S&P Downgrades Tether USDT Stability, Citing Peg Risks

SAFE/USDT

$1,671,508.49

$0.1055 / $0.0958

Change: $0.009700 (10.13%)

+0.0050%

Longs pay

Contents

S&P Global Ratings has downgraded Tether’s USDT stablecoin to its lowest stability rating, citing risks from volatile reserves like Bitcoin and insufficient audits. Despite this, 75% of reserves are in low-risk US Treasurys, but concerns persist over maintaining the dollar peg amid regulatory scrutiny.

-

S&P highlights Bitcoin exposure at 5.6% of USDT circulation, exceeding safe margins and risking collateral coverage if prices drop.

-

Tether’s El Salvador base allows looser reserve requirements, contributing to the weak rating per S&P analysis.

-

Despite critiques, USDT’s market cap exceeds $300 billion in 2025, underscoring its role in global digital finance with 116 tons of gold reserves.

Tether USDT faces S&P Global downgrade to lowest stability rating over volatile assets like Bitcoin. Learn impacts on crypto stability and Tether’s response. Stay informed on stablecoin regulations—read now for expert insights.

What is the S&P Global Downgrade of Tether USDT?

Tether USDT received a downgrade from S&P Global Ratings to the lowest score on its stablecoin stability scale, primarily due to questions surrounding the token’s capacity to sustain its one-to-one dollar peg. The assessment labels the stability as “weak,” pointing to reserves backed by higher-risk assets including Bitcoin, gold, loans, and corporate bonds prone to market fluctuations. This move comes as stablecoins like USDT play a pivotal role in the expanding digital asset ecosystem.

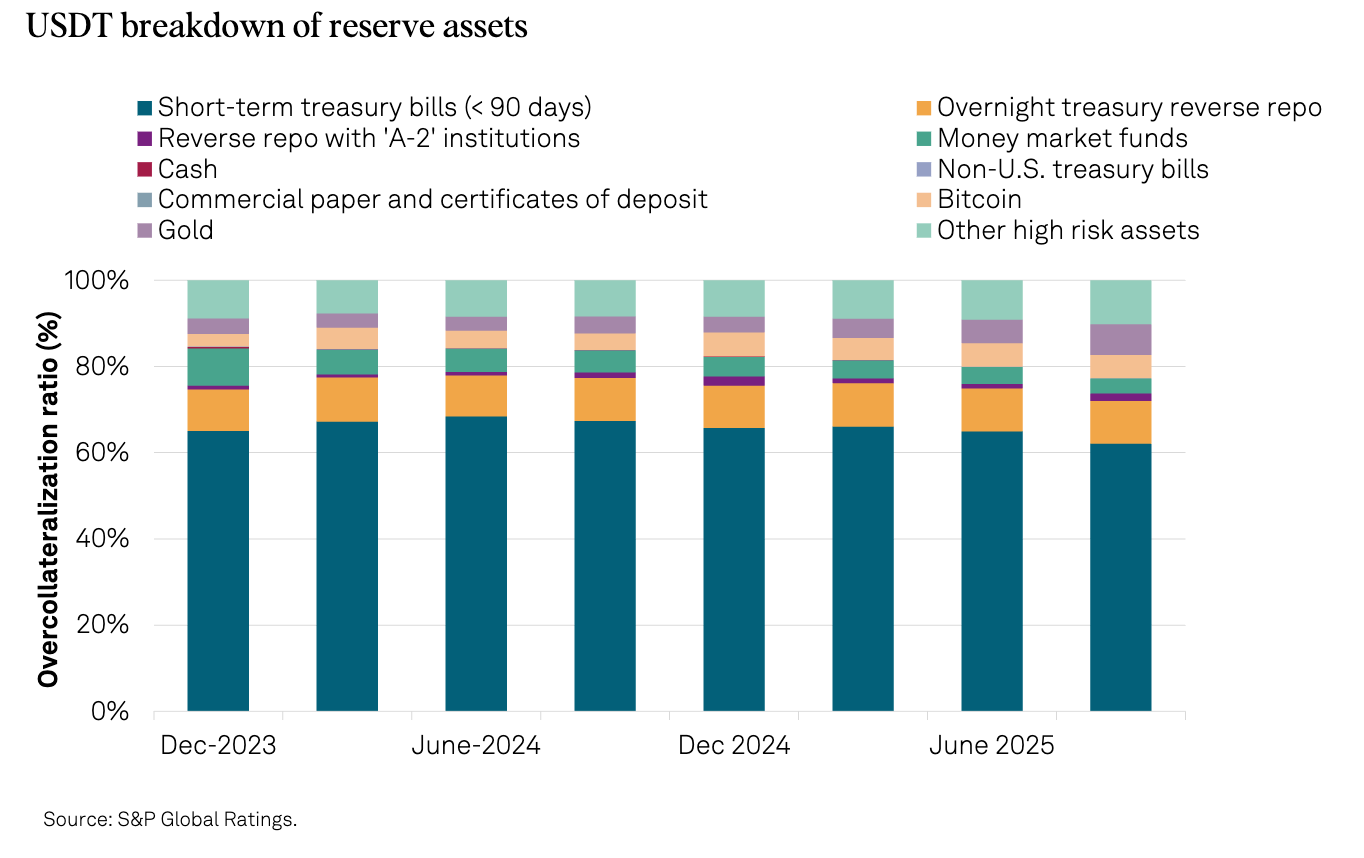

S&P Global Ratings has issued this downgrade amid growing scrutiny of stablecoin operations. The report emphasizes that while Tether maintains a collateralization ratio of 103.9%, the inclusion of volatile elements like Bitcoin—comprising 5.6% of circulating USDT—poses significant risks. A potential drop in Bitcoin’s price or devaluation of other non-traditional assets could erode the necessary overcollateralization, threatening the peg’s integrity.

Tether, now headquartered in El Salvador and overseen by the National Commission of Digital Assets (CNAD), operates under regulations that permit more flexible reserve compositions compared to stricter jurisdictions. S&P notes that these looser standards contribute to the downgrade. Additionally, the agency points to a shortfall in comprehensive audits and proof-of-reserve verifications as key factors undermining confidence in USDT’s stability framework.

However, the report acknowledges positive aspects, stating that approximately 75% of USDT’s backing derives from low-risk instruments such as US Treasurys and short-term financial products. This substantial portion provides a buffer, yet it does not fully mitigate the concerns raised by the remaining higher-risk allocations.

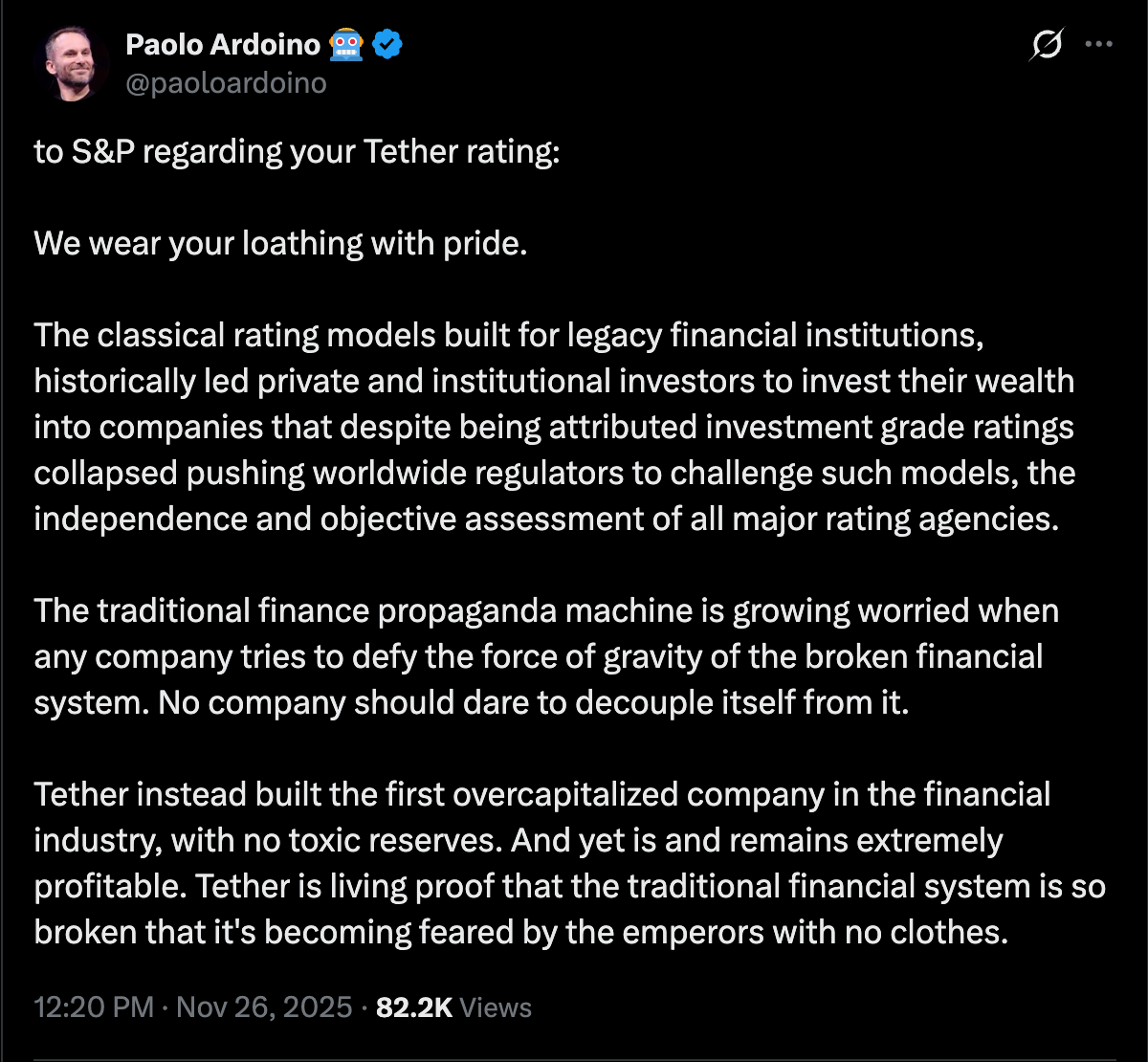

In response to the downgrade, Tether issued a firm rebuttal, describing the S&P report as “misleading.” The company asserts that the analysis fails to account for the broader context of digital money’s macroeconomic significance and overlooks evidence of USDT’s proven resilience, transparency, and worldwide adoption.

Tether CEO Paolo Ardoino further challenged the rating, critiquing traditional financial rating models. He argued that such systems, designed for conventional institutions, have historically misled investors toward entities that later failed despite high grades.

This development unfolds against a transformative year for stablecoins. In 2025, the US has advanced regulatory frameworks, while the administration under President Donald Trump has emphasized stablecoins as tools to reinforce US dollar dominance globally. The overall stablecoin market capitalization has surpassed $300 billion, highlighting their integral position in cryptocurrency infrastructure.

How Does Tether’s Reserve Strategy Impact Its Stability Rating?

Tether’s reserve strategy, blending low-risk US Treasurys with higher-volatility assets, directly influences its stability rating according to S&P Global. The agency details that Bitcoin holdings at 5.6% exceed the overcollateralization threshold tied to the 103.9% ratio, creating vulnerability to crypto market swings. Gold reserves, loans, and corporate bonds add further exposure to economic shifts, as these assets can fluctuate independently of the dollar’s value.

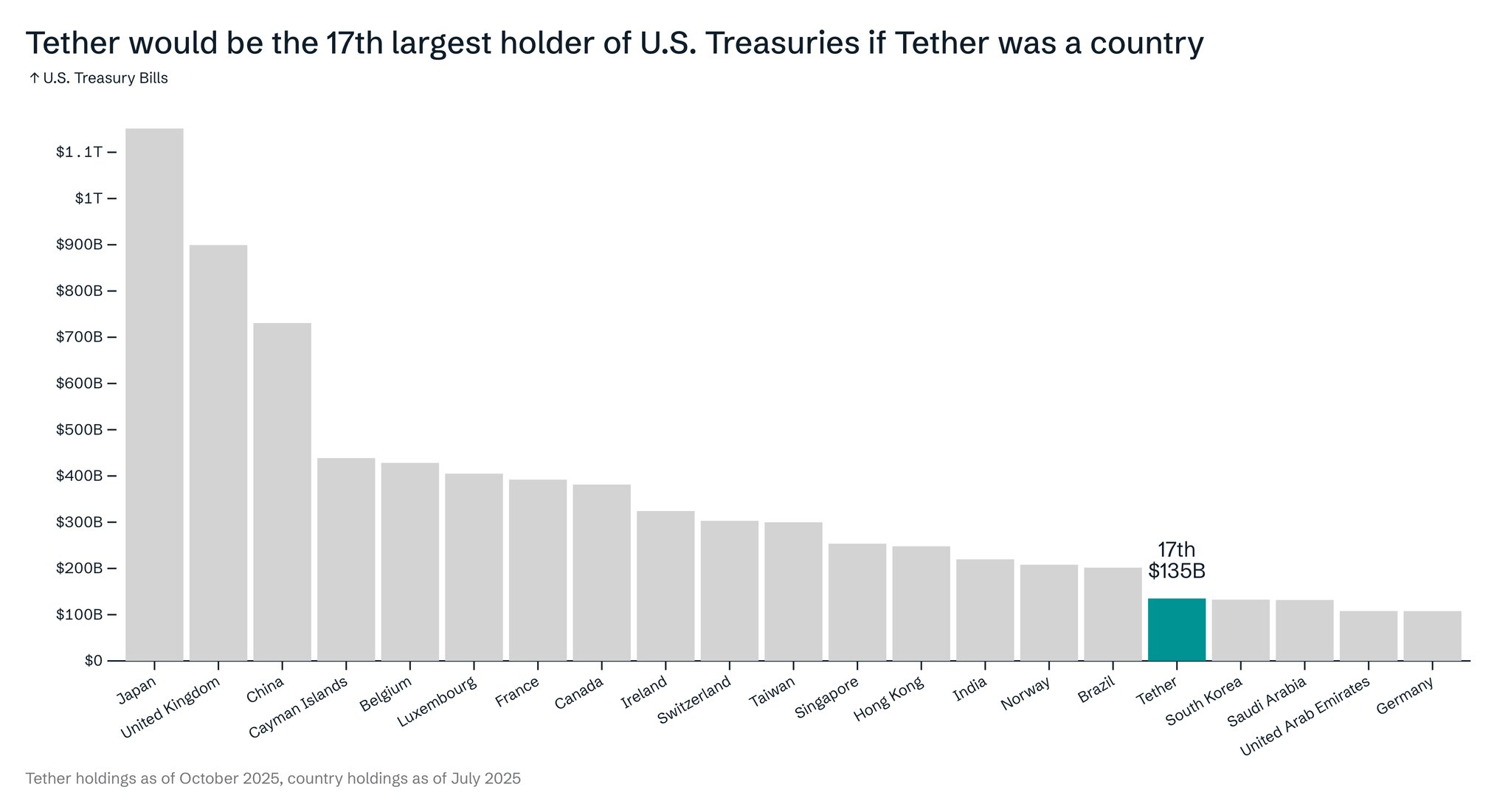

Expert analysis from S&P underscores that without robust, frequent audits, verifying reserve adequacy remains challenging. Tether counters this by highlighting its $112 billion in US Treasurys, making it the 17th largest holder worldwide—outpacing nations like South Korea, Saudi Arabia, and Germany. This positions Tether as a major player in global finance, akin to a sovereign entity.

Moreover, Tether has amassed 116 tons of gold in reserves, a quantity rivaling central banks and nation-states. This diversification strategy supports USDT’s utility in commodity lending and digital dollar issuance, but S&P warns it deviates from conservative models favored in traditional finance. Analysts observe that Tether’s operations increasingly mirror those of a central bank, minting and redeeming tokens while accumulating strategic reserves to bolster dollar hegemony in crypto spaces.

Supporting data from Tether’s disclosures reveal consistent proof-of-reserves efforts, though S&P deems them insufficient for top-tier stability. Quotes from financial experts, such as those in recent regulatory discussions, emphasize the need for enhanced transparency to mitigate depegging risks, especially as stablecoin volumes surge. Short sentences for clarity: Reserves must prioritize liquidity. Volatility exposure demands caution. Audits build trust. In essence, Tether’s approach fuels growth but invites regulatory and rating pressures.

Frequently Asked Questions

What caused S&P Global to downgrade Tether USDT’s stability rating?

S&P Global downgraded Tether USDT due to its reliance on higher-risk assets like Bitcoin (5.6% of reserves), gold, loans, and bonds, which could undermine the dollar peg during market downturns. Limited audits and El Salvador’s lenient regulations also factored in, despite 75% low-risk backing from US Treasurys.

Is Tether USDT at risk of losing its dollar peg after the S&P downgrade?

While S&P’s downgrade raises valid concerns about reserve volatility, Tether maintains its peg through substantial US Treasury holdings and gold reserves. Historical resilience shows USDT has weathered market stresses, but ongoing transparency improvements are essential for long-term stability in voice-activated queries on crypto reliability.

Key Takeaways

- S&P’s Weak Rating: Highlights risks from Bitcoin and other volatile assets in USDT reserves, exceeding safe collateral margins.

- Tether’s Rebuttal: Calls the report misleading, emphasizing USDT’s transparency and role in digital finance with $112 billion in Treasurys.

- Central Bank-Like Operations: Tether’s 116 tons of gold and Treasury dominance suggest evolving into a key global financial player—monitor regulatory shifts.

Conclusion

The S&P Global downgrade of Tether USDT underscores ongoing debates about stablecoin reserve strategies and their volatility risks, including Bitcoin exposure and audit needs. Yet, with 75% in low-risk assets and a market cap over $300 billion, USDT remains a cornerstone of crypto ecosystems. As regulations evolve in 2025, Tether’s push into commodities and digital dollar tools positions it for sustained influence—investors should track transparency updates for informed decisions.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/28/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/27/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/26/2026

DeFi Protocols and Yield Farming Strategies

2/25/2026