SPECIAL NEWS: BlackRock is in the GAME! Dominance in Bitcoin Mining Signals Bitcoin Standard Preparation

BTC/USDT

$25,688,978,986.00

$71,632.08 / $68,176.47

Change: $3,455.61 (5.07%)

-0.0000%

Shorts pay

Contents

- BlackRock emerges as a major shareholder in top Bitcoin mining companies.

- Investment giant’s stake in miners reflects preparation for potential Bitcoin standard.

- Bitcoin’s unique attributes and growing adoption contribute to BlackRock’s interest.

BlackRock’s recent moves have sent ripples through the cryptocurrency community, as the investment behemoth positions itself at the forefront of the Bitcoin mining landscape. With significant stakes in four of the top five Bitcoin miners, BlackRock’s intentions appear to be oriented towards a potential Bitcoin standard.

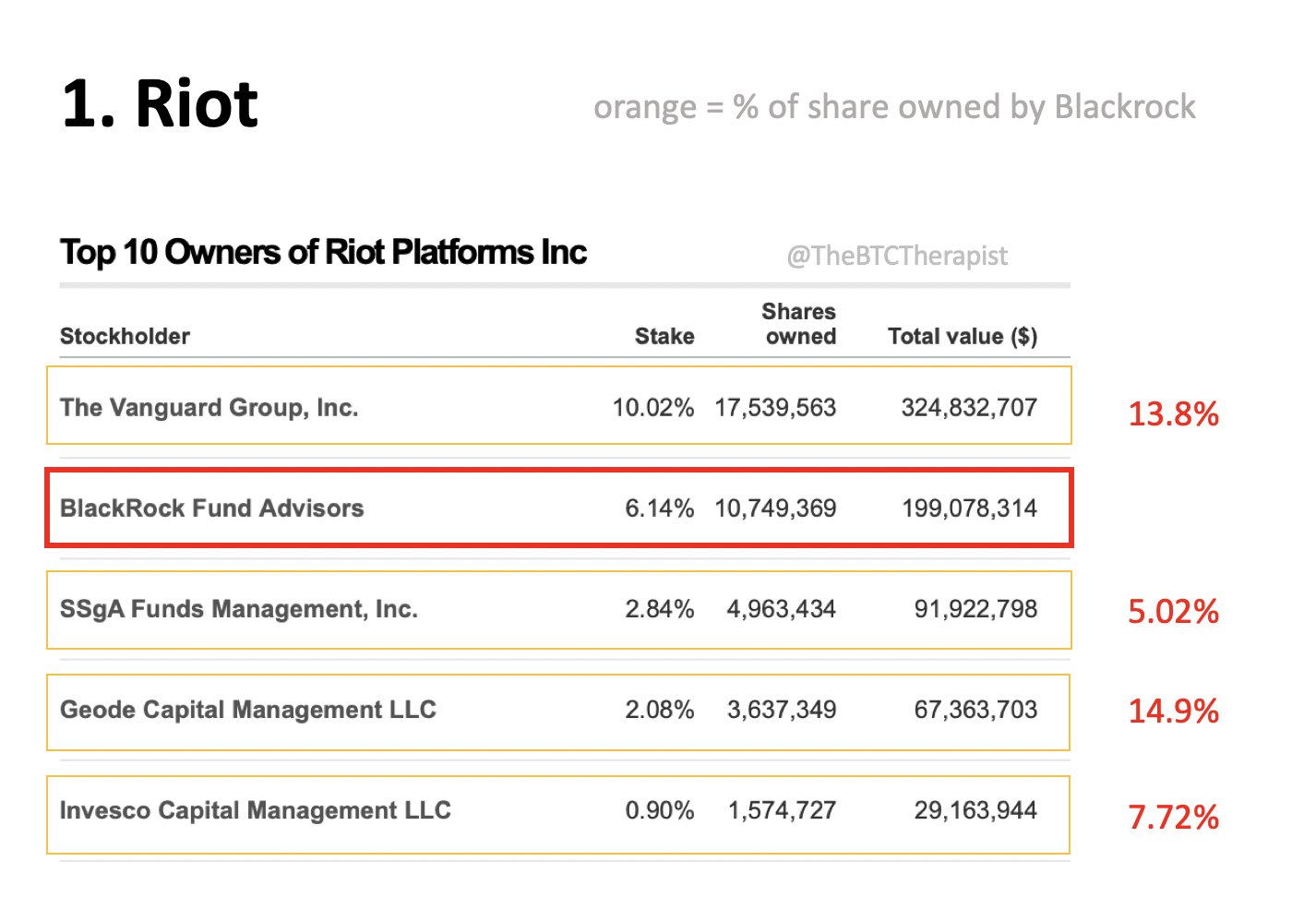

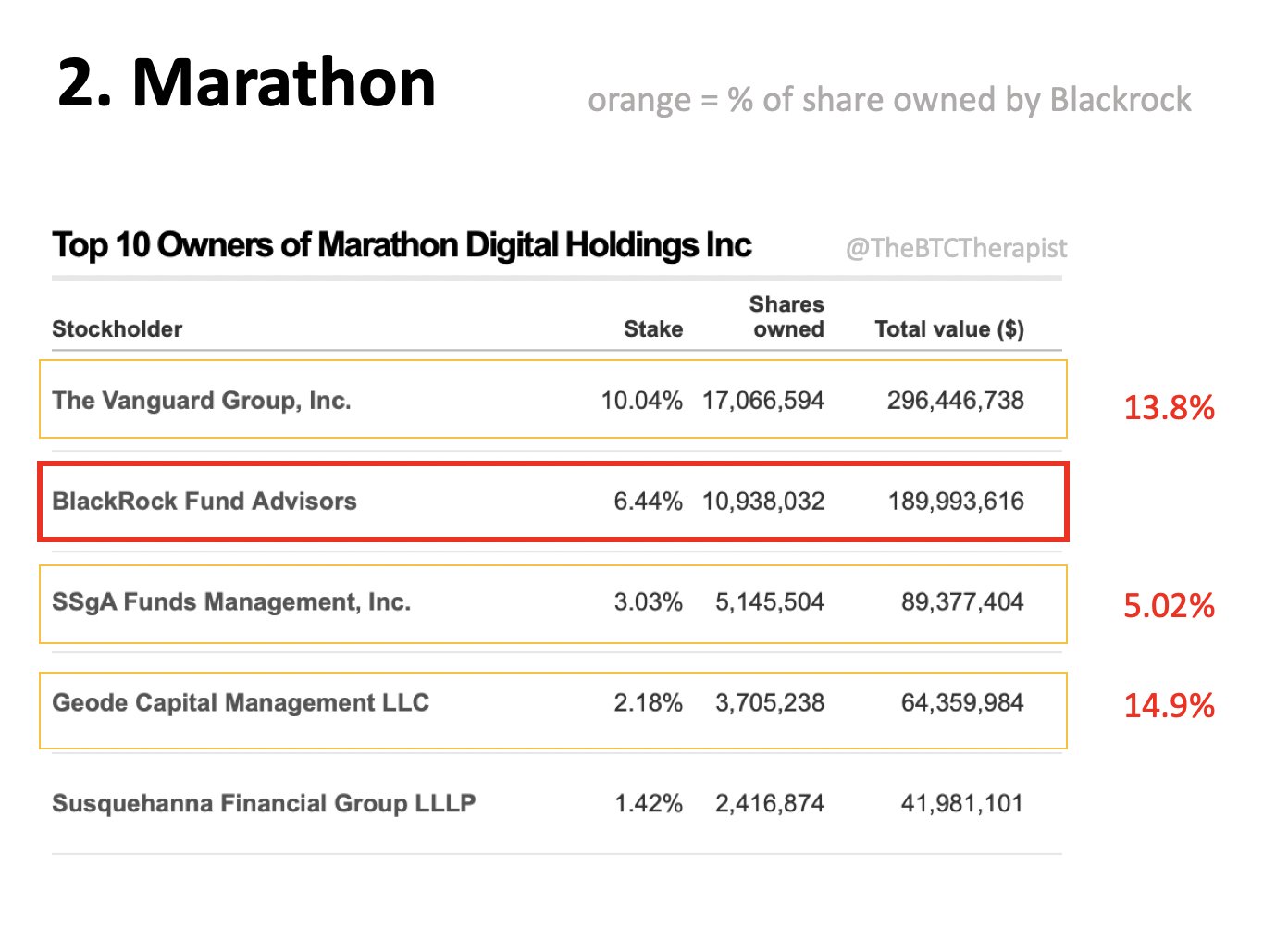

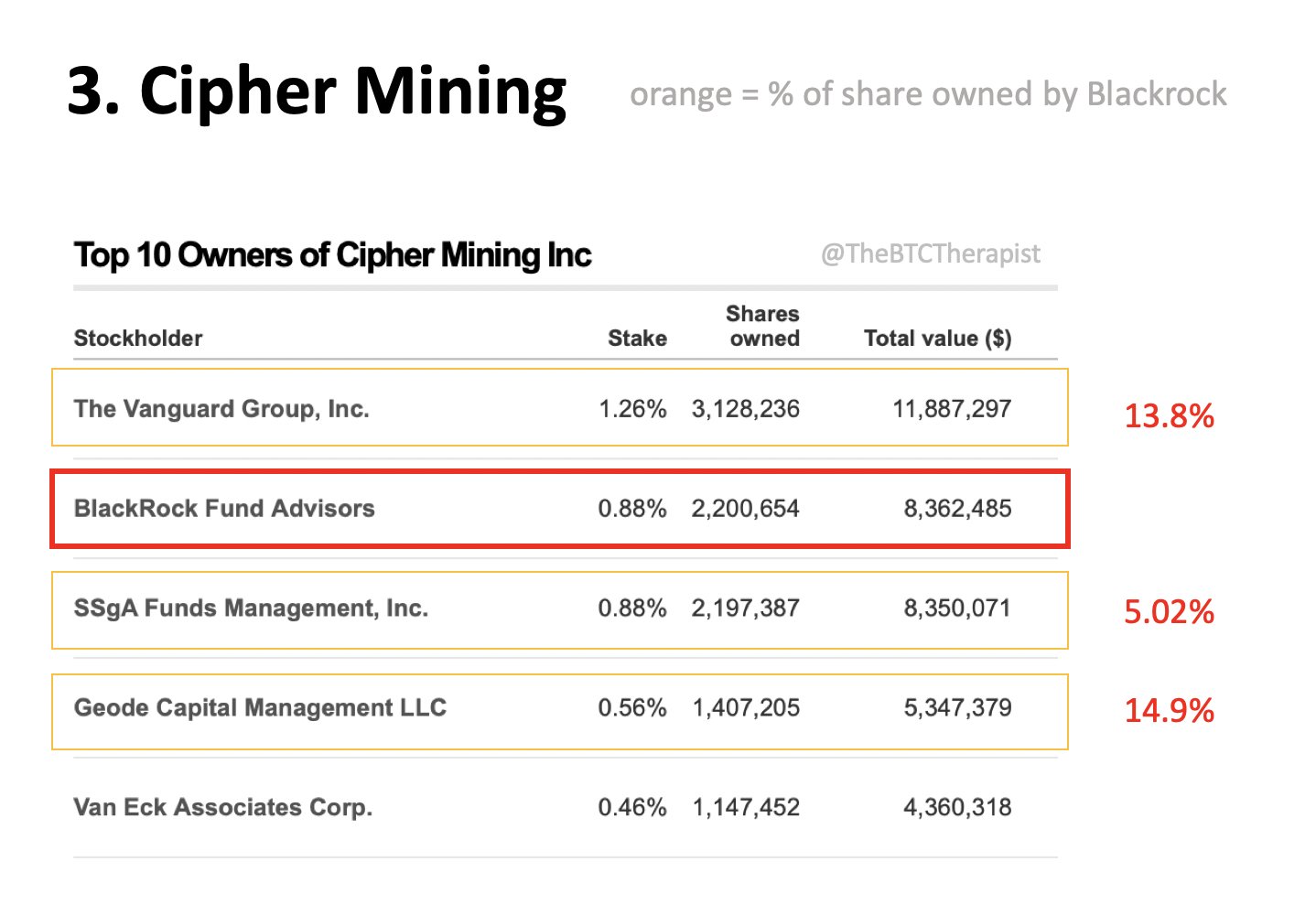

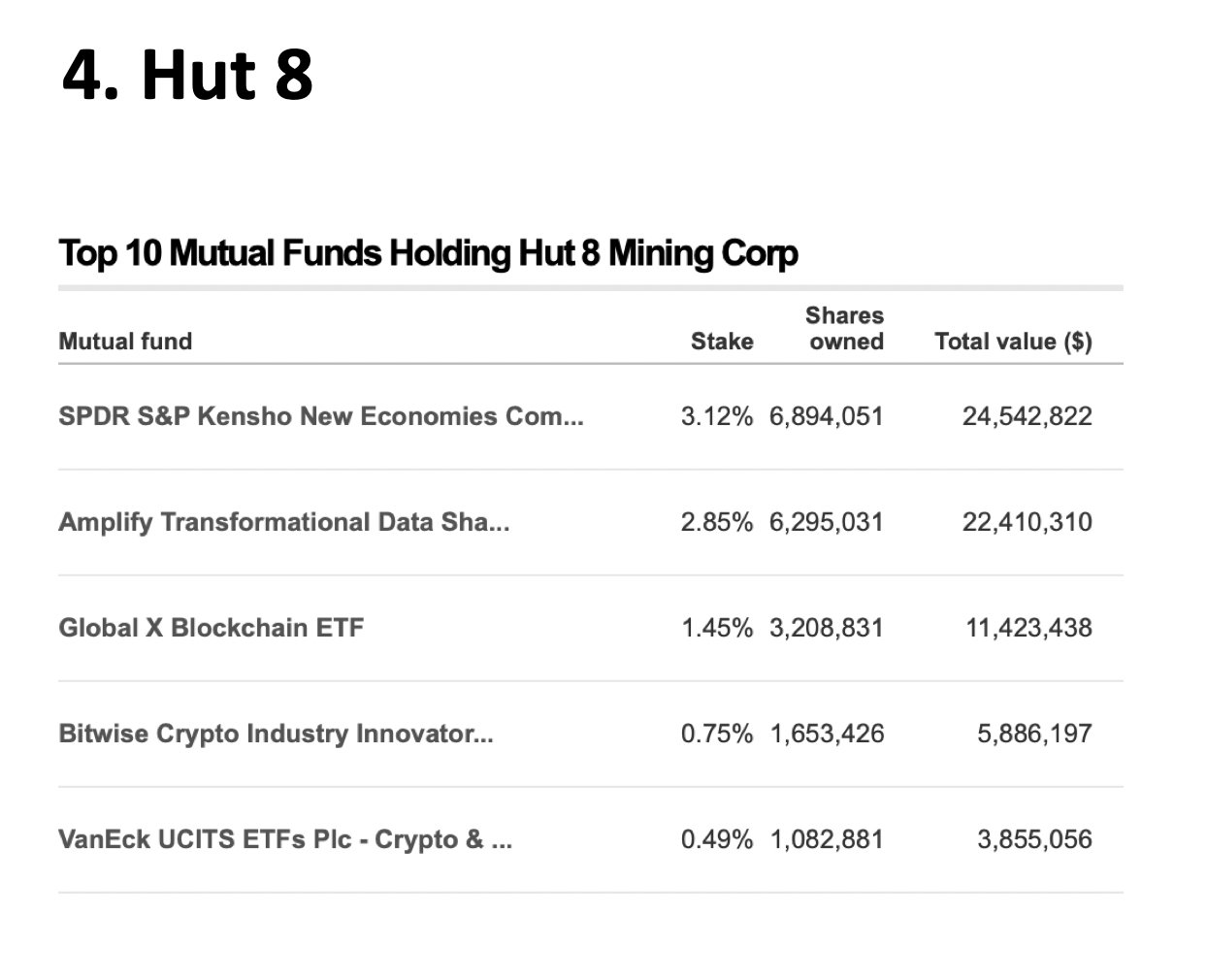

A Closer Look at BlackRock’s Holdings

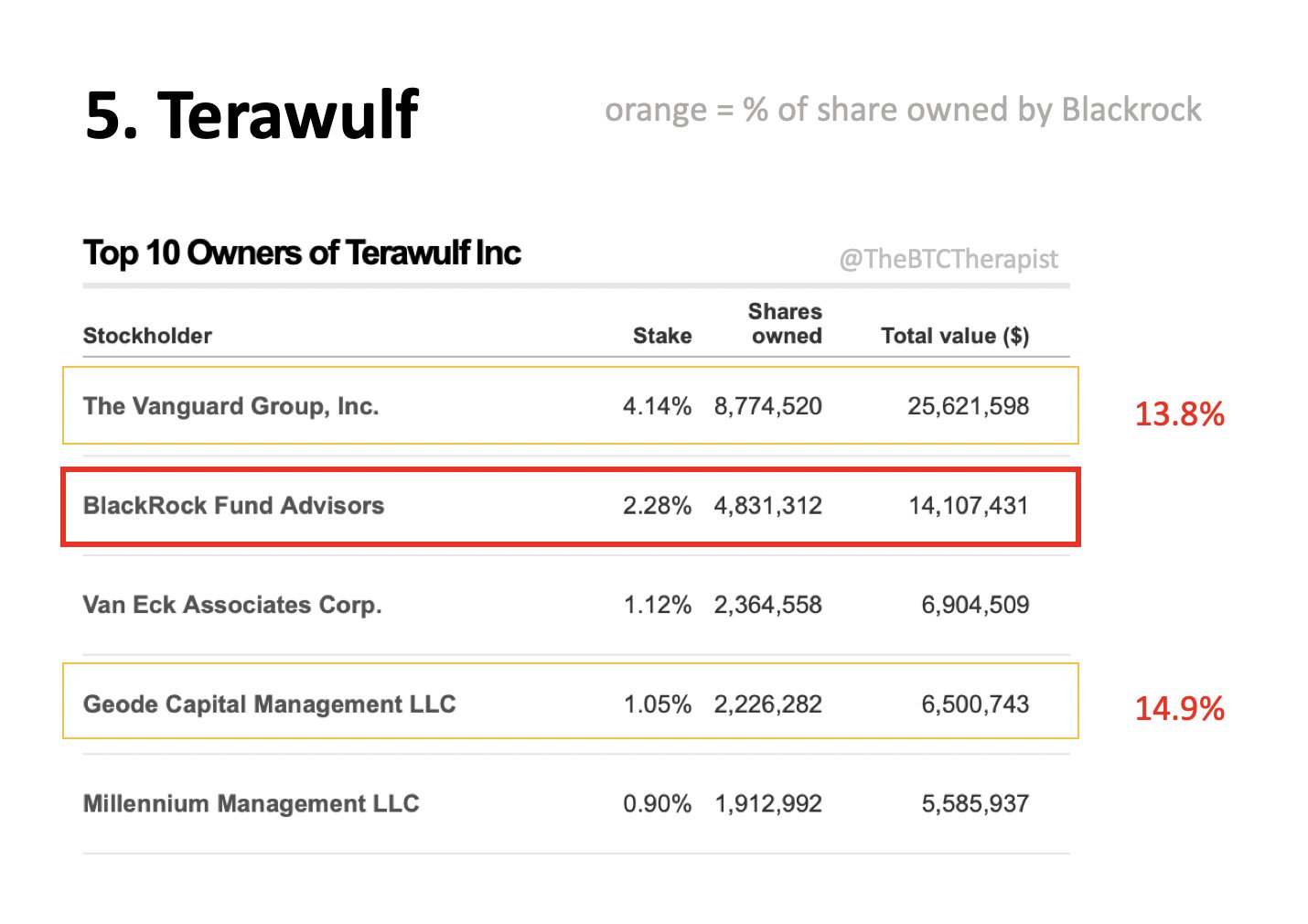

BlackRock’s presence in the world of Bitcoin mining cannot be understated. The firm boasts majority shareholder status in four out of the five largest Bitcoin miners: Riot Blockchain, Marathon Digital Holdings, Cipher Mining, and Hut 8 Mining. Additionally, BlackRock wields substantial influence as a key shareholder in Terawulf, the fifth-largest Bitcoin mining company.

Bitcoin Standard on the Horizon?

What drives BlackRock’s strategic interest in Bitcoin miners? The answer lies in the prospect of a Bitcoin standard. A Bitcoin standard envisions a financial landscape where Bitcoin takes center stage as the primary unit of account, store of value, and medium of exchange.

Also check please: Bitcoin ETF Dates

Reasons Behind BlackRock’s Bitcoin Move

The rationale behind BlackRock’s embrace of Bitcoin mining and its potential standardization is multifaceted. Firstly, Bitcoin’s decentralized nature and its immunity to inflation make it an attractive addition to institutional portfolios. BlackRock, like other financial powerhouses, seeks to safeguard assets against inflation and mitigate risks through diversified investments.

Secondly, Bitcoin’s increasing popularity as a payment method amplifies its appeal. Thanks to its low transaction fees and rapid processing times, Bitcoin is gradually establishing itself as a viable method of payment. This trend makes Bitcoin an enticing proposition for institutions such as BlackRock.

Lastly, the evolving investment landscape sees competition from rival firms investing heavily in Bitcoin. BlackRock’s entry into Bitcoin mining ensures it maintains a stake in the unfolding Bitcoin narrative and the broader cryptocurrency ecosystem.

Conclusion

While the trajectory of Bitcoin towards becoming a global reserve currency remains uncertain, BlackRock’s strategic investments in Bitcoin miners indicate its belief in Bitcoin’s potential as a pivotal player in the international financial arena. As the investment giant solidifies its position in the Bitcoin mining sector, the crypto community watches closely for further signals of BlackRock’s evolving engagement with the world of cryptocurrencies.