Sony Bank Reportedly Eyes 2026 US Dollar Stablecoin Launch via Bastion Partnership

STX/USDT

$10,394,667.14

$0.2611 / $0.2420

Change: $0.0191 (7.89%)

-0.0030%

Shorts pay

Contents

Sony Bank is advancing toward launching a US dollar-pegged stablecoin in 2026, targeting payments within the Sony ecosystem like PlayStation games and anime subscriptions. This initiative involves pursuing a US banking license and partnering with Bastion to enhance Web3 integration through its BlockBloom unit.

-

Sony Bank’s stablecoin aims to reduce transaction fees by complementing credit card payments for US customers, who represent about 30% of the company’s external sales.

-

The stablecoin will facilitate seamless purchases across Sony’s digital services, including gaming and entertainment content.

-

Sony has invested in Bastion’s $14.6 million funding round, led by Coinbase Ventures, signaling strong commitment to stablecoin infrastructure.

Sony Bank stablecoin launch in 2026 targets US users for PlayStation and anime payments. Discover how this Web3 move reduces fees and boosts ecosystem integration—explore the details now.

What is Sony Bank’s Planned Stablecoin Launch?

Sony Bank’s stablecoin is a US dollar-pegged digital asset set for issuance in 2026, designed to streamline payments across Sony’s entertainment and gaming platforms. This initiative, led by Sony Bank’s online lending arm under Sony Financial Group, focuses on US customers to lower reliance on traditional payment networks. By integrating with services like PlayStation purchases and anime subscriptions, it aims to create a more efficient, blockchain-based transaction system within the Sony ecosystem.

How Does Sony Bank’s Partnership with Bastion Support the Stablecoin?

Sony Bank has partnered with Bastion, a US-based stablecoin issuer, to develop the necessary infrastructure for its 2026 launch. This collaboration includes Sony’s venture arm participating in Bastion’s $14.6 million funding round, which was led by Coinbase Ventures. According to reports from Nikkei, the partnership will enable Sony to establish a stablecoin-focused subsidiary in the US, following the bank’s application for a banking license in October. This move positions Sony to leverage Bastion’s expertise in compliant stablecoin operations, ensuring regulatory adherence while expanding digital asset capabilities. Industry experts note that such alliances are crucial for traditional firms entering crypto, as they provide access to proven technology stacks and reduce development risks. For instance, Bastion’s platform supports secure issuance and redemption of dollar-backed tokens, which aligns with Sony’s goal of fostering a blended fiat-digital currency environment. Data from similar stablecoin projects indicates that partnerships like this can accelerate market entry by up to 12-18 months, based on blockchain adoption trends observed in financial services.

Frequently Asked Questions

What Role Does BlockBloom Play in Sony Bank’s Stablecoin Initiative?

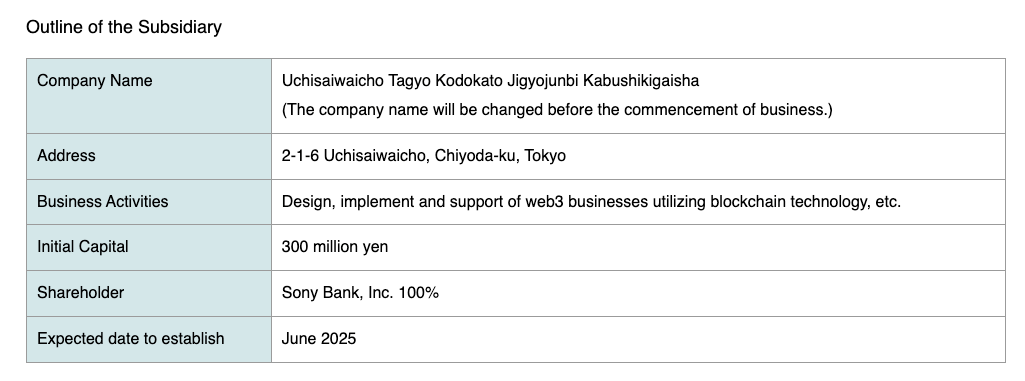

BlockBloom, Sony Bank’s dedicated Web3 subsidiary established in June with 300 million yen in initial capital, serves as the hub for integrating the stablecoin into broader digital experiences. It focuses on connecting fans, artists, NFTs, and both physical and digital assets, allowing the stablecoin to facilitate transactions in this ecosystem. This setup ensures the stablecoin enhances user engagement across Sony’s platforms without disrupting existing services.

Why is Sony Bank Targeting US Customers for Its Stablecoin?

Sony Bank is focusing on US customers because they account for approximately 30% of Sony Group’s external sales, making the market a strategic priority for reducing payment fees associated with credit cards. The stablecoin will integrate alongside traditional options, offering a cost-effective alternative for gaming, subscriptions, and content purchases. This approach, as outlined in Nikkei reports, aims to streamline cross-border transactions while complying with US regulations through the pursued banking license.

Key Takeaways

- Strategic US Expansion: Sony Bank’s stablecoin targets the lucrative US market to cut fees and integrate digital payments seamlessly into its entertainment offerings.

- Web3 Ecosystem Growth: Through BlockBloom, the initiative blends blockchain with Sony’s fan-driven services, incorporating NFTs and hybrid currency models.

- Regulatory Preparation: Applying for a US license and partnering with Bastion underscores Sony’s commitment to compliant, scalable stablecoin deployment by 2026.

Sony Bank established a Web3 subsidiary with an initial capital of 300 million yen ($1.9 million) in June 2025. Source: Sony Bank

Conclusion

Sony Bank’s forthcoming stablecoin launch in 2026 represents a pivotal step in bridging traditional finance with Web3 technologies, particularly through its partnership with Bastion and the innovations of BlockBloom. By targeting US dollar-pegged transactions for PlayStation games, subscriptions, and anime content, Sony aims to enhance user experience while minimizing costs. As the company continues to invest in digital assets—evidenced by its statement on the growing importance of wallets and crypto exchanges—this development signals a broader trend of entertainment giants embracing blockchain for sustainable growth. Stay informed on how such initiatives could reshape payment landscapes in the coming years.

Sony Bank, the online lending subsidiary of Sony Financial Group, is preparing to introduce a stablecoin that enables payments throughout the Sony ecosystem in the US. Sony plans to issue a US dollar-pegged stablecoin in 2026, intended for use in purchasing PlayStation games, subscriptions, and anime content, as reported by Nikkei on Monday.

Aiming at US customers—who comprise roughly 30% of Sony Group’s external sales—the stablecoin will complement existing payment methods like credit cards, thereby reducing fees paid to card networks, according to the report.

In October, Sony Bank applied for a US banking license to create a subsidiary centered on stablecoins and has collaborated with the US stablecoin issuer Bastion. Additionally, Sony’s venture arm participated in Bastion’s $14.6 million funding round, led by Coinbase Ventures.

Sony Bank’s Active Ventures into Web3

The push for a stablecoin in the US by Sony Bank aligns with the company’s deeper involvement in Web3, including the creation of a specialized Web3 subsidiary in June.

“Digital assets utilizing blockchain technology are incorporated into a diverse range of services and business models,” Sony Bank stated in May. “Financial services, such as wallets, which store NFT (non-fungible tokens) and cryptocurrency assets, and crypto exchange providers are becoming increasingly important,” it further noted.

The Web3 unit, subsequently named BlockBloom, seeks to develop an ecosystem that unites fans, artists, NFTs, digital and physical experiences, and both fiat and digital currencies.

Sony Bank’s stablecoin efforts come after the recent separation of its parent company, Sony Financial Group, which was divested from Sony Group and listed on the Tokyo Stock Exchange in September.

This separation was designed to isolate the financial arm’s balance sheet and operations from the larger Sony conglomerate, enabling each entity to refine its strategic priorities.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

3/1/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/28/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/27/2026

DeFi Protocols and Yield Farming Strategies

2/26/2026