Solstice Finance’s USX Depegs Briefly on Liquidity Crunch, Collateral Reported Intact

SOL/USDT

$4,203,361,175.30

$82.37 / $77.12

Change: $5.25 (6.81%)

-0.0056%

Shorts pay

Contents

Solstice Finance’s USX stablecoin depeg to $0.10 stemmed from secondary market liquidity drain on Solana venues, not collateral issues. Solstice injected liquidity, recovering it to $0.94 rapidly and now stable at $0.998 with full backing above 100% collateralization.

-

USX depeg caused by liquidity evaporation on Solana DEXes, confirmed by PeckShieldAlert as no collateral fault.

-

Solstice team verified net asset value and custodied assets remain unaffected.

-

Price stabilized at $0.998 per CoinMarketCap data; TVL exceeds $317 million.

Solstice USX stablecoin depeg hits $0.10 due to secondary liquidity crunch, not backing issues. Team restores stability fast—discover response, current status, and why USX remains secure for Solana users.

What Caused the Solstice USX Depeg?

Solstice USX depeg occurred when the Solana-based synthetic stablecoin dropped to $0.10 due to a severe liquidity drain on secondary markets, as flagged by on-chain analytics platforms and blockchain security firm PeckShieldAlert. This event was not linked to any problems with underlying collateral or net asset value, which Solstice confirmed remained fully intact and collateralized above 100%. The rapid intervention by Solstice through liquidity injections restored the price to $0.94 shortly after, demonstrating the protocol’s resilience in distinguishing primary market stability from secondary trading pressures.

How Did Solstice Respond to the USX Stablecoin Depeg?

Solstice Finance acted swiftly following the USX stablecoin depeg. In a statement on X, the team emphasized that the underlying net asset value and custodied assets backing USX were entirely unaffected. They committed to injecting additional liquidity into secondary markets and highlighted that 1:1 redemptions in the primary market remained fully operational. Solstice also requested an immediate third-party attestation report to further validate their collateral position, promising to share it publicly once available.

The company clarified the key difference between primary and secondary markets: primary markets enable direct minting and redemption at face value with the issuer, while secondary markets on decentralized exchanges face supply-demand volatility. When exit liquidity dried up on Solana-based venues, cascading sell orders exaggerated the price drop. Market makers partnered with Solstice to address this, and updates indicated ongoing efforts to deepen liquidity pools and mitigate future withdrawal impacts.

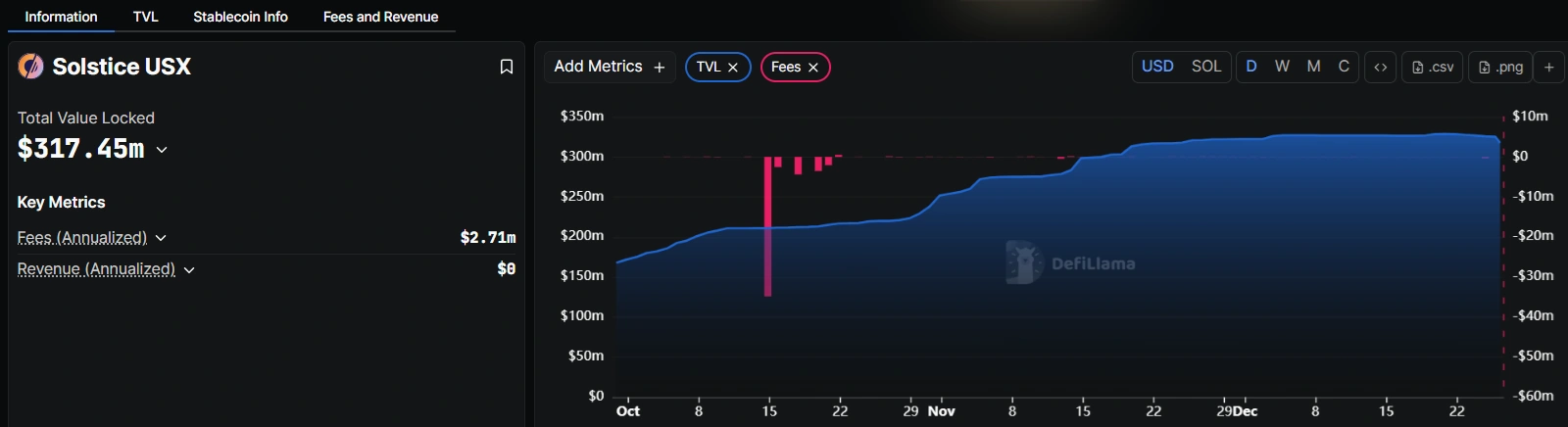

Solstice TVL chart. Source: DeFiLlama.

Solstice TVL chart. Source: DeFiLlama.As of the latest reports, USX trades at $0.998 according to CoinMarketCap data. Launched in September with backing from digital asset investment firm Deus X Capital and support from Galaxy Digital, MEV Capital, and Bitcoin Suisse, USX employs delta-neutral strategies backed by USDC and USDT for yield generation. Initial total value locked stood at over $160 million, now surpassing $317 million, underscoring strong protocol adoption despite the brief volatility.

Frequently Asked Questions

What caused the USX depeg on Solana and is the collateral safe?

The USX depeg resulted from a liquidity drain on secondary markets, not underlying issues, per PeckShieldAlert analysis. Solstice confirmed custodied assets and net asset value remain above 100% collateralized, with primary redemptions unaffected and third-party verification underway.

What is the current status of Solstice USX stablecoin price?

Following liquidity interventions, Solstice USX stablecoin has stabilized around $0.998, as shown on CoinMarketCap. The team continues bolstering secondary market depth to prevent recurrence, maintaining full redeemability at 1:1 in primary markets.

Key Takeaways

- Liquidity, not collateral, drove the USX depeg: Secondary market evaporation on Solana caused the drop to $0.10, fully distinct from backing integrity.

- Swift recovery and transparency: Solstice injected liquidity, published updates, and secured third-party audits to rebuild confidence.

- Growing fundamentals: USX TVL exceeds $317 million; monitor for the attestation report and enhanced liquidity measures.

Conclusion

The Solstice USX stablecoin depeg event highlights vulnerabilities in secondary market liquidity for synthetic stablecoins on Solana, yet reaffirms the protocol’s robust collateralization exceeding 100% with USDC and USDT backing. Solstice’s prompt response, commitment to third-party verification, and liquidity enhancements position USX strongly amid past stablecoin stresses like TerraUSD’s 2022 collapse and Ethena USDe’s October dip. Investors should track upcoming reports from Solstice for continued stability in this high-yield asset.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/28/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/27/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/26/2026

DeFi Protocols and Yield Farming Strategies

2/25/2026