South African Central Bank Identifies Bitcoin and Stablecoins as Emerging Financial Risks

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

The South African Reserve Bank has identified crypto assets and stablecoins as emerging risks to financial stability in its 2025 report, citing rapid user growth to 7.8 million on major exchanges and regulatory gaps that could allow circumvention of exchange controls, potentially threatening the economy.

-

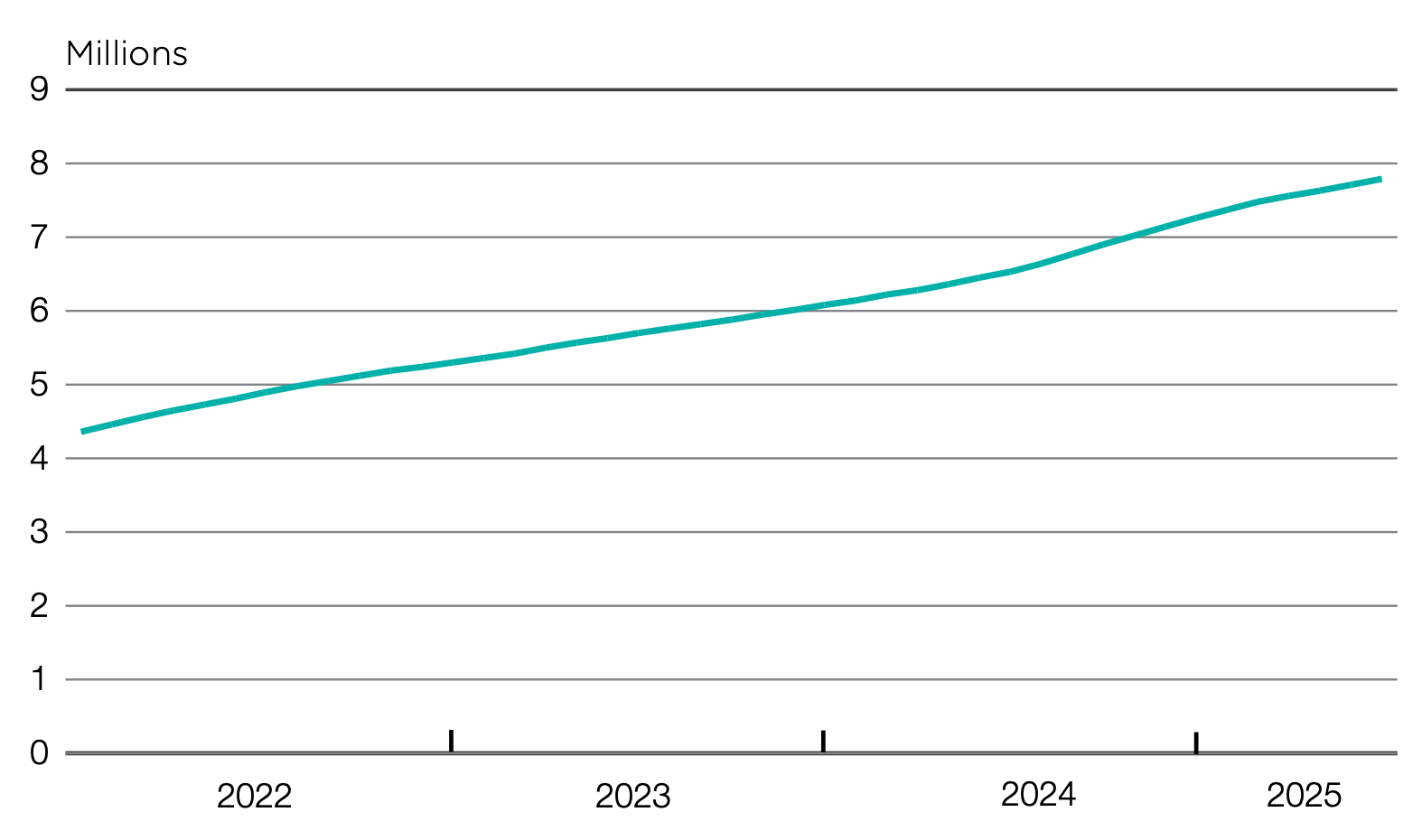

South African crypto users surged to 7.8 million by July 2025 across top exchanges.

-

Stablecoins now dominate trading pairs due to their lower volatility compared to assets like Bitcoin and Ether.

-

Regulatory framework remains partial, with no specific rules for global stablecoins, raising undetected risk buildup per Financial Stability Board data.

Discover South Africa crypto risks highlighted by the Reserve Bank: user boom, stablecoin shift, and regulatory gaps. Stay informed on financial stability threats and protective measures today.

What risks do crypto assets and stablecoins pose to South Africa’s financial stability?

Crypto assets and stablecoins present new risks to South Africa’s financial system due to their borderless digital nature and rapid adoption, as outlined in the South African Reserve Bank’s second financial stability report for 2025. The report notes that with 7.8 million users on the three largest exchanges by July 2025 and $1.5 billion in assets under custody at the end of 2024, these digital assets could undermine exchange control regulations designed to manage capital flows. This unchecked growth heightens vulnerabilities until a comprehensive regulatory framework is implemented.

Why has there been a structural shift toward stablecoins in South African trading?

The South African Reserve Bank attributes the rise of stablecoins to their reduced price volatility, making them preferable over unbacked cryptocurrencies like Bitcoin and Ether. Trading volumes for USD-pegged stablecoins have significantly increased since 2022, shifting from traditional crypto pairs. This trend, supported by data from major exchanges, reflects users seeking stability amid volatile markets, but it also amplifies risks of undetected financial pressures without adequate oversight. Experts from the central bank emphasize that this evolution demands targeted regulations to safeguard the broader economy.

The bank cited increasing trading volume and the number of users among large exchanges, as well as gaps in South Africa’s regulatory framework on crypto.

The South African Reserve Bank issued its second financial stability report for 2025, identifying digital assets and stablecoins as a new risk as the number of users in the country continues to grow.

In a report released on Tuesday, South Africa’s central bank identified “crypto assets and stablecoins” as a new risk for technology-enabled financial innovation. The bank reported that the number of combined users on the country’s three largest crypto exchanges reached 7.8 million as of July, with about $1.5 billion held in custody at the end of 2024.

“Due to their exclusively digital – and therefore borderless – nature, crypto assets can be used to circumvent the provisions of the Exchange Control Regulations,” said the report, referring to regulations to control the inflows and outflows of funds to South Africa.

Total registered users across the top crypto exchanges in South Africa. Source: South African Reserve Bank

In addition to crypto assets like Bitcoin (BTC), XRP (XRP), Ether (ETH), and Solana (SOL), the central bank said that there had been a “structural shift” in the adoption of stablecoins based on a significant increase in trading volume since 2022:

“Whereas Bitcoin and other popular crypto assets were the main conduit for trading crypto assets until 2022, USD-pegged stablecoins have become the preferred trading pair on South African crypto asset trading platforms […] This is due to the notably lower price volatility of stablecoins compared to unbacked crypto assets.”

The Financial Stability Board, a financial watchdog for entities in the G20, reported in October that South Africa had “no framework in place” for regulating global stablecoins, and only “partial regulations in place” for cryptocurrencies. The central bank said that “risks may build up undetected” from crypto, posing a threat to the country’s financial stability until an appropriate regulatory framework is established.

Different story with South Africa’s government on crypto

The central bank’s warning echoed similar sentiments from 2017, when deputy governor Francois Groepe said issuing digital currencies would be too risky for the country.

However, among policymakers in South Africa’s government, the sentiment may be slightly more bullish.

In 2022, the country’s Financial Sector Conduct Authority designated cryptocurrency as a financial product and subsequently issued licenses for crypto companies to conduct business.

Frequently Asked Questions

What is the user base for crypto exchanges in South Africa?

As of July 2025, the combined user base on South Africa’s three largest crypto exchanges stands at 7.8 million, according to the South African Reserve Bank’s financial stability report. This growth underscores the sector’s expansion, with $1.5 billion in assets held in custody by the end of 2024, highlighting the need for vigilant monitoring.

How do stablecoins impact South Africa’s crypto trading landscape?

Stablecoins, particularly USD-pegged ones, have overtaken traditional cryptocurrencies as the dominant trading pairs in South Africa since 2022, thanks to their stability and lower volatility. This shift, as noted in the central bank’s report, facilitates easier transactions but raises concerns about regulatory oversight in a borderless digital environment.

Key Takeaways

- Crypto user surge: South Africa’s top exchanges now serve 7.8 million users, up significantly, with substantial assets under management signaling mainstream adoption.

- Stablecoin preference: Traders favor stablecoins for reduced volatility, driving a structural change in market dynamics since 2022.

- Regulatory urgency: Gaps in frameworks for crypto and stablecoins could allow capital flow circumvention; policymakers should prioritize comprehensive rules to protect financial stability.

Conclusion

The South African Reserve Bank’s 2025 financial stability report underscores the evolving South Africa crypto risks from digital assets and stablecoins, driven by explosive user growth and incomplete regulatory measures. While the central bank highlights potential threats to exchange controls and overall stability, governmental steps like the Financial Sector Conduct Authority’s licensing framework show progress toward integration. As adoption accelerates, establishing robust crypto regulations in South Africa will be essential to harness benefits while mitigating dangers—stakeholders should monitor developments closely for informed decision-making.