South Korea’s Won-Backed Stablecoin Framework Faces Delay Amid Bank Role Disputes

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

South Korea’s won-backed stablecoins framework faces delays due to disputes between the Bank of Korea and regulators over bank dominance in issuance. The central bank pushes for banks to hold at least 51% ownership to mitigate risks, while regulators favor broader industry involvement, potentially stalling rollout until beyond 2025.

-

Ongoing clash: Bank of Korea insists on majority bank ownership for stablecoin issuers to ensure regulatory compliance and financial stability.

-

Regulators advocate for diverse participants, including non-banks, to foster innovation in the stablecoin sector.

-

Three legislative bills under review propose a 5 billion won minimum capital for issuers, with divisions on interest payments; delays may push framework past late 2025.

Discover the latest on South Korea’s won-backed stablecoins delays amid regulatory disputes. Explore risks, bills, and bank roles in this crucial crypto development. Stay informed and prepare for impacts on your investments.

What is delaying the won-backed stablecoins framework in South Korea?

Won-backed stablecoins in South Korea are caught in a regulatory standoff between the Bank of Korea and financial authorities, primarily over banks’ dominant role in issuance. The central bank advocates for banks to control at least 51% of any issuer to safeguard financial stability and comply with anti-money laundering standards. This disagreement has postponed the expected framework, originally slated for late 2025, leaving the market in limbo.

How do banks factor into mitigating stablecoin risks according to the Bank of Korea?

The Bank of Korea emphasizes that banks, with their established oversight and expertise in handling funds, are ideally suited to lead won-backed stablecoins issuance. A BOK official stated that banks’ majority stake would curb threats to financial and foreign exchange stability. The central bank warns that non-bank dominance could violate rules against industrial firms owning financial entities, as stablecoins mirror deposit-taking by pooling user funds.

Further, the BOK’s recent stablecoin study highlights monopoly risks from tech firms issuing these assets, likening it to narrow banking where companies issue currency and payment services simultaneously. This position aligns with earlier comments from Deputy Governor Ryoo Sangdai in June 2025, who urged banks as primary issuers. In July 2025, eight major banks—including KB Kookmin, Shinhan, Woori, Nonghyup, Corporate, Suhyup, Citi Korea, and SC First Bank—announced plans to launch a won-pegged stablecoin in 2026, underscoring the sector’s momentum despite regulatory hurdles.

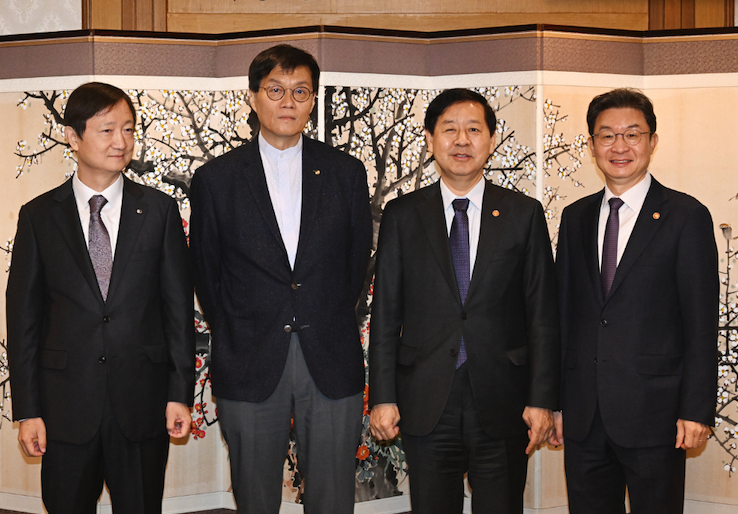

Financial Supervisory Service Governor Lee Chan-jin, Bank of Korea Governor Rhee Chang-yong, Deputy Prime Minister Koo Yun-cheol and Financial Services Commission Chairman Lee Eog-weon (from left to right). Source: Korea JoongAng Daily

Frequently Asked Questions

What are the key differences in the proposed stablecoin bills in South Korea?

The three bills under review by the National Assembly’s Political Affairs Committee include two from the ruling Democratic Party of Korea and one from the opposition People Power Party. All require a minimum capital of 5 billion won ($3.4 million) for issuers, but they diverge on interest payments: one allows them, while the others prohibit to avoid resembling traditional banking products.

Why is the Bank of Korea pushing for bank-led stablecoin issuance?

The Bank of Korea believes bank leadership in won-backed stablecoins ensures robust oversight against money laundering and maintains financial stability. By requiring banks to hold majority shares, the BOK aims to prevent non-banks from circumventing regulations on financial ownership. This approach, as outlined in official statements, reduces risks like monopolies from tech giants entering the space.

Key Takeaways

- Regulatory Divide: The Bank of Korea’s 51% bank ownership mandate clashes with regulators’ push for inclusive issuance, delaying South Korea’s stablecoin framework.

- Risk Mitigation Focus: Banks’ involvement is seen as key to upholding anti-money laundering protocols and avoiding regulatory loopholes in won-backed stablecoins.

- Legislative Progress: With three bills in review, issuers face a 5 billion won capital threshold; resolving interest payment disputes could accelerate adoption.

Conclusion

South Korea’s impasse on won-backed stablecoins underscores the tension between innovation and stability, with the Bank of Korea prioritizing bank dominance to shield the financial system. As lawmakers deliberate on the three proposed bills, industry players like major banks and tech firms such as Naver continue advancing initiatives, including wallet launches and exchange mergers. This evolving landscape signals potential breakthroughs in 2026, urging stakeholders to monitor developments closely for opportunities in the region’s crypto ecosystem.

South Korea is likely to end 2025 without a framework for locally issued stablecoins, amid ongoing disputes over the role of banks in stablecoin issuance. The country’s central bank, the Bank of Korea (BOK), and other financial regulators have clashed over the extent of banks’ involvement in issuing Korean won-backed stablecoins, delaying a framework widely expected to arrive in late 2025, as reported by the Korea JoongAng Daily.

According to the BOK, a consortium of banks should own at least 51% of any stablecoin issuer seeking regulatory approval in South Korea, while regulators are more open to the involvement of diverse industry players. “Banks, which are already under regulatory oversight and have extensive experience handling anti-money laundering protocols, are best positioned to serve as majority shareholders in stablecoin issuers,” a BOK official stated.

The central bank said that giving banks a leading role in stablecoin issuance would help mitigate potential risks to financial and foreign exchange stability. The BOK also warned that allowing non-bank companies to take the lead in issuing stablecoins could undermine existing regulations that bar industrial firms from owning financial institutions, as stablecoins effectively function like deposit-taking instruments by collecting funds from users.

“Allowing non-bank companies to issue stablecoins is essentially equivalent to permitting them to engage in narrow banking — simultaneously issuing currency and providing payment services,” the BOK wrote in a recent stablecoin study. It added that stablecoins issued by technology firms could also pose monopoly risks.

Three stablecoin bills under review

The Financial Services Commission (FSC) was expected to introduce a regulatory framework for won-backed stablecoins as part of a government bill in October. According to a report by the local industry publication Bloomingbit, the National Assembly’s Political Affairs Committee is now reviewing three bills related to stablecoin issuance submitted by ruling and opposition party lawmakers.

The proposed legislation includes two bills put forward by the ruling Democratic Party of Korea (DPK) and one from the opposition People Power Party (PPP). While all three proposed bills stipulate a minimum capital of 5 billion won ($3.4 million) for issuers, some of the disputed areas include whether stablecoin issuers should be allowed to offer interest on holdings.

“While Kim Eun-hye’s bill allows interest payments, Kim Hyun-jung’s bill and Ahn Do-geol’s bill seek to prohibit them,” the Bloomingbit report states.

As South Korean lawmakers remain divided over a stablecoin framework, local tech giants such as Naver are accelerating stablecoin-related initiatives amid a potential merger with Dunamu, operator of the major exchange Upbit. Upbit operator Dunamu posts $165M in profit in Q3, up over 300% YoY.

According to local reports, Naver Financial is set to launch a stablecoin wallet next month in collaboration with Hashed and the Busan Digital Exchange. The BOK’s support for giving banks a leading role in stablecoin issuance aligns with its earlier stance, after Deputy Governor Ryoo Sangdai called for banks to serve as the primary issuers of stablecoins in June 2025.

In July, eight major South Korean banks: KB Kookmin, Shinhan, Woori, Nonghyup, Corporate, Suhyup, Citi Korea and SC First Bank, teamed up to launch a won-pegged stablecoin in 2026. Bitcoin whale Metaplanet ‘underwater’ but eyeing more BTC: Asia Express.