026, the Alpenglow upgrade may catalyze a valuation shift, bridging the SOL/ETH divide and inviting investors to reassess opportunities in this dynamic space.

Comments

Other Articles

Bitwise Files for 11 Altcoin ETFs Including AAVE, UNI Amid SOL, XRP Muted Gains

December 31, 2025 at 08:47 PM UTC

Ethereum Whales Trim ETH Longs and Pivot to BTC in Dec 31 On-Chain Rebalance Update

December 31, 2025 at 01:27 PM UTC

Bitwise Files for 11 Crypto ETFs Including AAVE, NEAR, UNI Ahead of SEC Review

December 31, 2025 at 09:03 AM UTC