SPX6900 Holders Grow Across Chains as Price Lags with Possible Downside from Liquidity Clusters

SPX/USDT

$21,770,162.05

$0.3132 / $0.2722

Change: $0.0410 (15.06%)

+0.0031%

Longs pay

Contents

SPX6900 holders are increasing across Base, Solana, and Ethereum chains despite the price lagging around $0.50, signaling an accumulation phase amid a 3% sector rise. Liquidity clusters below current levels suggest potential downside pressure, but a break above $0.60 could target $0.75.

-

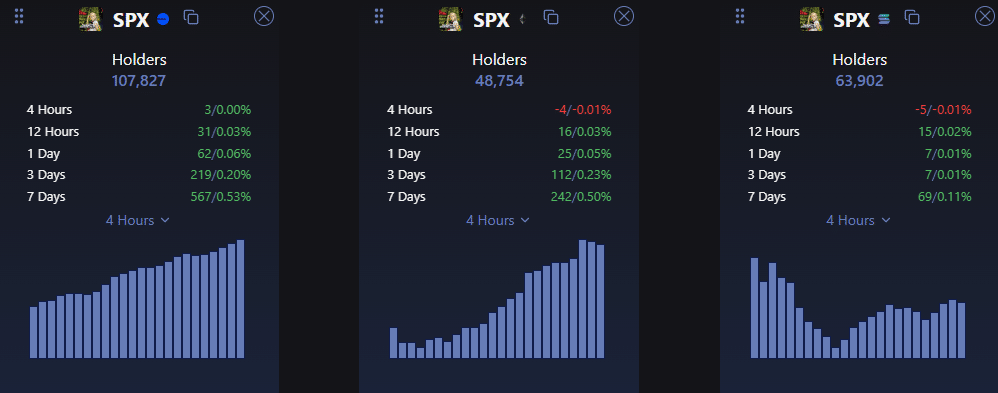

Holder Growth: SPX6900 saw holder counts rise to 107,827 on Base, with gains on Solana and Ethereum, indicating strong community interest.

-

Memecoin Sector Surge: The overall memecoin market cap hit $42.01 billion, up 3% in 24 hours, driven by volume increases to $4.96 billion.

-

Price Resistance: SPX6900 faces hurdles at $0.60, with open interest declining to $9.73 million, hinting at possible market turns.

Discover why SPX6900 holders are surging despite price stagnation in the booming memecoin market. Explore liquidity insights and price forecasts to stay ahead—read now for key crypto updates.

What is driving the increase in SPX6900 holders despite lagging price action?

SPX6900, a prominent memecoin, is experiencing a notable uptick in holders across multiple blockchain networks even as its price hovers around $0.50. This discrepancy points to an accumulation period where investors are building positions at discounted levels amid broader memecoin sector growth. Data from on-chain analytics shows steady inflows, suggesting confidence in future upside despite current resistance.

How is the memecoin sector performing relative to SPX6900’s holder trends?

The memecoin ecosystem has shown resilience, with its total market capitalization climbing approximately 3% over the past 24 hours to reach $42.01 billion. Trading volume followed suit, surging 11% to about $4.96 billion, reflecting heightened activity across various tokens. In this environment, SPX6900 has outperformed many peers, posting a daily gain of over 7% and a weekly increase of 14%. Standouts like Fartcoin, Bonk, and Pudgy Penguins achieved double-digit returns in the same period, underscoring the sector’s momentum. According to market trackers, this growth is fueled by renewed retail interest and cross-chain expansions, which have bolstered SPX6900’s visibility. However, while the sector thrives, SPX6900’s price has not kept pace, trading sideways and highlighting a divergence between community expansion and immediate valuation.

On the three primary chains—Base, Solana, and Ethereum—the number of SPX6900 holders has steadily increased. Base Chain leads with 107,827 holders, demonstrating consistent expansion that aligns with its low-cost transaction appeal for memecoin enthusiasts. Solana follows with 68,902 holders, though growth here has been more tempered, possibly due to network congestion concerns. Ethereum, the original blockchain for many tokens, reports 48,754 holders, with weekly additions of 242 providing a solid foundation despite higher gas fees.

This holder growth occurs against a backdrop of price stability at around $0.50, which market analysts interpret as a classic accumulation signal. Investors appear to be positioning for potential rallies, drawn by the token’s meme-driven narrative and multi-chain presence. Data from HolderScan indicates that even as prices trade at a perceived discount, wallet addresses holding SPX6900 are diversifying across ecosystems, reducing reliance on any single network.

Source: HolderScan

Why is SPX6900’s price facing resistance and mixed market sentiments?

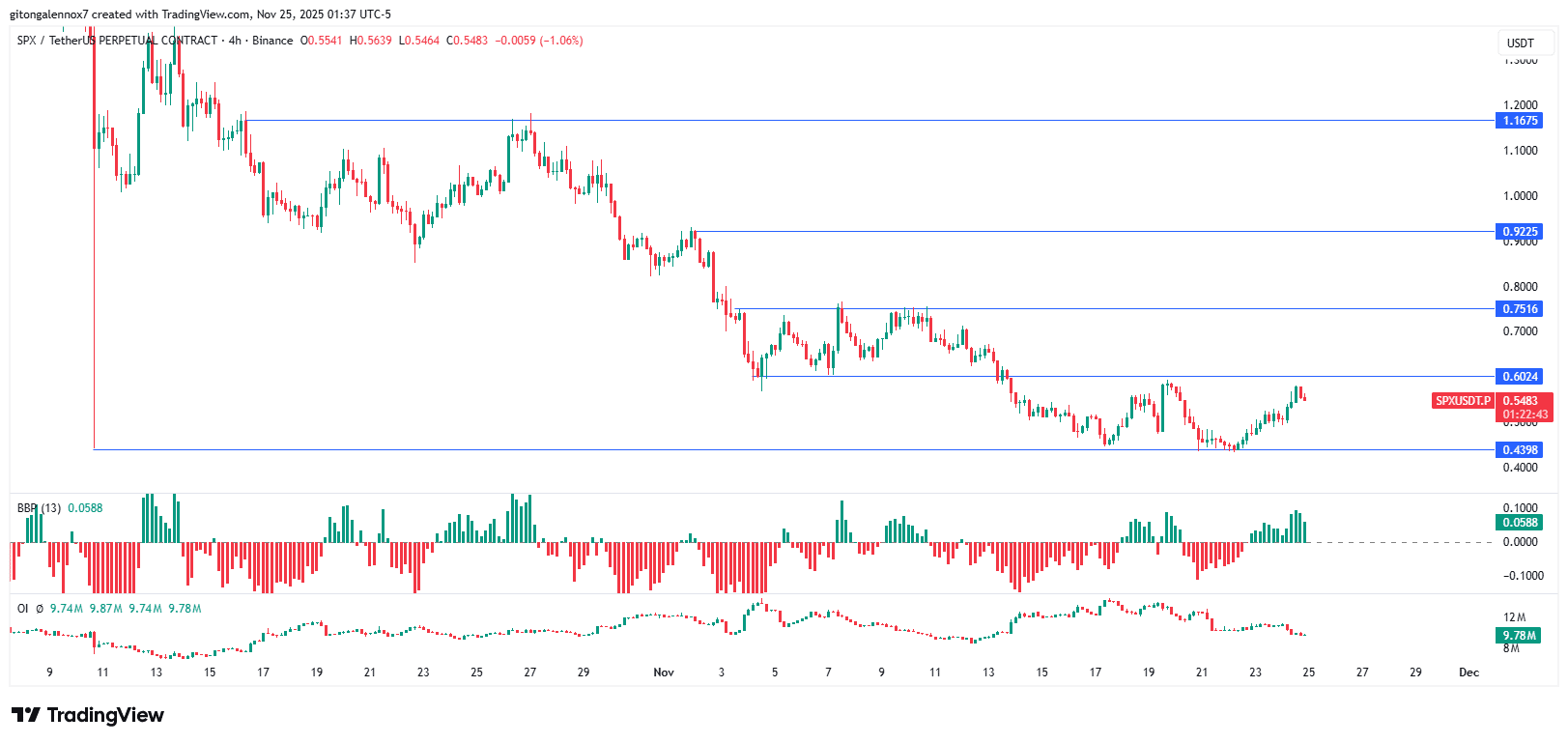

SPX6900’s price chart reveals underlying strength but is currently capped by a key resistance at $0.60, preventing sustained upward movement. Technical indicators, including the Bull Bear Power, show buyers maintaining control, though fading momentum suggests caution. A successful breakout above $0.60 could open paths to $0.75 and even revisit $1, based on historical patterns observed in similar memecoins.

Open interest for SPX6900 stands at $9.73 million, a decline from its recent peak of $14.24 million when the price dipped to $0.4398. This divergence often precedes market shifts, particularly as the token trades near multi-month lows. On-chain metrics from platforms like TradingView highlight reduced leverage in derivatives markets, which could stabilize prices but also limit explosive gains. Google Trends data further illustrates subdued interest, with search volume steady at around 36 over the past 30 days, punctuated by spikes in early November during the $0.60-$0.75 range.

Market participants exhibit mixed sentiments, with optimism from holder accumulation tempered by liquidity dynamics. While the memecoin’s community-driven appeal continues to attract new entrants, broader crypto market volatility— including Bitcoin’s influence on altcoins—adds layers of uncertainty. Experts monitoring memecoin trends note that such phases are common before major catalysts, like network upgrades or viral marketing pushes, emerge.

Source: TradingView

What role do liquidity clusters play in SPX6900’s potential price direction?

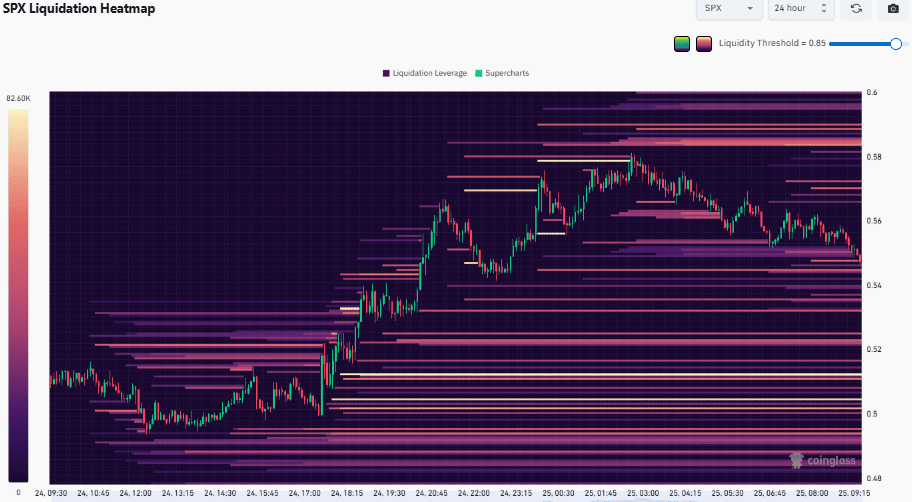

Liquidity analysis reveals denser order concentrations below the current SPX6900 price, particularly between $0.48 and $0.52, compared to upper levels at $0.58. This imbalance suggests downward pressure if price seeks the nearest liquidity pools, potentially testing supports near $0.4398. Data from CoinGlass underscores that while buy orders could spark a rebound, the volume of resting sells below current action tilts the short-term outlook bearish.

In trading environments, liquidity clusters act as magnets for price movement, drawing assets toward high-order zones to fill gaps. For SPX6900, the lower clusters indicate possible retests of recent lows, but a hold above $0.4398 might catalyze a reversal, especially with sector-wide volume supporting broader recovery. Analysts emphasize that multi-chain liquidity enhances resilience, allowing SPX6900 to navigate these dynamics more effectively than single-chain tokens.

Source: CoinGlass

Overall, these liquidity patterns align with the ongoing accumulation narrative, where holder increases provide a buffer against potential dips. If buying pressure intensifies, SPX6900 could defy the clusters and push higher, rewarding patient investors in the volatile memecoin space.

Frequently Asked Questions

Why are SPX6900 holders increasing on Base Chain more than on Solana or Ethereum?

Base Chain’s appeal lies in its low fees and seamless integration with Ethereum’s ecosystem, attracting over 107,827 SPX6900 holders with consistent growth. In contrast, Solana’s 68,902 holders reflect moderate gains of 69 weekly, limited by occasional network issues, while Ethereum’s 48,754 holders benefit from established security but face higher costs, per HolderScan metrics.

Could SPX6900’s liquidity below $0.50 lead to a price rebound soon?

Yes, if buy orders overwhelm the clustered liquidity between $0.48 and $0.52, SPX6900 could rebound toward $0.60 resistance. Holding $0.4398 as support would strengthen this scenario, especially with memecoin volume at $4.96 billion signaling active participation across chains.

Key Takeaways

- Holder Accumulation Phase: SPX6900’s rising holders on Base, Solana, and Ethereum indicate building interest despite price at $0.50, pointing to undervalued entry points.

- Sector Momentum: Memecoin market cap up 3% to $42.01 billion supports SPX6900’s 7% daily and 14% weekly gains, with peers like Bonk showing similar strength.

- Liquidity-Driven Outlook: Denser lower liquidity suggests short-term downside risk, but breaking $0.60 could target $0.75—monitor open interest for reversal signals.

Conclusion

In summary, SPX6900’s holder growth across Base, Solana, and Ethereum chains amid a thriving memecoin sector underscores an accumulation trend, even as price faces resistance at $0.60 and liquidity clusters hint at volatility. With open interest diverging and volume rising, the token remains positioned for potential upside in the evolving crypto landscape. Investors should track these on-chain developments closely to capitalize on emerging opportunities in SPX6900 and beyond.