Spot BTC ETFs $104.9M Outflow, Volume Drops 80%

BTC/USDT

$17,272,160,469.17

$68,476.22 / $66,621.06

Change: $1,855.16 (2.78%)

+0.0011%

Longs pay

Contents

US Spot Bitcoin ETFs Record $104.9 Million Net Outflow on Tuesday

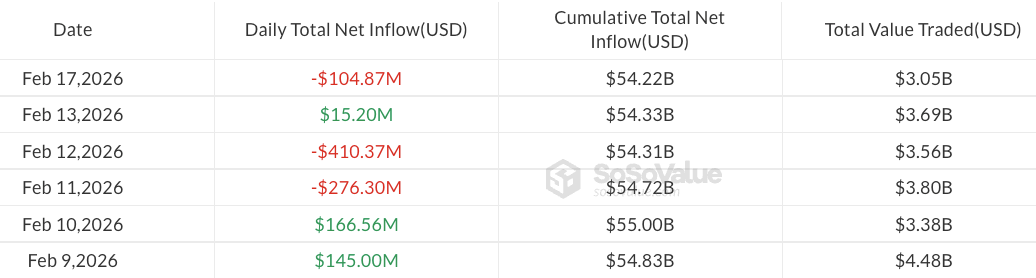

US spot Bitcoin ETFs recorded a net outflow of $104.9 million on Tuesday, the first trading day of this week. The total trading volume of spot BTC ETFs fell to $3 billion according to SoSoValue data, down approximately 80% from the record $14.7 billion level on February 5.

Daily flows in US spot Bitcoin ETFs since Feb. 9, 2026. Source: SoSoValue

Institutional Investors' BlackRock IBIT Positions

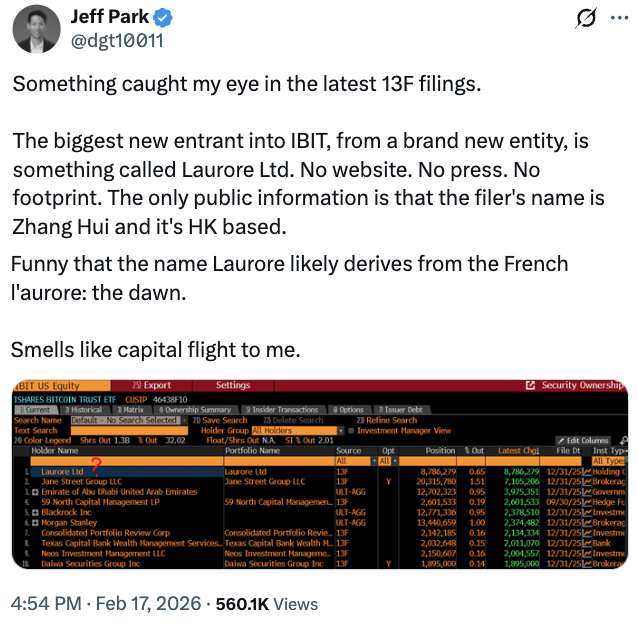

According to Q4 2025 institutional holdings reports, Jane Street became the second largest buyer by purchasing $276 million worth of BlackRock's iShares Bitcoin ETF (IBIT). Hong Kong-based Laurore company made a single purchase of $436.2 million in IBIT. Weiss Asset Management added approximately $107.5 million, 59 North Capital $99.8 million. Mubadala Investment increased its IBIT position by 45% to $630.7 million. On the other hand, Brevan Howard reduced its holdings by 85% to $273.5 million, and Goldman Sachs cut its position by 40% to around $1 billion.

Source: Jeff Park

Source: Zerohedge

Bitcoin Price and Technical Indicators: RSI 35.91 in Downtrend

Bitcoin price is currently at 67,798.56 dollars, showing +0.03% change in the last 24 hours. RSI at 35.91 is in the oversold region, but the overall trend is downward and Supertrend is giving a bearish signal. Above EMA 20: 72,306 dollars. Strong supports: S1 65,498 dollars (75% score, -3.81% distance), S2 62,910 dollars. Resistances: R1 70,249 dollars (73% score, +3.17%), R2 78,145 dollars. ETF outflows support this bearish outlook; caution is advised for futures.

Bitcoin Mining and Asset Losses from Hive and Metaplanet

In recent news, Bitcoin mining company Hive reported a net loss of $91 million due to accelerated depreciation but increased its hash rate. Metaplanet announced a net loss of $619 million in Bitcoin valuation; its assets rose to 35.102 BTC. These developments, combined with the ETF volume decline, signal caution in institutional BTC positions.